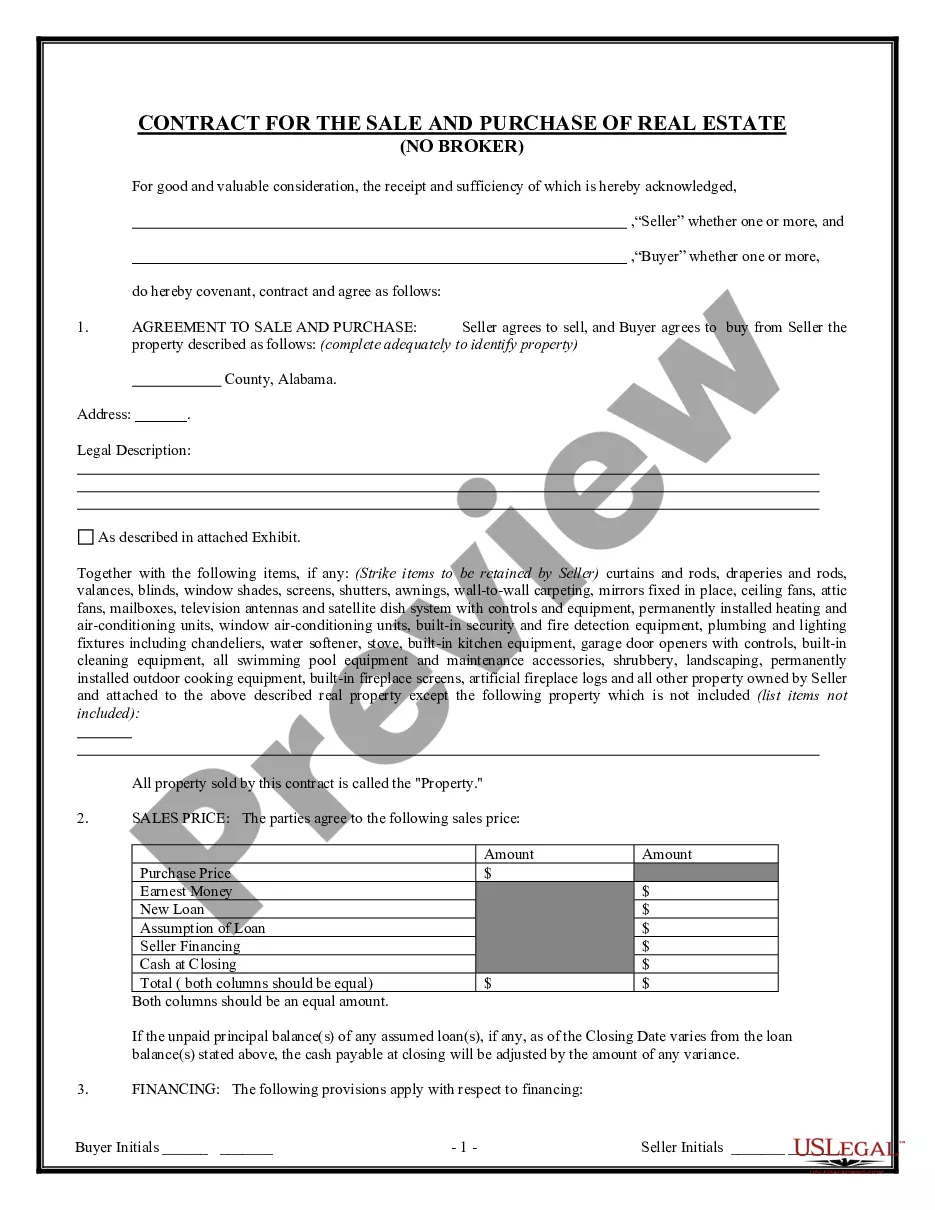

Alabama Contract Sales Withholding Form

Description

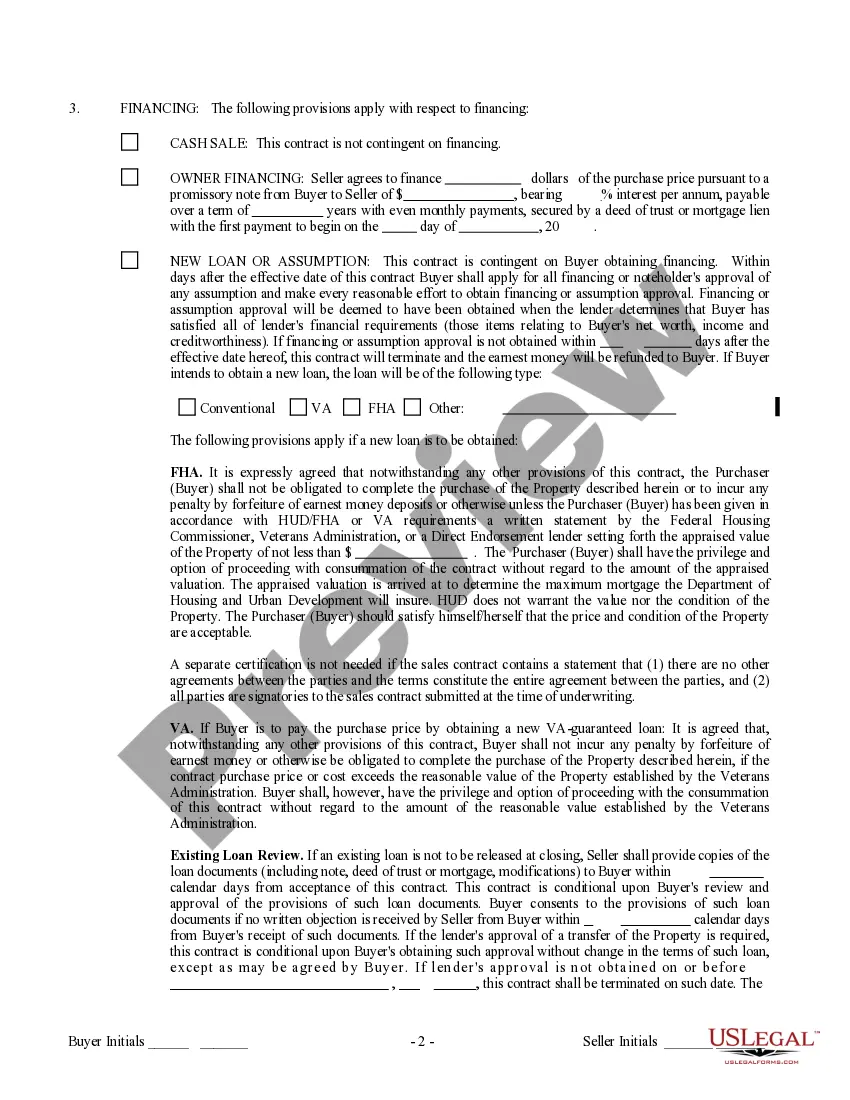

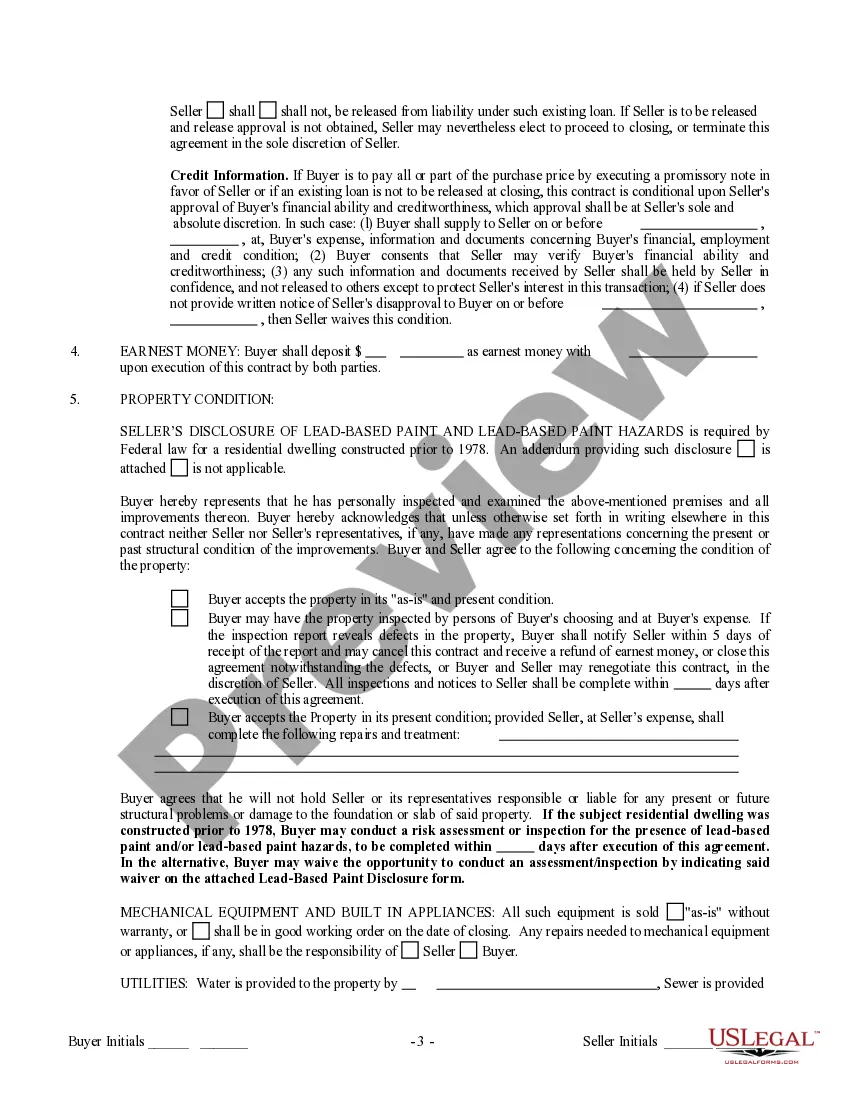

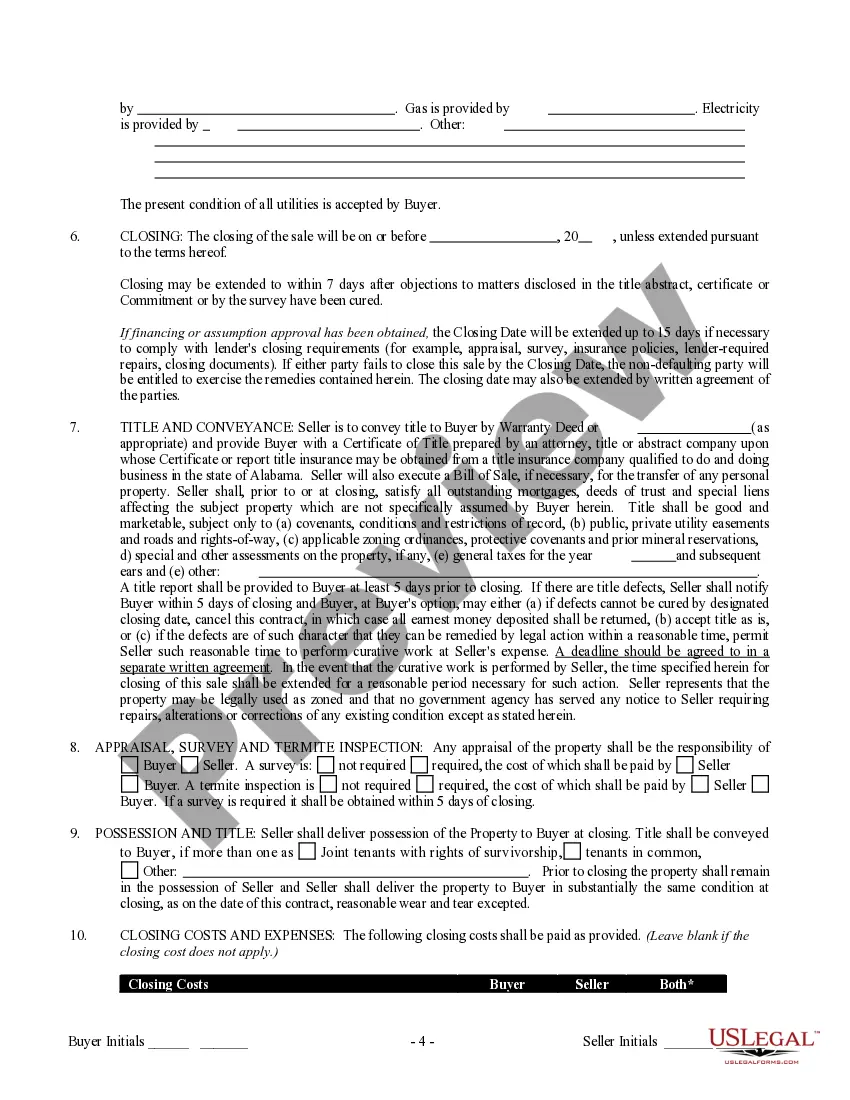

How to fill out Alabama Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

Whether you frequently handle paperwork or only occasionally need to send a legal document, it is crucial to find a resource containing all relevant and current samples.

One action to take with the Alabama Contract Sales Withholding Form is to ensure that it is the latest version, as this determines its submission eligibility.

If you want to simplify your quest for the most recent document templates, search for them on US Legal Forms.

To acquire a form without creating an account, follow these instructions: Use the search feature to locate the desired form. Review the preview and description of the Alabama Contract Sales Withholding Form to ensure it meets your requirements. After confirming the form, click Buy Now. Select a subscription plan that suits you. Create a new account or Log In to your existing one. Use your credit card or PayPal details to complete the purchase. Choose your preferred download file format and confirm it. Say goodbye to confusion when handling legal documents; all your templates will be structured and validated with a US Legal Forms account.

- US Legal Forms is a collection of legal documents that includes almost any sample you might need.

- Look for the templates you require, assess their relevance immediately, and discover more about their applications.

- With US Legal Forms, you gain access to over 85,000 form templates across a broad range of fields.

- Obtain the Alabama Contract Sales Withholding Form samples in just a few clicks and store them at any time in your account.

- A US Legal Forms account enhances your ability to access all necessary samples with greater ease and less hassle.

- Simply click Log In in the site header and navigate to the My documents section where all your required forms are conveniently available.

- You will not need to spend time either searching for the appropriate template or verifying its applicability.

Form popularity

FAQ

If you would like to apply for a Sales Tax Exempt Certificate, you can find the form on Alabama Department of Revenue website. If you are granted sales tax exempt status, please read the instructions for use included with the approval letter. Sales Tax Exempt status must be renewed every year.

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.

810-6-1-. 09. Automobile Repair Shops and Garages.Charges for labor and service performed in connection with such repair work or installations are to be included in the measure of the tax, if not separately billed to customers.

Contractors are considered the end user and are responsible for remitting the applicable sales or use tax on their purchases of building material, equipment, etc., for construction projects.

Some customers are exempt from paying sales tax under Alabama law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.