Alabama Construction Fee Withdrawal

Description

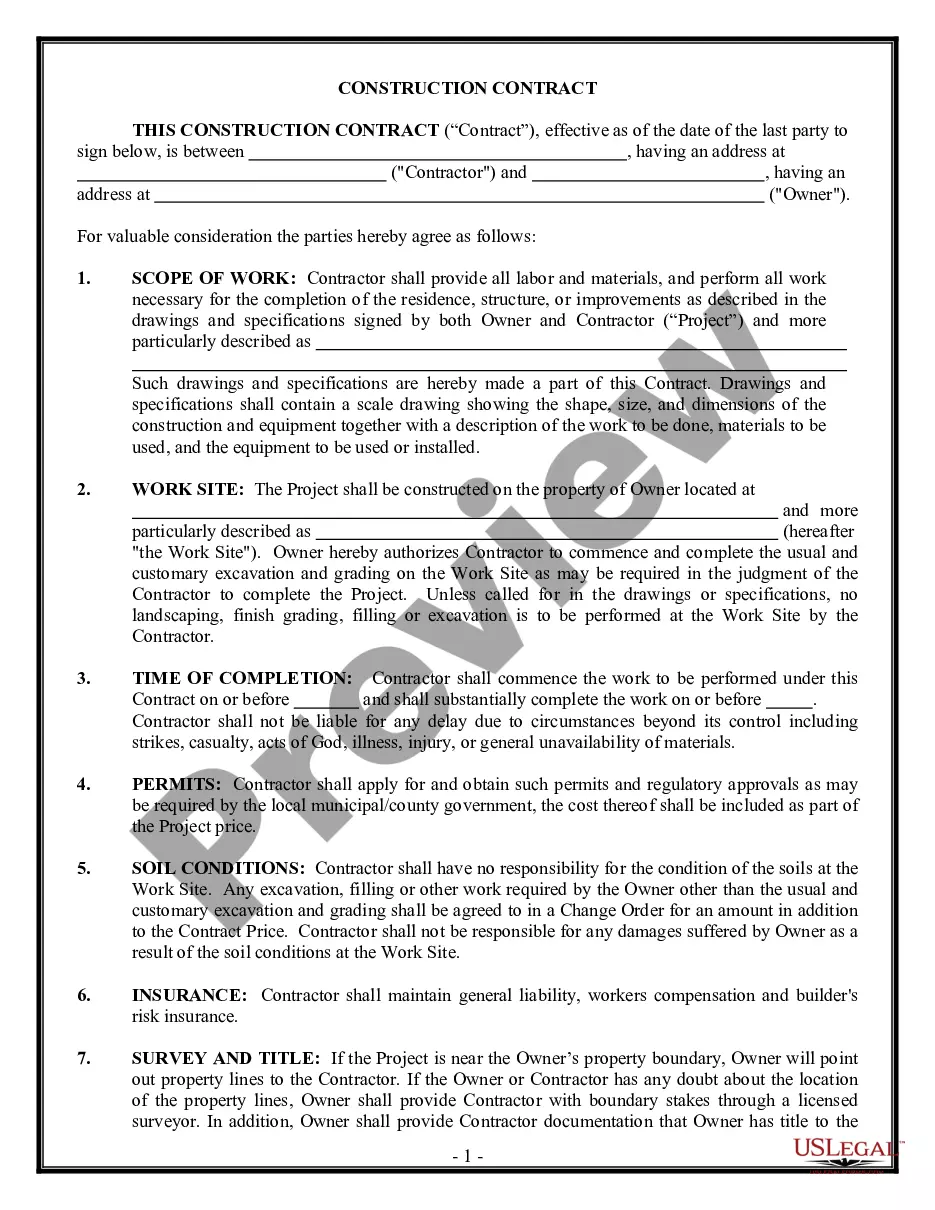

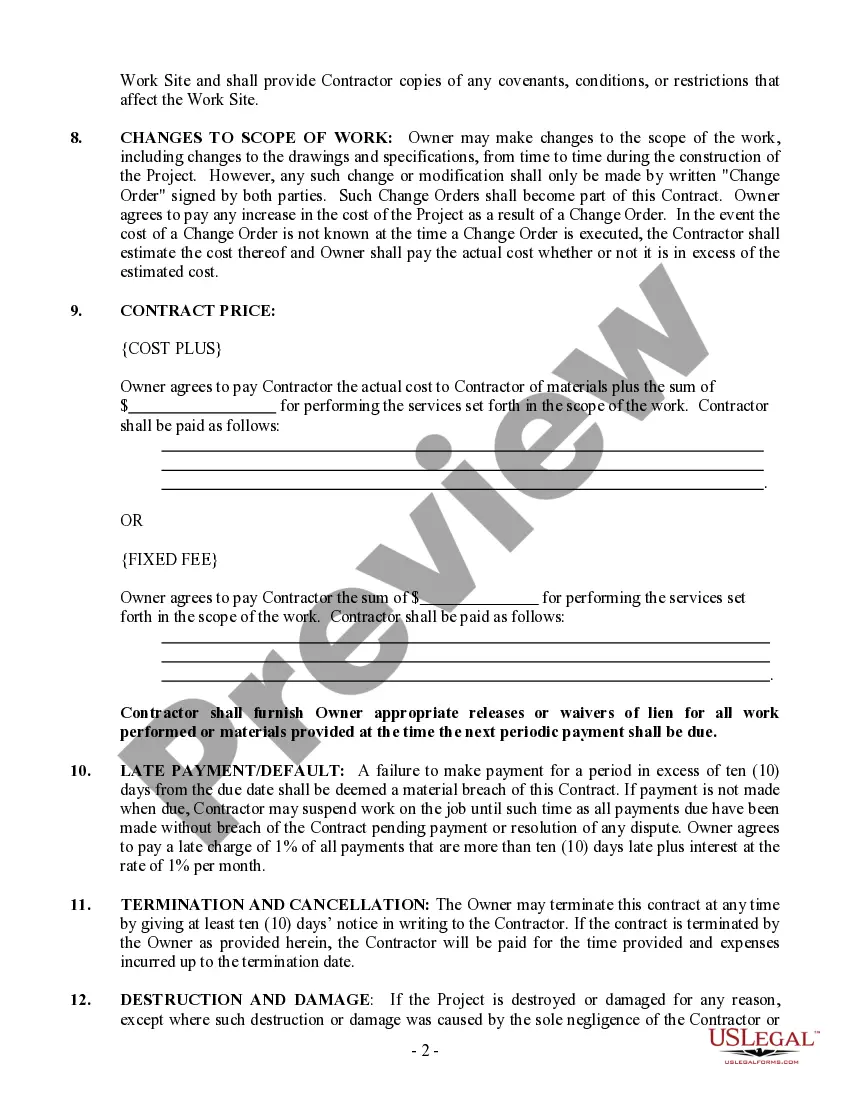

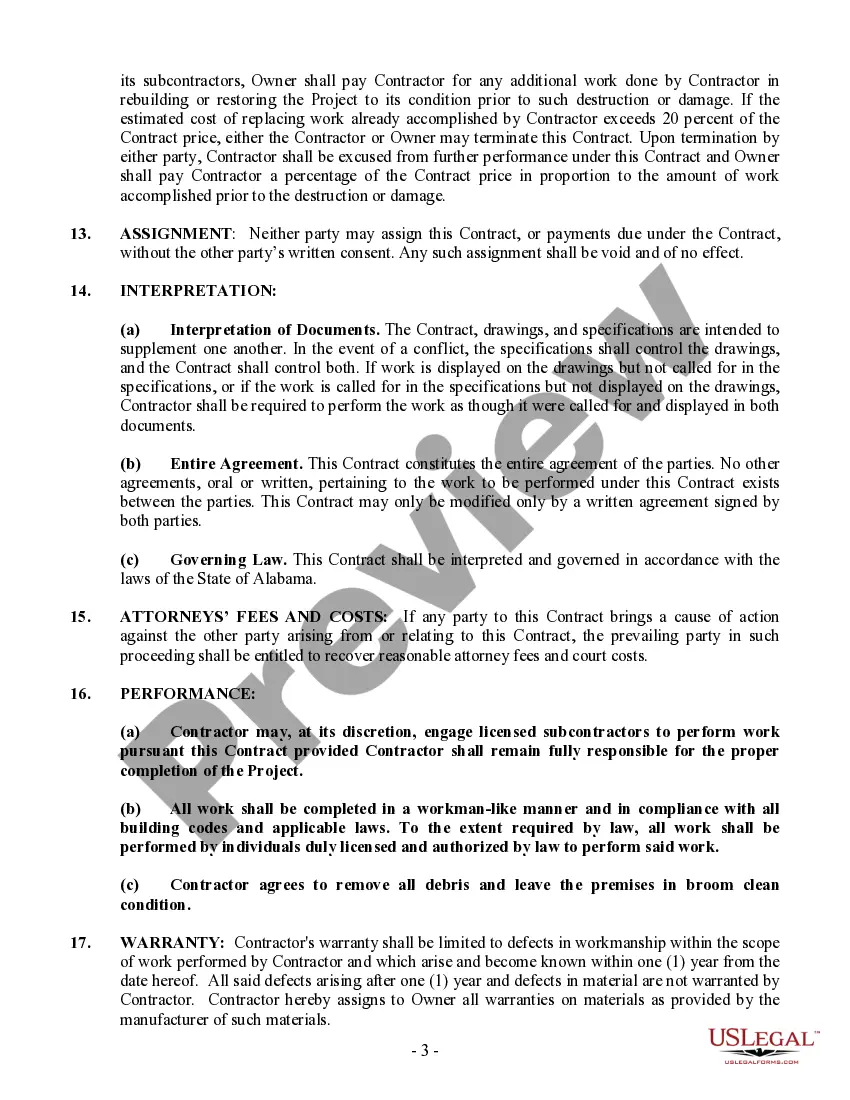

How to fill out Alabama Construction Contract Cost Plus Or Fixed Fee?

What is the most reliable service to acquire the Alabama Construction Fee Withdrawal and various current iterations of legal documents.

US Legal Forms is the answer! It represents the largest assortment of legal papers for any purpose. Each template is correctly drafted and verified for conformity with federal and state laws and regulations.

US Legal Forms is an ideal option for anyone who needs to manage legal documentation. Premium users enjoy additional benefits as they can fill out and approve previously saved documents electronically at any time using the built-in PDF editing tool. Try it out today!

- They are categorized by region and state of application, making it easy to find the one you require.

- Experienced individuals using the site only need to Log In to the platform, check if their subscription is active, and click the Download button next to the Alabama Construction Fee Withdrawal to retrieve it.

- Once saved, the template will remain accessible for future use in the My documents section of your account.

- If you haven't created an account in our library yet, here are the steps you should follow to establish one.

Form popularity

FAQ

In Short: Shipping may be taxable in Alabama. If you use your own vehicle or if the cost of shipping and handling is built into the price of the goods (or not billed separately), you will need to charge sales tax on shipping.

(b) Labor or service charges are not taxable when billed for labor or services expended in repairing or altering existing tangible personal property belonging to another in order to restore the property to its original condition or usefulness without producing new parts.

Yes, they are taxable.

Services in Alabama are generally not taxable. However, if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on these products. Tangible personal property is generally taxable in Alabama, with a few exceptions for items used in agriculture or industry.

Are services subject to sales tax in Alabama? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Alabama, services are generally not taxable.