Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual

Understanding this form

The Enhanced Life Estate or Lady Bird Deed is a legal document that allows an individual (the Grantor) to convey property to another individual (the Grantee) while retaining a life estate. This means the Grantor retains the right to live in and manage the property during their lifetime. Unlike traditional life estate deeds, the Grantor can sell or mortgage the property without affecting the Grantee's future interest, except when transferring the property through a will. This deed complies with state statutory laws and provides flexibility and control for the Grantor while ensuring the Grantee ultimately receives the property.

Form components explained

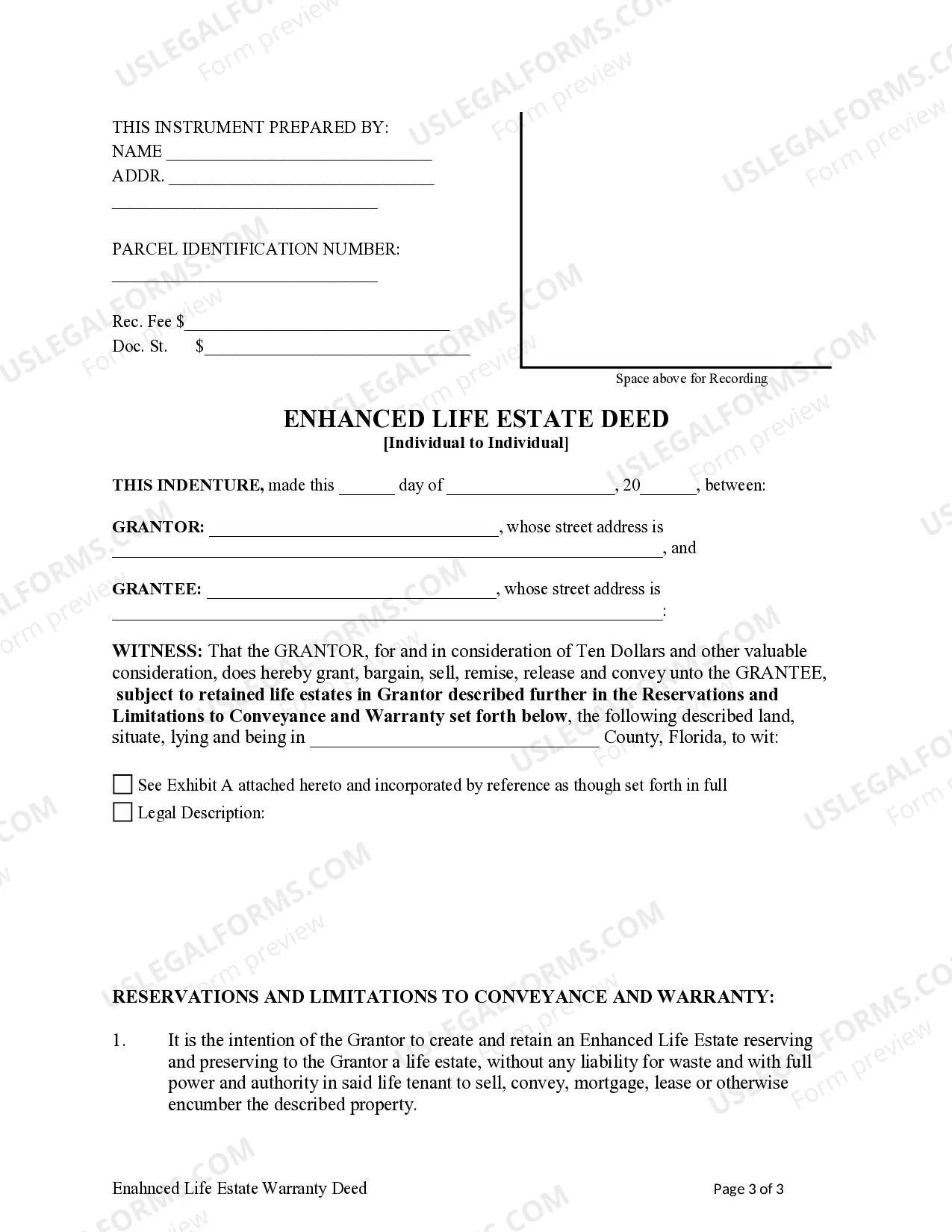

- Description of the Grantor and Grantee.

- Specification of the retained life estate by the Grantor.

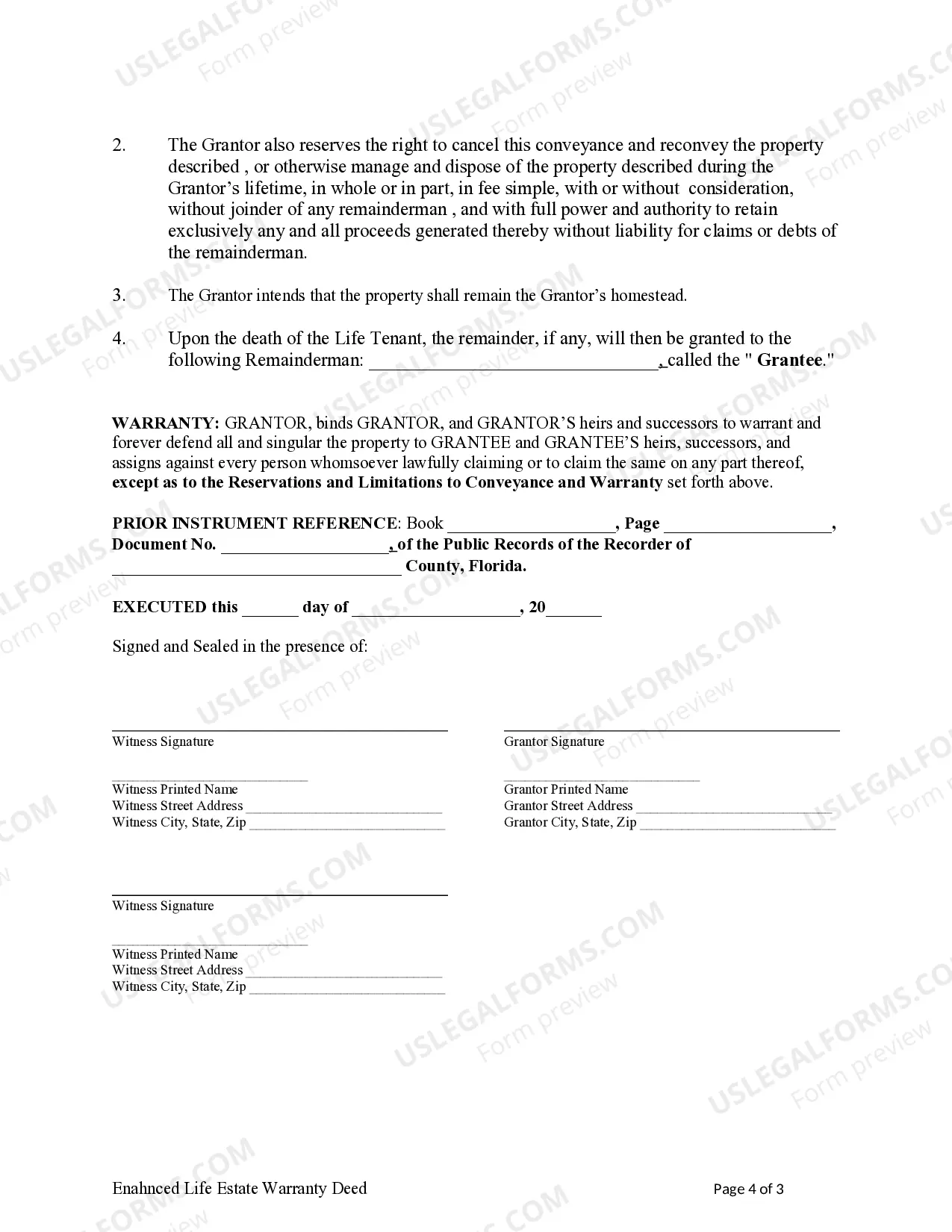

- Rights reserved by the Grantor, including the ability to sell or encumber the property.

- Conditions under which the Grantee will receive the property after the Grantor's death.

- Compliance with state statutory laws.

When to use this form

This form is useful when an individual wants to transfer property to another person while retaining control and usage of the property during their lifetime. It is typically used in estate planning to ensure a smooth transition of property ownership upon the Grantor's passing, allowing the Grantor to modify the property's status as needed without affecting the Grantee's future rights.

Intended users of this form

This form is intended for:

- Individuals looking to transfer property to another individual while retaining lifetime control.

- Property owners who wish to manage their estate and ensure a specific heir receives the property.

- People seeking to minimize estate tax implications through strategic property transfer.

Instructions for completing this form

- Identify the parties involved by entering the names and addresses of the Grantor and Grantee.

- Specify the property that is being transferred, including a clear legal description.

- Indicate any conditions or rights the Grantor wishes to retain over the property.

- Ensure all areas of the form are filled out completely, including signatures and dates.

- Review the form for accuracy before finalizing the document.

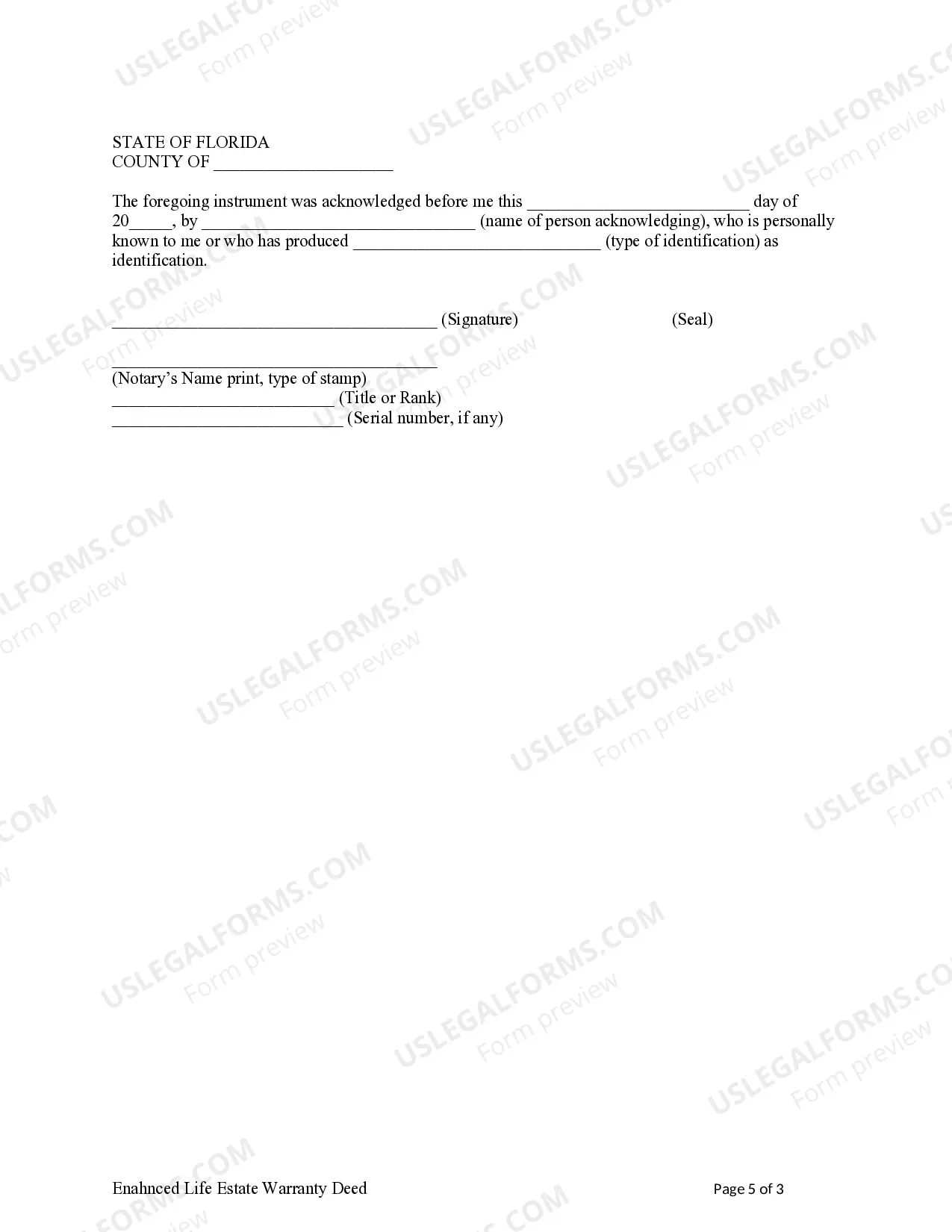

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes to avoid

- Failing to include a clear legal description of the property.

- Not specifying all of the Grantor's retained rights.

- Leaving out signatures or dates, which can invalidate the deed.

- Using outdated or incorrect state-specific language.

Why complete this form online

- Convenient access to legal documents from any location.

- Editability allows users to tailor the form to their specific needs.

- Reliable templates drafted by licensed attorneys ensure compliance with legal standards.

- Immediate download option enables quick processing of legal needs.

Legal use & context

- This form creates a legal record of the Grantor's intent to transfer property upon death while retaining use rights.

- It is enforceable in the state of Florida and can help avoid probate for the property involved.

- Legal advice may be necessary if complexities arise in property ownership or transfer.

Key takeaways

- The Enhanced Life Estate or Lady Bird Deed allows significant control over property during the Grantor's lifetime.

- The form should be filled with attention to detail to ensure its validity.

- Consider local regulations regarding notarization and legal enforceability.

Form popularity

FAQ

To complete a Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual, you must first gather the required information, including the property details and names of all parties involved. Next, carefully fill in the deed, making sure to address all legal requirements. After signing the deed in front of a notary, you should record it with the county clerk to finalize the process. Platforms like uslegalforms can facilitate this by offering clear instructions and templates.

Yes, a Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual is essentially the same as an enhanced life estate deed. Both documents allow the property owner to retain the right to live in the property for their lifetime while granting rights to heirs upon their passing. This setup provides flexibility and avoids many probate issues. Understanding this equivalence can help streamline your estate planning process.

Yes, you can prepare your own Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual. However, it is vital to ensure that you follow the correct legal format and include all necessary information. Mistakes can lead to complications in the future, so double-checking your work is essential. Consider using online resources or platforms like uslegalforms for easy-to-follow templates that guide you through the process.

Filling out a Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual involves several important steps. You need to provide the names of the grantor and the grantee, a legal description of the property, and any specific terms of the transfer. Additionally, it's essential to clearly state your intentions for the property, especially your right to live there until you pass away. Using a platform like uslegalforms can simplify the process by providing templates and guidance for completion.

Yes, you need to record the Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual with your county's clerk of court. Recording the deed officially documents the transfer of interest and protects your rights against future claims. This step is crucial for ensuring that your wishes regarding the property are honored after your passing. Failing to record the deed could lead to complications down the line.

While it is not a legal requirement to hire an attorney to create a Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual, it is highly recommended. An attorney can help ensure that the deed meets all legal standards and accurately reflects your intentions. They can also guide you through any complexities related to property laws and estate planning. Plus, having professional assistance can provide peace of mind that your deed is valid.

One notable disadvantage of the Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual is the potential impact on Medicaid planning. If the grantor needs long-term care, the property may still be counted as part of their assets. Moreover, once the deed is executed, the grantor cannot simply change their mind without legal interventions. Exploring these limitations with a knowledgeable advisor can help you make informed decisions for your estate planning.

The Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual can have specific tax implications. When the grantor passes away, the property receives a step-up in basis, which can help reduce capital gains tax liability for heirs. Additionally, as the grantor retains control during their lifetime, there are typically no gift tax implications at the time of creation. Consulting with a tax professional can provide further insights tailored to your financial situation.

The primary difference lies in the control retained by the grantor. With a traditional life estate deed, the grantor loses some control over the property during their lifetime. In contrast, the Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual allows the grantor to retain the right to sell or modify the property without needing consent from the remaindermen. This flexibility often makes the Lady Bird deed a more attractive choice for many homeowners.

The choice between a trust and the Florida Enhanced Life Estate or Lady Bird Deed - Individual to Individual often depends on individual circumstances. A trust can provide more comprehensive estate planning and asset protection features. However, a Lady Bird deed is simpler and may have fewer administrative burdens, especially for avoiding probate. Evaluating your specific needs with an estate planning professional can help clarify which option is better for you.