Washington Heirship Affidavit - Descent

What this document covers

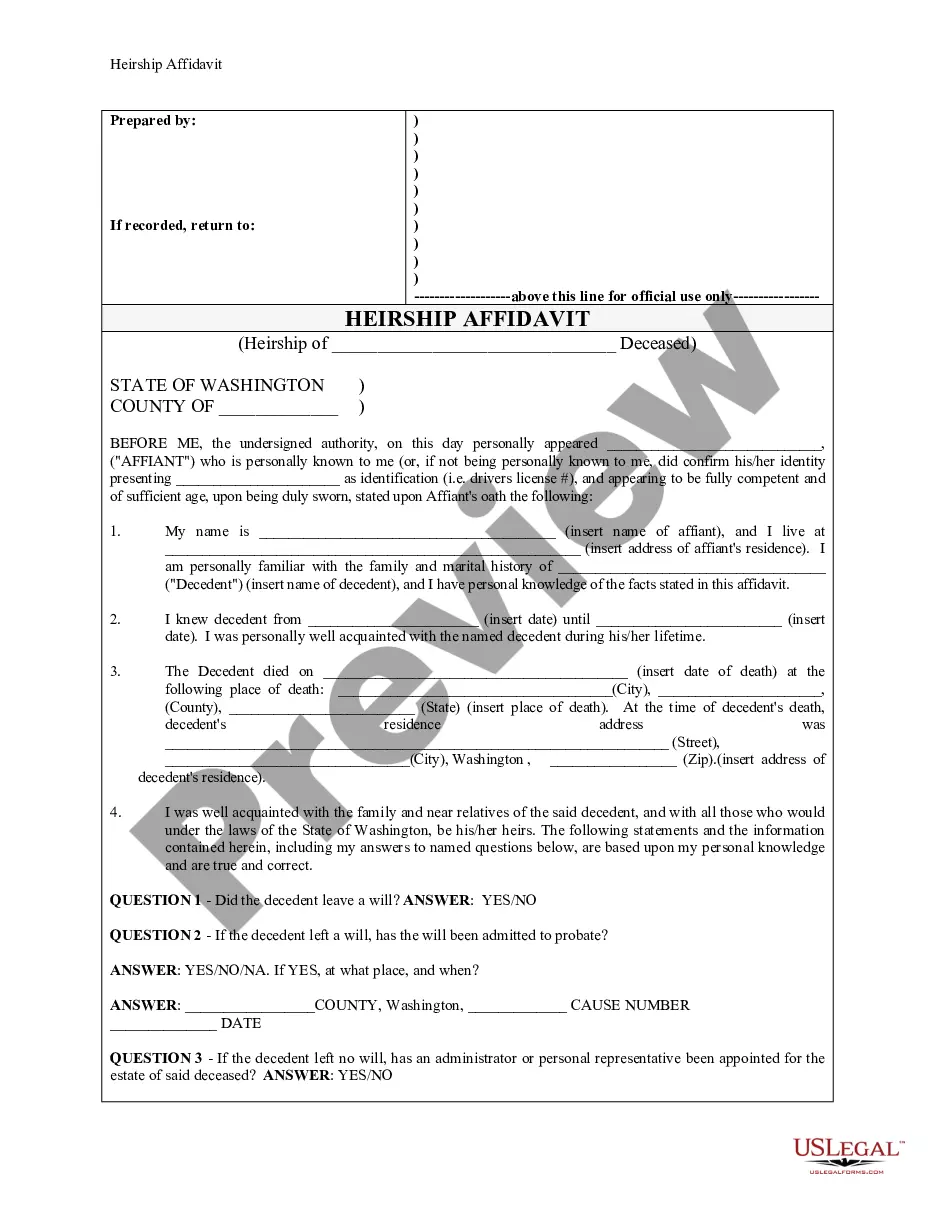

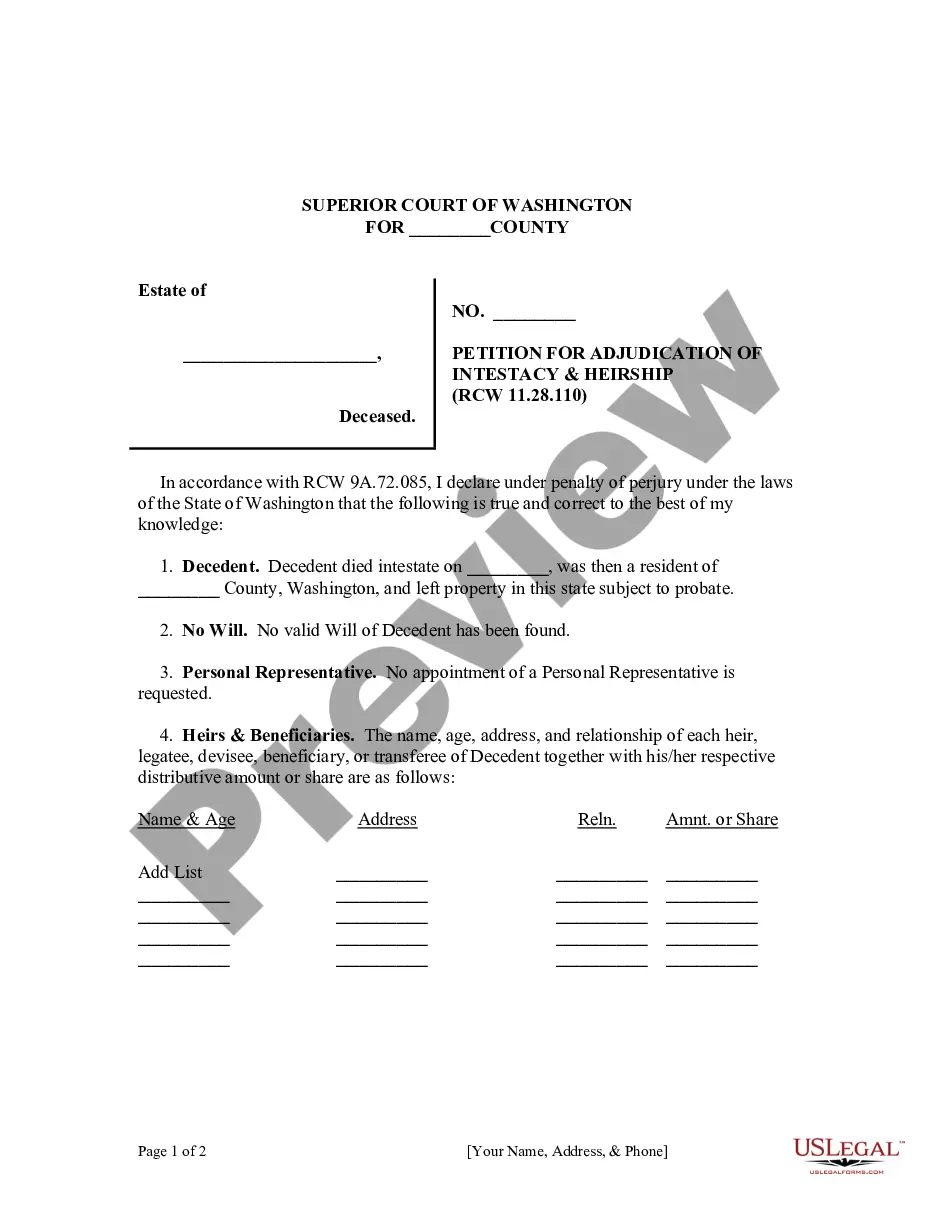

The Heirship Affidavit - Descent is a legal document that confirms the heirs of a deceased person. This form helps establish rightful ownership of personal and real property when someone passes away without leaving a will. Unlike a probate process, this affidavit can be used to clarify the heirship of an estate, especially when transferring property ownership, making it an essential tool in estate management.

What’s included in this form

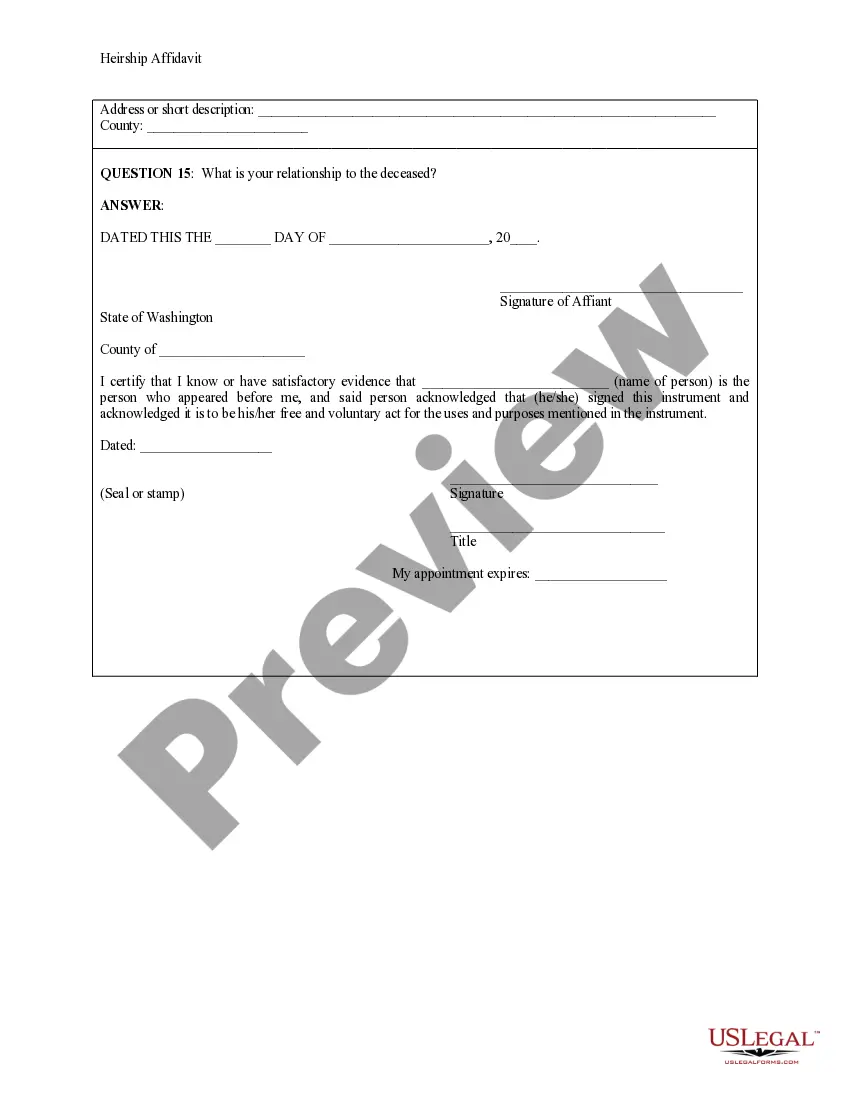

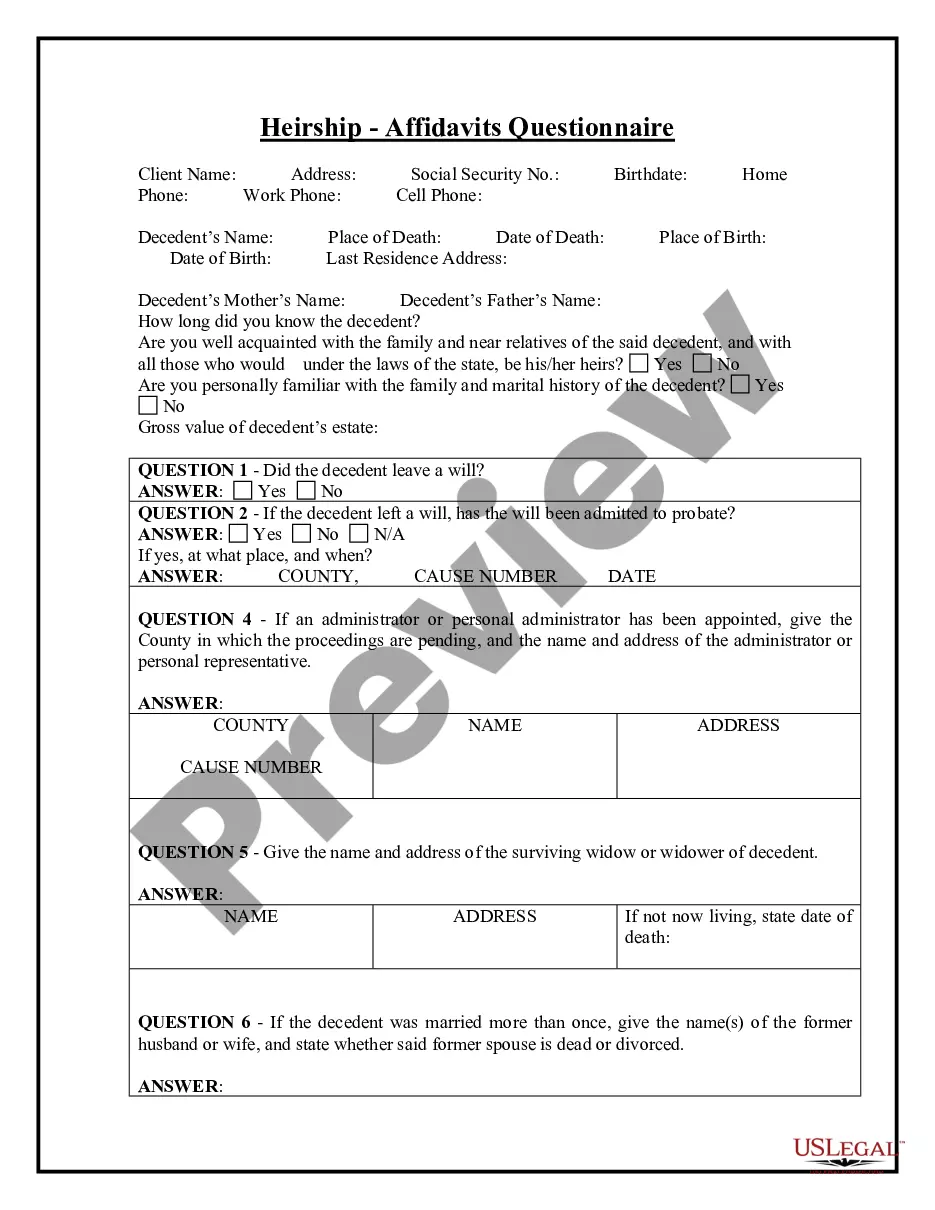

- Affiant's personal information, including name and address.

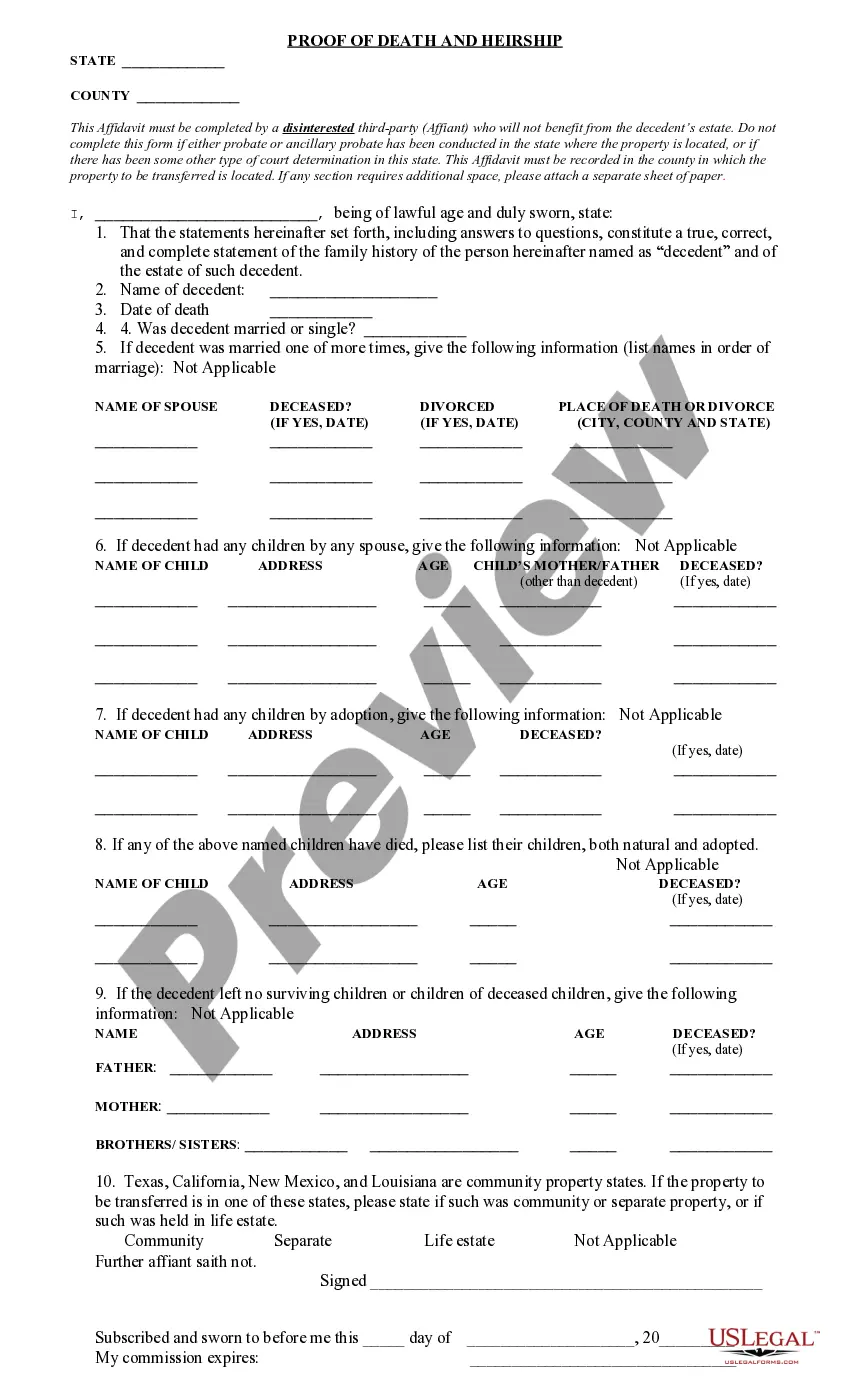

- Details about the deceased, including name, date of death, and place of death.

- Information addressing whether the decedent left a will.

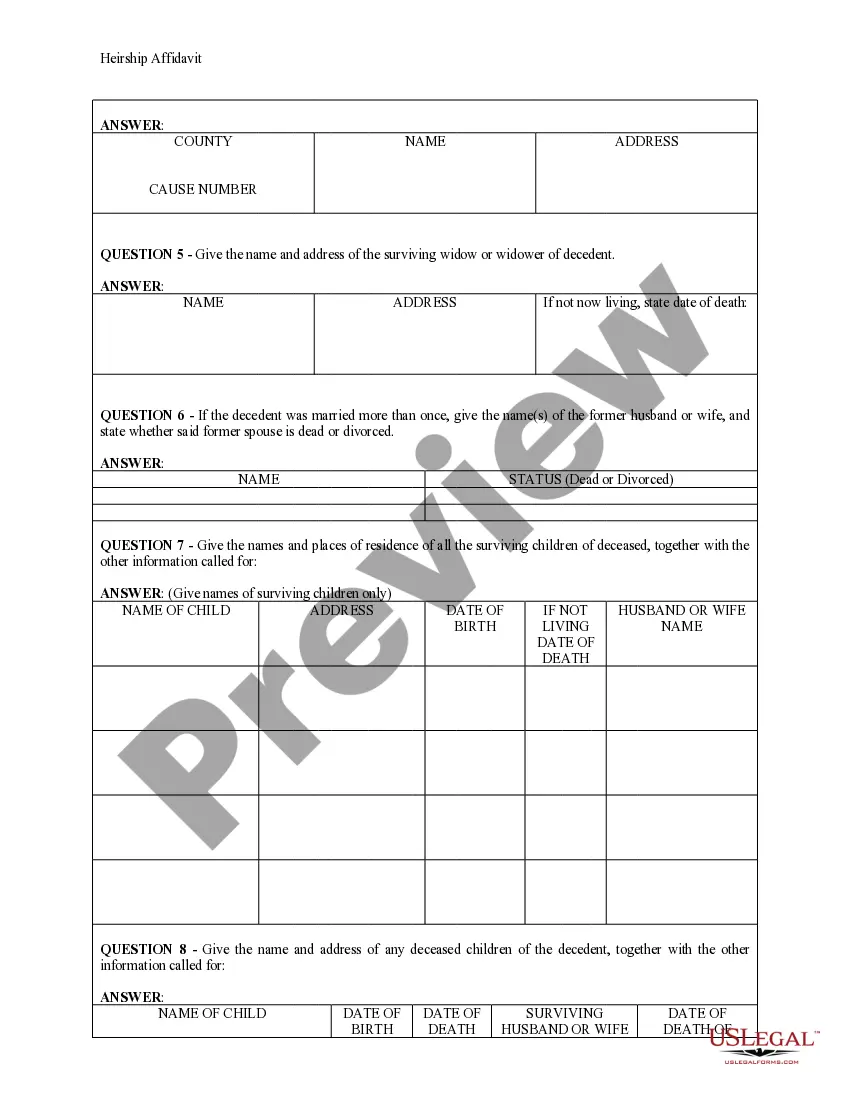

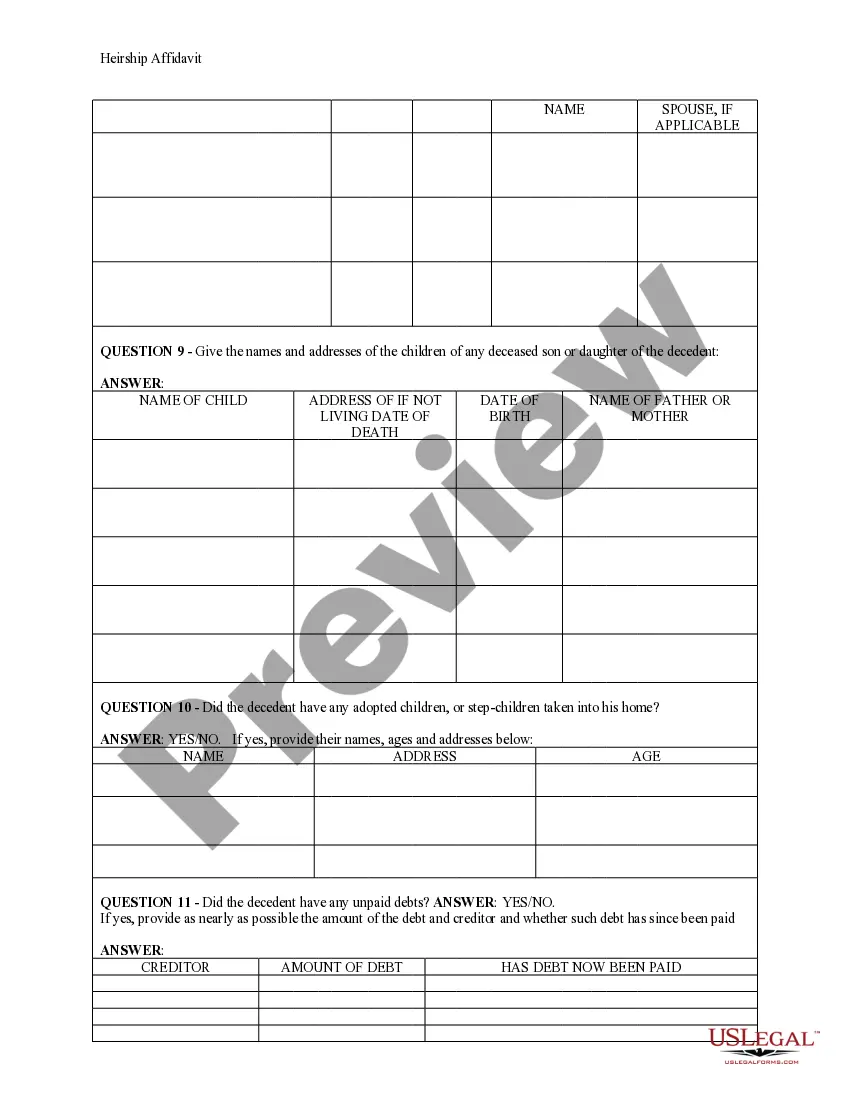

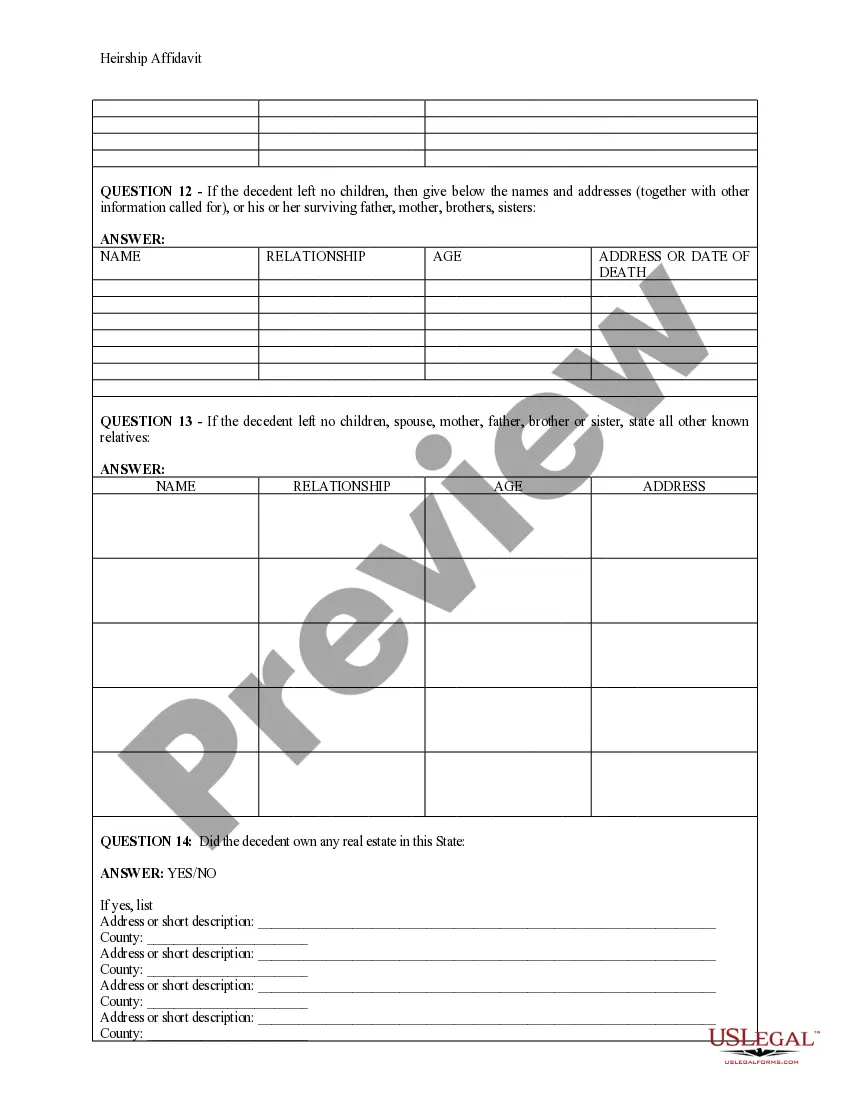

- Information about the relatives of the deceased and their relationship.

- Details regarding any property owned by the decedent.

- Signature of the affiant and notary acknowledgement.

Situations where this form applies

This form should be used when a person dies intestate, meaning without a will, and there is a need to establish who the legal heirs are. It is particularly useful for heirs who wish to sell or transfer property left by the deceased. In scenarios where legal probate processes are unavailable or undesirable, this affidavit provides a streamlined method to assert ownership rights.

Intended users of this form

- Heirs of a deceased person who did not leave a will.

- Individuals authorized to handle the estate of the deceased.

- Anyone needing to transfer property ownership that belonged to the decedent.

How to prepare this document

- Identify the affiant by entering their name and address.

- Provide the full name, date of death, and place of death of the decedent.

- Answer questions regarding the presence of a will and whether the estate has been entered into probate.

- List all surviving heirs and their relationships to the decedent.

- Sign the affidavit in the presence of a notary public and complete any required notary information.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete and accurate information about the decedent's family.

- Not having the affidavit notarized when required.

- Incorrectly answering questions about the existence of a will or probate.

- Missing signatures or dates necessary for validation.

Advantages of online completion

- Convenience of filling out the form from home without the need for legal consultations.

- Editable form ensures users can easily input their information at their own pace.

- Access to professionally drafted templates that are legally compliant.

Looking for another form?

Form popularity

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Maximum $100,000. Laws Section 11.62.010. Step 1 Write in your name at the top (successor's name) Step 2 Write in the state and county. Step 3 Write in your name again. Step 4 Write in the name of the decedent in Section 1 as well as decedent's SSN. Step 5 Write in your name and address.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.