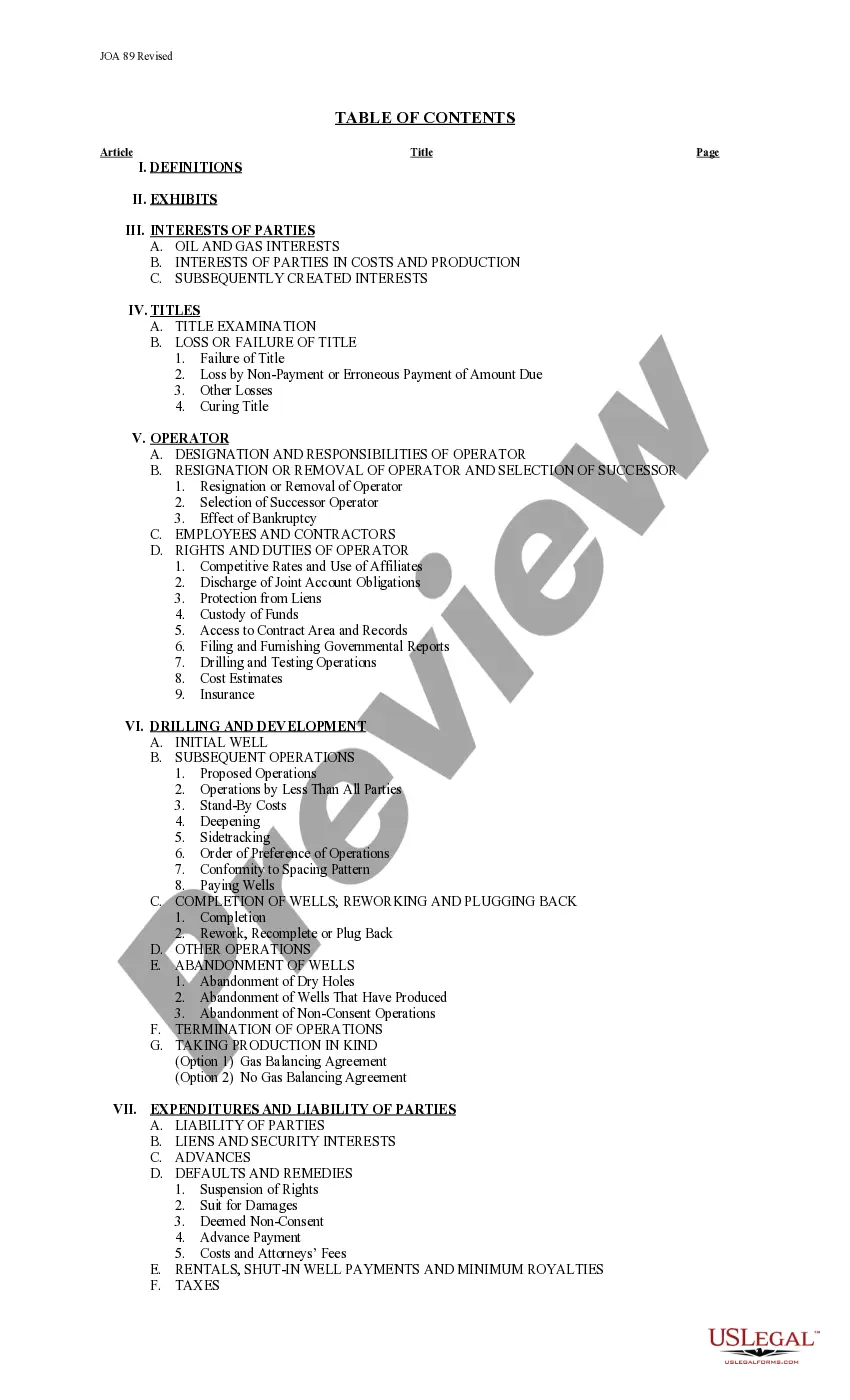

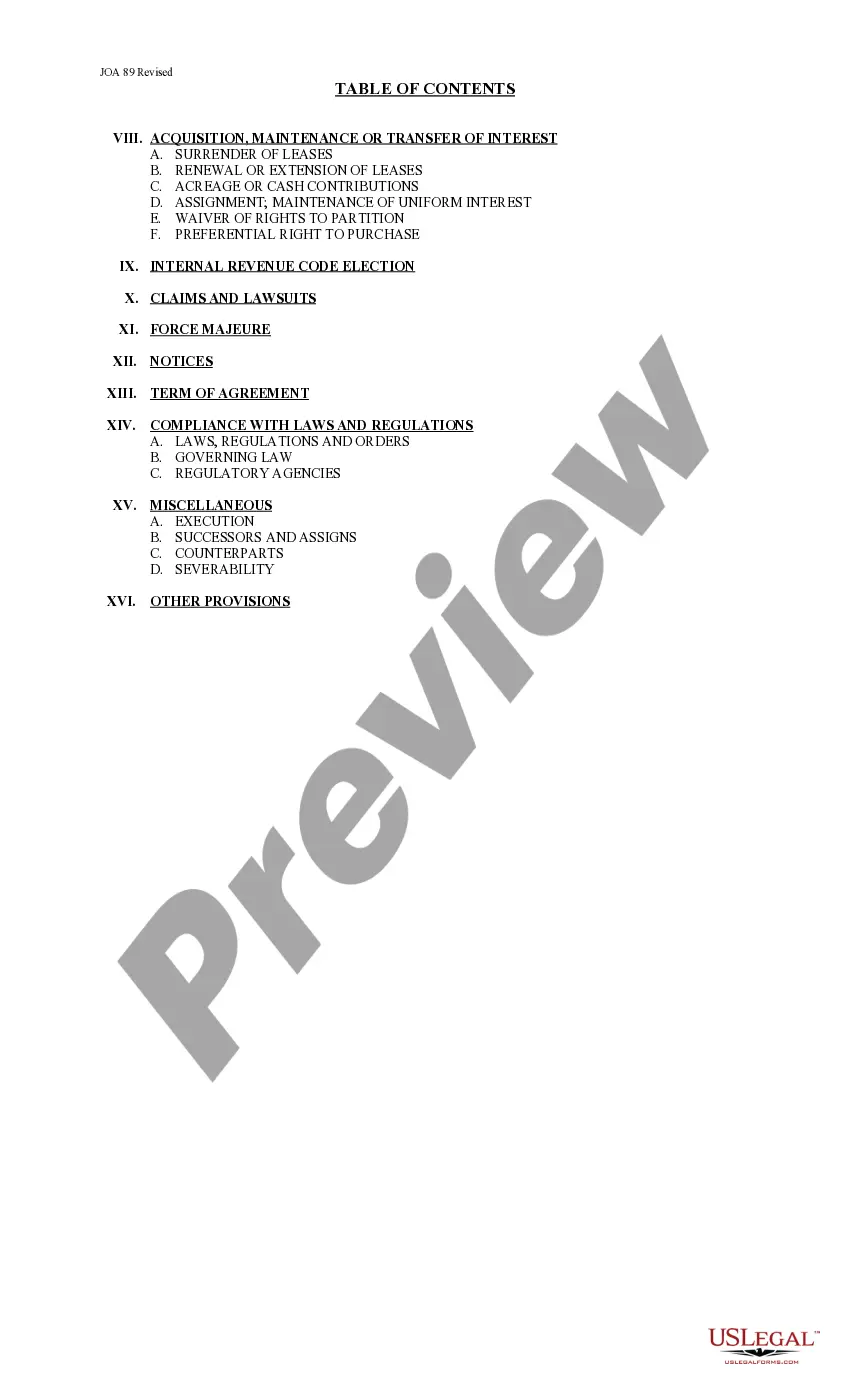

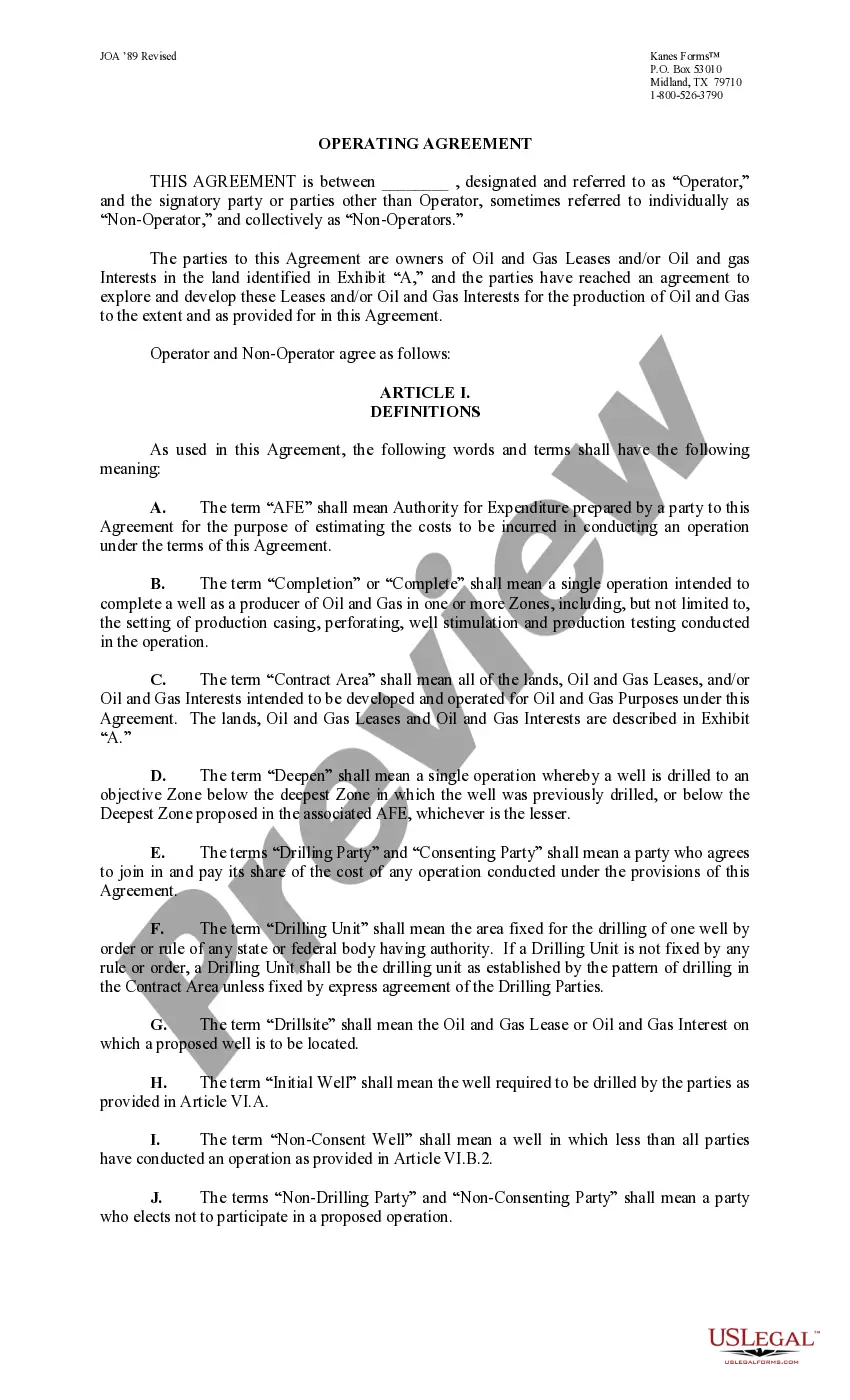

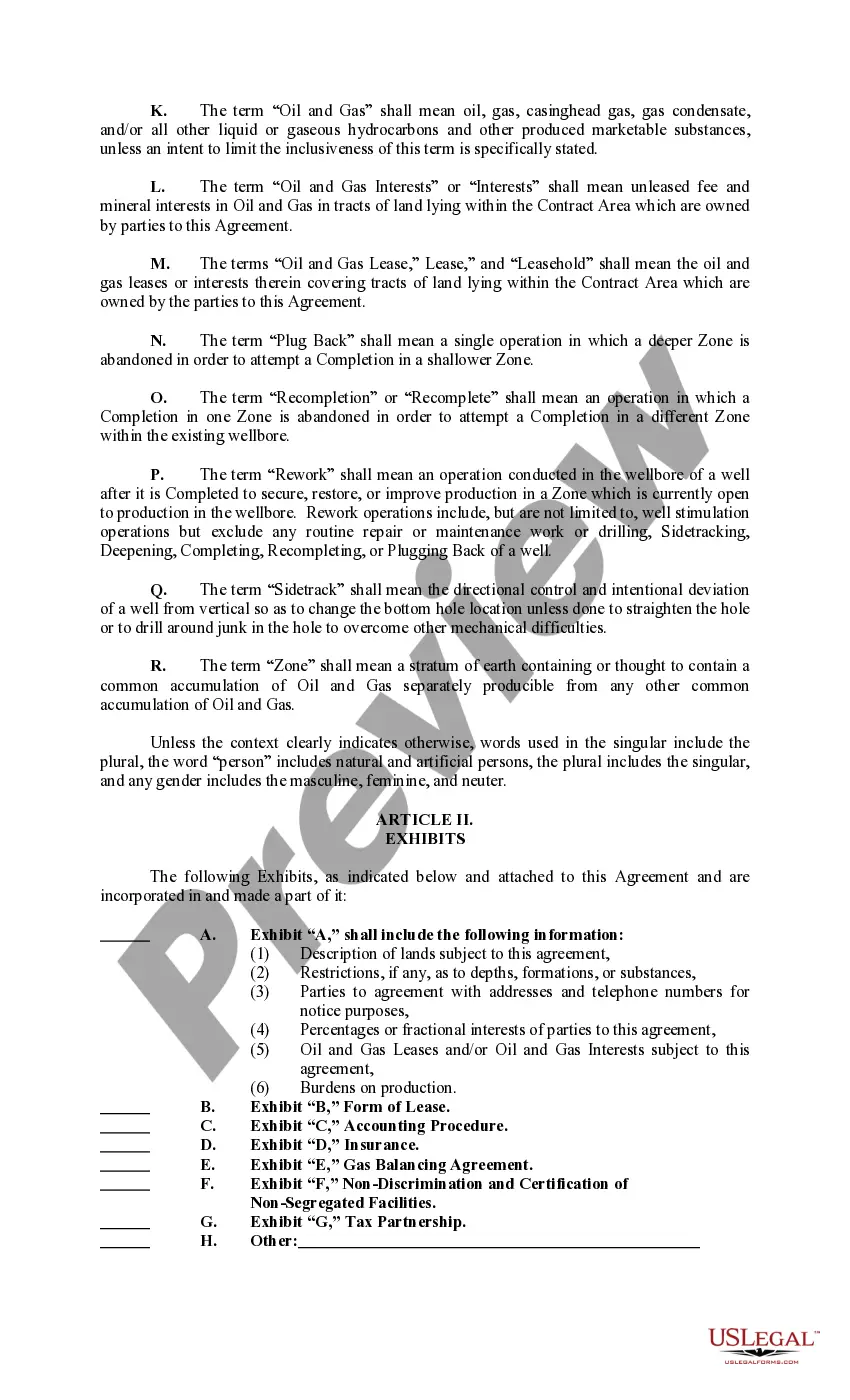

This operating agreement is used when the parties to this Agreement are owners of Oil and Gas Leases and/or Oil and gas Interests in the land identified in Exhibit A to the Agreement, and the parties have reached an agreement to explore and develop these Leases and/or Oil and Gas Interests for the production of Oil and Gas to the extent and as provided for in this Agreement.

Joint Operating Agreement 89 Revised

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Joint Operating Agreement 89 Revised?

When it comes to drafting a legal form, it’s better to leave it to the specialists. Nevertheless, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Joint Operating Agreement 89 Revised straight from the US Legal Forms site. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you’re signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Joint Operating Agreement 89 Revised fast:

- Make confident the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the document.

Once the Joint Operating Agreement 89 Revised is downloaded you are able to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

PetroChina $360bn. Royal Dutch Shell $345bn. Saudi Arabian Oil $330bn. BP $278bn. Exxon Mobil $265bn. Total $200bn. Chevron Corporation $146.5bn. Rosneft Oil Corporation $140bn.

#1. SCORE 9.151. Exxon Mobil Corporation. SCORE 9.014. Chevron Corporation. SCORE 8.843. 2018 Rank 3. SCORE 8.723. Valero Energy Corporation. SCORE 8.572. 2018 Rank 6. SCORE 8.401. Citgo Petroleum Corporation. SCORE 8.194. 2018 Rank 5. SCORE 7.882. 2018 Rank 9.

Exxon Mobil (NYSE:XOM) Suncor Energy (NYSE:SU) Enbridge (NYSE:ENB) Schlumberger (NYSE:SLB) Cheniere (NYSE:LNG) BP (NYSE:BP) Royal Dutch Shell (NYSE:RDS-B)

Chevron Corp. (CVX) Suncor Energy (SU) Magellan Midstream Partners (MMP) Enterprise Products Partners (EPD) BP (BP) Cheniere Energy (LNG) EOG Resources (EOG)

In the Oil and Gas industry, Operator means the individual, company, trust, or foundation responsible for the exploration, development, and production of an oil or gas well or lease. Generally, it is the oil company by whom the drilling contractor is engaged.

#1 China Petroleum & Chemical Corp. (SNP) #2 PetroChina Co. Ltd. (PTR) #3 Saudi Arabian Oil Co. (Saudi Aramco) (Tadawul: 2222) #4 Royal Dutch Shell PLC (RDS. A) #5 BP PLC (BP) #6 Exxon Mobil Corp. (XOM) #7 Total SE (TOT) #8 Chevron Corp. (CVX)

#1 China Petroleum & Chemical Corp. (SNP) #2 PetroChina Co. Ltd. (PTR) #3 Saudi Arabian Oil Co. (Saudi Aramco) (Tadawul: 2222) #4 Royal Dutch Shell PLC (RDS. A) #5 BP PLC (BP) #6 Exxon Mobil Corp. (XOM) #7 Total SE (TOT) #8 Chevron Corp. (CVX)

While ZipRecruiter is seeing annual salaries as high as $376,500 and as low as $24,500, the majority of Crude Oil Owner Operator salaries currently range between $91,000 (25th percentile) to $328,000 (75th percentile) with top earners (90th percentile) making $366,500 annually across the United States.

With the oil industry's headwinds in mind, three top oil companies worthy of investors' consideration are ConocoPhillips(NYSE:COP) a global E&P company; Enbridge (NYSE:ENB), a large-scale, diversified midstream company; and Phillips 66 (NYSE:PSX), a leading refining company with midstream, chemical, and distribution