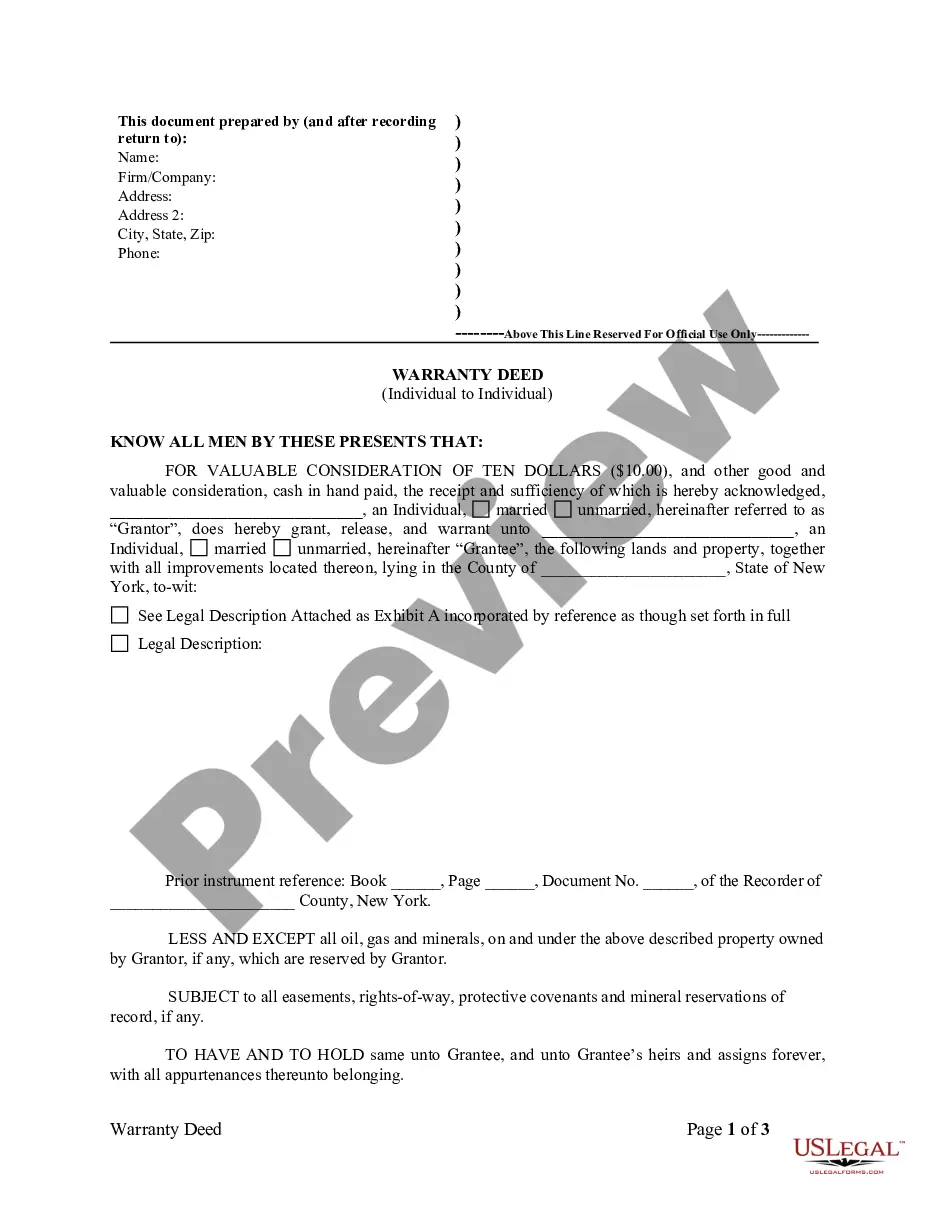

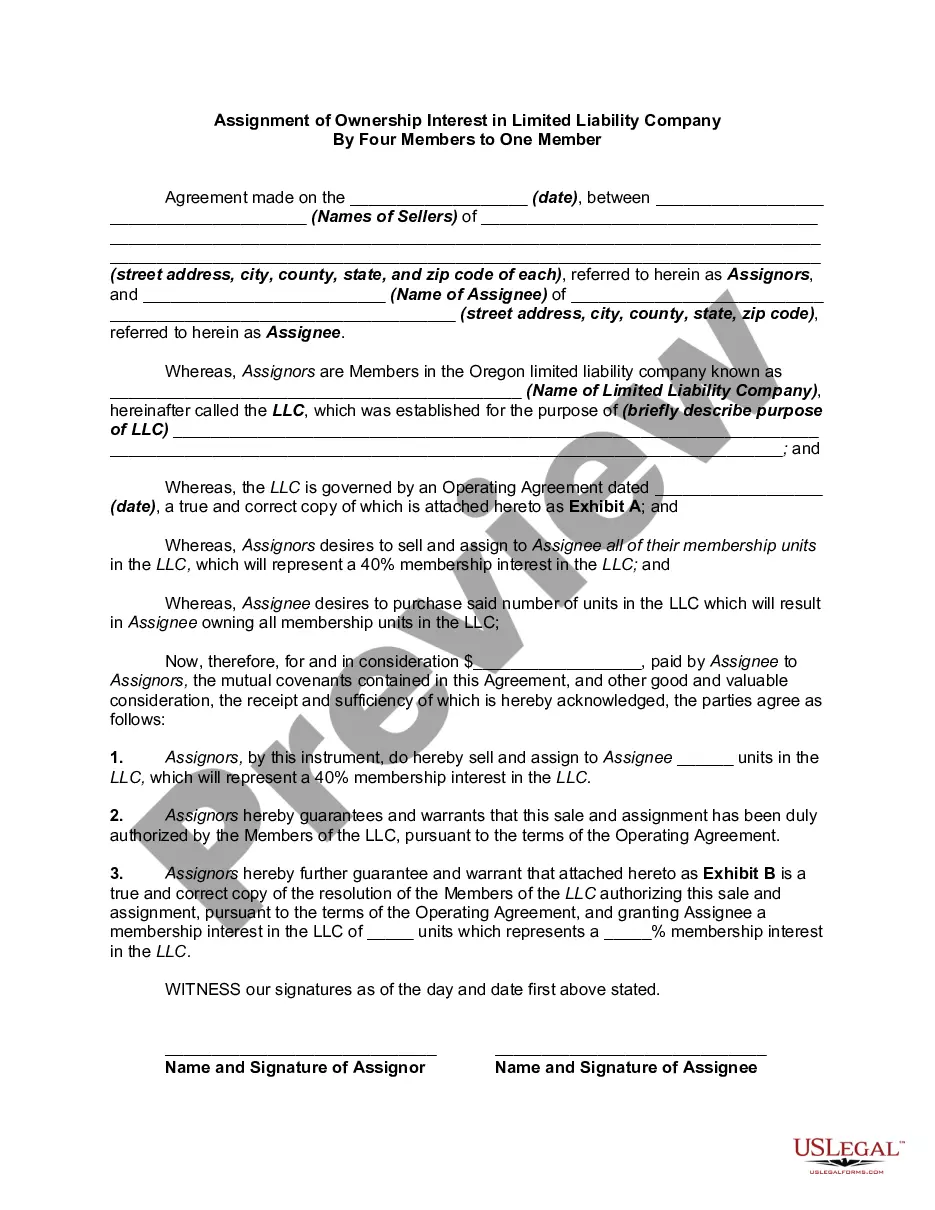

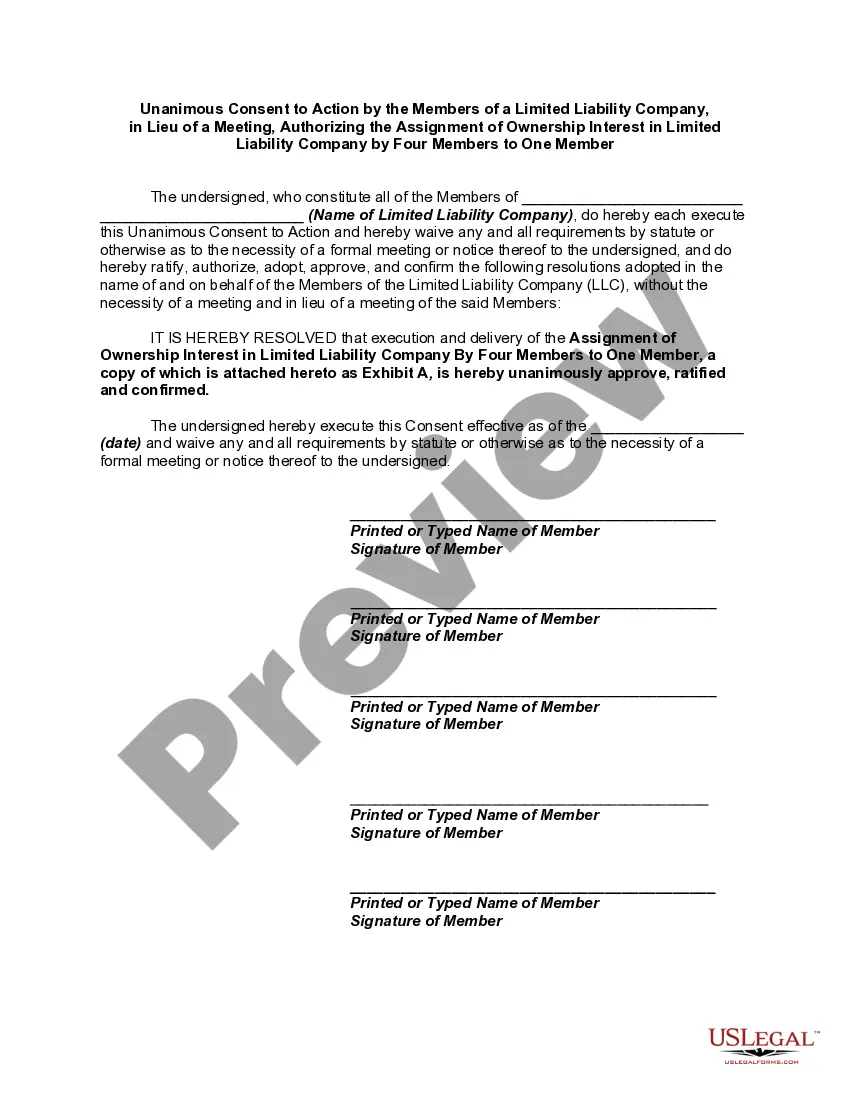

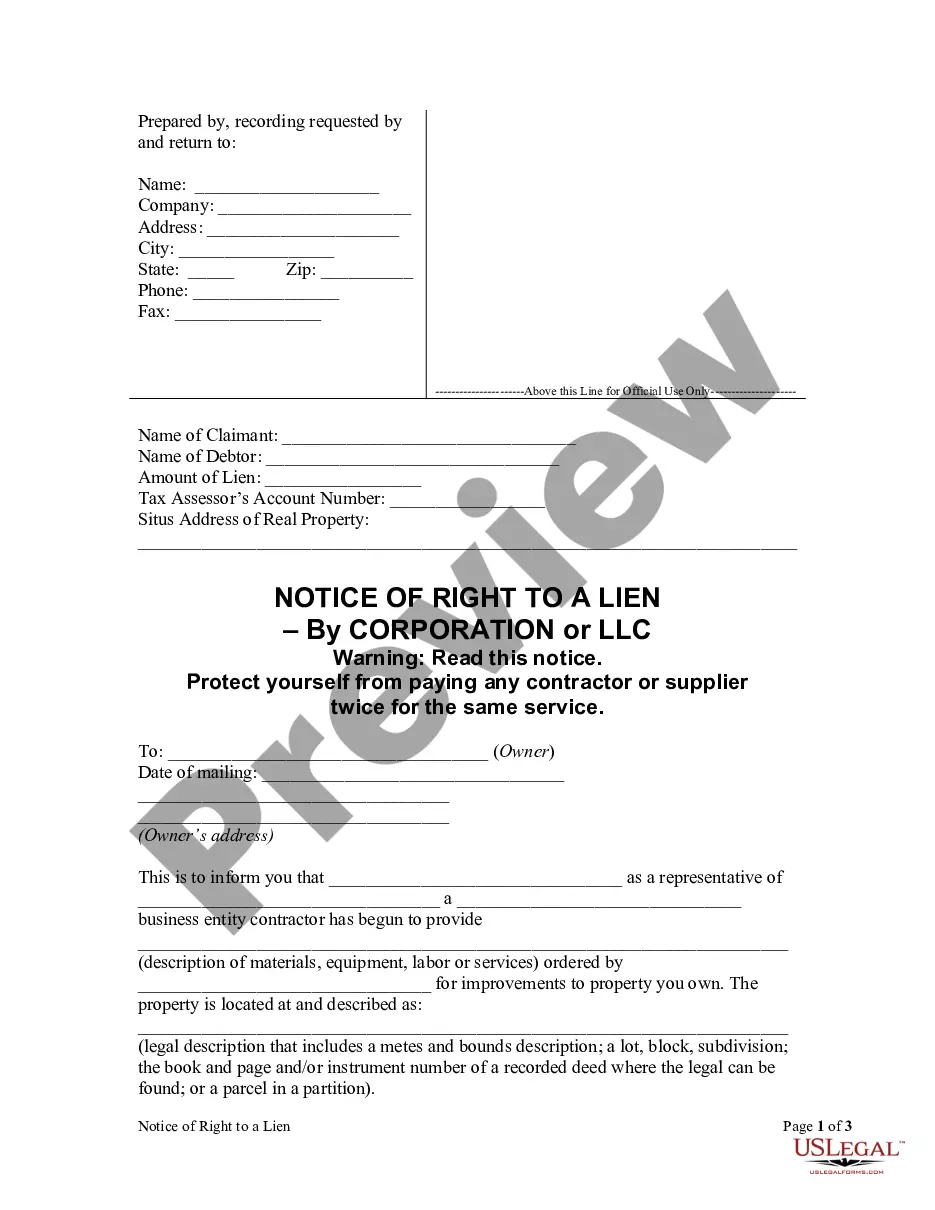

Exhibit A to Operating Agreement - Contract Area and Parties - Form 2

Description

How to fill out Exhibit A To Operating Agreement - Contract Area And Parties - Form 2?

When it comes to drafting a legal form, it’s better to leave it to the specialists. Nevertheless, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself can’t get a template to utilize, however. Download Exhibit A to Operating Agreement - Contract Area and Parties - Form 2 right from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. As soon as you’re registered with an account, log in, find a certain document template, and save it to My Forms or download it to your device.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Exhibit A to Operating Agreement - Contract Area and Parties - Form 2 fast:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Click Buy Now.

- Select the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the document.

Once the Exhibit A to Operating Agreement - Contract Area and Parties - Form 2 is downloaded you can complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

Step 1 Name Your LLC. Step 2 State of Jurisdiction (Choose Your State) Step 3 Select Type. Step 4 Principal Place of Business. Step 5 Registered Agent and Office. Step 6 Member Contributions. Step 7 Member Meetings. Step 8 Assignment of Interests.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties.

Draft the operating agreement?" Sometimes, yes (especially if you have multiple owners). But more often than not for single-owner businesses, you don't need a lawyer to start your business.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on