Due Diligence Field Review and Checklist

Description

Key Concepts & Definitions

Due diligence field review and checklist refers to a comprehensive process employed during the evaluation of a business or investment opportunity. The objective is to confirm all material facts, assess the accuracy of information, and ensure that there are no legal impediments to the deal. Typically, this involves reviewing financial records, legal contracts, and other pertinent documents.

Step-by-Step Guide

- Initial Preparation: Gather all necessary documents and records relevant to the transaction. It is crucial to outline the areas of focus such as financials, operations, and legal issues.

- Financial Review: Analyze financial statements, audit reports, and tax records to evaluate the financial health of the business.

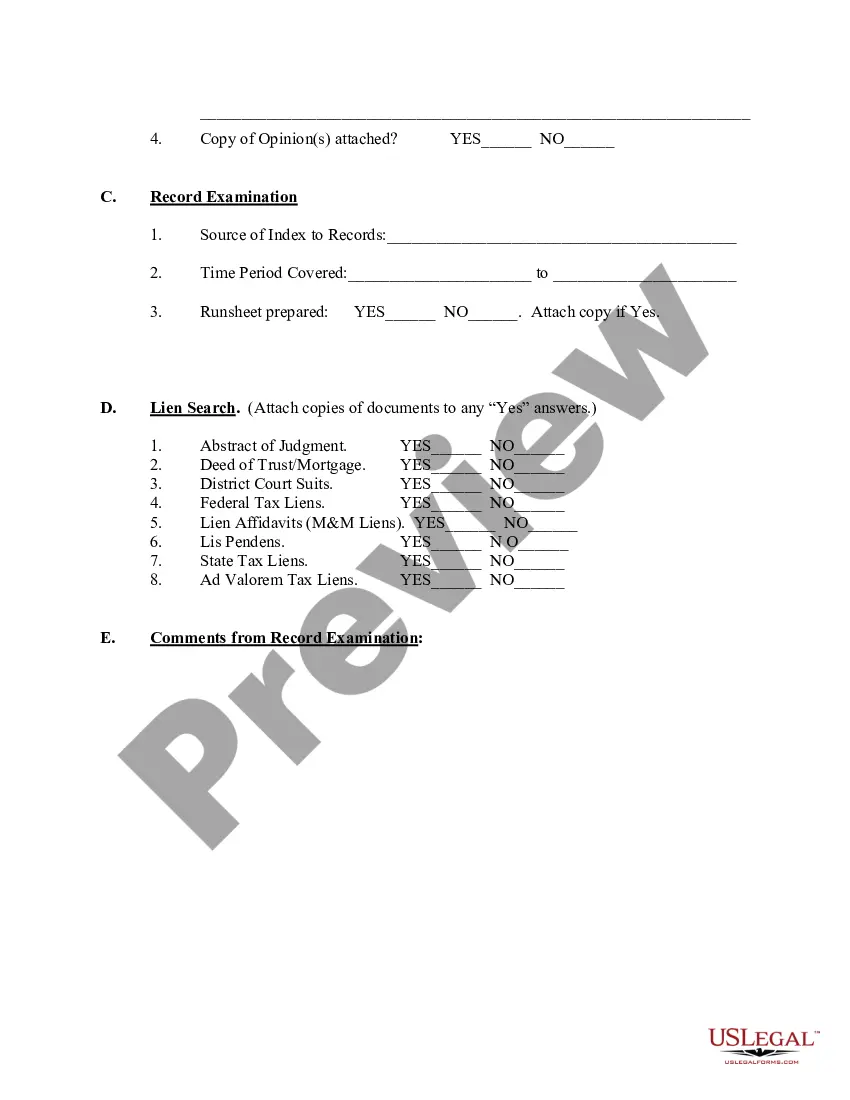

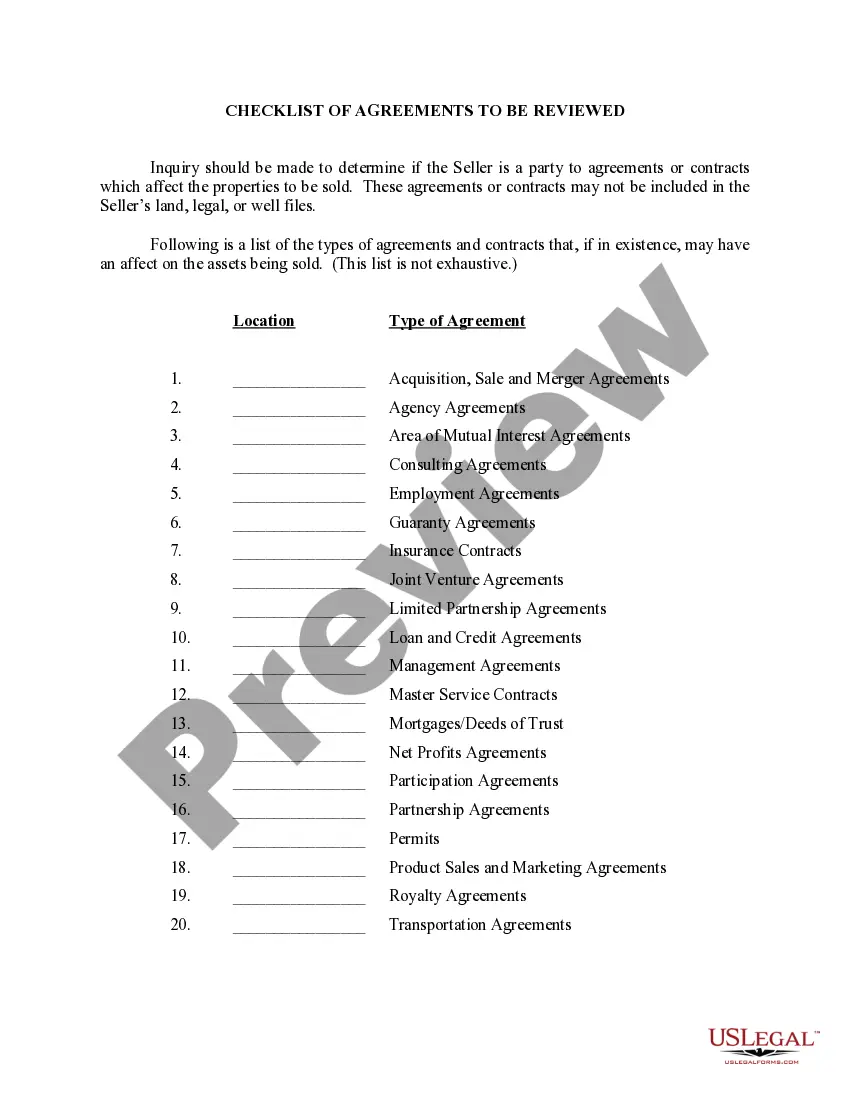

- Legal Review: Examine any legal agreements, past litigation, and compliance with laws to identify possible risks or liabilities.

- Operational Review: Assess the operational aspects of the business including, but not limited to, human resources policies, supply chain management, and asset conditions.

- Report Compilation: Summarize findings and prepare a detailed report that supports the investment decision-making process.

Risk Analysis

- Financial Risks: Misrepresentation of financial data or unresolved tax liabilities can pose significant financial risks.

- Legal Risks: Any ongoing or past litigation could potentially derange the investment value.

- Operational Risks: Inefficiencies in operational processes or issues with asset management may lead to unforeseen costs.

How to fill out Due Diligence Field Review And Checklist?

When it comes to drafting a legal document, it’s better to delegate it to the specialists. However, that doesn't mean you yourself can not get a sample to utilize. That doesn't mean you yourself cannot get a sample to utilize, however. Download Due Diligence Field Review and Checklist right from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Due Diligence Field Review and Checklist quickly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Press Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

Once the Due Diligence Field Review and Checklist is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

The report will include a list of key findings and valid recommendations, as well as a reasoned conclusion with a financial analysis explaining the feasibility of our recommendations, and its impact on the company.

There are several reasons why due diligence is conducted: To confirm and verify information that was brought up during the deal or investment process. To identify potential defects in the deal or investment opportunity and thus avoid a bad business transaction.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Company information. Who owns the company? Finances. Where are the company's quarterly and annual financial statements from the past several years? Products and services. What are the company's current and future products and services? Customers. Technology assets. IP assets. Physical assets. Legal issues.

Due diligence is the investigation of every aspect of a property that could affect its value and suitability as a home or investment. Unfortunately for many buyers, due diligence involves little more than a building and pest inspection and contract review. These steps are essential, but only form part of the process.

Due Diligence Examples Conducting thorough inspections on a property before buying it in order to make sure that it is a good investment. An underwriter auditing an issuer's business and operations prior to selling it.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.