Oklahoma Renunciation And Disclaimer of Real Property Interest

What this document covers

The Renunciation and Disclaimer of Real Property Interest is a legal document that allows a beneficiary to refuse interest in real property following the death of a decedent. This form is specifically designed under Oklahoma law, allowing beneficiaries to formally decline their inherited rights and thereby avoid any associated tax liabilities or responsibilities. Unlike other estate planning forms, this document is used exclusively for disclaiming an interest in real estate, making it a critical tool for beneficiaries wanting to opt-out of inheritance.

Key components of this form

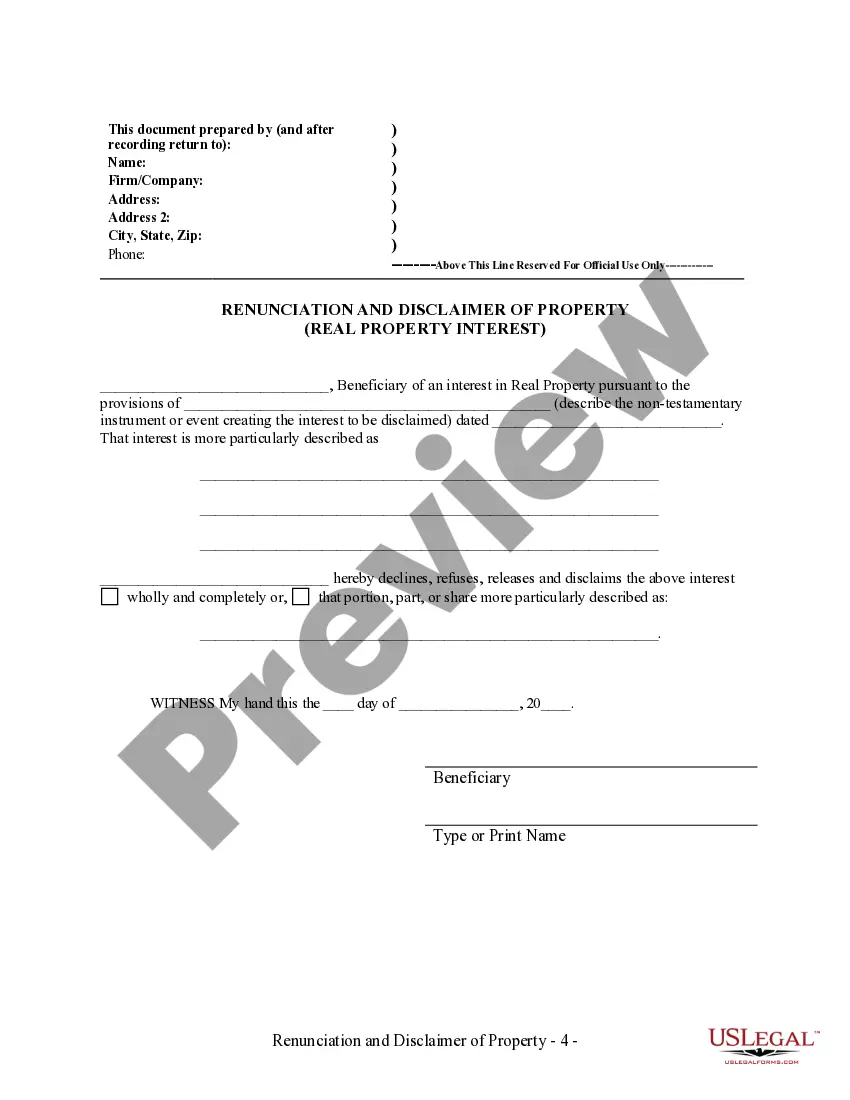

- Declaration of disclaimer: A formal statement where the beneficiary renounces their property interest.

- Property description: Detailed identification of the specific real property being disclaimed.

- Timing clause: An assertion that the disclaimer will be filed within nine months of the decedent's death.

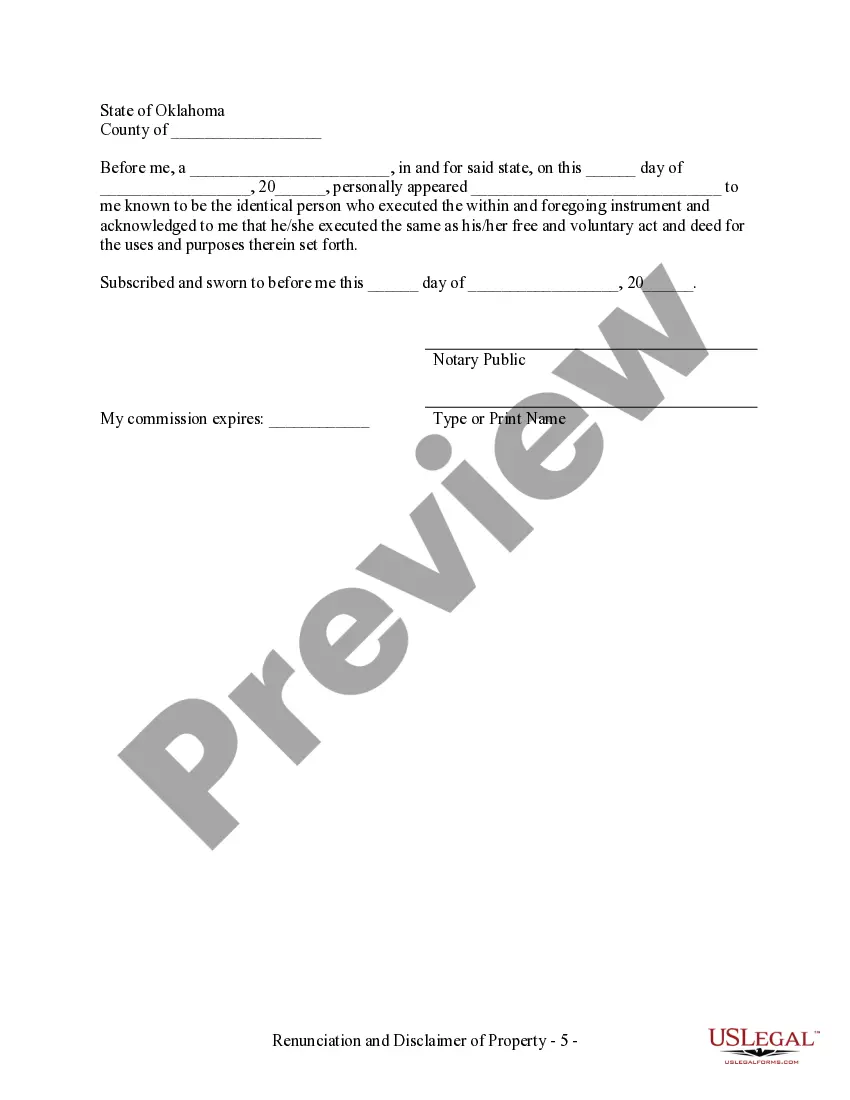

- Acknowledgment section: A state-specific section that requires the beneficiary's signature, along with a notary acknowledgment.

Legal requirements by state

This form is designed specifically under Oklahoma Statutes, Title 60, Chapter 15. It adheres to state laws governing the renunciation of real property interests, including specific timelines and requirements for executing the disclaimer.

When to use this document

This form should be used in situations where an individual is designated as a beneficiary of real estate but chooses to reject that inheritance. Common scenarios include wanting to avoid estate taxes, protecting against potential liabilities tied to the property, or resolving family disputes over property distribution.

Intended users of this form

- Individuals who are beneficiaries of a decedent's estate and wish to renounce their interest in real property.

- Heirs looking to avoid potential tax liability associated with inherited real estate.

- Anyone who needs to formally document their decision to disclaim an inheritance in favor of other heirs or beneficiaries.

Steps to complete this form

- Identify the parties involved, including the beneficiary and the decedent.

- Clearly describe the real property interest that is being disclaimed.

- Complete the declaration of disclaimer by indicating whether the interest is being wholly or partially refused.

- Include the date and signatures as required, ensuring the document is properly witnessed and notarized.

- File the completed disclaimer within nine months after the decedent's passing to ensure its validity.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Avoid these common issues

- Failing to complete the form within the nine-month deadline.

- Not properly identifying the specific real property being disclaimed.

- Omitting signatures or not using a notary when required.

Advantages of online completion

- Convenience of accessing and completing the form from home.

- Editability, allowing users to fill out the document at their own pace.

- Reliable, state-specific templates drafted by licensed attorneys.

Form popularity

FAQ

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

These documents can include the will, death certificate, transfer of ownership forms and letters from the estate executor or probate court.If you received the inheritance in the form of cash, request a copy of the bank statement that reflects the deposit.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.