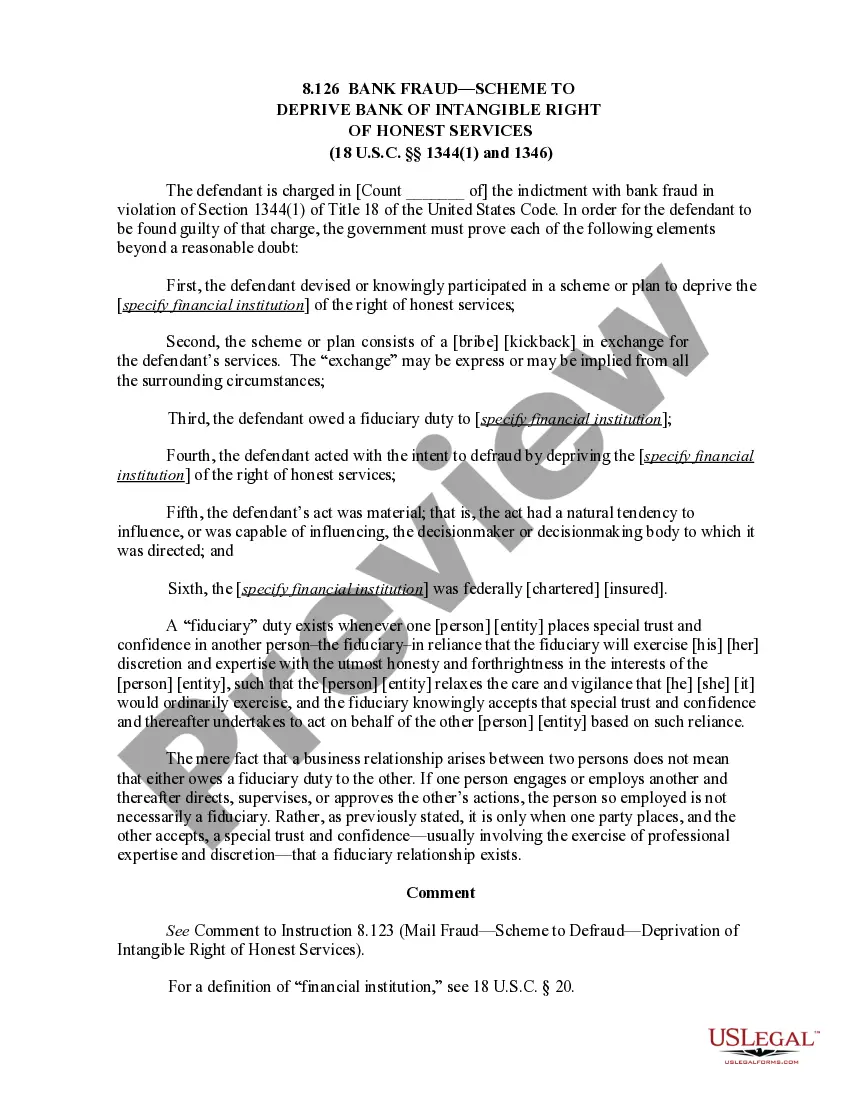

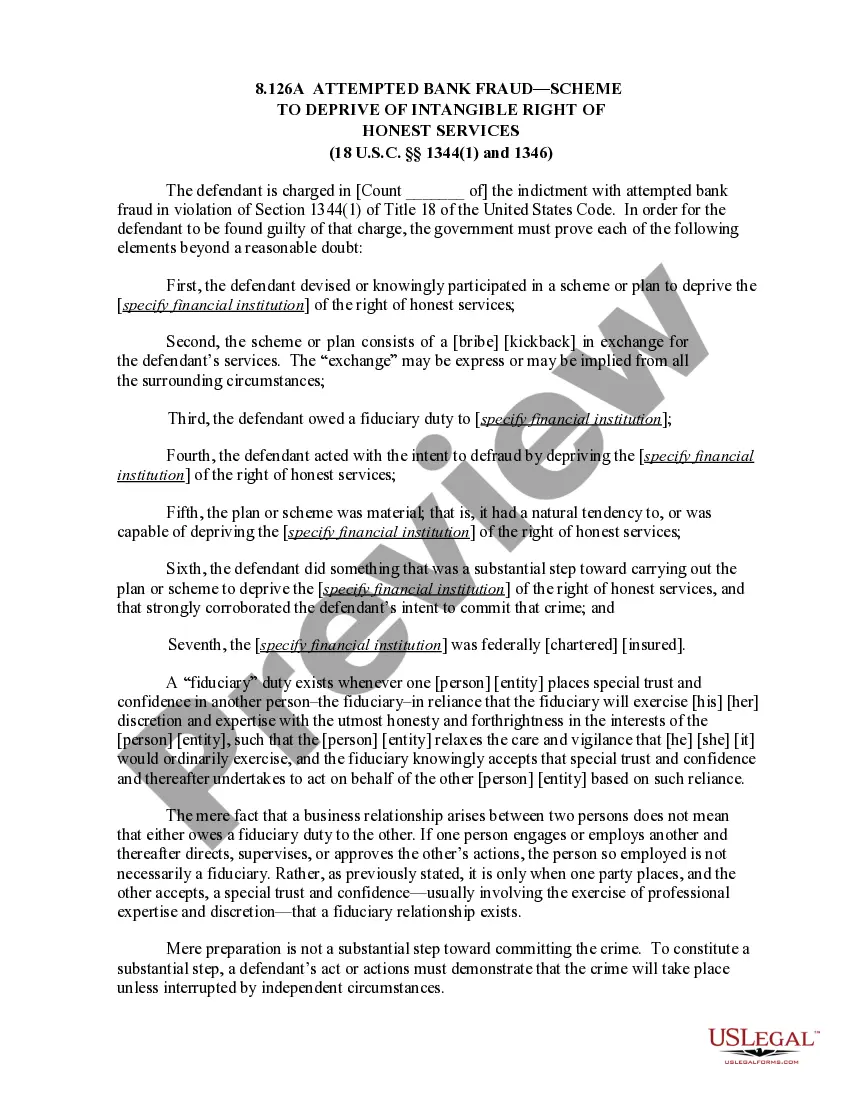

8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)) is a type of fraud wherein an individual or group of individuals use false or deceptive promises to defraud a bank or financial institution of its funds. This type of fraud is punishable under the United States Code in Title 18, Section 1344. The most common type of 8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)) is when an individual or group of individuals makes false or misleading statements in an attempt to obtain money or property from a financial institution. This could include promises of payment or returns that cannot be fulfilled or statements of future performance that are not true. Other types of fraud that fall under this category include check forgery, credit card fraud, and identity theft. In some cases, this type of fraud may also involve creating false documents that appear to be from a legitimate bank or financial institution. In the United States, 8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)) is a federal crime and can be punished by up to 30 years in prison and a fine of up to $1 million. Those found guilty of this type of fraud may also be subject to forfeiture of any assets or proceeds gained from the fraudulent activity.

8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2))

Description

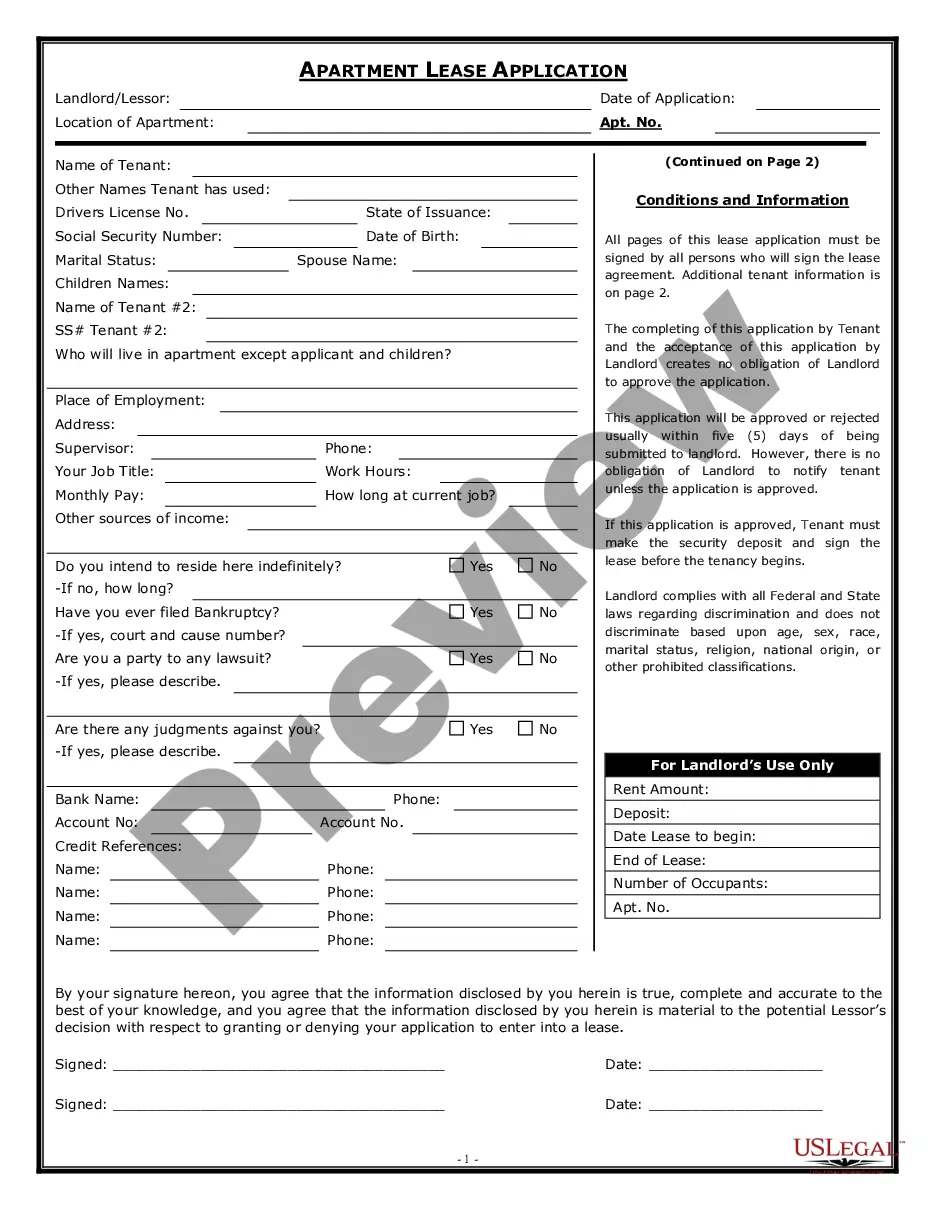

How to fill out 8.127 Bank Fraud-Scheme To Defraud By False Promises (18 U.S.C. Sec. 1344(2))?

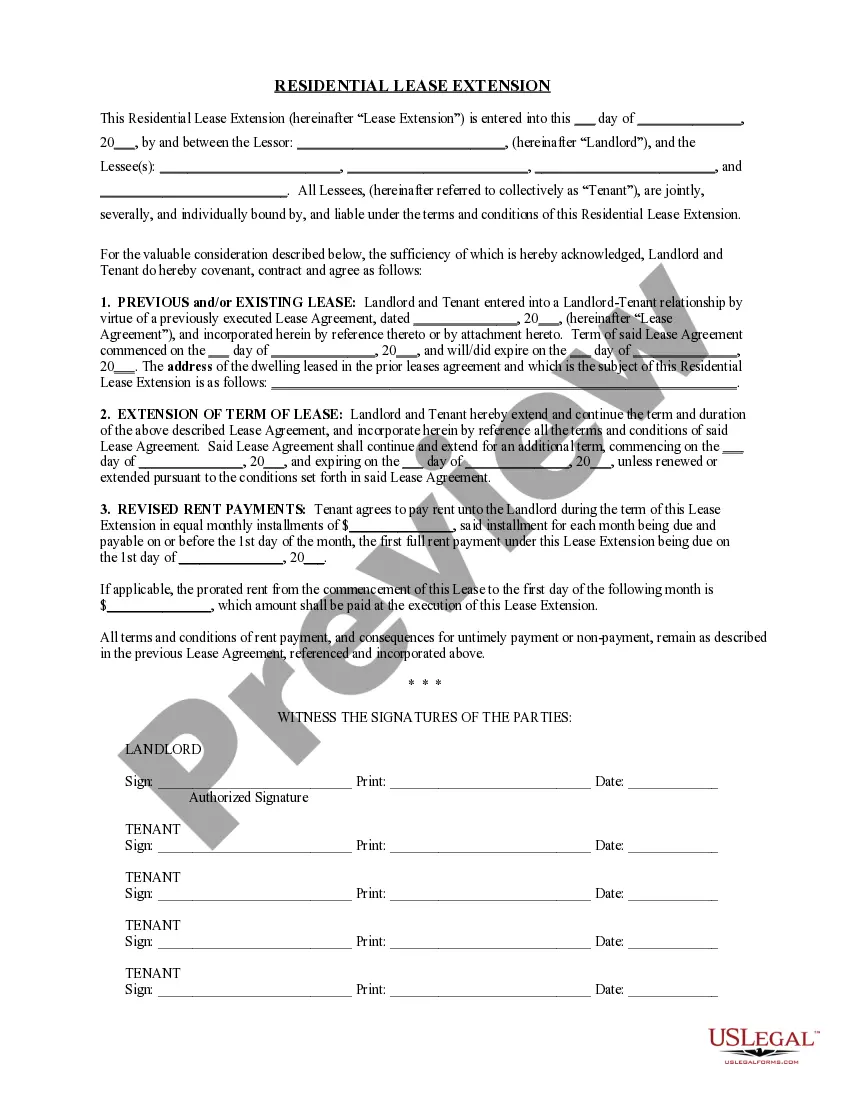

How much time and resources do you usually spend on drafting official paperwork? There’s a better option to get such forms than hiring legal experts or spending hours searching the web for a suitable template. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, like the 8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)).

To get and prepare an appropriate 8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)) template, adhere to these simple steps:

- Examine the form content to ensure it meets your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the 8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)). If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally secure for that.

- Download your 8.127 Bank Fraud-Scheme to Defraud by False Promises (18 U.S.C. Sec. 1344(2)) on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

It violates PC 532a(1) making false financial statements. If convicted of this crime, you could be facing up to 3 years in prison.

The bank fraud penalty varies depending on the exact charges the accused faces. But in general, punishment for bank fraud includes jail time and fines. For example, for an individual convicted of a state jail felony for forgery, the sentence could include up to 2 years in prison and up to $10,000 in fines.

In those cases, the company cancels the loan before it is funded. With other companies, you may have to immediately repay loan funds you've received if the lender learns that you've misrepresented yourself. Your credit score and ability to take out loans in the future may also be impacted if you are caught lying.

Section 1344 of Title 18, United States Code, covers any scheme to defraud occurring on or after October 12, 1984. The statutory language is modeled directly after the mail fraud statute.

Prison. Misdemeanor misappropriation of funds convictions bring with them the possibility of up to one year in jail, while felony convictions come with sentences of at least a year or more in prison. Depending on the state, felony convictions can bring sentences of up to 10 years or more. Fines.

Ing to U.S. law, forgery (which includes faking a bank stub and passing it off as an original statement) is a federal crime. Depending on the type of document that was altered and the exact charges, punishments for individuals convicted of forgery are jail time and paying fines of up to $10,000, or both.

Section 1344. 1344. The deposition taken must, by the magistrate, be sealed up and transmitted to the Clerk of the Court in which the action is pending or may come for trial.

The bank usually pays for stolen credit card purchases. Sometimes, the merchant is responsible. The consumer almost never pays for stolen credit card purchases.