Stock Redemption Agreements with exhibits of Fair Lanes, Inc.

Description

How to fill out Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

When it comes to drafting a legal form, it is easier to delegate it to the specialists. However, that doesn't mean you yourself can not get a sample to use. That doesn't mean you yourself cannot get a template to use, however. Download Stock Redemption Agreements with exhibits of Fair Lanes, Inc. straight from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Stock Redemption Agreements with exhibits of Fair Lanes, Inc. promptly:

- Make sure the document meets all the necessary state requirements.

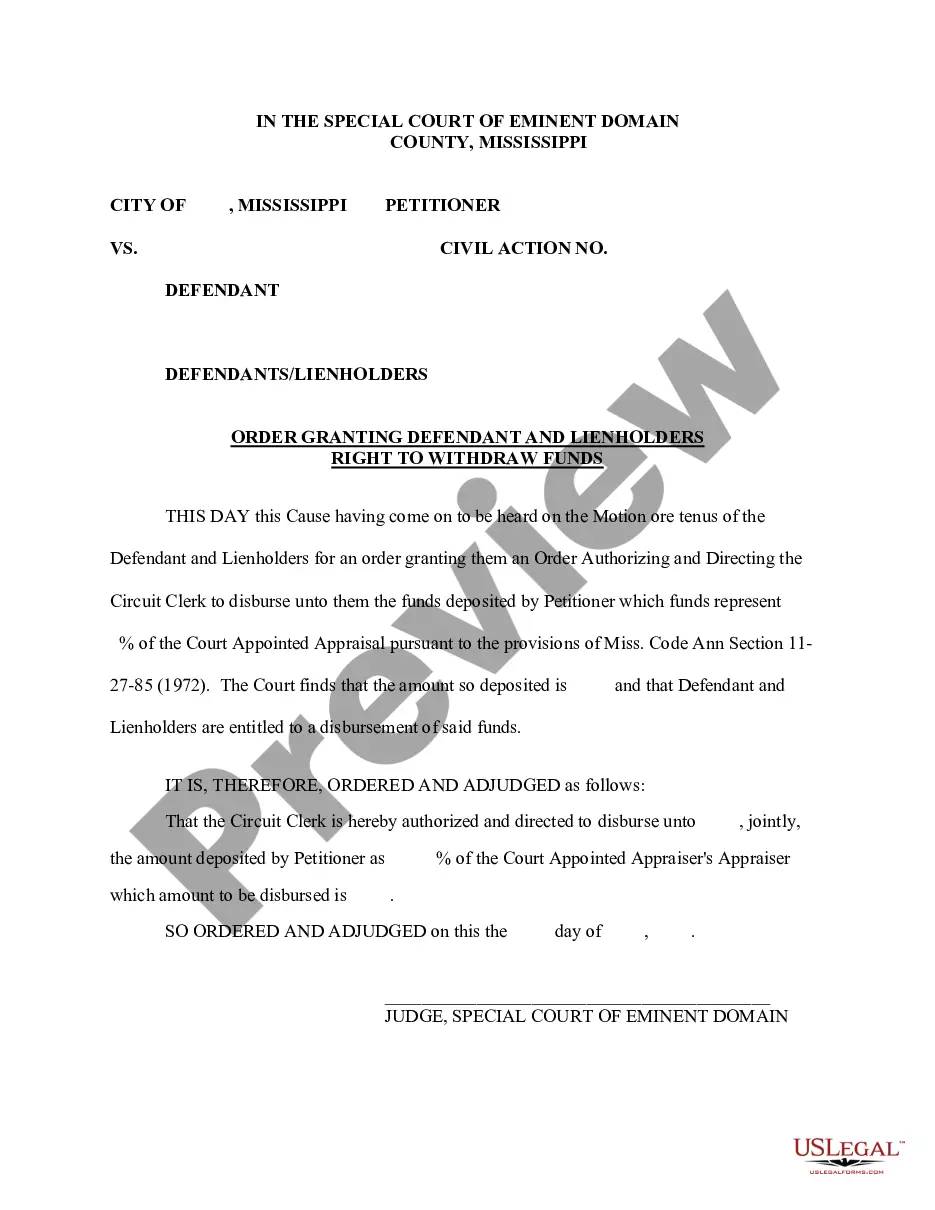

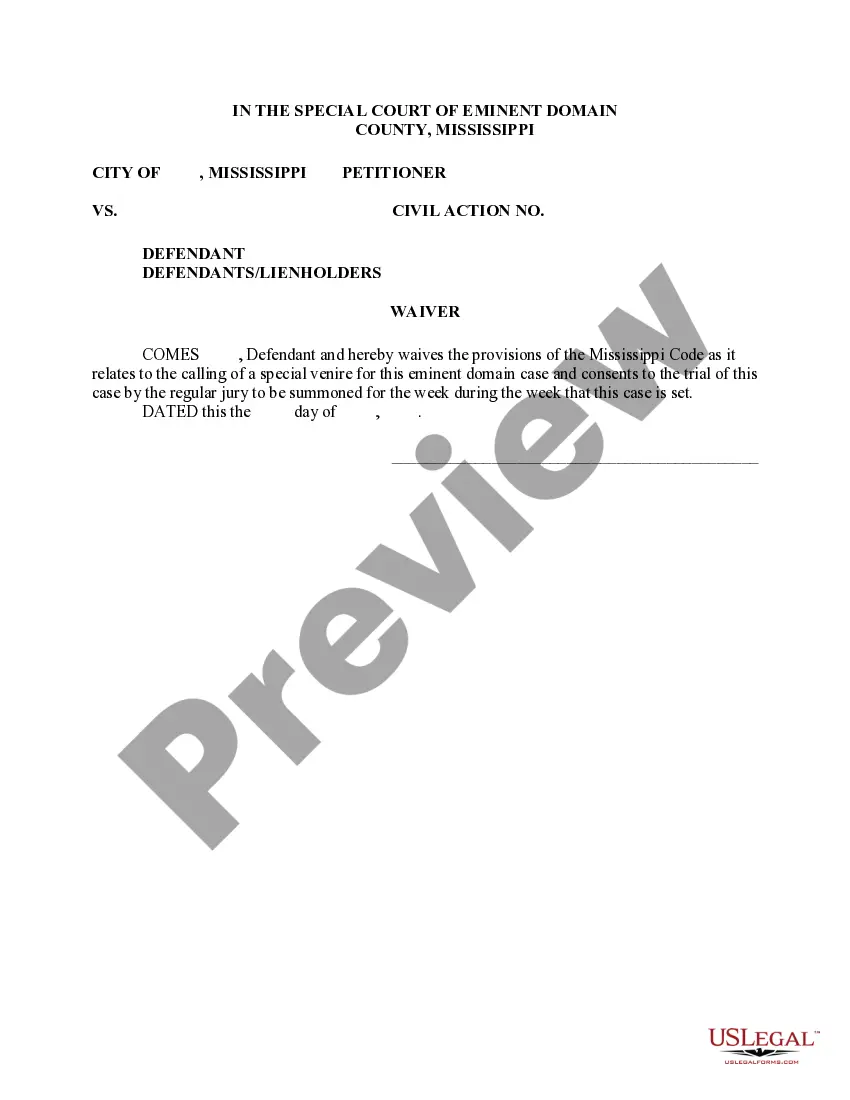

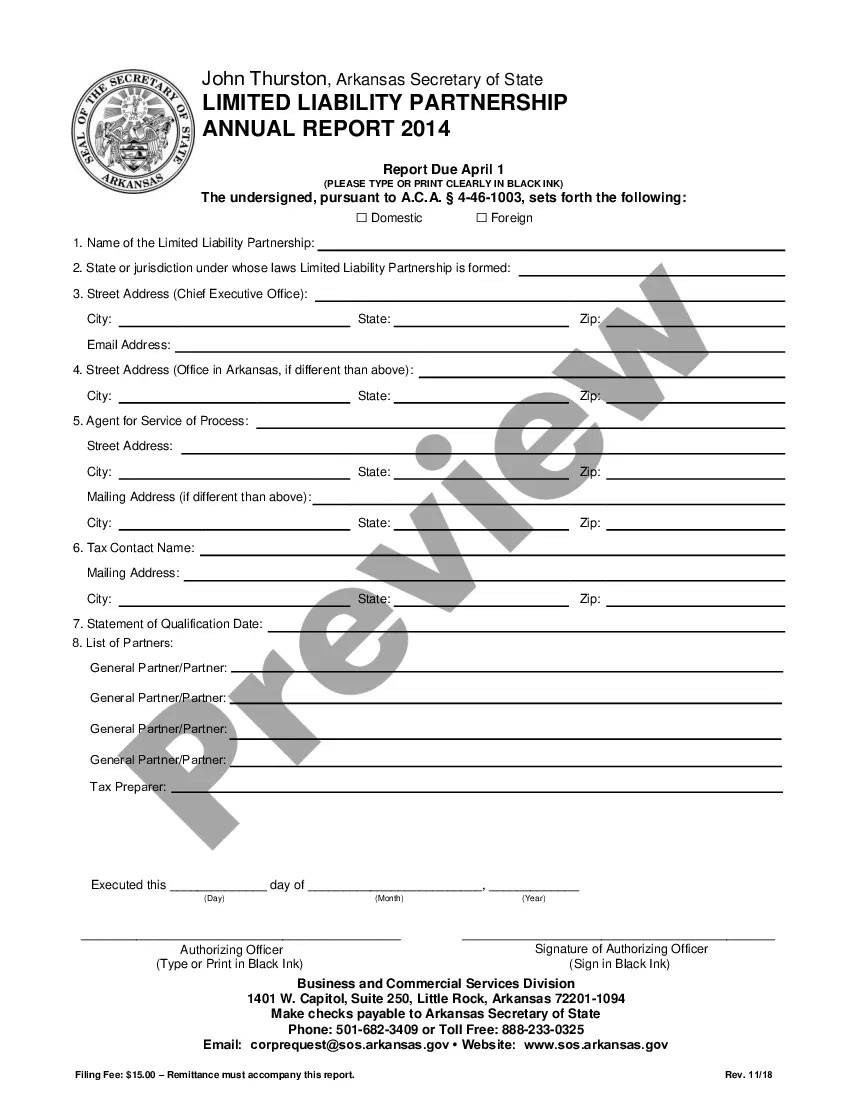

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Stock Redemption Agreements with exhibits of Fair Lanes, Inc. is downloaded you can fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

If the stock redemption significantly decreases the stockholder's equity stake in the corporation, then the stock redemption is treated as a capital sale, in which a stockholder will either have a capital gain or loss, just as if the stock was sold on the market.

In finance, redemption describes the repayment of any money market fixed-income security at or before the asset's maturity date. Investors can make redemptions by selling part or all of their investments such as shares, bonds, or mutual funds.

Accounting for Redemptions on the Corporation's Books Debit the treasury stock account for the amount the company paid for the redemption. Credit the company's cash account for any payments already made to the shareholder. Credit accounts receivable for any future payment obligations.

The general rule for a stock redemption payment received by a C corporation shareholder is the payment is treated as a taxable dividend to the extent of the corporation's earnings and profits (similar to the financial accounting concept of retained earnings).