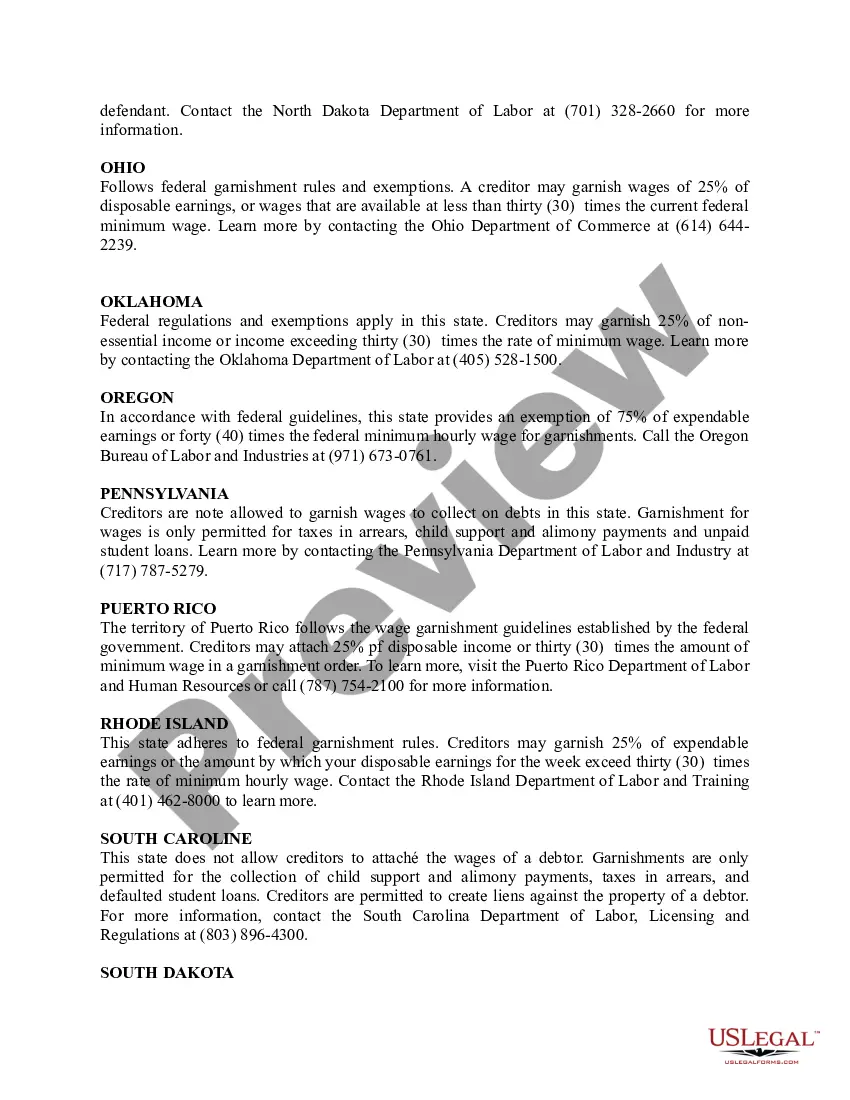

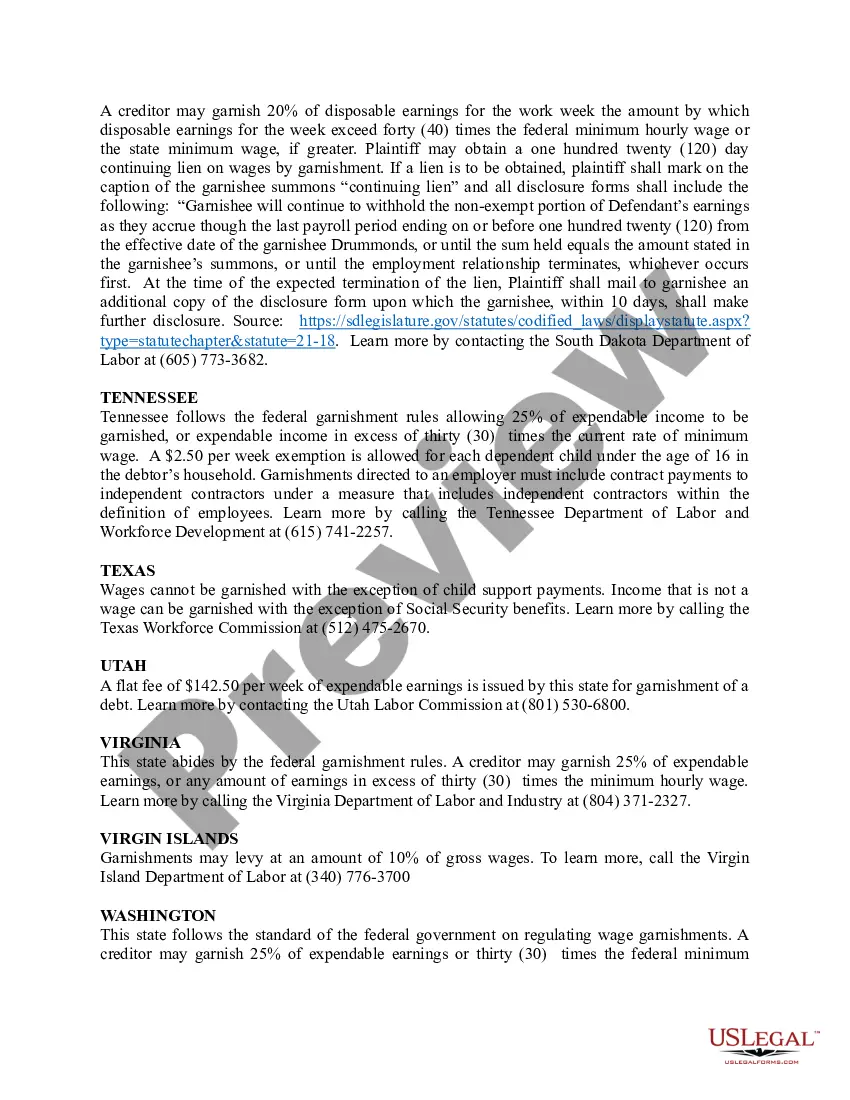

Garnishment Laws — State-by-State refer to the legal statutes and regulations that determine how creditors in the United States can collect money owed to them from debtors. These laws vary from state to state, with some states having stricter regulations than others. Generally, garnishment laws allow creditors to take a portion of a debtor's wages, bank accounts, or other sources of income to pay the debt. Some states may also allow creditors to seize property or assets to satisfy debts owed. The two main types of garnishment laws — State-by-State are wage garnishment and bank account garnishment. Wage garnishment is the process of withholding a portion of a debtor’s wages to pay off a debt. It is important to note that there are limits on how much a creditor can garnish from a debtor’s wages. Bank account garnishment is the process of a creditor taking money from a debtor’s bank account to pay off a debt. This type of garnishment is typically limited to the amount of money in the debtor’s account at the time of the garnishment. Overall, garnishment laws — State-by-State are designed to protect debtors from aggressive creditors while ensuring that creditors are able to collect money owed to them.

Garnishment Laws - State-by-State

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Garnishment Laws - State-by-State?

If you’re searching for a way to appropriately complete the Garnishment Laws - State-by-State without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of paperwork you find on our web service is created in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to obtain the ready-to-use Garnishment Laws - State-by-State:

- Ensure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Garnishment Laws - State-by-State and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. ing to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

In Florida, bank account garnishment is authorized by Chapter 77 of the Florida Statutes. Under Section 77.03, a judgment creditor can request that a court issue a writ of garnishment. Once issued, the creditor serves the bank with the garnishment.

States that prohibit wage garnishment for consumer debt: North Carolina. Pennsylvania. South Carolina. Texas.

A wage garnishment is a legal procedure where a portion of a person's earnings is required to be withheld by an employer for the payment of a debt. In general, a creditor in Hawaii may garnish up to 25% of the disposable earnings.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

With few exceptions, all wages are fully protected from garnishment in North Carolina, Pennsylvania, South Carolina, and Texas. Judgment creditors may seek to evade these protections by serving the wage garnishment order on the consumer's employer's office in another state.

Federal law gives states the option of protecting a larger portion of a debtor's paycheck. State law protections include 4 states (North Carolina, Pennsylvania, South Carolina, and Texas) that ban wage garnishment for consumer debts.