Sample Letter for Closing of Estate with no Distribution

Description

Definition and meaning

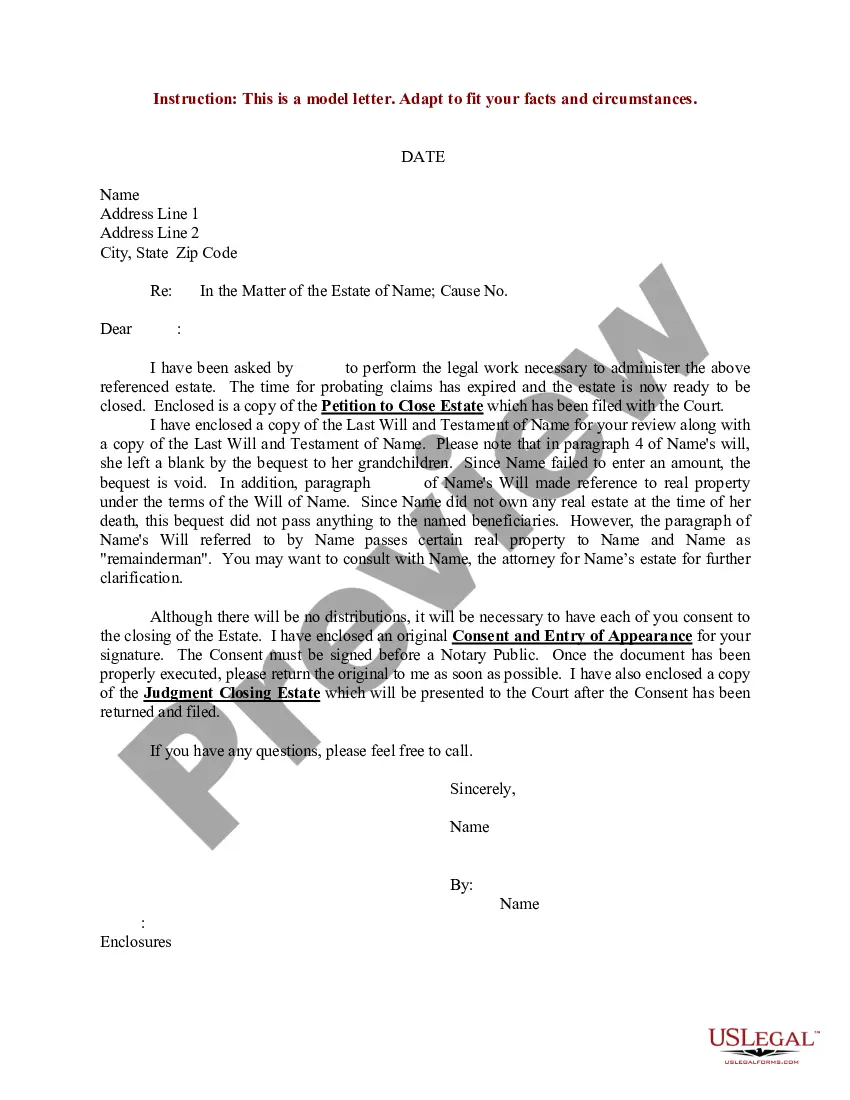

A Sample Letter for Closing of Estate with no Distribution is a formal document used to notify interested parties that an estate is being closed. This letter is particularly relevant when the estate does not hold any assets for distribution to beneficiaries. It serves to inform all parties involved and ensures that they understand the final steps in the estate's administration.

Who should use this form

This form is intended for estate administrators or personal representatives who are responsible for managing the estate after the death of the individual. Additionally, this letter is useful for beneficiaries or interested parties who need to acknowledge the closure of the estate without expecting any distribution.

Legal use and context

In legal terms, closing an estate involves ensuring all assets and debts are accounted for before finalizing the estate's administration. This letter is typically filed with the court to formally close the estate and to provide documentation that there are no distributions to be made.

Key components of the form

The key components of a Sample Letter for Closing of Estate with no Distribution include:

- The date of the letter.

- The name and address of the estate administrator.

- A reference to the estate's name and relevant court case information.

- A summary of the estate's status, noting any void bequests or lack of real property.

- A request for consent from interested parties.

- Instructions for notarization and return of documents.

Common mistakes to avoid when using this form

When preparing a Sample Letter for Closing of Estate with no Distribution, it is crucial to avoid the following mistakes:

- Failing to provide complete and accurate names and addresses.

- Neglecting to include all necessary enclosures, such as the Petition to Close Estate.

- Not obtaining the required notarization for signatures.

- Overlooking the deadline for submitting the letter to the court.

What documents you may need alongside this one

Along with the Sample Letter for Closing of Estate with no Distribution, you may need the following documents:

- A Petition to Close Estate.

- A copy of the Last Will and Testament of the deceased.

- A Consent and Entry of Appearance form.

- Judgment Closing Estate documentation.

How to fill out Sample Letter For Closing Of Estate With No Distribution?

Use US Legal Forms to obtain a printable Sample Letter for Closing of Estate with no Distribution. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms catalogue on the web and provides reasonably priced and accurate samples for customers and attorneys, and SMBs. The templates are grouped into state-based categories and many of them can be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Sample Letter for Closing of Estate with no Distribution:

- Check to make sure you have the right form with regards to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search field if you need to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Closing of Estate with no Distribution. Above three million users have already utilized our service successfully. Select your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

If the estate is small and has a reasonable amount of debt, six to eight months is a fair expectation. With a larger estate, it will likely be more than a year before everything settles.

Examples could include: If unknown/unspecified debtors arise, the executor can delay settlement for up to six months, whilst the debtor is settled.

If no backup executor was selected by the deceased person, the court will appoint someone who is appropriate. Usually, this is another close relative of the individual who has passed away. The appointed person will be called a personal administrator or an estate administrator in these situations.

Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate. Why does settling an estate take time?

For those who wish to continue to receive estate tax closing letters, estates and their authorized representatives may call the IRS at (866) 699-4083 to request an estate tax closing letter no earlier than four months after the filing of the estate tax return.

If no one moves to open or settle an estate, all assets in the estate could be lost, instead of being distributed to loved ones or other beneficiaries. Probate is not an automatic process. When a loved one dies, a family member or other interested party must petition the probate court to open an estate.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

The court can remove an executor who is not following the law, who is not following the will, or who is not fulfilling his duties. The court can appoint a new personal representative to oversee the estate.For example, if the executor refuses to pay estate taxes, he could be held responsible for penalties and interest.