Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

Use the most comprehensive legal library of forms. US Legal Forms is the perfect place for finding up-to-date Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages templates. Our service offers a large number of legal forms drafted by licensed lawyers and categorized by state.

To obtain a sample from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and choose the document you are looking for and buy it. Right after buying templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

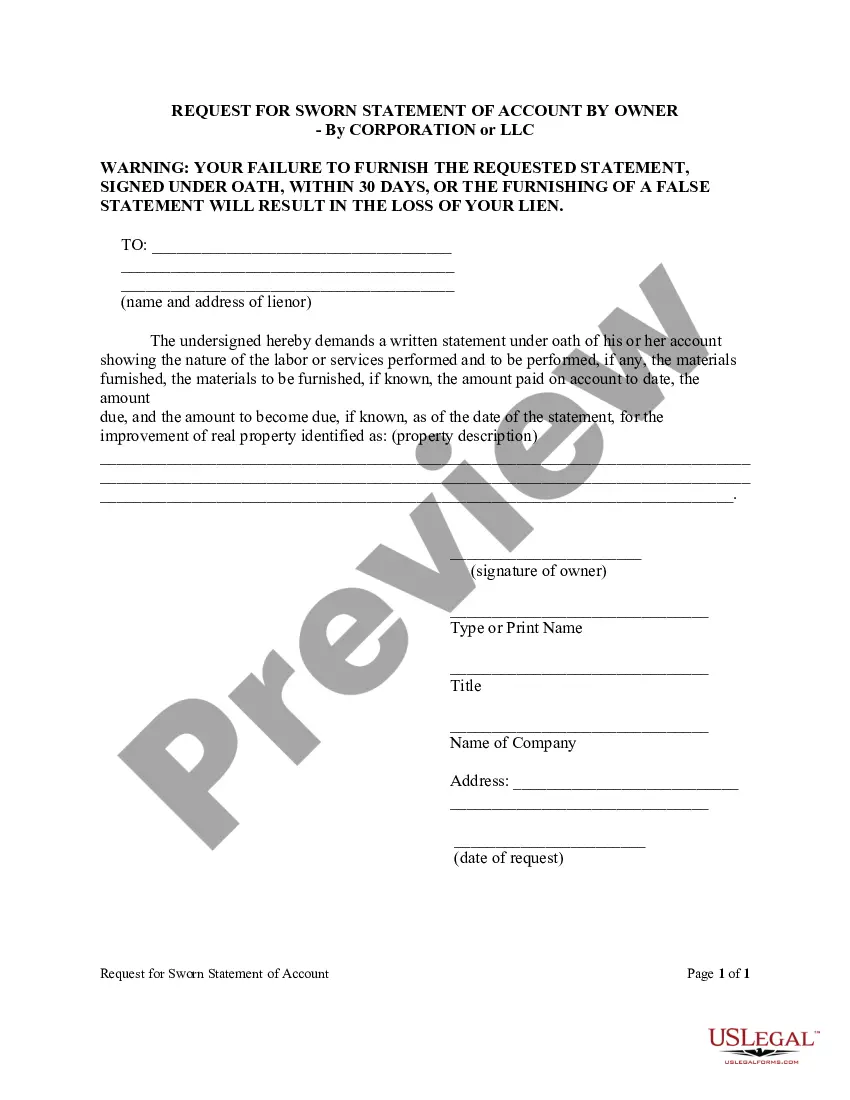

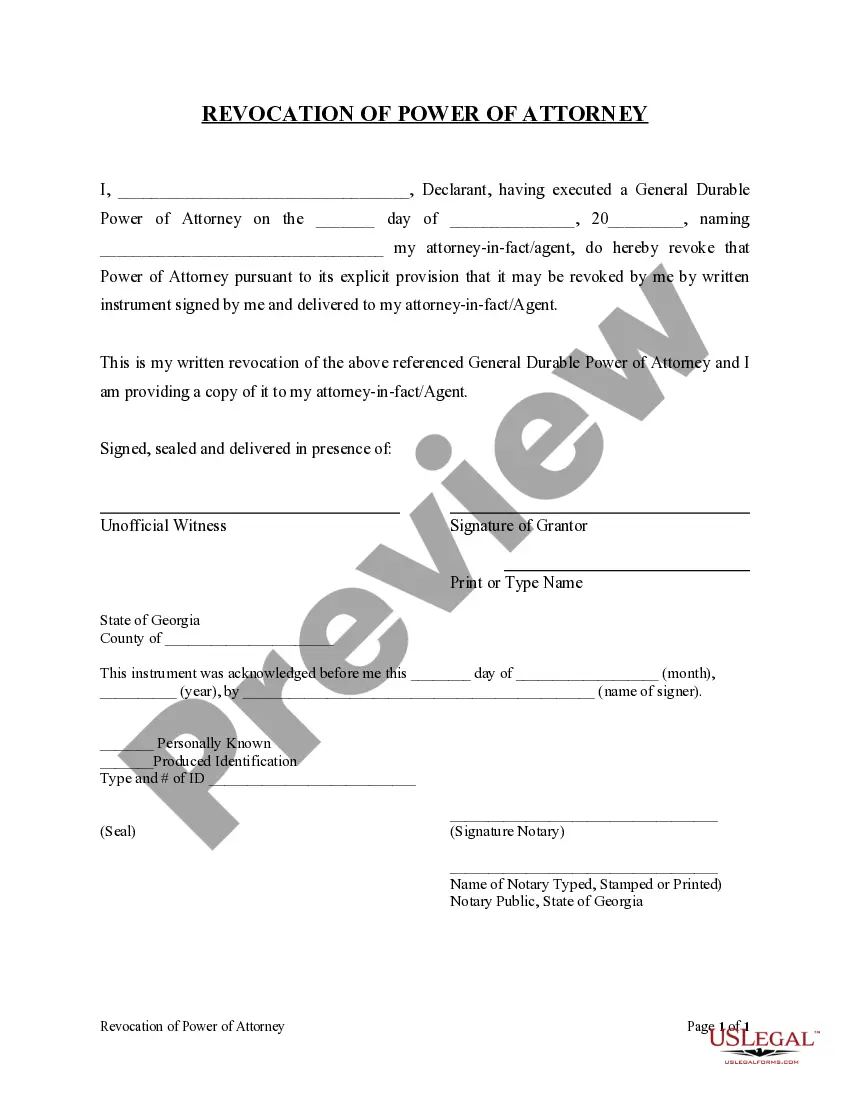

- If the template has a Preview function, utilize it to check the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your needs.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/credit card.

- Choose a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill in the Form name. Join a large number of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Inheritance is Considered Separate Property It's also considered separate property under California law. This means that it is yours, and yours alone, if and when you get a divorce. Your spouse will have no ownership rights to that inheritance.

This insures the inheritance rights of their children from prior marriages in their respective estates, without having the estate reduced by the share given to the surviving spouse under the laws of intestacy.

A waiver of service or summons means that a party voluntarily enters a lawsuit without requiring the opposing party to serve them with a summons and petition.

If you and your spouse cannot reach an agreement between you and the court needs to decide how your finances should be divided, your spouse is entitled to a fair settlement even though they have cheated.

Negotiate a postnuptial agreement. Negotiate a divorce. Explicitly disinherit your spouse in your will and trust, understanding that your spouse will still be entitled to his/her community property share or Right of Election share.

You can use a prenuptial agreement to protect any assets you possess before entering into the marriage, including an inheritance. Inherited property is one of the assets many people agree isn't really a marital asset as long as it hasn't become part of the community property in the marriage.

A Member's spouse uses the Spousal Waiver Form to waive his/her legal right to pension benefits after the Member's death. If the Member wishes to select a form of pension that doesn't provide income to his spouse after the Member dies, then the spouse must complete this form prior to the Member's retirement.

The right to reside in the matrimonial home and the right to a financial settlement at the termination of marriage are the two distinct rights which are underlying the marriage contract. It is noted that women will choose to leave economic advantages during divorce settlements to obtain sole custody of their children.

If you received an inheritance before marriage, you get credit for the balance of the inheritance you had on the date of marriage.If you received your inheritance during the marriage, then you can exclude the value of the inheritance you have left on the date of separation from your net family property.