Sample Letter for Deed of Trust and Promissory Note

Description

How to fill out Sample Letter For Deed Of Trust And Promissory Note?

Use US Legal Forms to get a printable Sample Letter for Deed of Trust and Promissory Note. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms library on the internet and offers reasonably priced and accurate samples for customers and lawyers, and SMBs. The templates are grouped into state-based categories and some of them might be previewed prior to being downloaded.

To download samples, users need to have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

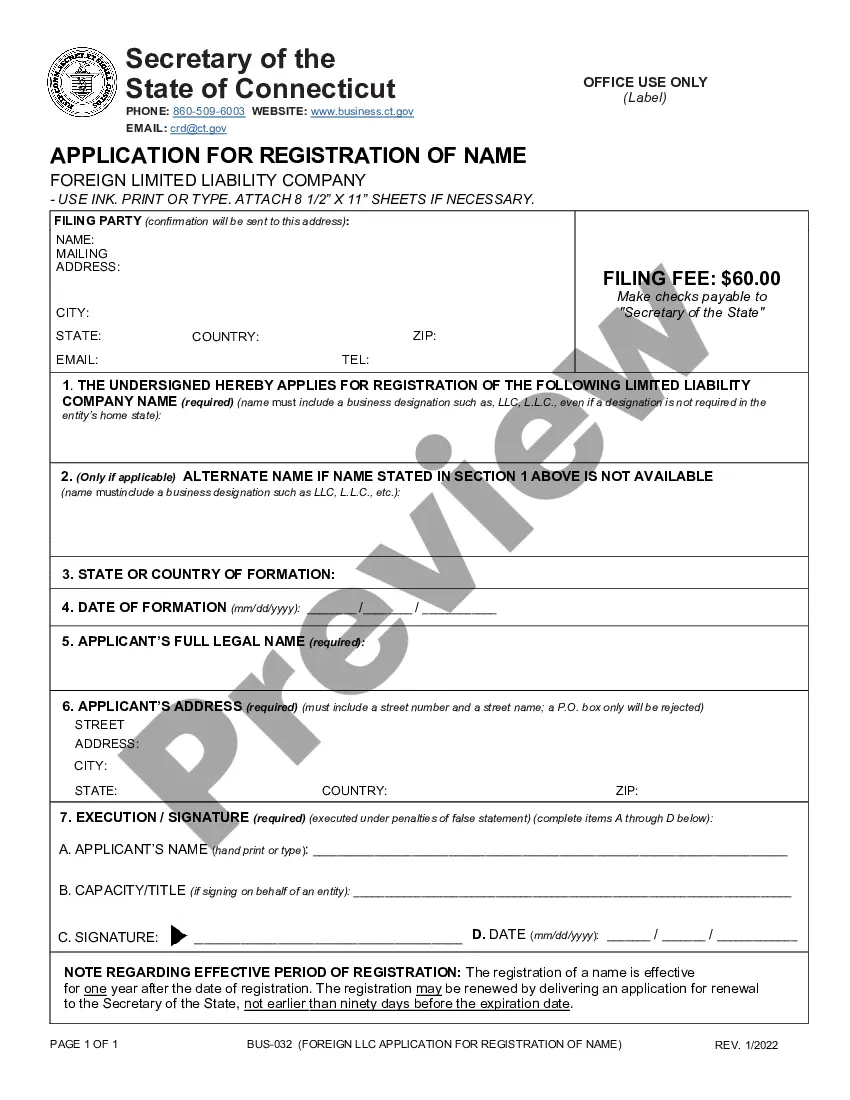

For individuals who do not have a subscription, follow the following guidelines to quickly find and download Sample Letter for Deed of Trust and Promissory Note:

- Check to ensure that you have the proper form in relation to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Deed of Trust and Promissory Note. More than three million users already have used our service successfully. Choose your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Typically in a residential settlement, the signers of the Note and the Deed of Trust are the same, but this is not always the case. The Note itself has virtually nothing to do with the property.The Deed of Trust is the document that grants the lender the rights to take the property if the loan is not repaid.

Deeds of trust are used in conjunction with promissory notes. The deed of trust is the security for the amount loaned to finance the real estate purchase, and is secured by the underlying piece of real estate. The deed of trust is what secures the promissory note.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.