Request for Credit Information

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Request For Credit Information?

Handling legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Request for Credit Information template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is simple and quick. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Request for Credit Information within minutes:

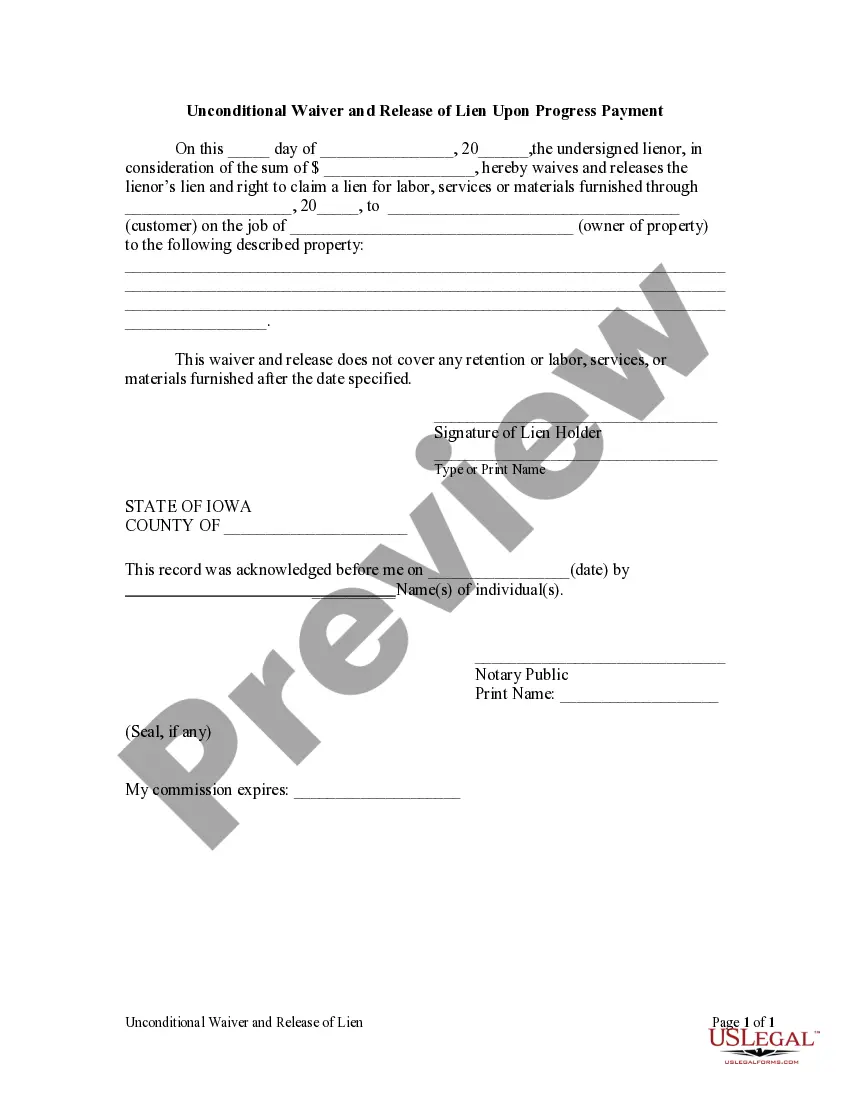

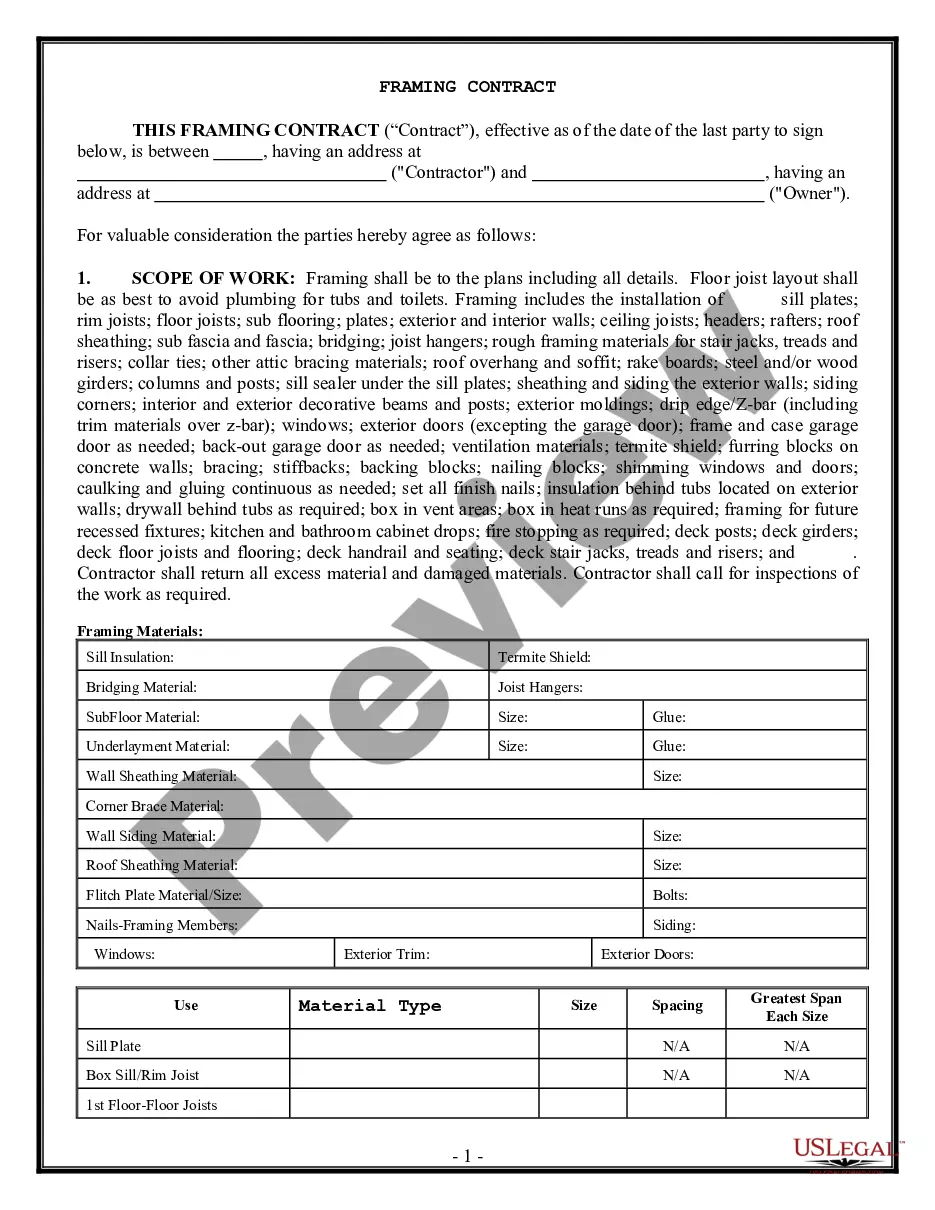

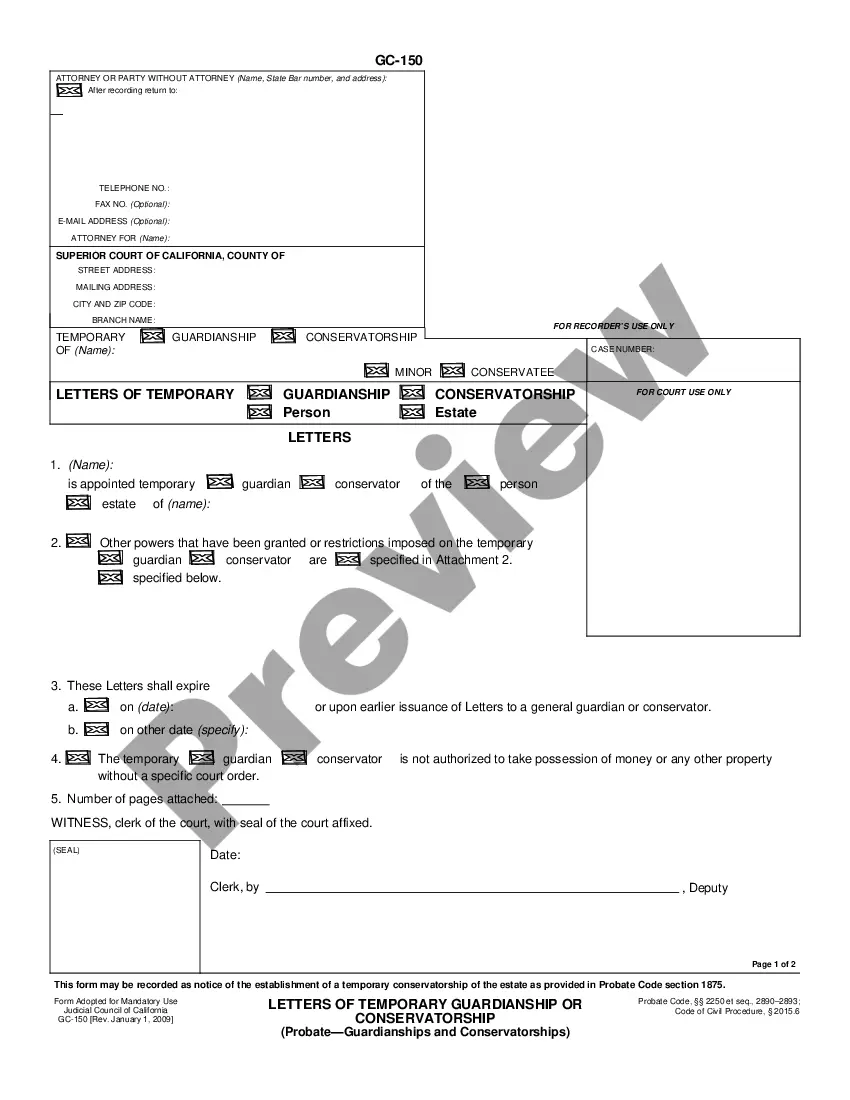

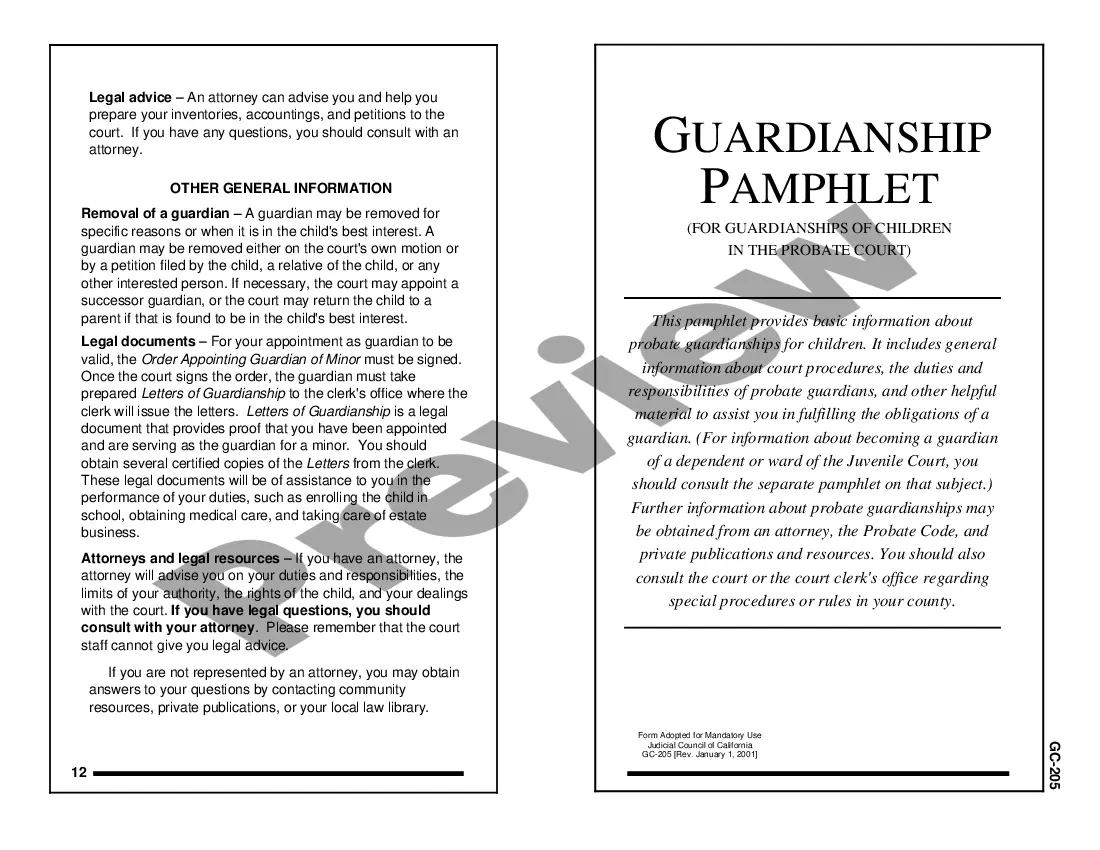

- Remember to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Request for Credit Information in the format you need. If it’s your first time with our service, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Request for Credit Information you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

You may request your reports: Online by visiting AnnualCreditReport.com. By calling 1-877-322-8228 (TTY: 1-800-821-7232) By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Equifax: 1-800-685-1111; Equifax.com/personal/credit-report-services. Experian: 1-888-397-3742; Experian.com/help. TransUnion: 1-888-909-8872; TransUnion.com/credit-help.

Dear Sir or Madam: I would like to request a copy of my credit report file. I am providing the following information to obtain the report. Please contact me if you have any questions or need additional information.

Online: If you request your report at AnnualCreditReport.com , you should be able to access it immediately. Phone: If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days.

Credit reporting is a voluntary process. There's nothing you can do to force a creditor to report an account to the credit bureaus. And you can't make a creditor update your account outside of its normal credit reporting cycle. You can ask, but you need to be ready for ?We can't do that? as the response.

Checking your own credit report is not an inquiry about new credit, so it has no effect on your score. In fact, reviewing your credit report regularly can help you to ensure that the information the credit reporting companies share with lenders is accurate and up-to-date.

Who can see your credit report Lenders. Whenever you apply for a loan, lenders will check a copy of your credit report and reference your credit score when deciding whether to approve you.Creditors.Landlords.Employers.Insurance companies.Government agencies.Utility companies.

Getting your credit report can help protect your credit history from errors and help you spot signs of identity theft. Check to be sure the information is accurate, complete, and up-to-date. It's important to do this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job.