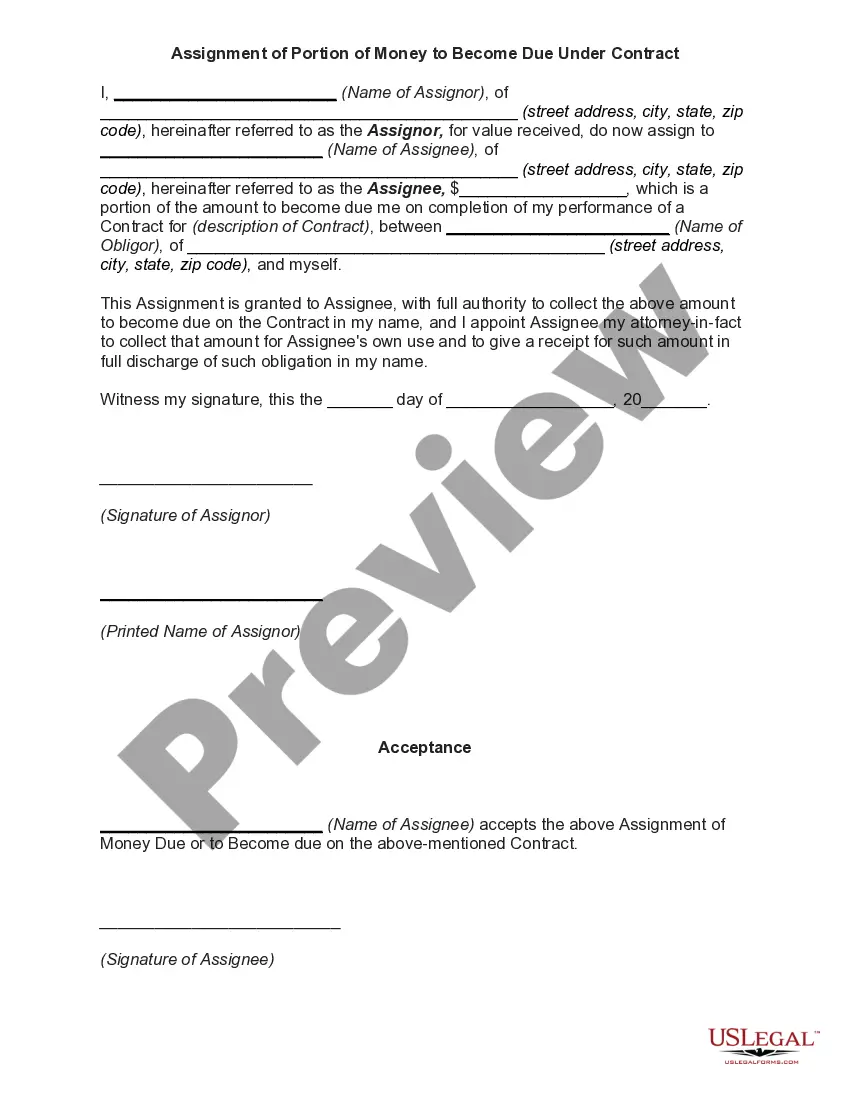

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

Aren't you sick and tired of choosing from countless templates every time you want to create a Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness? US Legal Forms eliminates the wasted time millions of American citizens spend browsing the internet for perfect tax and legal forms. Our professional crew of lawyers is constantly changing the state-specific Templates catalogue, to ensure that it always offers the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription should complete a few simple steps before having the capability to download their Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness:

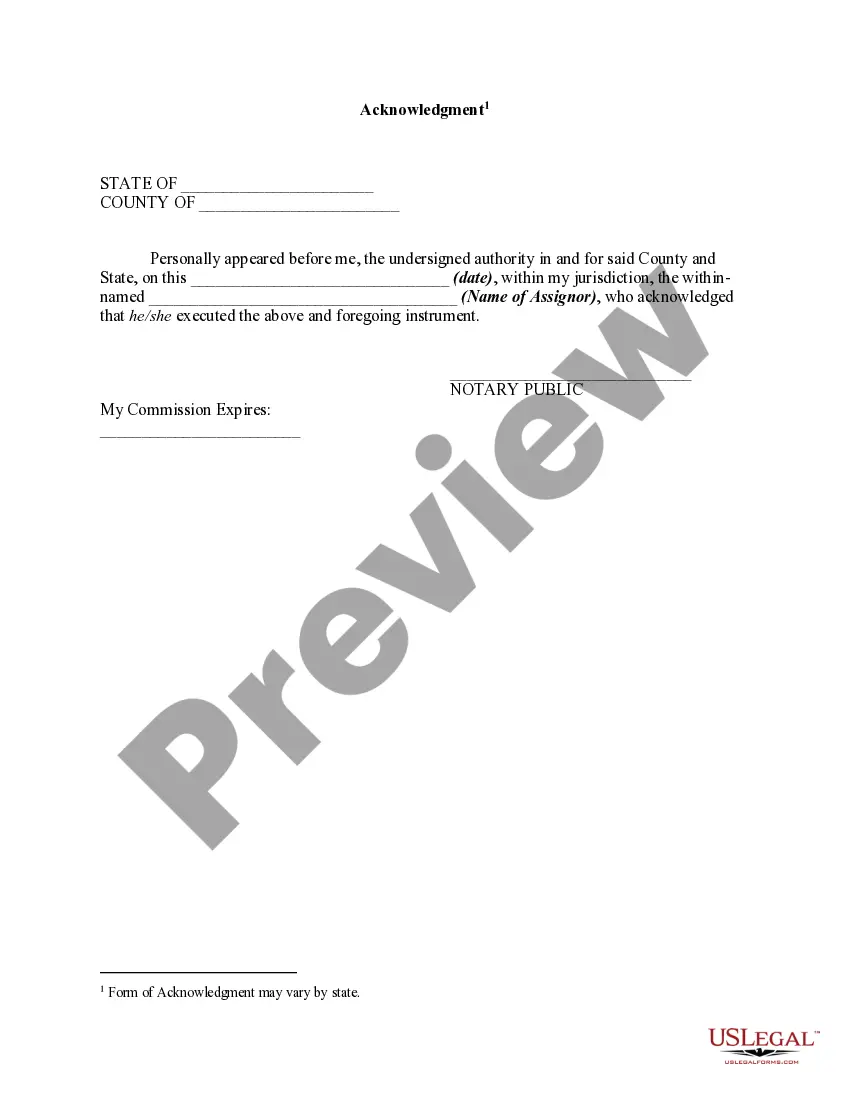

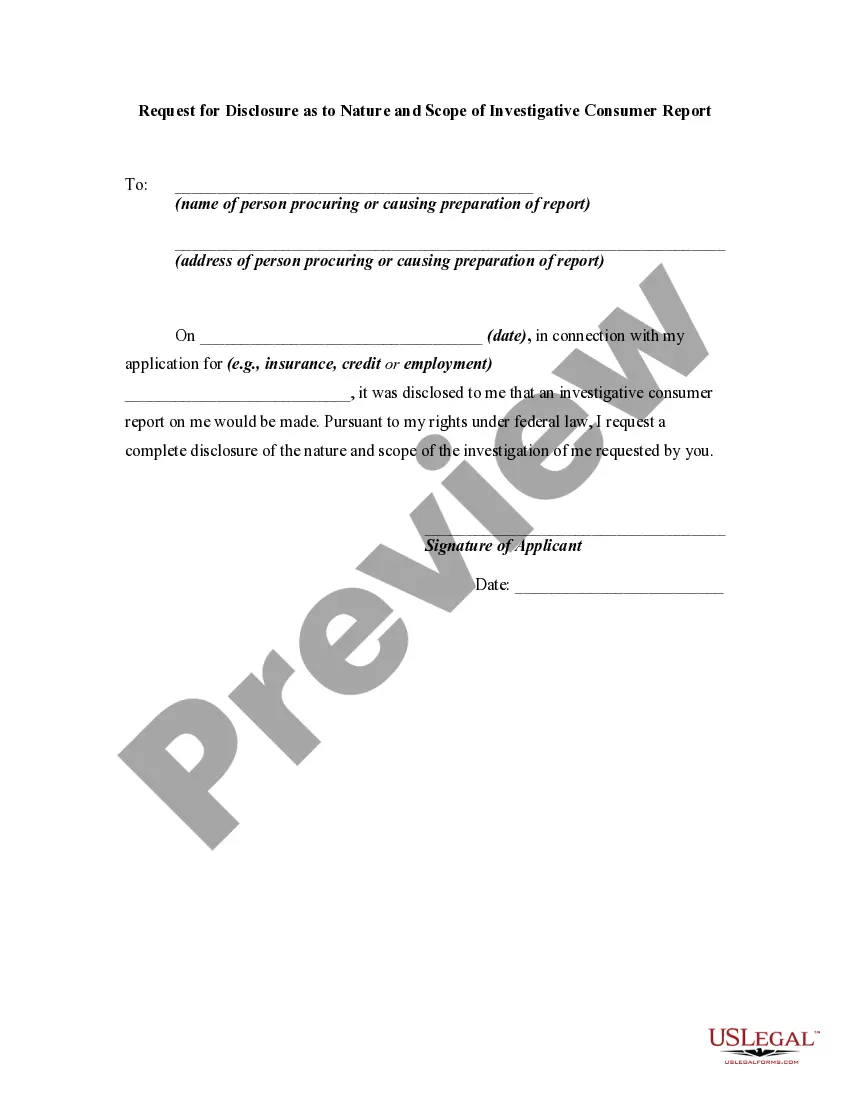

- Use the Preview function and look at the form description (if available) to ensure that it’s the best document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct template to your state and situation.

- Make use of the Search field at the top of the page if you have to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your document in a convenient format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever file you will need for whatever state you want it in. With US Legal Forms, finishing Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness samples or any other legal files is easy. Get started now, and don't forget to examine your samples with certified attorneys!

Form popularity

FAQ

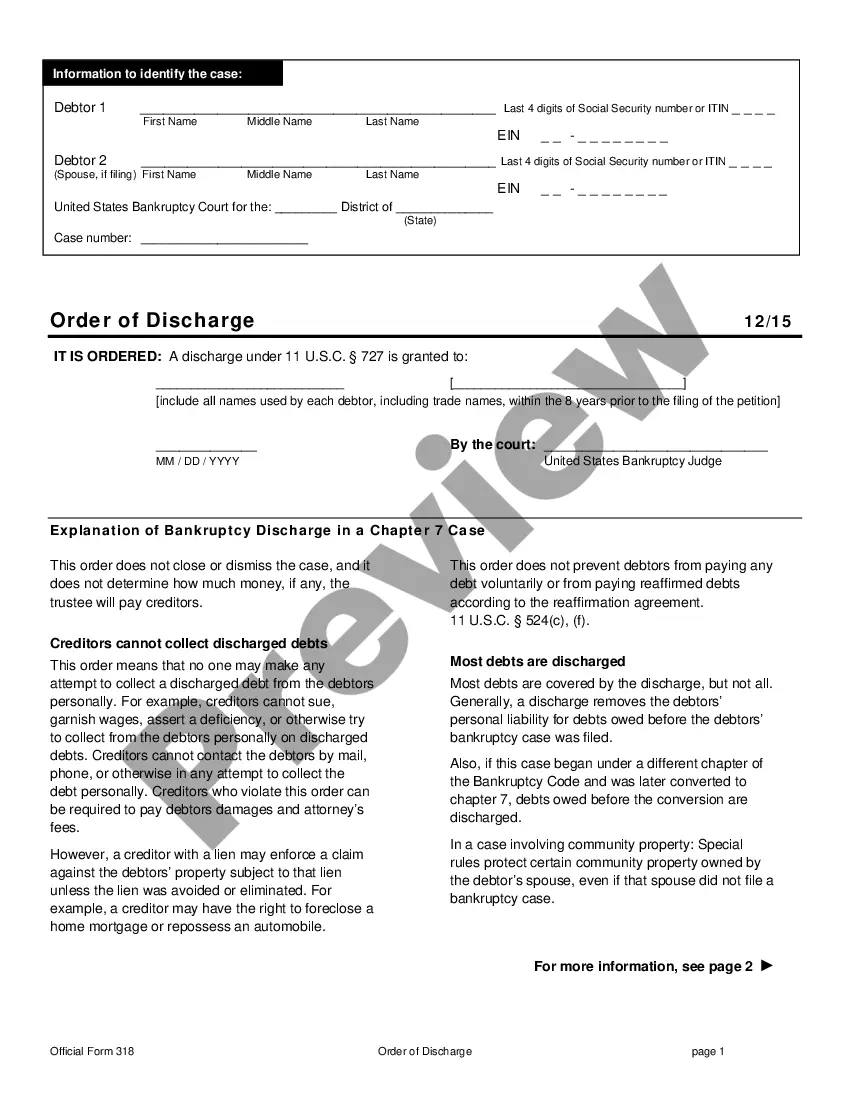

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution.

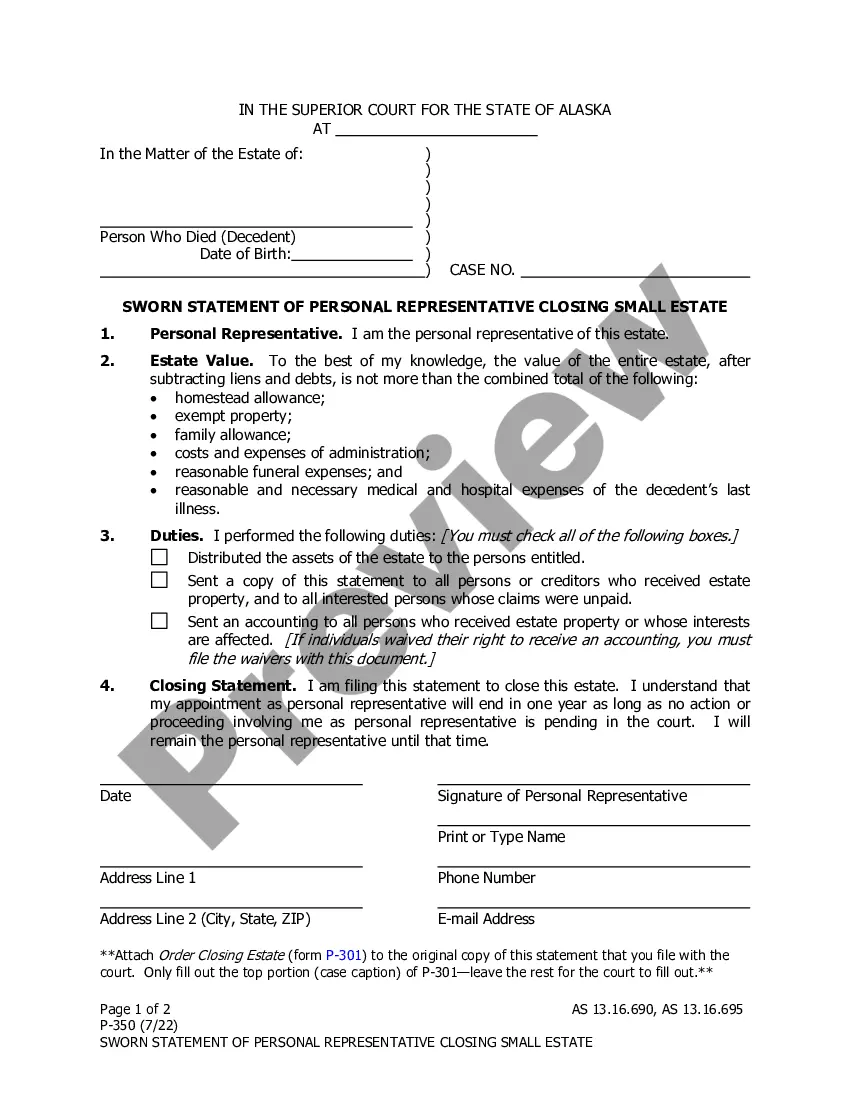

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

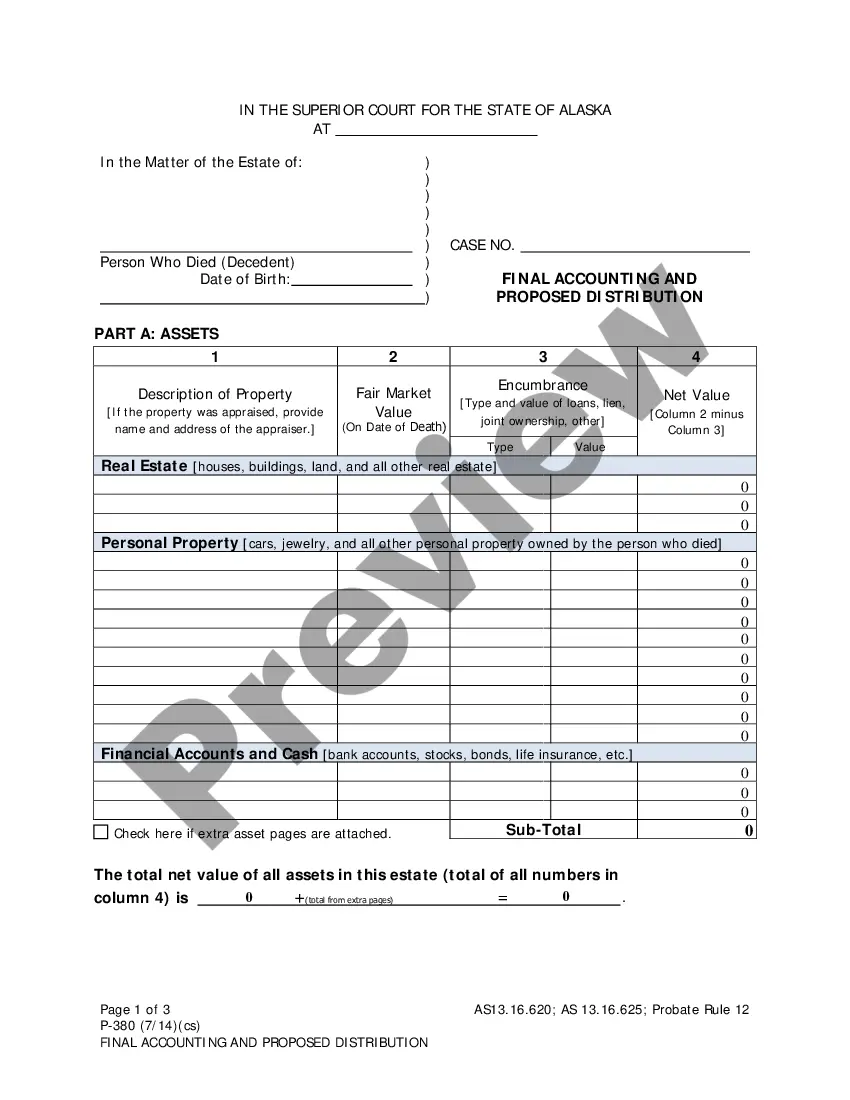

A personal representative has the discretion to make a partial distribution of assets during the administration of the estate.Once final expenses have been made and the estate is ready to close, the personal representative can distribute the remaining assets to the beneficiaries.

The assignment has to be filed with the probate court before the distribution can be made to the assignee. Note that inheritances from a trust typically cannot be assigned to someone else. Most trusts prohibit assigning an undistributed trust inheritance.There are legal restrictions on disclaiming an inheritance.

A beneficiary can also transfer his interest in the trust property and every person to whom a beneficiary transfers his interest acquires the rights and liabilities of the beneficiary at the date of the transfer.

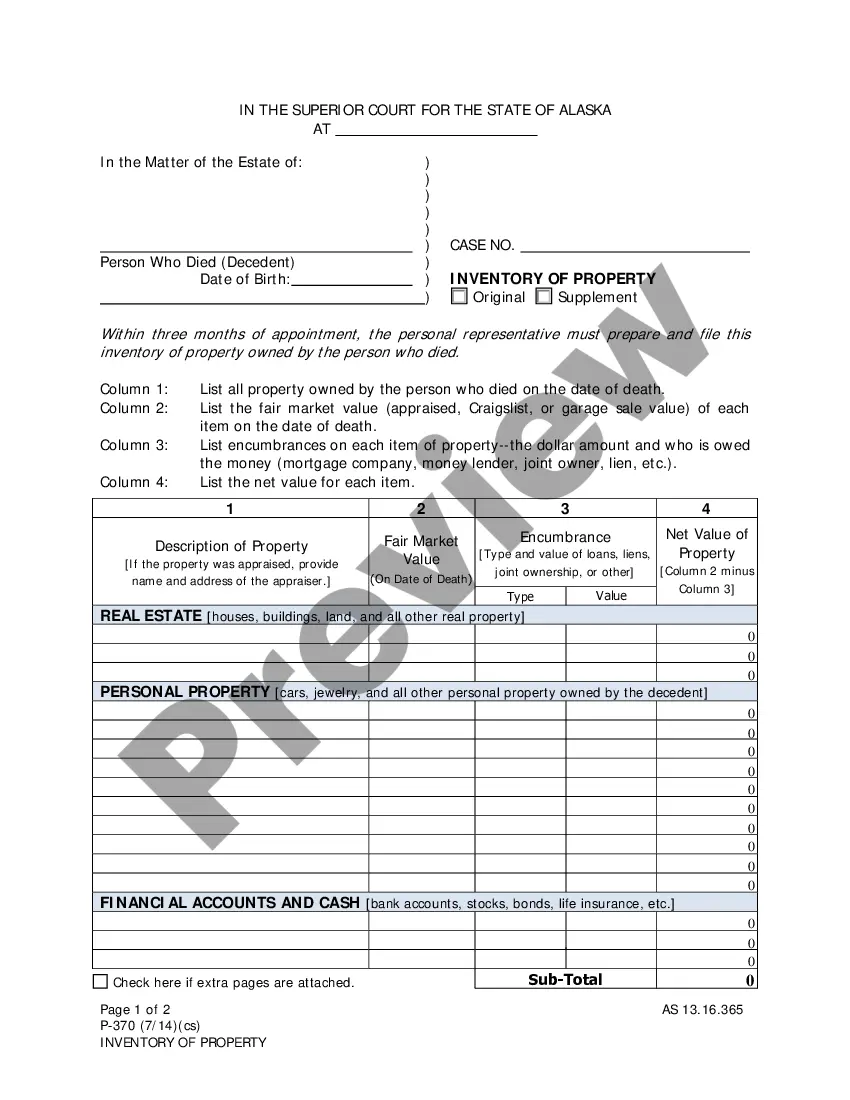

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Divide up assets based on their value. Instruct your executor to divide assets equally. Instruct your executor to sell everything and then distribute the proceeds to your beneficiaries equally.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.