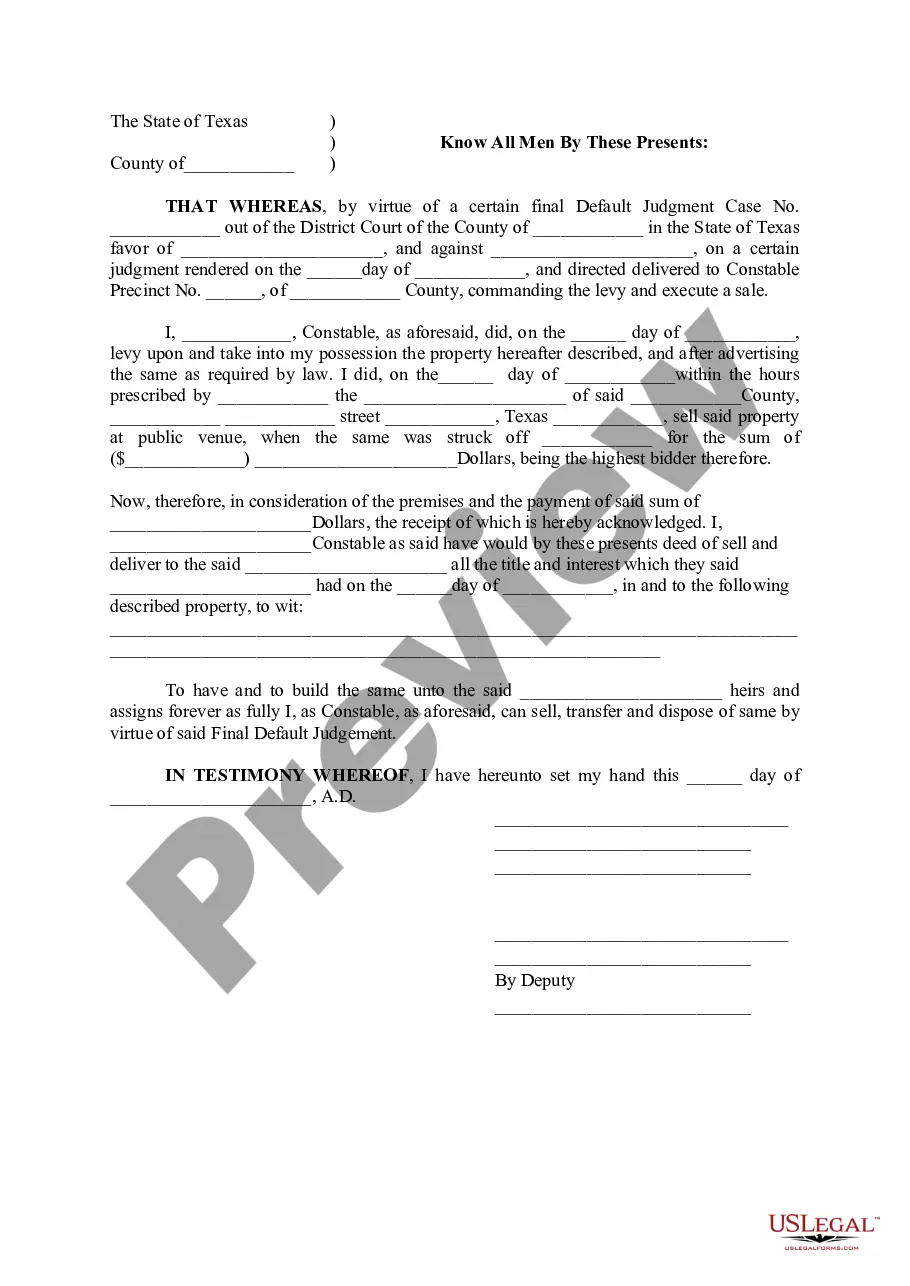

Texas Final Default Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

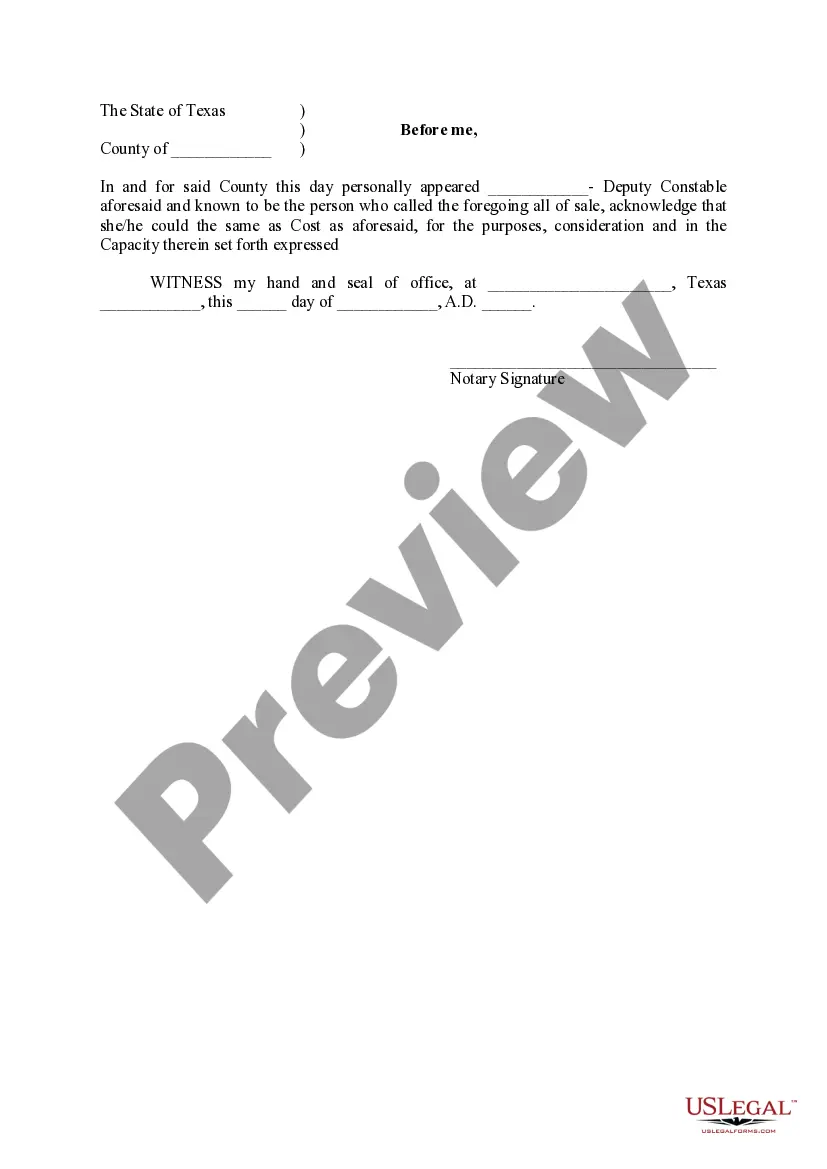

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Final Default Judgment: A legal decision by a court in favor of the plaintiff when the defendant fails to respond to a summons or fails to appear in court. This judgment resolves the case without trial and is enforceable by law. In the context of U.S. law, it often involves civil cases where monetary damages or specific performance are sought.

Step-by-Step Guide

- File a Complaint: The plaintiff files a legal complaint against the defendant in a suitable court.

- Serve the Defendant: Legally deliver the complaint and summons to the defendant, ensuring they are aware of the lawsuit.

- Wait for a Response: The defendant has a set period, typically 20 to 30 days, to respond. If no response is received, move to the next step.

- Request Default Judgment: File a motion for default judgment with the court, citing the defendant's failure to respond.

- Court Review: The court reviews the plaintiff's case and the defendants lack of response before issuing a default judgment.

- Issuance of Judgment: Once the judgment is entered, it is final and enforceable.

Risk Analysis

- Potential for Contest: Default judgments can be contested by the defendant, potentially prolonging the legal process.

- Improper Service Risks: If the service of process was improper, the judgment can be overturned.

- Financial Uncertainty: Collecting on a default judgment may be difficult if the defendant lacks funds or assets.

How to fill out Texas Final Default Judgment?

Access to top quality Texas Final Default Judgment samples online with US Legal Forms. Steer clear of hours of wasted time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms gives you a solution to exactly that. Get around 85,000 state-specific legal and tax samples that you can save and submit in clicks within the Forms library.

To get the example, log in to your account and click Download. The document will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Find out if the Texas Final Default Judgment you’re looking at is appropriate for your state.

- View the form making use of the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to complete making an account.

- Pick a favored format to save the document (.pdf or .docx).

Now you can open the Texas Final Default Judgment example and fill it out online or print it out and do it by hand. Take into account giving the papers to your legal counsel to make certain things are completed properly. If you make a mistake, print out and fill application again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and access far more samples.

Form popularity

FAQ

Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

First, you can ask the court to set aside the default judgment and give you an opportunity to contest it. Next, you can settle the debt with the debt buyer for an amount less than what the default judgment is for. And finally you can eliminate the default judgment completely by filing for bankruptcy.

Default judgments happen when you don't respond to a lawsuit often from a debt collector and a judge resolves the case without hearing your side.Next up could be wage garnishment or a bank account levy, which allows a creditor to remove money from your bank accounts to repay the debt.

A Texas judgment is valid for ten years from the date it's signed by the judge. After the expiration of ten years the judgment is dormant for two years. During that two year period of dormancy the judgment cannot be enforced.

If granted, the default judgment will be vacated and a new trial will be scheduled on the matter. In a county or district court in Texas, the deadline for a request for a new trial is 30 days from entry of the default judgment.

A default judgment means that the court has decided that you owe money. This a result of the person suing you in small claims court and you failed to appear at the hearing.

Do Judgments Expire in Texas? Judgments issued in Texas with a non-government creditor are generally valid for ten years but they can be renewed for longer.

Question: Can you overturn a default judgment? Yes, when there is a showing of excusable neglect and a meritorious defense. When a law suit is filed and a defendant fails to timely answered the complaint, the plaintiff may move for an entry of default judgment.

Under the Fair Credit Reporting Act (FCRA), a judgment can show up on your credit report for at least seven years.