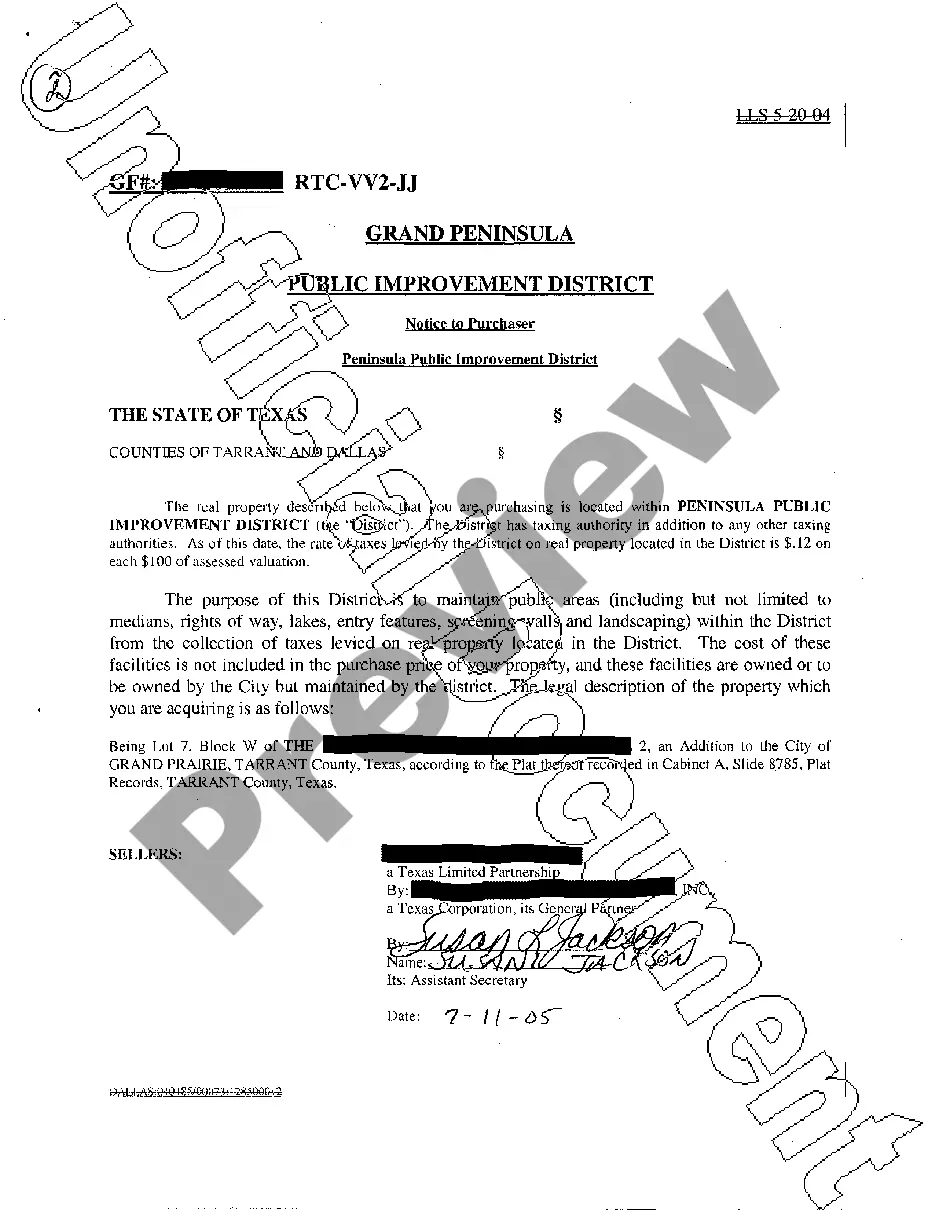

Texas Public Improvement District Notice to Purchaser

Description

How to fill out Texas Public Improvement District Notice To Purchaser?

Get access to quality Texas Public Improvement District Notice to Purchaser samples online with US Legal Forms. Steer clear of days of misused time seeking the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific legal and tax forms that you could download and submit in clicks within the Forms library.

To find the example, log in to your account and then click Download. The document will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Texas Public Improvement District Notice to Purchaser you’re considering is appropriate for your state.

- View the form using the Preview function and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay out by card or PayPal to complete creating an account.

- Choose a favored format to download the file (.pdf or .docx).

You can now open up the Texas Public Improvement District Notice to Purchaser template and fill it out online or print it out and do it by hand. Consider sending the file to your legal counsel to ensure all things are filled in correctly. If you make a mistake, print and complete sample once again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

(3) STATUTORY TAX DISTRICTS: If the Property is situated in a utility or other statutorily created district providing water, sewer, drainage, or flood control facilities and services, Chapter 49, Texas Water Code, requires Seller to deliver and Buyer to sign the statutory notice relating to the tax rate, bonded

Seller agrees to give Purchaser prompt notice of any fire or other casualty occurring at or to the Property between the date of this Agreement and the Closing Date, or of any actual or threatened condemnation of all or any part of the Land of which Seller has knowledge.

A Municipal Utility District (MUD) is a political subdivision of the State of Texas authorized by the Texas Commission of Environmental Quality (TCEQ) to provide water, sewage, drainage and other utility-related services within the MUD boundaries.

A Municipal Utility District (MUD) is one of several types of special districts that function as independent, limited governments. The purpose of a MUD is to provide a developer an alternate way to finance infrastructure, such as water, sewer, drainage, and road facilities.

The seller is required by the Texas Water Code to provide notice to a buyer that the property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

A Municipal Utility District (MUD) is one of several types of special districts that function as independent, limited governments. The purpose of a MUD is to provide a developer an alternate way to finance infrastructure, such as water, sewer, drainage, and road facilities.

A MUD is a taxing entity for a development outside of city limits. A MUD is governed by a board of directors elected by homeowners. The MUD has the power to tax residents and even issue bonds with homeowner approval, according to sources.

MUD notice information The notice provides information regarding the tax rate, bonded indebtedness, and standby fee, if any, of the MUD. A seller will typically know if a MUD is providing service to a property because the MUD assessment will be listed on the tax bill that the county sends to the property owner.

MUDs work by issuing bonds to pay for initial costs for infrastructure that are then serviced through property taxes by residents in the future. The MUD Board of Directors is charged with making decisions for the MUD district. The highest priority for the board is improving residents'quality of life.