Texas Deed in Lieu of Foreclosure

Description

Key Concepts & Definitions

Deed in Lieu of Foreclosure: A legal process in which a homeowner voluntarily transfers ownership of their property to the lender to avoid the foreclosure process. Mortgage Refinance: Replacing an existing mortgage with a new loan, typically to reduce interest rates or change the loans term. Home Equity Loans: Loans provided to homeowners based on the equity of their home. Credit Card Rates: The interest rates associated with borrowing on a credit card. Real Estate Market: The market where properties are bought, sold, or rented, influencing property value and investment opportunities.

Step-by-Step Guide: Navigating a Deed in Lieu of Foreclosure

- Review Financial Status: Utilize personal finance tools to assess your financial situation.

- Consult a Financial Advisor: Get professional advice to explore all options including mortgage refinance.

- Contact Your Lender: Discuss hardships and inquire about the homeowner assistance program or deed in lieu options.

- Application Submission: Submit required documentation to your lender, often including a financial package and a hardship letter.

- Lenders Review: Your lender will review the application to determine if a deed in lieu is appropriate.

- Agree on Terms: If approved, negotiate the terms of the deed in lieu agreement, often including relocation assistance.

- Finalize the Process: Sign the agreement to transfer the deed to the lender, formally closing the process.

Risk Analysis of Deed in Lieu of Foreclosure

- Impact on Credit Score: A deed in lieu can negatively impact your credit score similarly to a foreclosure.

- Deficiency Judgments: Depending on state laws, lenders might be able to pursue a deficiency judgment if property value doesn't cover the mortgage balance.

- Eligibility and Acceptance: Not all lenders accept a deed in lieu, and eligibility may depend on numerous factors including market conditions and other liens on the property.

- Potential Tax Implications: Cancelled debt may be considered taxable income, necessitating a review of potential tax obligations.

Comparison Table: Deed in Lieu vs. Other Foreclosure Alternatives

| Option | Impact on Credit | Financial Relief | Process Complexity |

|---|---|---|---|

| Deed in Lieu | Moderate to High Negative | High | Moderate |

| Loan Modification | Lower Negative | Moderate to High | High |

| Short Sale | Moderate Negative | Moderate | High |

Real-World Applications & Case Studies

- In 2020, amidst the changing real estate market, many homeowners leveraged the deed in lieu to avoid foreclosure as credit card rates and economic uncertainty soared.

- Case Study: A family in Texas successfully navigated the deed in lieu process after the primary earner lost their job, preventing foreclosure and allowing them to prioritize personal finances without the looming pressure of home loss.

Common Mistakes & How to Avoid Them

- Neglecting Other Options: Homeowners should compare mortgage rates and consider refinancing or home equity loans before opting for a deed in lieu.

- Inadequate Documentation: Ensure all paperwork, including proof of hardship and financial status, is thoroughly prepared.

- Failing to Negotiate Terms: Homeowners should negotiate terms and seek possible perks like relocation assistance in the deed in lieu agreement.

Key Takeaways

A deed in lieu of foreclosure offers a way for homeowners to avoid the extensive process of foreclosure, potentially mitigating the negative financial impact. Its imperative to consider all available options, consult with professionals, and negotiate terms clearly with lenders.

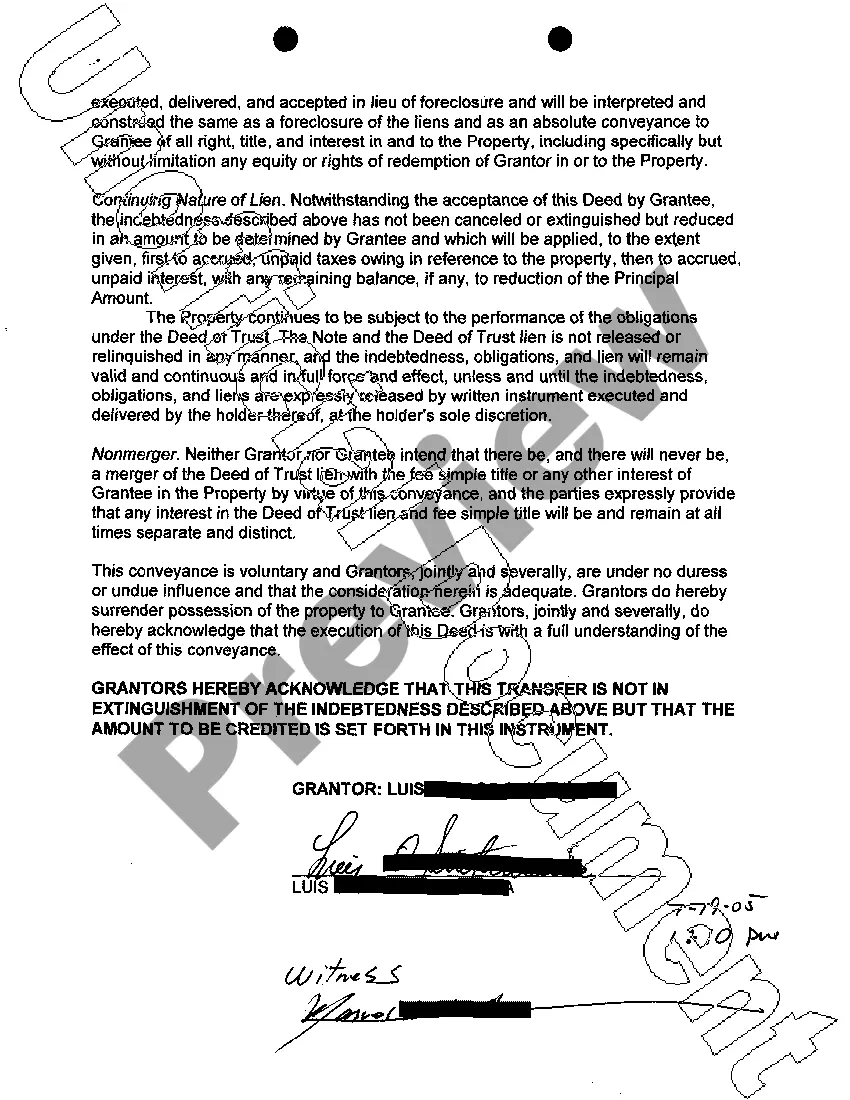

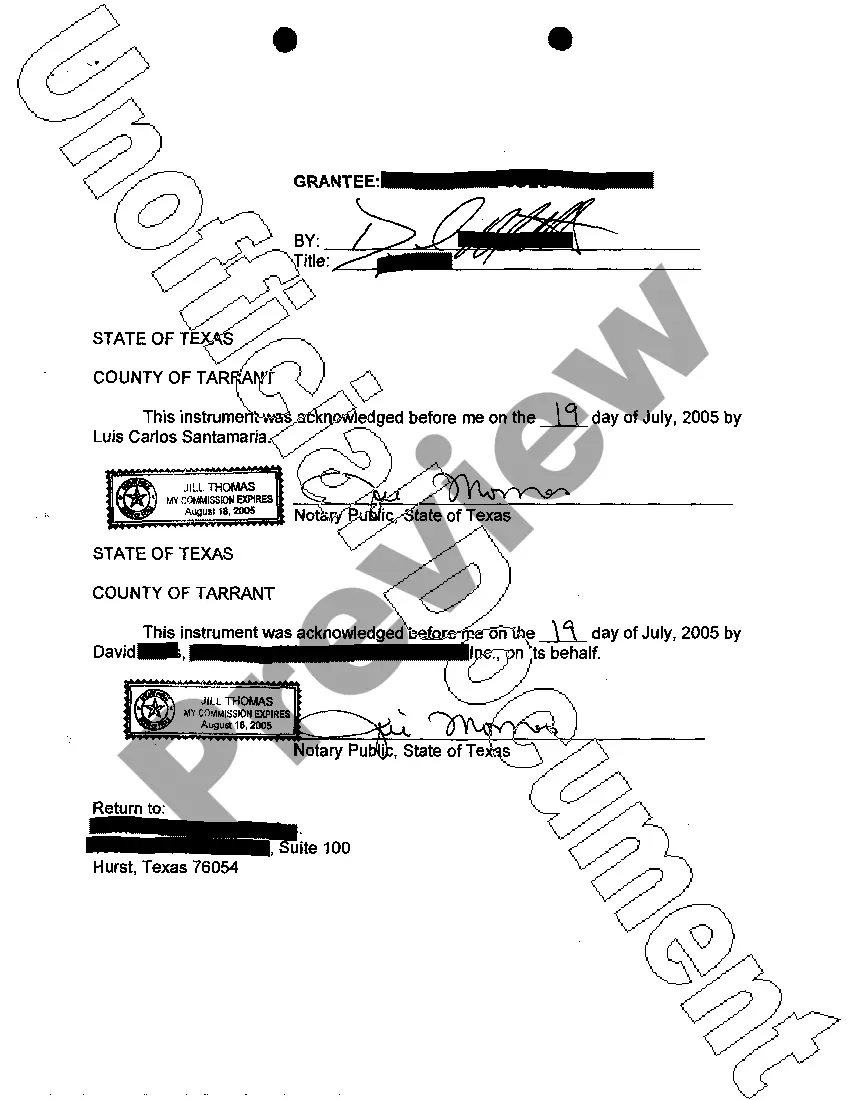

How to fill out Texas Deed In Lieu Of Foreclosure?

Get access to quality Texas Deed in Lieu of Foreclosure templates online with US Legal Forms. Prevent hours of misused time searching the internet and lost money on files that aren’t updated. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific legal and tax forms you can save and complete in clicks within the Forms library.

To get the example, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Find out if the Texas Deed in Lieu of Foreclosure you’re looking at is appropriate for your state.

- Look at the form utilizing the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to sign up.

- Pay by card or PayPal to complete creating an account.

- Pick a preferred format to save the document (.pdf or .docx).

Now you can open up the Texas Deed in Lieu of Foreclosure sample and fill it out online or print it and get it done yourself. Consider giving the document to your legal counsel to ensure things are filled out correctly. If you make a mistake, print and fill application again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

Disadvantages of a Deed in Lieu of Foreclosure. Perhaps the biggest disadvantage of a deed in lieu is that the Lender takes subject to all other encumbrances and interests in the Property. Therefore if there is a second mortgage, for example, a deed in lieu would likely not be a viable strategy.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

The waiting period on a conventional loan after a deed in lieu is 4 years, compared to 7 years on a conventional loan.

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.