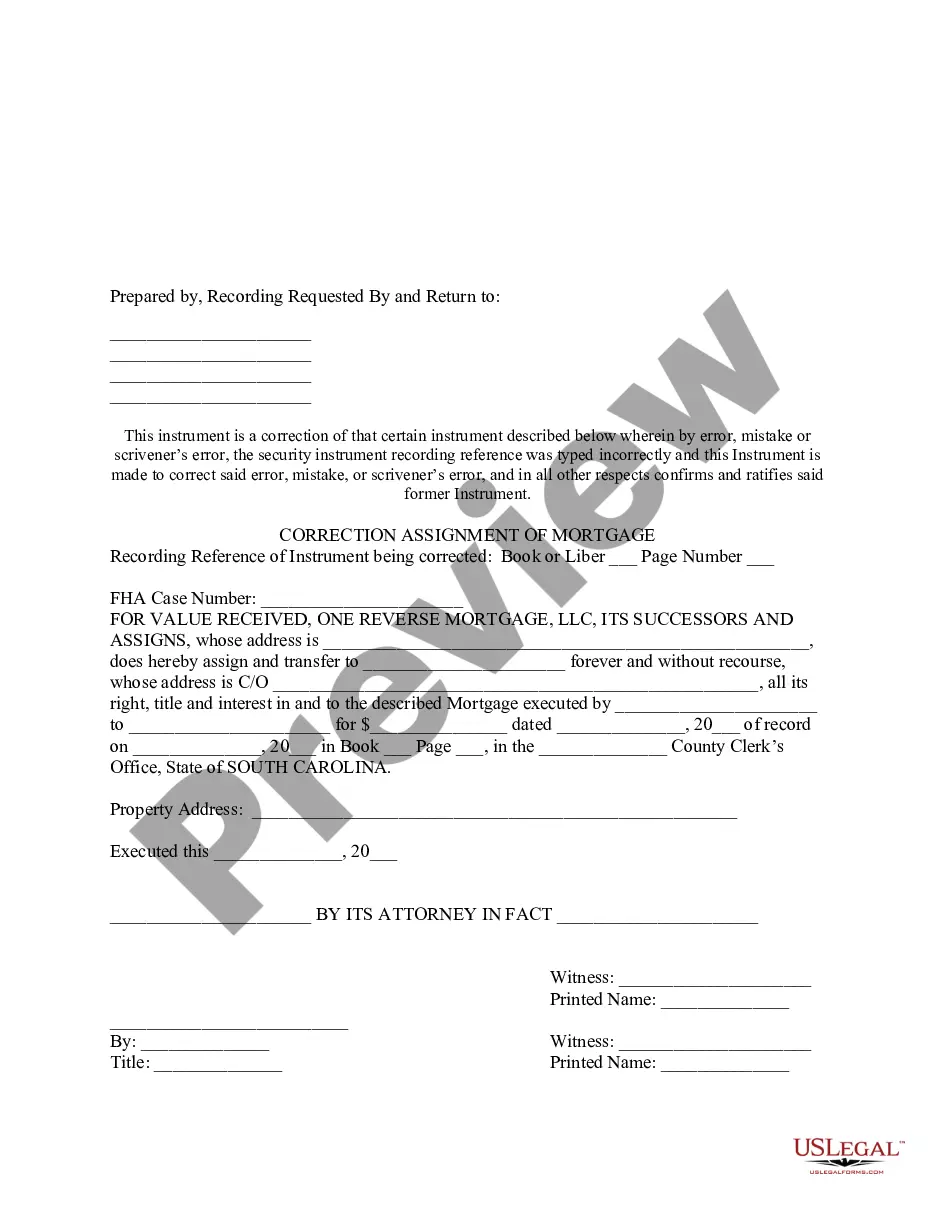

South Carolina Correction Assignment of Mortgage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Correction Assignment Of Mortgage?

Creating papers isn't the most simple process, especially for people who almost never deal with legal paperwork. That's why we advise utilizing accurate South Carolina Correction Assignment of Mortgage samples created by professional lawyers. It allows you to prevent difficulties when in court or working with official organizations. Find the templates you need on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file webpage. After accessing the sample, it’ll be stored in the My Forms menu.

Users without an active subscription can easily get an account. Look at this short step-by-step guide to get your South Carolina Correction Assignment of Mortgage:

- Be sure that the document you found is eligible for use in the state it is necessary in.

- Confirm the file. Use the Preview option or read its description (if available).

- Buy Now if this file is the thing you need or go back to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

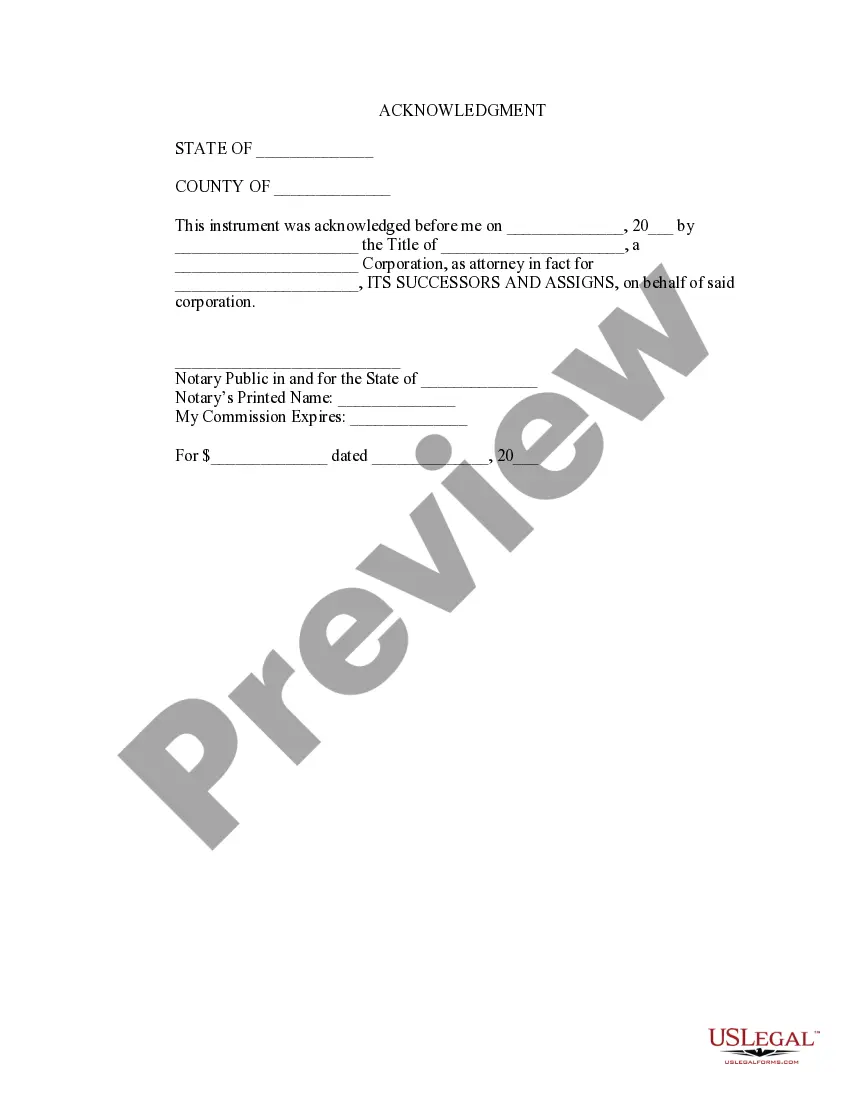

After completing these simple steps, it is possible to fill out the form in your favorite editor. Recheck filled in info and consider asking a lawyer to examine your South Carolina Correction Assignment of Mortgage for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

South Carolina is a race-notice jurisdiction. In 1958 the recording statute was amended to require a subsequent lien creditor without notice to file the instrument evidencing his lien in order to claim under the statute.

You can correct an error on a California deed through a Correction Deed or Corrective Deed. Usually deed errors are as a result of someone attempting to prepare a deed without proper knowledge or professional help.

Race-Notice Jurisdiction: A jurisdiction whose rule allows a subsequent bona-fide purchaser to prevail over an earlier purchaser if, and only if, the subsequent purchaser did not know of the earlier transfer and the subsequent purchaser's deed was recorded before the first purchaser's deed.

States that follow the Race-Notice statute: Alaska, Arkansas, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Indiana, Maryland, Michigan, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Jersey, New York, North Dakota, Ohio (regarding mortgages, OH follows the Race statute), Oregon,

If however, this is not your debt and the lien has wrongfully been placed on your property, then you should first seek to get the creditor/lender to voluntarily release the lien. If they refuse, you could then file a lawsuit to get the lien removed and possibly obtain damages for slander of title.

A recording act that gives priority of title to the party that records first, but only if the party also lacked notice of prior unrecorded claims on the same property. See Notice statute and Race statute. PROPERTY. property & real estate law. wex definitions.

Determine if the error is harmless or fatal to the transfer of title. Decide what instrument is best suited to the error. Draft a corrective deed, affidavit, or new deed. Obtain the original signature(s) of the Grantor(s). Re-execute the deed with proper notarization and witnessing.

If a deed is to have any validity, it must be made voluntarily.If FRAUD is committed by either the grantor or grantee, a deed can be declared invalid. For example, a deed that is a forgery is completely ineffective. The exercise of UNDUE INFLUENCE also ordinarily serves to invalidate a deed.