Rhode Island Non-Exclusive Online Affiliate Program Agreement

Description

How to fill out Non-Exclusive Online Affiliate Program Agreement?

Are you currently in the situation where you need documents for both business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, including the Rhode Island Non-Exclusive Online Affiliate Program Agreement, which is designed to meet state and federal requirements.

Once you locate the correct form, click on Get now.

Select the payment plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Non-Exclusive Online Affiliate Program Agreement template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct area/state.

- Use the Review option to check the document.

- Examine the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Yes, businesses selling online in Rhode Island typically need to obtain a business license. This license ensures compliance with state regulations and local laws, helping you operate legally. If you are considering the Rhode Island Non-Exclusive Online Affiliate Program Agreement, securing the necessary licenses aligns with best practices for a successful online business.

The taxable wage base refers to the limit on earnings that are subject to payroll taxes like unemployment insurance. In Rhode Island, this means that only a certain portion of employee wages will count towards tax calculations. Affiliates participating in the Rhode Island Non-Exclusive Online Affiliate Program Agreement should monitor changes to this base, as it impacts tax obligations and overall profitability.

Typically, a single member LLC does not need to file Form 1065 in Rhode Island. This form is generally required for partnerships, and a single member LLC is considered a disregarded entity for tax purposes. However, it's essential for affiliates using the Rhode Island Non-Exclusive Online Affiliate Program Agreement to consult with a tax advisor to ensure compliance with state and federal regulations.

The JDF tax, or Job Development Fund tax, is a contribution levied on employers in Rhode Island to fund workforce development initiatives. This tax is aimed at enhancing job growth, training, and opportunities for workers in various sectors. Affiliates in Rhode Island should consider this aspect when forming a business under the Rhode Island Non-Exclusive Online Affiliate Program Agreement, as it influences overall business expenses.

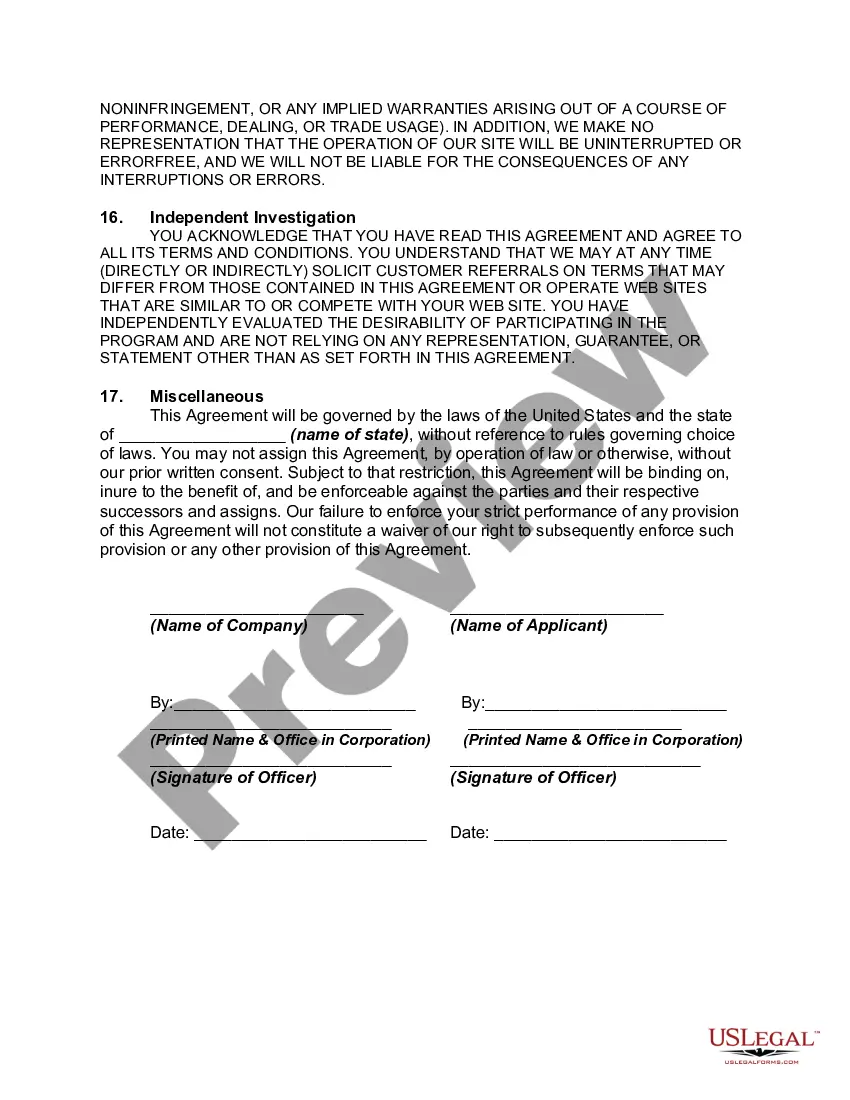

The affiliate marketing agreement should include the affiliate's role, the promotional guidelines an affiliate should follow, and how to earn commission. It should also lay out your company's role, responsibilities, and the commission you offer in the affiliate program.

How to Become an Affiliate Marketer in 6 StepsChoose a Niche. Every affiliate marketer has a niche in which they try to influence their audience.Evaluate Market Demand.Analyze the Competition.Research Affiliate Programs.Pick Your Affiliate Marketing Methods.Create and Publish Top-Notch Content.

An affiliate agreement refers to the terms of services between an advertiser and an affiliate (generally a publisher or website) that oversee and define the affiliate relationship.

An affiliate marketing agreement is a contract between a company and an independent contractor or agency to perform affiliate marketing services on behalf of the company. These services are typically referral services and are often seen in real estate transactions.

For companies who have an affiliate program, you will often have a standard boilerplate agreement that is required for all new affiliates to sign. Two of the most vital parts of your agreement that should be included in your contract are the legal and monetary stipulations.

Percentage commissions are most common in affiliate programs, and the average affiliate commission is between 530%. But if you sell only a few specific products, each with a set price, then fixed-amount commissions may work well for your business.