Oregon Notice to Heirs and Devisees

Description

Key Concepts & Definitions

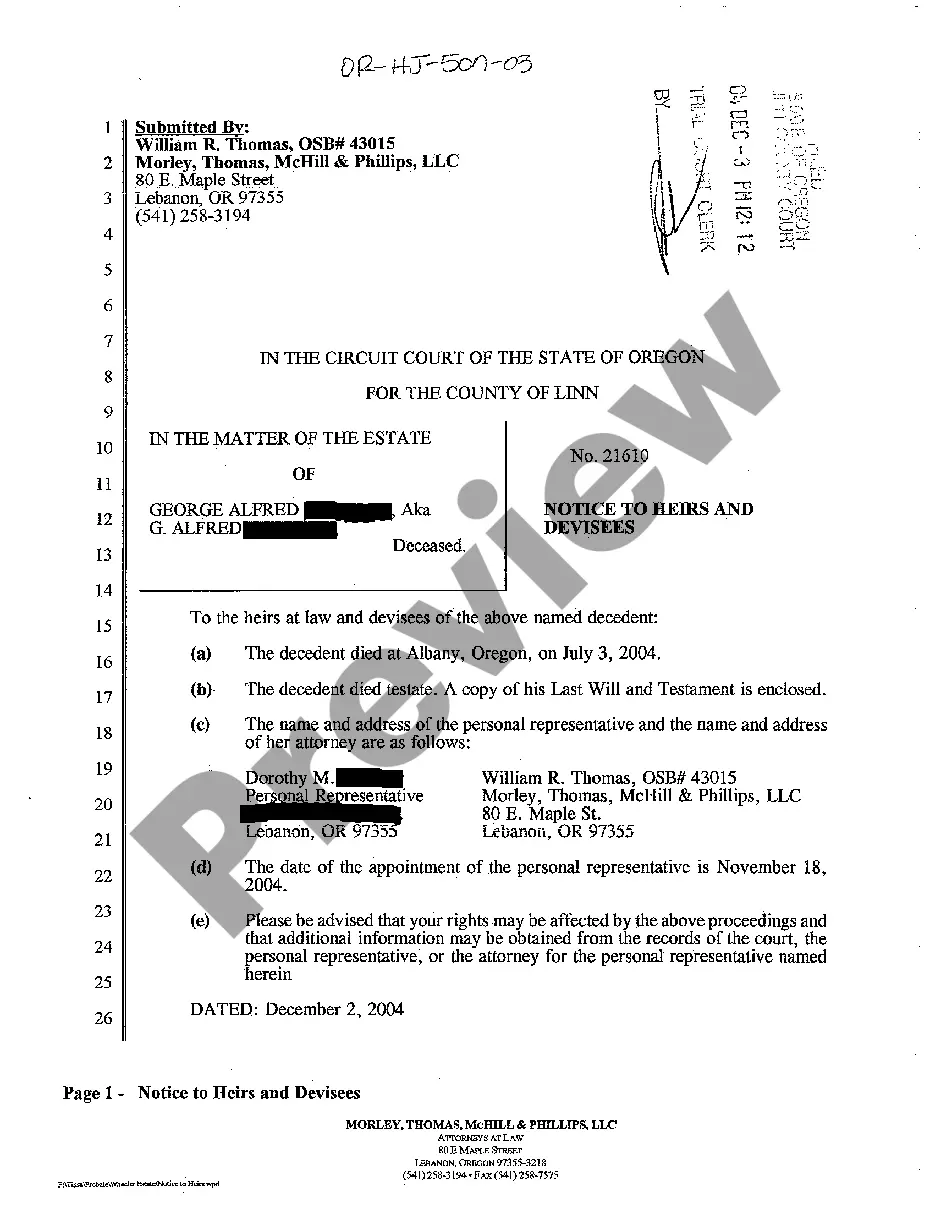

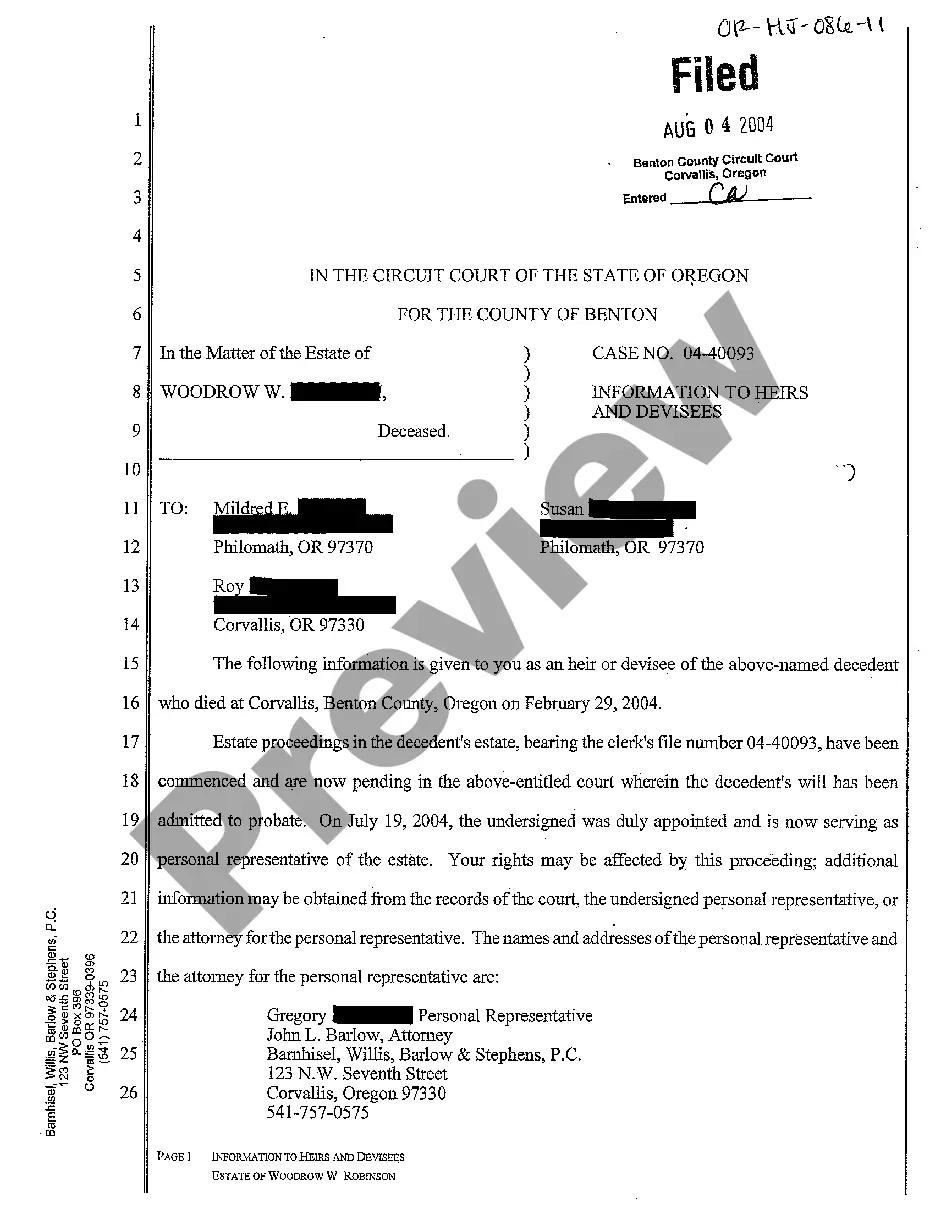

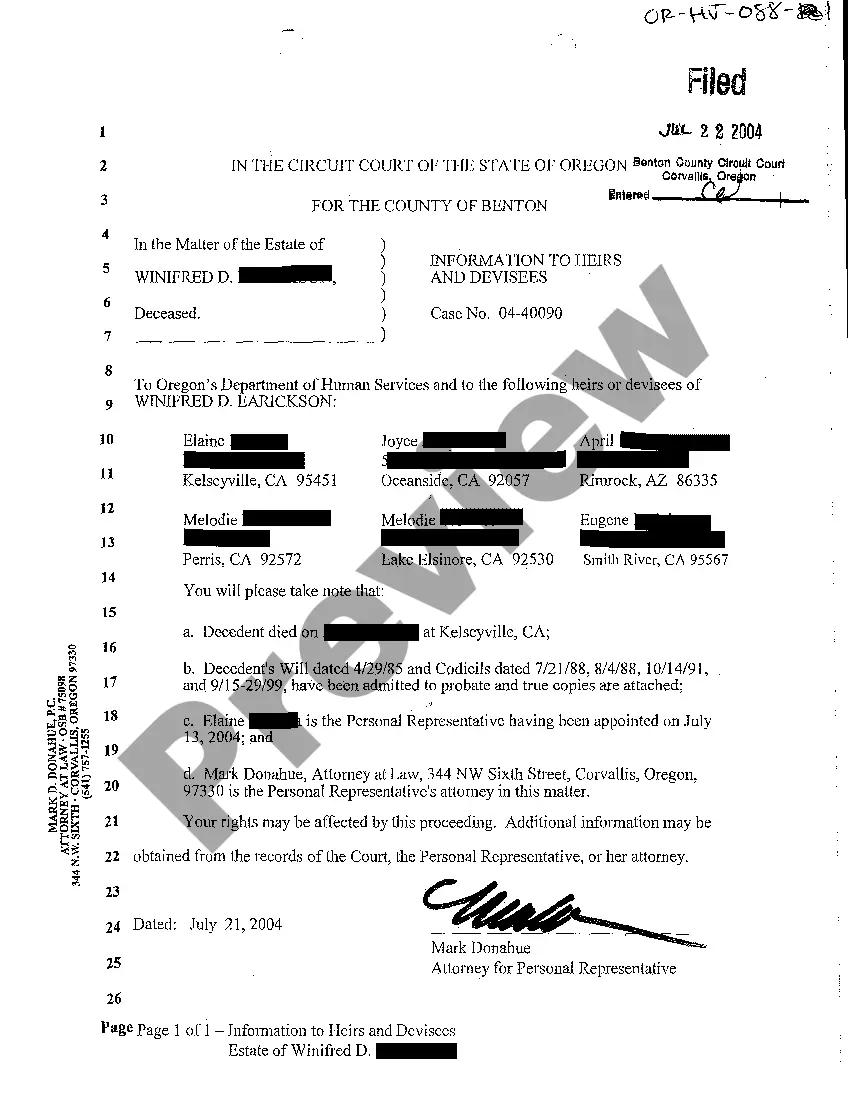

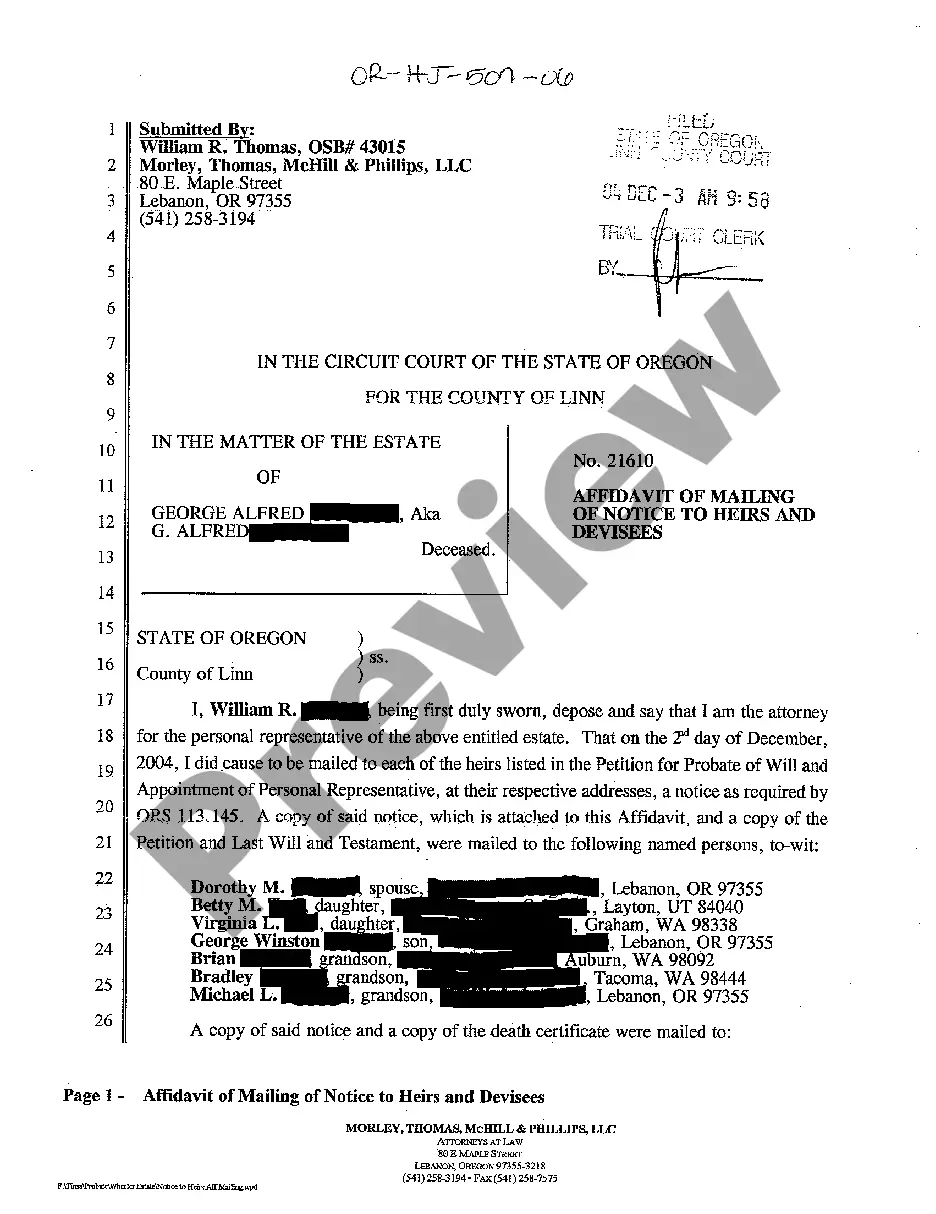

A03 Notice to Heirs and Devisees: This is a legal document used in the United States probate process. It informs designated individuals, including heirs and those named in a will (devisees), that a probate case has been opened. This notice typically outlines the estate, the decedents details, and other critical information pertaining to the inheritance process.

Step-by-Step Guide

- Filing the Notice: The executor or administrator of the estate must prepare the A03 Notice, containing necessary details about the deceased and the estate.

- Identifying Heirs and Devisees: Compile a list of all individuals entitled to receive an inheritance under the will or state law.

- Distribution of Notice: The notice must be formally issued to all identified parties, typically via mail or personal delivery, within a stipulated timeframe set by state law.

- Confirm Receipt: It is advisable to obtain acknowledgments of receipt from all parties to avoid future disputes.

- Proceed With Probate: After the notices have been acknowledged, continue with the remainder of the probate process, addressing claims against the estate and distributing assets accordingly.

Risk Analysis

- Non-Compliance: Failure to properly issue the A03 notice can lead to legal challenges against the estates distribution.

- Delay in Proceedings: Inadequate notices or lack of acknowledgement receipts can delay the probate process, potentially increasing costs and legal fees.

- Disputes Among Heirs: Ambiguities in the notice or failure to notify all rightful heirs can result in disputes that prolong legal proceedings.

Best Practices

- Accuracy in Information: Ensure all details within the A03 notice are accurate to prevent potential legal challenges.

- Comprehensive Record Keeping: Maintain thorough records of all notices sent and receipts obtained.

- Legal Assistance: Enlist the help of a probate attorney to navigate state laws and avoid common pitfalls.

Common Mistakes & How to Avoid Them

- Omitting Heirs: Double-check the list of heirs and devisees against the will and state intestacy laws to ensure no one is omitted.

- Ignoring Time Frames: Adhere strictly to the timelines set by law for sending notices to avoid legal repercussions.

- Poor Documentation: Keep precise records of all communication and notices related to the estates distribution.

How to fill out Oregon Notice To Heirs And Devisees?

Creating documents isn't the most uncomplicated task, especially for people who rarely deal with legal papers. That's why we recommend making use of correct Oregon Notice to Heirs and Devisees samples made by skilled attorneys. It allows you to prevent difficulties when in court or handling official institutions. Find the documents you want on our site for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the file page. Soon after downloading the sample, it will be saved in the My Forms menu.

Customers without an active subscription can easily get an account. Look at this simple step-by-step help guide to get the Oregon Notice to Heirs and Devisees:

- Make sure that the document you found is eligible for use in the state it’s necessary in.

- Confirm the file. Utilize the Preview feature or read its description (if offered).

- Buy Now if this form is what you need or utilize the Search field to find a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these simple steps, it is possible to complete the form in an appropriate editor. Check the filled in info and consider asking a legal professional to review your Oregon Notice to Heirs and Devisees for correctness. With US Legal Forms, everything gets much simpler. Test it now!

Form popularity

FAQ

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Probate is not always necessary. If the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically.Settle a dispute between people who claim they are entitled to assets of the deceased person.

In Oregon, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

How long does probate take? Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer.

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In Oregon, each co-owner must own an equal share.

Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer. A small estate proceeding cannot be filed until 30 days after death and is complete upon filing.

By way of introduction, an estate is a small estate if the total value of the assets that need to be administered does not exceed the following values: $200,000 for real property and $75,000 for personal property. Small estates can be administered through a formal probate proceeding, just like larger estates.

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Attorneys' fees in Oregon are based on the number of hours billed and the lawyer's hourly rate. For the simplest of probates, the fees can be around $2000. In general, probate legal fees will run between $3,000 and $5,000. If the estate is large, complex or has unusual assets, the costs can be much higher.