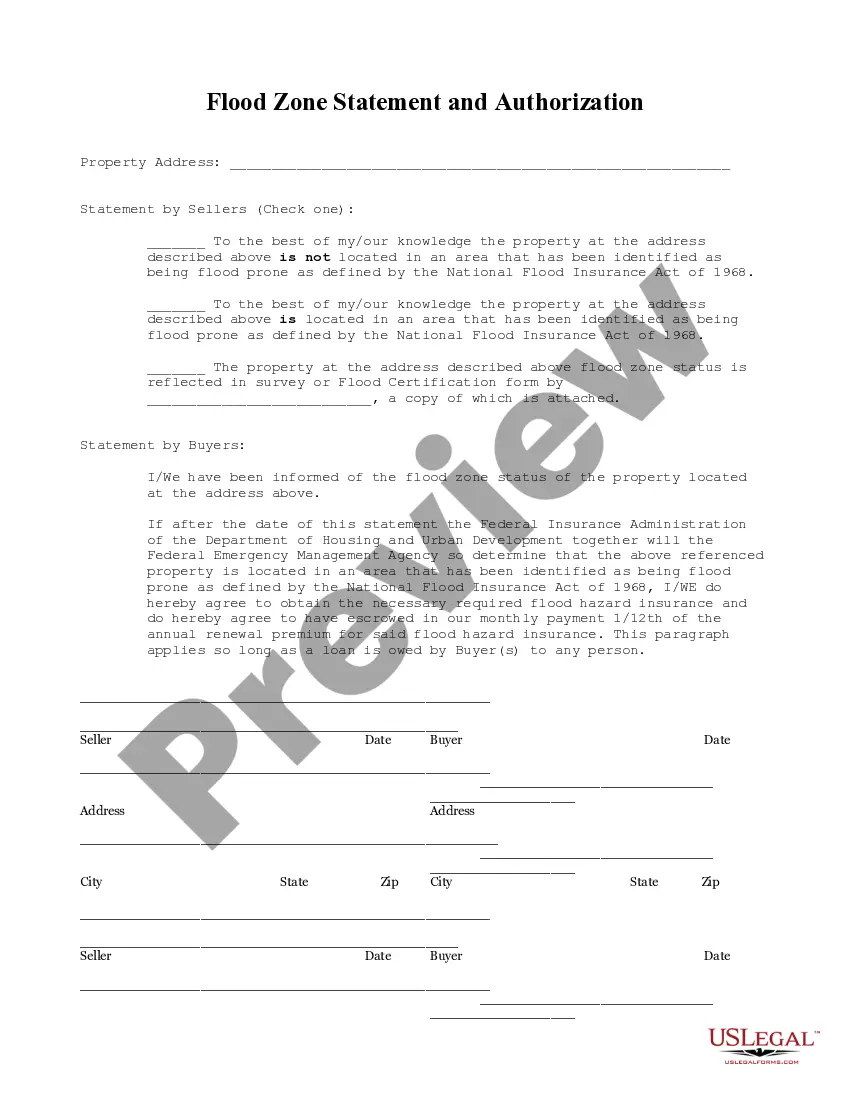

Mississippi Flood Zone Statement and Authorization

Description

How to fill out Mississippi Flood Zone Statement And Authorization?

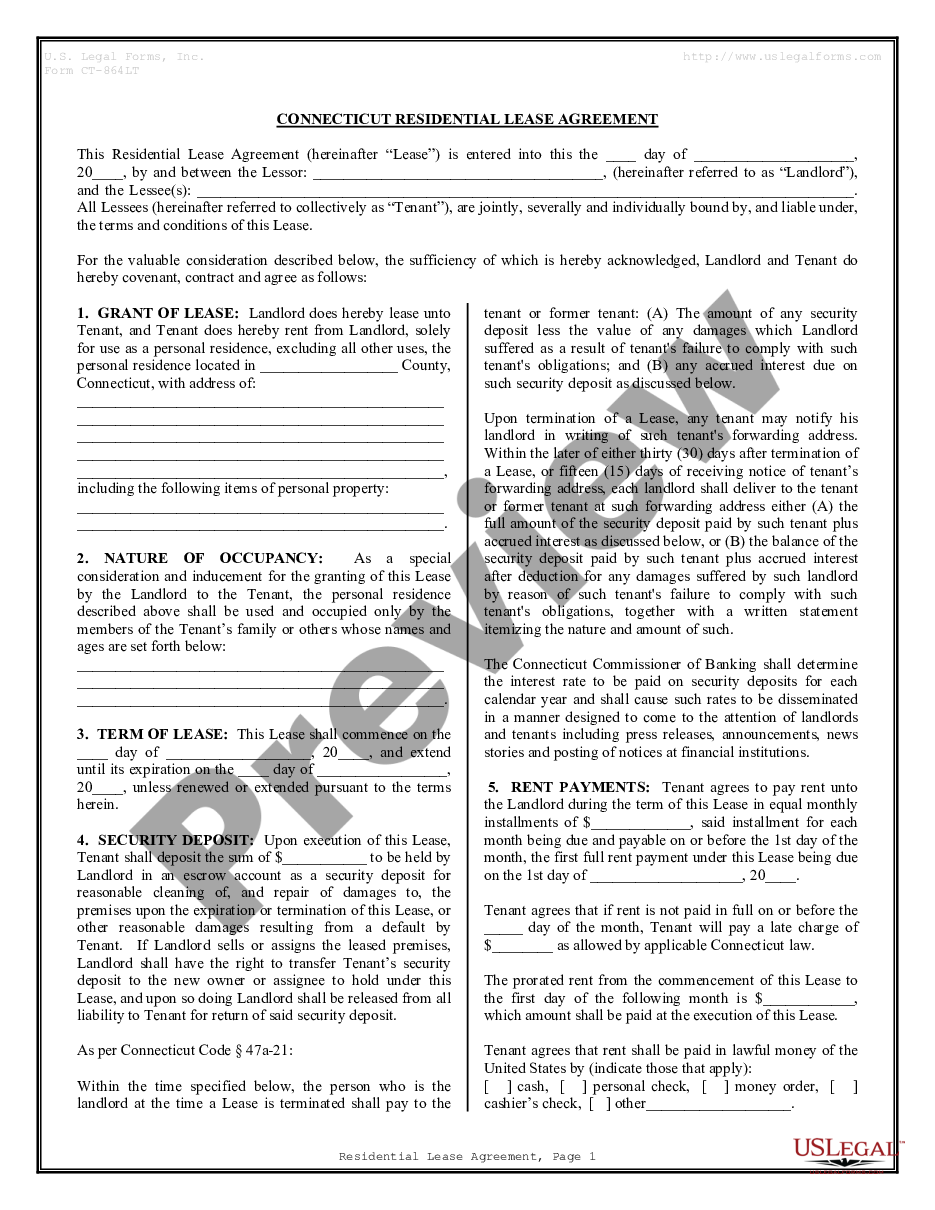

Acquire a printable Mississippi Flood Zone Statement and Authorization with just a few clicks in the most comprehensive collection of legal electronic documents.

Locate, download, and print expertly prepared and validated samples on the US Legal Forms platform. US Legal Forms has been the leading provider of budget-friendly legal and tax documents for US citizens and residents online since 1997.

After downloading your Mississippi Flood Zone Statement and Authorization, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Individuals who already possess a subscription must Log In to their US Legal Forms account, download the Mississippi Flood Zone Statement and Authorization, and find it saved in the My documents section.

- Those without a subscription should adhere to the following steps.

- Confirm that your document aligns with your state’s regulations.

- If available, examine the description of the document for more information.

- If provided, analyze the document to discover additional details.

- Once you're certain the document is appropriate for you, select Buy Now.

- Establish a personal account.

- Select a subscription plan.

- Make payment via PayPal, Visa, or Mastercard.

- Download the document in Word or PDF format.

Form popularity

FAQ

Summary: Proximity to a flood zone lowers property values. By law, a property is considered in a flood zone if any part of the structure falls within a floodplain, an area that is adjacent to a stream or river that experiences periodic flooding.

The federal government offers coverage through the National Flood Insurance Program at an average cost of about $700 per year. But premiums vary depending on your property's flood risk.

Flood Zone A is a special flood hazard area designation by the Federal Emergency Management Agency (FEMA). Zone A areas have a 1 percent annual chance of flooding. This flood is also called the 100-year flood.

Areas in flood zone A have a 1 percent chance of flooding per year and a 25 percent chance of flooding at least once during a 30-year mortgage. Since there haven't been detailed hydraulic analysis in these areas, the base flood elevation and depths have not been determined.

Flood Zone A. Areas subject to inundation by the 1-percent-annual-chance flood event generally determined using approximate methodologies. Flood Zone AE, A1-30. Flood Zone AH. Flood Zone AO. Flood Zone AR. Flood Zone A99. Flood Zone V. Flood Zone VE, V1-30.

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance