Michigan Corrected Deed of Personal Representative

Description

Key Concepts & Definitions

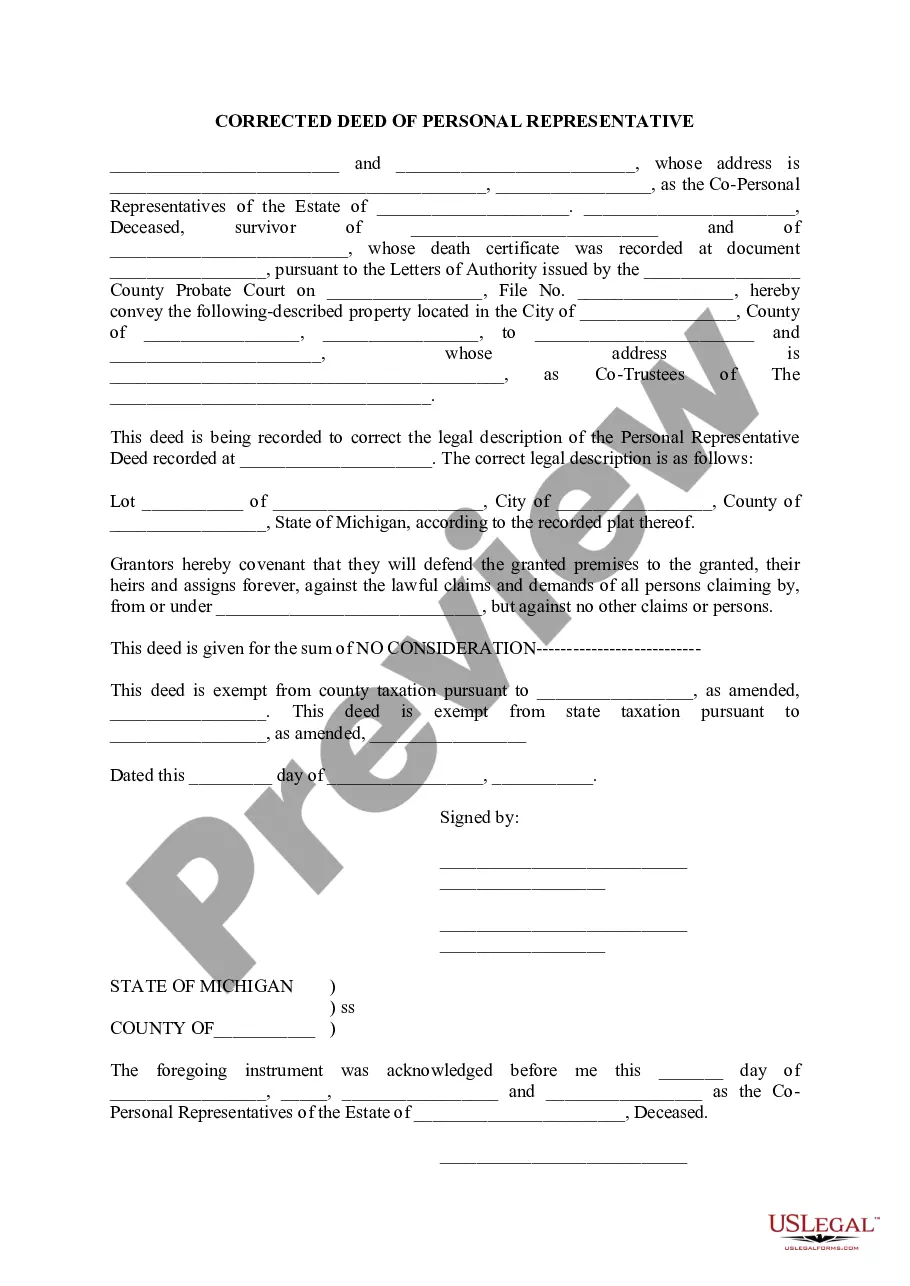

Corrected Deed of Personal Representative: A legal document issued by the personal representative of an estate to correct any errors present in a previously issued deed. This deed ensures that the property transfer reflects the accurate details as intended by the deceased's will or estate plan.

Step-by-Step Guide to Issuing a Corrected Deed

- Identify the Error: Review the original deed to pinpoint the exact inaccuracies that need correction.

- Consult with a Lawyer: Engage with an attorney who specializes in estate planning or real estate law to ensure the correction adheres to legal standards.

- Prepare the Corrected Deed: The personal representative should draft the corrected deed, including all accurate and corrected details.

- Signatures and Notarization: The deed must be signed by the personal representative and notarized to be legally valid.

- Record the Deed: File the corrected deed with the appropriate county recorder's office to make the correction official and part of the public record.

Risk Analysis

- Legal Risks: Improperly corrected deeds can lead to disputes among beneficiaries or claims against the estate.

- Financial Risks: Errors in the deed that are not corrected promptly may lead to financial losses, such as penalties or additional taxes.

- Reputation Risks: Mistakes in estate documentation can affect the personal representative's credibility and trustworthiness.

Common Mistakes & How to Avoid Them

- Overlooking Small Errors: Even minor mistakes in a deed can lead to significant legal problems. Always double-check the details before recording a deed.

- Delaying Corrections: Delay in addressing deed errors can complicate property transfers and estate settlements.

- DIY Approach: Drafting or correcting legal documents without professional advice can increase the likelihood of errors. Always consult with an estate or real estate lawyer.

Key Takeaways

A corrected deed of personal representative is crucial for ensuring that property is transferred correctly according to the deceased's wishes. Thoroughly review and seek legal counsel when dealing with property deeds to prevent potential legal issues.

How to fill out Michigan Corrected Deed Of Personal Representative?

Get any form from 85,000 legal documents such as Michigan Corrected Deed of Personal Representative on-line with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Corrected Deed of Personal Representative you would like to use.

- Read through description and preview the template.

- When you are confident the sample is what you need, click Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform gives you access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Michigan Corrected Deed of Personal Representative easy and fast.

Form popularity

FAQ

In order to provide finality to the termination of a trust or the closing of an estate, the form of deed given by a personal representative or a trustee simply calls for the seller to convey as opposed to convey and warrant the property.Again, all the buyer gets is whatever the trust or estate owned.

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

The personal representative is the court representative who has the authority to search for any important documents. The search should include the home, office, place of business, and any safe deposit boxes.

The personal representative can close a bank account and move the funds to an estate account.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

A personal representative or legal personal representative is the executor or administrator for the estate of a deceased person.For example, the person authorized to make health-care-related decisions for another person because the latter is very ill or not lucid is a personal representative.

Yes, It's Possible for an Executor to Sell Property To Themselves Here's How. If you've been named the executor of an estate, you have a crucial job.In most cases, the executor sets about putting the house on the market and selling it so the proceeds can be distributed to any heirs.