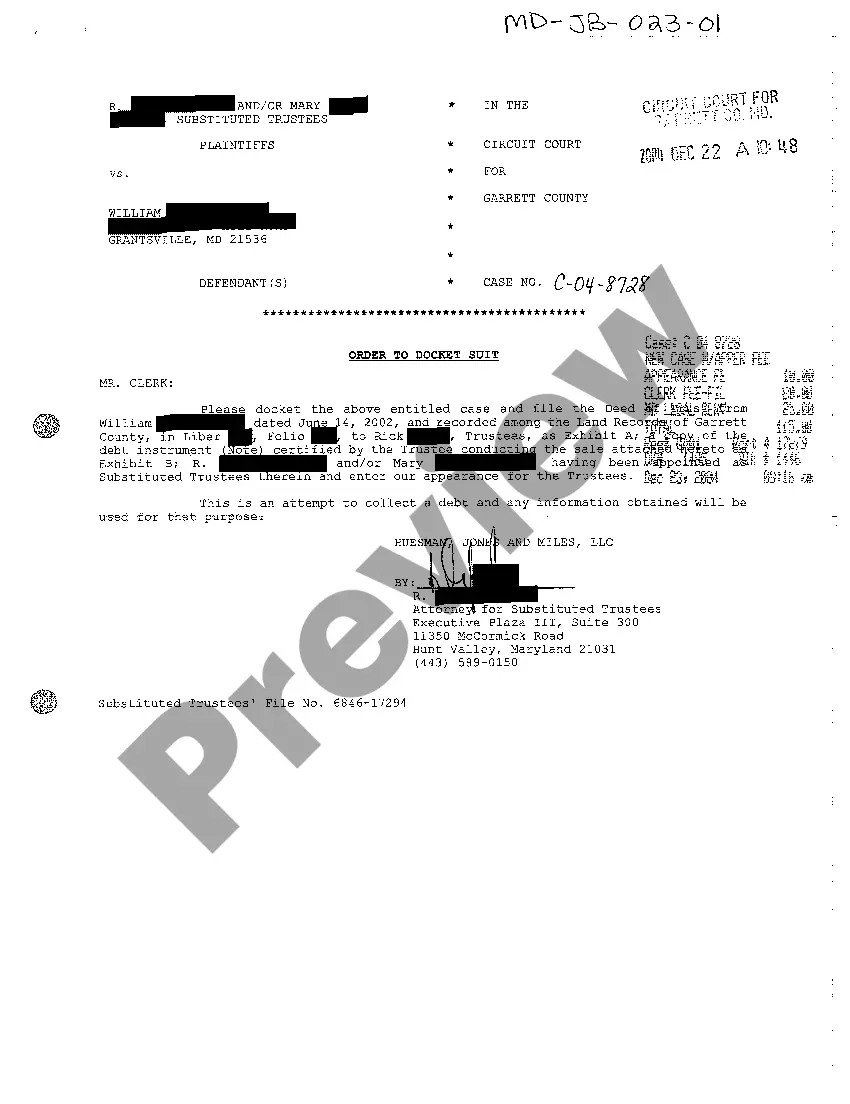

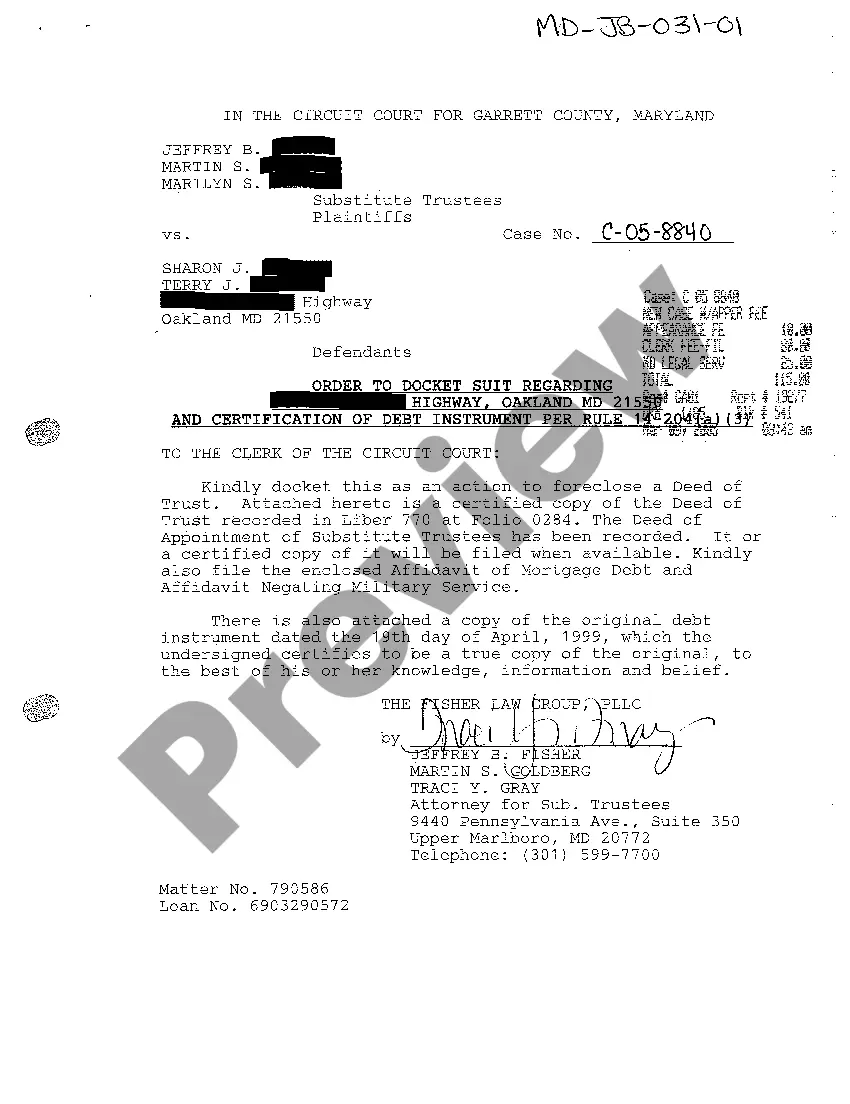

Maryland Order to Docket Foreclosure of Mortgage

Description

How to fill out Maryland Order To Docket Foreclosure Of Mortgage?

Greetings to the most extensive library of legal documents, US Legal Forms. Here you can discover any template, including Maryland Order to Docket Foreclosure of Mortgage templates, and retain as many of them as you desire.

Prepare official documents in just a few hours, rather than days or weeks, without spending a fortune on a lawyer. Obtain the state-specific example in a few clicks and feel confident knowing it was created by our state-certified lawyers.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Order to Docket Foreclosure of Mortgage you wish to obtain. Since US Legal Forms is an online service, you’ll typically have access to your downloaded forms, regardless of the device you’re using. Locate them under the My documents section.

Download the document in the format you need (Word or PDF). Print the file and complete it with your or your business information. Once you’ve filled out the Maryland Order to Docket Foreclosure of Mortgage, send it to your attorney for validation. It’s an extra step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and access a vast collection of reusable templates.

- If you don't have an account yet, what are you waiting for.

- Review our instructions below to get started.

- If this is a state-specific example, check its relevance in your state.

- Refer to the description (if available) to ascertain if it’s the correct example.

- View additional content using the Preview feature.

- If the document meets all your criteria, click Buy Now.

- To set up your account, select a pricing plan.

- Utilize a card or PayPal account to register.

Form popularity

FAQ

First, the costs and expenses of conducting the foreclosure sale are paid. Second, the lien that was foreclosed on is paid off. Third, if there is any money remaining after the foreclosed lien is paid, then any liens junior to the foreclosed lien are paid in their order of priority.

Notice of Intent to Foreclose (NOI) The NOI is a warning notice to the homeowner that a foreclosure action could be filed against them in court. The mortgage company must send the NOI by certified and first-class mail to the homeowner no less than 45 days before a foreclosure action is filed in court.

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.

During foreclosure, the mortgage lender may seize the property and sell it to recoup the money it lost from the mortgage default. The lender is allowed to take back the home because a mortgage is a secured loan. That means the borrower guarantees repayment by providing collateral.

(Md. Code Ann., Tax-Prop. § 14-833). These six months are called a "redemption period." (In Baltimore City, the redemption period is nine months from the date of sale for owner-occupied residential properties.

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.

Foreclosure is what happens when a homeowner fails to pay the mortgage. More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction.

"Commencement of Foreclosure" for HUD's purposes is the first public action required by law such as filing a complaint or petition, recording a notice of default, or publication of a notice of sale.