Louisiana Endorsement and Assignment of Mortgage Note

Description

Definition and meaning

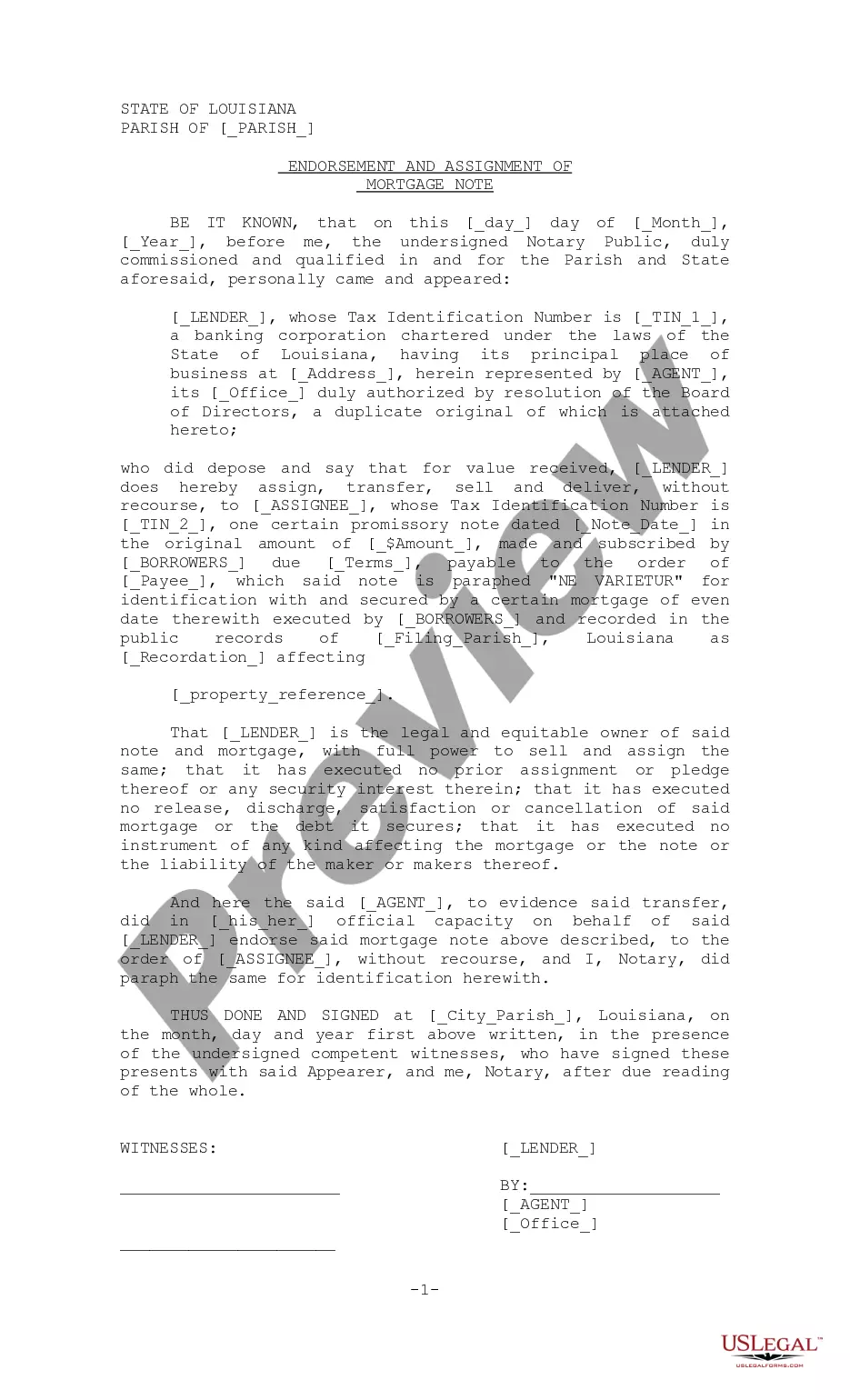

The Louisiana Endorsement and Assignment of Mortgage Note is a legal document that facilitates the transfer of interest in a mortgage note from one party to another. This document is essential for lenders who wish to assign their rights under an existing mortgage note, thereby allowing another party, known as the assignee, to enforce the terms of the note. The endorsement signifies that the original lender has legally transferred the note, providing the assignee with the authority to collect payments and manage the mortgage.

How to complete a form

To properly complete the Louisiana Endorsement and Assignment of Mortgage Note, follow these steps:

- Enter the current date of the endorsement, including the day, month, and year.

- Fill in the lender's details, including the name, Tax Identification Number, and address.

- Identify the agent who is authorized to act on behalf of the lender and provide their title.

- Complete the assignee details, including their name and Tax Identification Number.

- Include information about the promissory note, such as the date it was issued, the original amount, and the repayment terms.

- State the name of the payee who is entitled to receive payments on the note.

- Provide details about the mortgage, including the parish where it was filed and the recordation data.

Who should use this form

This form is primarily used by lenders who want to assign their rights to a mortgage note to another party. It is also suitable for individuals or entities that are acquiring mortgage notes as investment opportunities or for the purpose of collecting payments. Users of this form should have a clear understanding of the terms and obligations associated with the mortgage note they are acquiring.

Key components of the form

The Louisiana Endorsement and Assignment of Mortgage Note contains several key components:

- Lender Information: Details of the original lender, including their Tax Identification Number and address.

- Assignee Information: Details about the party receiving the assignment.

- Promissory Note Details: Information about the note, including its date, amount, and terms.

- Mortgage Information: Data on the mortgage, including where it is filed and its recordation.

- Signature and Notarization: The signature of the agent representing the lender, along with notarization to validate the endorsement.

Benefits of using this form online

Using the Louisiana Endorsement and Assignment of Mortgage Note online offers various advantages:

- Convenience: Users can complete the form at their own pace from anywhere with internet access.

- Time-saving: Online forms can often be filled out and submitted more quickly than traditional paper methods.

- Accuracy: Online platforms frequently provide prompts and guidance to prevent common errors.

- Immediate Access: Users can download a completed version of the form immediately, facilitating faster processing.

How to fill out Louisiana Endorsement And Assignment Of Mortgage Note?

You are welcome to the biggest legal files library, US Legal Forms. Here you can get any sample including Louisiana Endorsement and Assignment of Mortgage Note templates and download them (as many of them as you want/need to have). Prepare official files with a few hours, rather than days or weeks, without having to spend an arm and a leg on an attorney. Get your state-specific example in clicks and feel confident with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download next to the Louisiana Endorsement and Assignment of Mortgage Note you need. Because US Legal Forms is web-based, you’ll generally get access to your saved forms, regardless of the device you’re using. Locate them inside the My Forms tab.

If you don't have an account yet, just what are you awaiting? Check our guidelines below to start:

- If this is a state-specific form, check its validity in your state.

- Look at the description (if offered) to learn if it’s the correct template.

- See far more content with the Preview feature.

- If the sample meets all of your needs, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the file in the format you want (Word or PDF).

- Print out the file and complete it with your/your business’s details.

Once you’ve filled out the Louisiana Endorsement and Assignment of Mortgage Note, send away it to your lawyer for confirmation. It’s an additional step but an essential one for being sure you’re entirely covered. Join US Legal Forms now and get access to thousands of reusable examples.

Form popularity

FAQ

Endorsements. When an investor purchases a loan, the previous owner will sign or endorse the note, formally indicating that the note is being transferred to a new owner. This process is called endorsement. Just as with a check, one party can transfer ownership of a note by signing it over to another party.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An allonge is a sheet of paper that is attached to a negotiable instrument, such as a bill of exchange. Its purpose is to provide space for additional endorsements when there is no longer sufficient space on the original instrument. The word allonge derives from the French word allonger, which means to lengthen."

You will need to sign a promissory note and a mortgage or trust deed.The document should be signed and dated by the borrower, and you will need to file or record the document at the local recorder of deeds office or other office responsible for the filing of real estate documents.

1If a loan is "assumable," you're in luck: That means you can transfer the mortgage to somebody else.2In most cases, the new borrower needs to qualify for the loan.3To complete a transfer of an assumable loan, request the change with your lender.How to Transfer a Mortgage to Another Borrower - The Balance\nwww.thebalance.com > can-you-transfer-a-mortgage-315698

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.