A Kentucky Order Directing Employer To Make Wage Deductions For Remittance To Chapter 13 Trustee is an order issued by the Kentucky Court to an employer, requiring them to deduct wages from an employee's salary and remit the funds to a Chapter 13 Trustee. This order is typically issued when an employee has filed for bankruptcy under Chapter 13 of the US Bankruptcy Code. There are two types of Kentucky Order Directing Employer To Make Wage Deductions For Remittance To Chapter 13 Trustee: 1. Wage Deduction Order: This type of order requires the employer to deduct a certain amount from the employee's wages each pay period and remit the funds to the Chapter 13 Trustee. 2. Wage Garnishment Order: This type of order requires the employer to deduct a certain percentage of the employee's wages each pay period and remit the funds to the Chapter 13 Trustee.

Kentucky Order Directing Employer To Make Wage Deductions For Remittance To Chapter 13 Trustee

Description

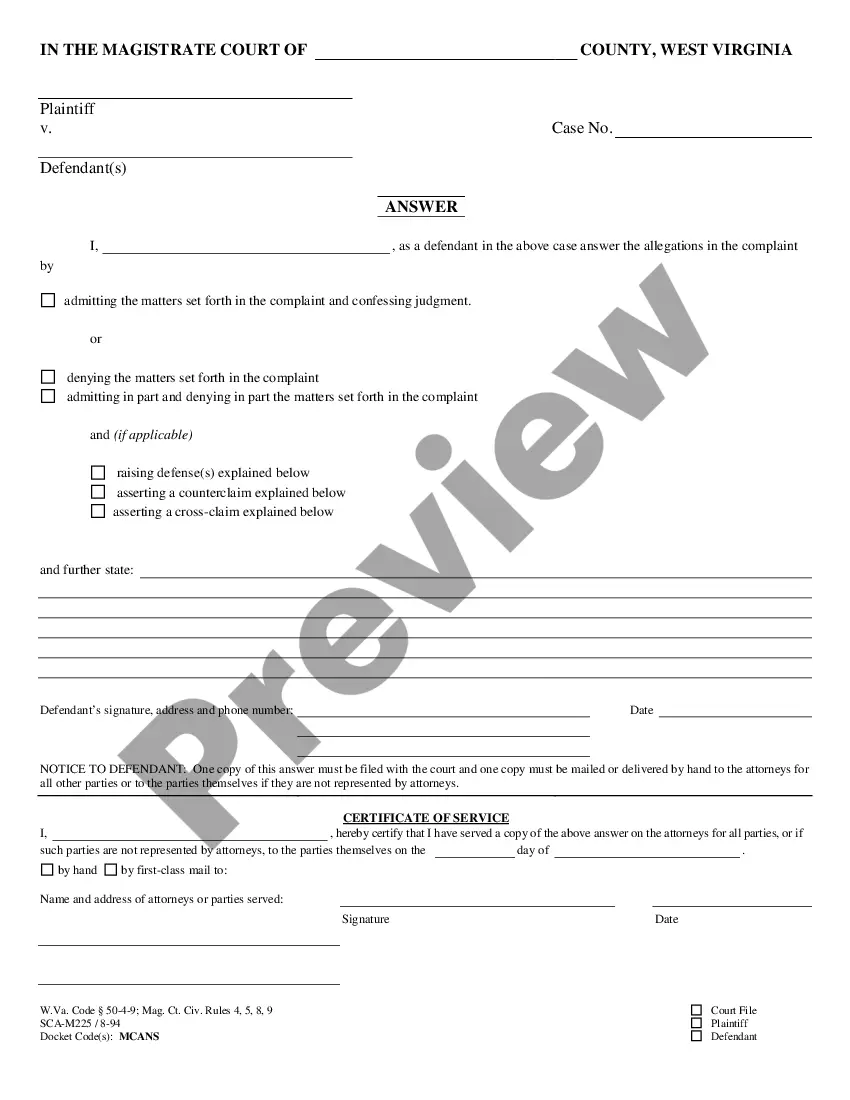

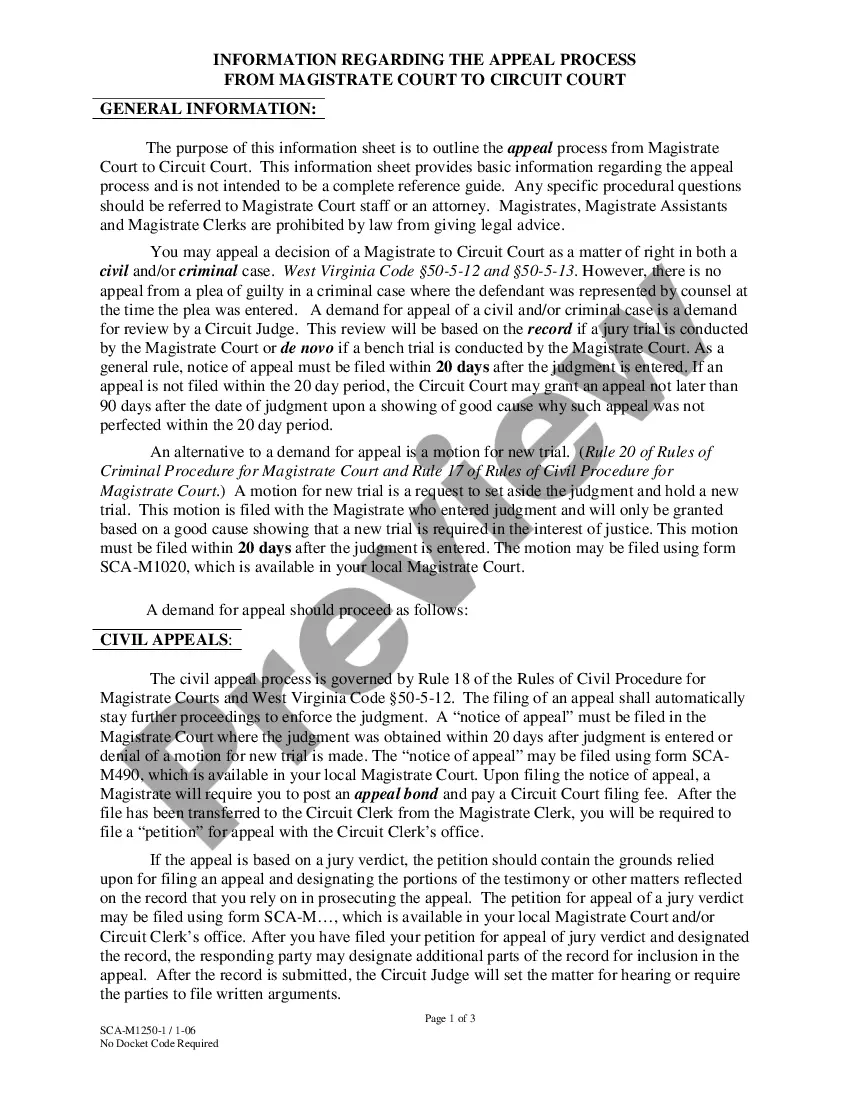

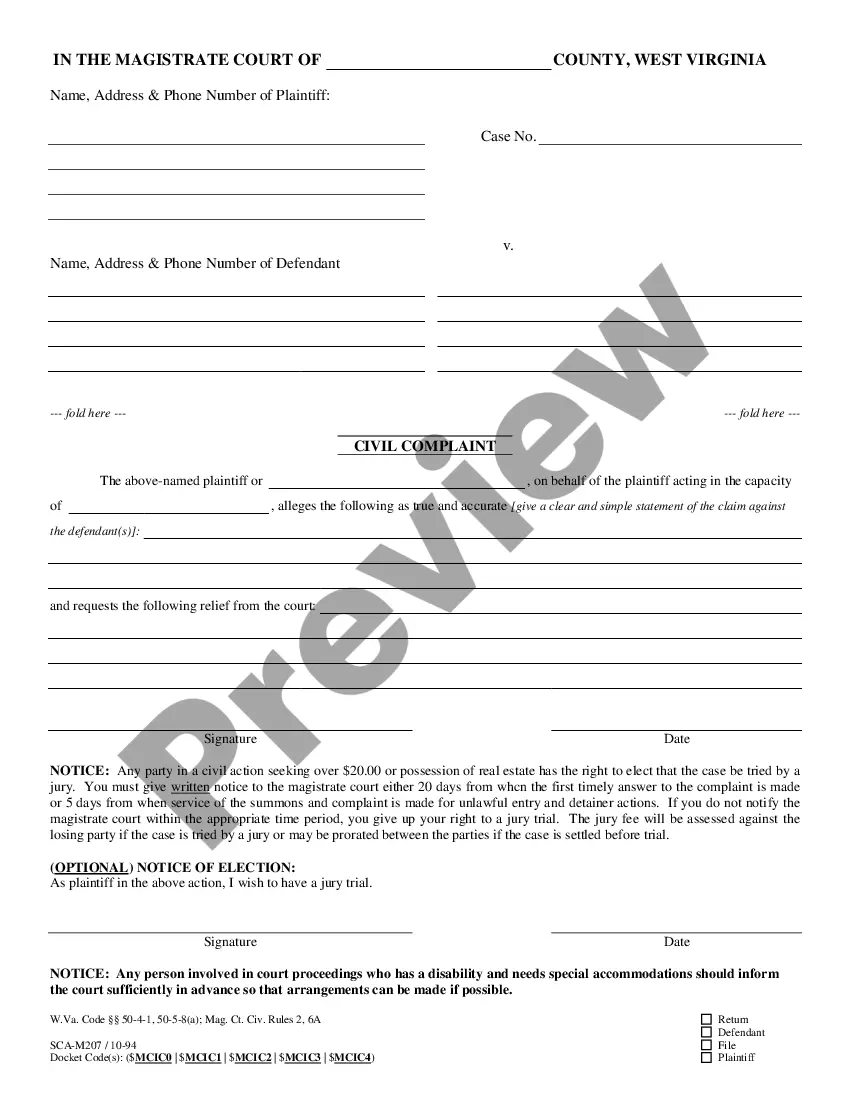

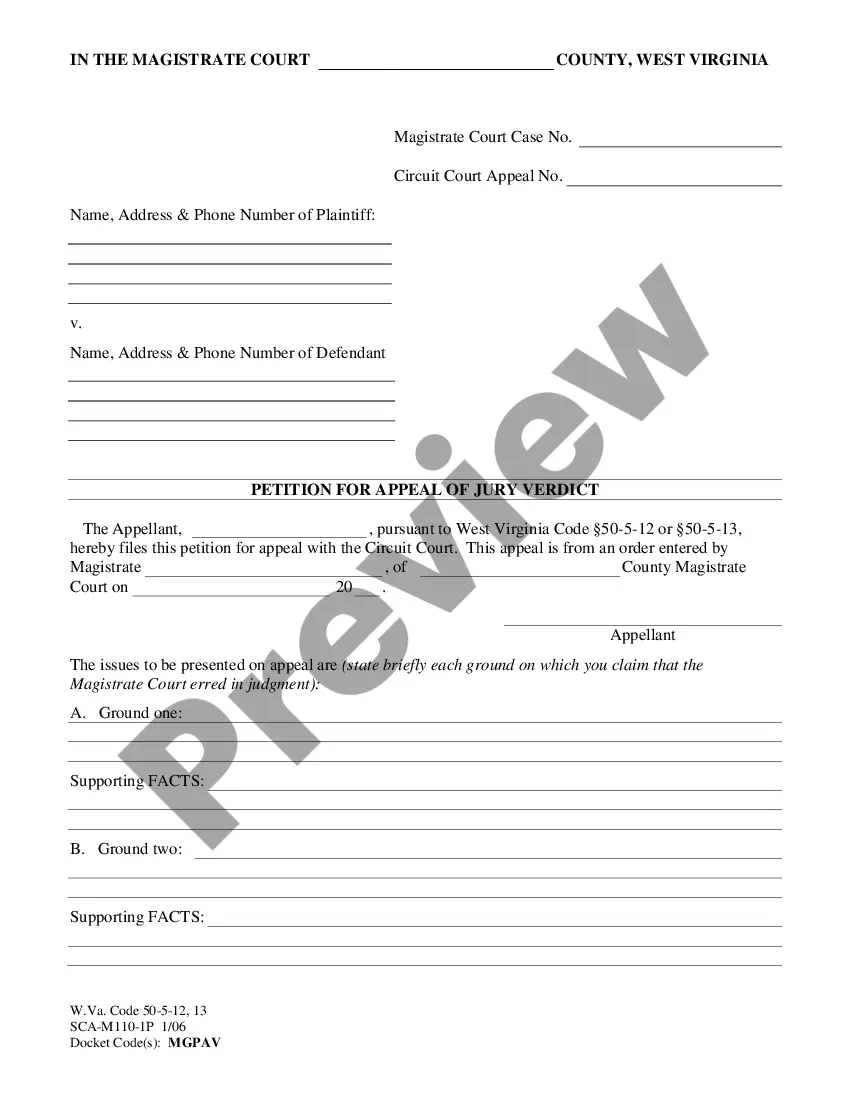

How to fill out Kentucky Order Directing Employer To Make Wage Deductions For Remittance To Chapter 13 Trustee?

If you’re looking for a method to accurately finalize the Kentucky Order Directing Employer To Make Wage Deductions For Remittance To Chapter 13 Trustee without employing a legal advisor, then you’re in the ideal place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and business scenario. Each document you find on our online service is crafted in accordance with national and state regulations, ensuring that your paperwork is organized.

One more fantastic aspect of US Legal Forms is that you will never misplace the documents you bought - you can access any of your downloaded templates in the My documents tab of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or exploring the Preview mode.

- Input the form title in the Search tab located at the top of the page and select your state from the dropdown to discover another template in case of any discrepancies.

- Proceed with the content verification and click Buy now when you are assured of the document's compliance with all requirements.

- Log in to your account and click Download. Sign up for the service and select a subscription plan if you do not already possess one.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The blank will be ready for download immediately afterward.

- Select the format in which you wish to receive your Kentucky Order Directing Employer To Make Wage Deductions For Remittance To Chapter 13 Trustee and download it by clicking the corresponding button.

- Import your template to an online editor for swift completion and signing, or print it out to prepare a hard copy manually.

Form popularity

FAQ

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

In a Chapter 13 bankruptcy, the trustee can freeze your bank accounts long enough to use some of the money to pay your creditors if that money is not exempt. That would happen at the beginning of the case. They can and often do release the claim if you need that money for necessity.

Chapter 13 is essentially a consolidation loan in which you make a monthly payment to a court-appointed trustee, who then distributes the money to creditors. Creditors are not allowed to have any direct contact with you and must go through the trustee instead. You can keep your property and gain time to pay off debts.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

In Chapter 13 bankruptcy, you must devote all of your "disposable income" to the repayment of your debts over the life of your Chapter 13 plan. Your disposable income first goes to your secured and priority creditors. Your unsecured creditors share any remaining amount.

In chapter 12 and chapter 13 cases, the debtor is usually entitled to a discharge upon completion of all payments under the plan. As in chapter 7, however, discharge may not occur in chapter 13 if the debtor fails to complete a required course on personal financial management.

What does a Chapter 13 discharge mean? A ?discharge? is the fancy legal term for your debts being forgiven in your bankruptcy. When we talk about debts forgiven in bankruptcy, we would say that your debts are discharged. The Chapter 13 ?discharge order? is the final order you receive in your Chapter 13 bankruptcy.

PAYROLL DEDUCTION ORDERS This order tells your employer to deduct your plan payment from your paycheck and send it to the Chapter 13 Trustee. This order prohibits your employer from honoring any garnishments while you are under Chapter 13, including back taxes.