Illinois Transfer on Death Instrument Revocation

Description

Definition and meaning

The Illinois Transfer on Death Instrument Revocation is a legal document that allows an owner of real estate to revoke a previously executed Transfer on Death Instrument (TODI). This instrument originally allowed the owner to designate a beneficiary who would receive the property automatically upon the owner's death. Revocation ensures that the beneficiary designation is no longer valid, effectively nullifying any prior wishes regarding the transfer of the property.

How to complete a form

To correctly complete the Illinois Transfer on Death Instrument Revocation, follow these steps:

- Identify the Owner: Include the full name and address of the owner or owners revoking the TODI.

- Provide the Original Instrument Details: Document the date and document number of the initial Transfer on Death Instrument.

- Legal Description: Insert the legal description of the property being revoked.

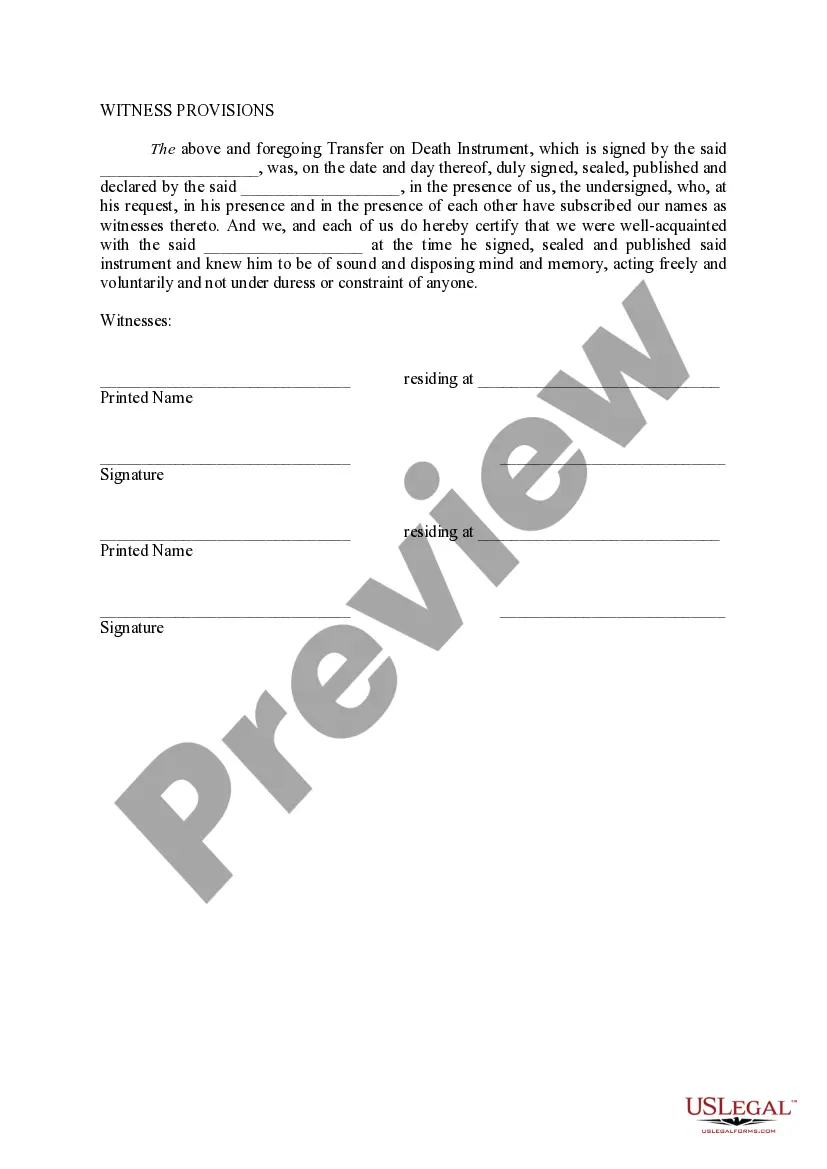

- Signatures: The owner(s) must sign the document in front of a notary public and witnesses.

Ensure all information is accurate and complete to prevent potential legal issues.

Who should use this form

This form is ideal for individuals who have previously created a Transfer on Death Instrument in Illinois and wish to revoke it. Reasons for revocation may include changes in personal circumstances, such as divorce, the death of a beneficiary, or a shift in the owner's intentions regarding property distribution.

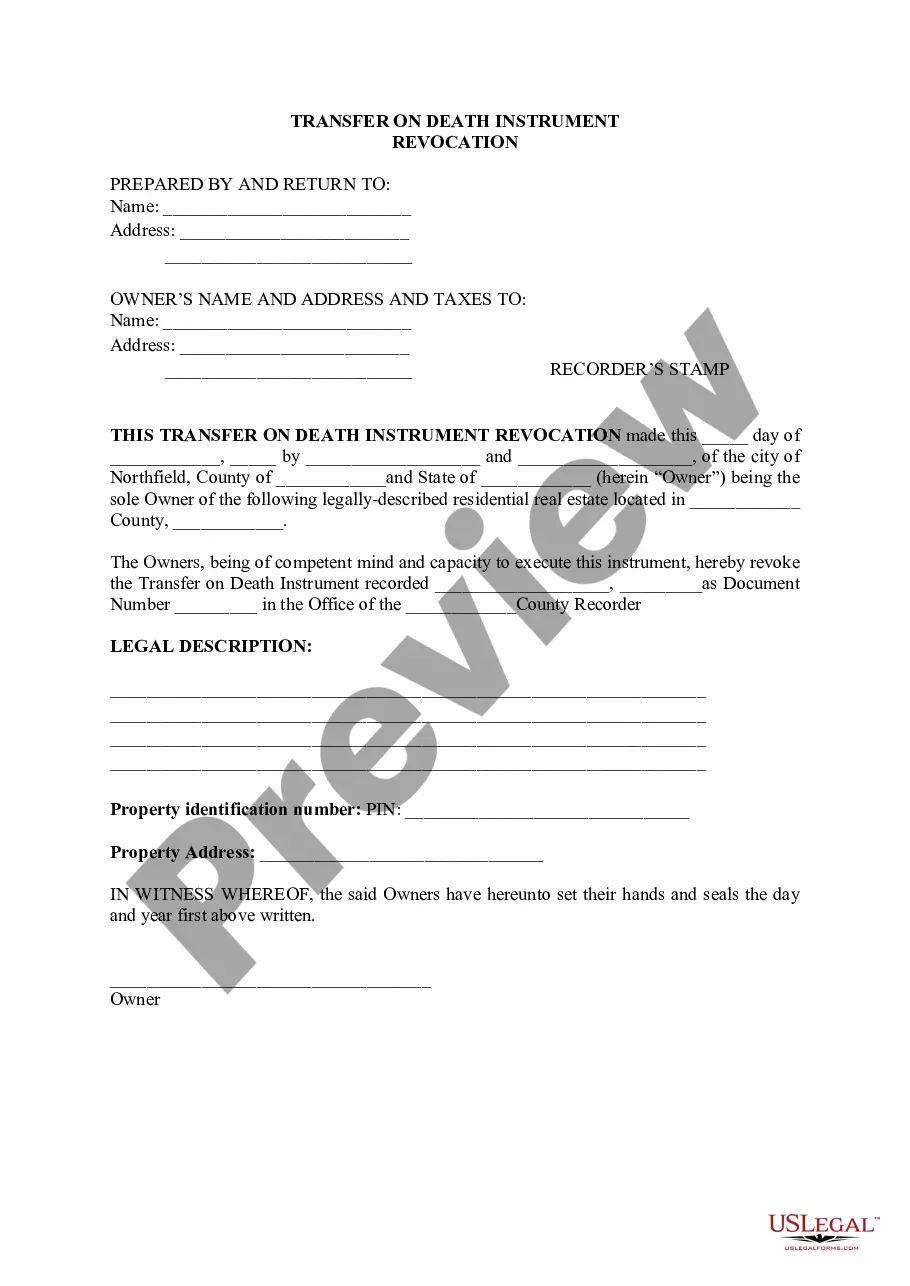

Key components of the form

The Illinois Transfer on Death Instrument Revocation includes several important components:

- Owner Details: Names and addresses of the current property owners.

- Property Information: Legal description and property identification number (PIN) of the real estate being revoked.

- Prevailing Instrument Information: Date, document number, and recorder's office where the original TODI was filed.

- Witness and Notary Sections: Areas for witness signatures and notary acknowledgment to validate the revocation.

Including all required components is crucial for the document's legality.

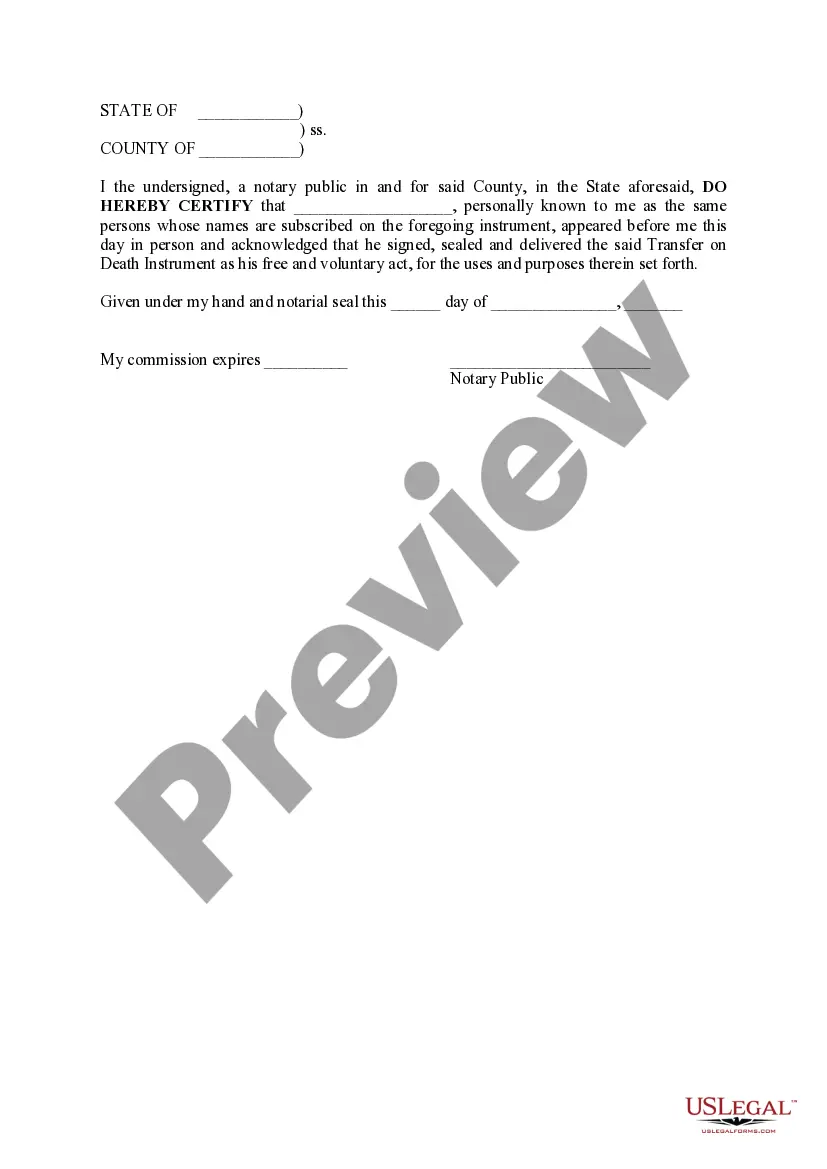

What to expect during notarization or witnessing

During the notarization of the Illinois Transfer on Death Instrument Revocation, the following steps typically occur:

- Presence of the Owner: The owner must be present to sign the document in front of the notary.

- Notary Verification: The notary public will verify the identities of the signers through valid identification.

- Signatures and Seals: After verifying identities, the owner signs the document, and the notary will add their signature and seal to certify it.

Witnesses must also sign the document to ensure that the revocation was executed properly under Illinois law.

Common mistakes to avoid when using this form

When completing the Illinois Transfer on Death Instrument Revocation, avoid these common pitfalls:

- Incomplete Information: Ensure all required fields are filled in fully, including the legal property description.

- Invalid Signatures: Verify that all signatures are collected in the presence of a notary and witnesses.

- Failing to Retain Copies: Keep copies of the completed revocation for personal records and future reference.

Avoiding these errors will help ensure the document is legally effective.

How to fill out Illinois Transfer On Death Instrument Revocation?

Utilize US Legal Forms to acquire a printable Illinois Transfer on Death Instrument Revocation.

Our court-admissible documents are crafted and frequently updated by experienced attorneys.

Ours is the most comprehensive Forms catalog on the internet and provides affordably priced and precise templates for clients, lawyers, and small to medium-sized businesses.

US Legal Forms provides thousands of legal and tax templates and packages for both business and personal requirements, including Illinois Transfer on Death Instrument Revocation. More than three million users have successfully used our service. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- The templates are categorized based on state and many can be previewed before downloading.

- To download samples, clients need to have a subscription and to Log In to their account.

- Click Download next to any template you desire and locate it in My documents.

- For users without a subscription, follow these steps to easily locate and download the Illinois Transfer on Death Instrument Revocation.

- Ensure you obtain the correct form pertaining to the necessary state.

- Examine the document by reviewing the description and utilizing the Preview function.

- Click Buy Now if it is the document required.

- Establish your account and pay through PayPal or by credit/debit card.

- Download the template to your device and feel free to reuse it multiple times.

- Utilize the Search field if you need to locate another document template.

Form popularity

FAQ

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

The Illinois TOD deed form form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process. A transfer on death deed can be a helpful estate planning tool but it is not permitted in every state.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.