The Georgia Summons of Continuing Garnishment is a legal document issued by the courts in the State of Georgia. It is used to continue a garnishment of wages or other income for the payment of a debt or judgment. There are three types of Georgia Summons of Continuing Garnishment: Wage Garnishment Summons, Bank Account Garnishment Summons, and Real Property Garnishment Summons. A Wage Garnishment Summons is used to garnish wages from a debtor’s employer. A Bank Account Garnishment Summons is used to garnish funds from a debtor’s bank account. A Real Property Garnishment Summons is used to garnish funds from a debtor’s real estate. Each type of garnishment summons requires the debtor to appear in court and answer questions about their debt or judgment. The garnishment will continue until the debt or judgment is paid in full.

Georgia Summons Of Continuing Garnishment

Description

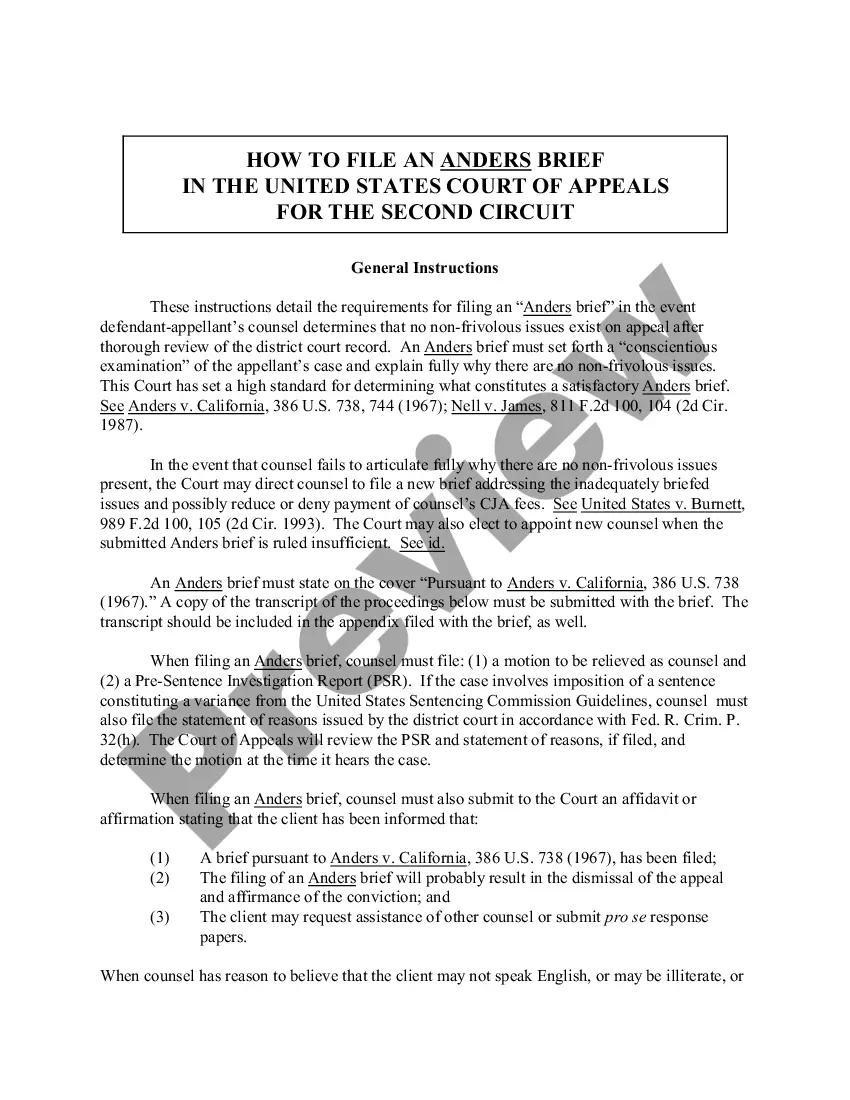

How to fill out Georgia Summons Of Continuing Garnishment?

Drafting legal documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online collection of formal paperwork, you can trust the forms you receive, as they all adhere to federal and state laws and have been validated by our specialists.

Acquiring your Georgia Summons Of Continuing Garnishment from our library is as straightforward as ABC. Previously registered users with an active subscription just need to Log In and click the Download button once they find the suitable template. Later, if necessary, users can retrieve the same document from the My documents section of their account. Nevertheless, even if you are new to our service, signing up with a valid subscription will only take a few minutes. Here’s a simple guide for you.

Have you not yet explored US Legal Forms? Subscribe to our service now to obtain any official document swiftly and effortlessly whenever necessary, and keep your paperwork organized!

- Document compliance check. You should meticulously examine the content of the form you desire and verify if it meets your needs and adheres to your state’s legal requirements. Reviewing your document and checking its general description will assist you in doing just that.

- Alternative search (optional). If there are discrepancies, browse the library using the Search tab located at the top of the page until you locate an appropriate blank, and click Buy Now once you find the one you need.

- Account creation and form purchase. Establish an account with US Legal Forms. Following account verification, Log In and select your desired subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Georgia Summons Of Continuing Garnishment and click Download to store it on your device. Print it to fill out your documents manually, or utilize a multi-functional online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

To resolve a garnishment in Georgia, you can file a motion to dissolve the Georgia Summons Of Continuing Garnishment. This motion requests the court to end the garnishment based on specific grounds, such as showing the debt is not valid or demonstrating undue hardship. It is essential to provide supporting documentation when filing this motion. Additionally, consulting a legal expert can help you understand your options and navigate the process more effectively.

A continuing writ of garnishment is a court order that allows a creditor to collect a debt over time from your wages or bank account. This is particularly relevant when you deal with a Georgia Summons Of Continuing Garnishment, as it means the garnishment will remain in effect until the debt is settled. It's important to comprehend these terms to manage your financial interactions and avoid complications with creditors.

Ignoring a garnishment summons, such as the Georgia Summons Of Continuing Garnishment, can lead to severe consequences, including defaults or additional legal action against you. Creditors may pursue further compensation, and you risk losing a portion of your wages or bank funds. It is advisable to respond to the summons promptly and seek legal advice to explore your options.

In Georgia, a garnishment may last up to 3 years from the date of the initial court order, specifically when issued under the Georgia Summons Of Continuing Garnishment. However, the duration may be modified based on the specific circumstances of the case. It's crucial to regularly review the status of your garnishment to ensure compliance with the law and to address any potential changes.

To file a garnishment in Georgia, you must first prepare the necessary documents, including the Georgia Summons Of Continuing Garnishment. Next, you will file these documents in the appropriate court. It is essential to serve the summons on the garnishee, which is typically the employer of the debtor. Using UsLegalForms can simplify this process, providing you with the correct forms and guidance to ensure your submission is accurate and timely.

There are two types of garnishment: Continuing garnishment - The employer will deduct from the defendant's wages for approximately 179 days (or six months) provided the defendant makes wages which are subject to garnishment. garnishment deductions are based on the employee's net pay.

In Georgia, a creditor can garnish the lesser of 25% of your disposable income or the amount by which your disposable earnings exceed 30% of federal minimum wage. If your disposable income is less than 30 times minimum wage, it cannot be garnished at all.

3. How Does a Creditor File a Garnishment? file the garnishment suit in court; show that the creditor has a judgment against you; serve the bank or the employer via a sheriff or private process server; and, provide you with a copy of the garnishment (but not necessarily through personal service).

There are legal limits on how much of your paycheck can be garnished through a wage garnishment. In Georgia, a creditor can garnish the lesser of 25% of your disposable income or the amount by which your disposable earnings exceed 30% of federal minimum wage.

You can expect wage garnishment to stop when you: Challenge a judgment by filing wage garnishment proceedings and asking for wage garnishments to stop through a claim of exemption. Pay off all or some of the debt through a Chapter 13 repayment plan. Discharge the debt by filing for bankruptcy under Chapter 7 provisions.