Florida Financial Record Storage Chart

Description

How to fill out Financial Record Storage Chart?

You might spend countless hours online trying to locate the valid document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of verified forms that are reviewed by professionals.

You can easily download or print the Florida Financial Record Storage Chart from their service.

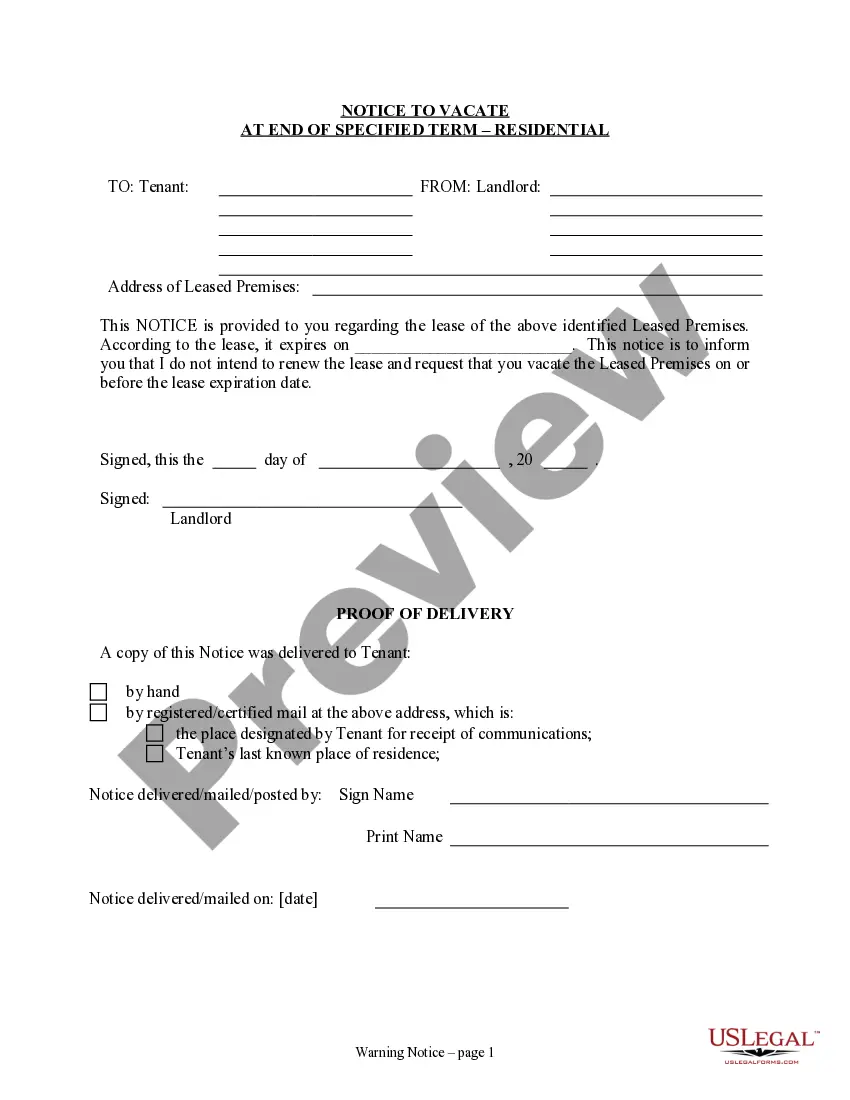

If available, use the Preview button to browse the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Get button.

- After that, you can complete, modify, print, or sign the Florida Financial Record Storage Chart.

- Every valid document template you acquire is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click on the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/region.

- Check the form information to confirm you’ve chosen the right template.

Form popularity

FAQ

You should retain mortgage information for at least seven years, especially if you want to protect yourself against potential legal issues or disputes. Keeping this information organized is crucial for easy access and compliance with regulations. The Florida Financial Record Storage Chart serves as a practical solution, helping you track the necessary timelines and manage your mortgage documents efficiently.

The 7 year retention rule typically refers to the guideline that individuals and businesses should keep financial records for at least seven years. This is particularly important for tax purposes, as it allows for proper audit trails and accountability. The Florida Financial Record Storage Chart helps you navigate these requirements effectively and ensures that you maintain the right documents for the right amount of time.

In Florida, real estate agents are required to keep files for a minimum of five years. This rule applies to all transactions and includes all relevant documentation. To streamline the management of these records, the Florida Financial Record Storage Chart can be a valuable tool for organization and compliance.

According to ORS 86A 112, a mortgage banker or mortgage broker must retain records for at least three years after the transaction. This period allows for adequate review in case of audits or disputes. Understanding these requirements is essential, and using the Florida Financial Record Storage Chart can help ensure compliance and ease the documentation process.

To ensure compliance and accurate financial management, keep paperwork such as bank statements, tax returns, and donation records for seven years. The duration may vary for different types of documents, so consulting the Florida Financial Record Storage Chart can provide detailed insights. Properly retaining these records not only protects your organization but also enhances transparency with your stakeholders. Make it a practice to review and categorize your documents regularly.

You should keep paperwork such as receipts, invoices, and contracts for seven years. This record retention is crucial for tax purposes and overall financial clarity. The Florida Financial Record Storage Chart outlines various categories of documents that fall within this retention period. Staying organized and keeping these papers can simplify your financial management processes.

Employee records that must be kept for seven years include payroll records, tax withholding records, and performance evaluations. Retaining these documents helps ensure compliance with employment regulations and serves as a reference for any disputes that may arise. The Florida Financial Record Storage Chart can assist in identifying additional personnel records worth preserving for this duration. Maintaining these records promotes a fair workplace and protects your organization.

year retention policy outlines the types of documents and records that must be kept for a period of seven years. This policy ensures that organizations comply with legal standards and easily access information when necessary. Using the Florida Financial Record Storage Chart can aid in developing this policy effectively. Adopting such a policy not only protects your organization but also enhances its operational efficiency.

Records that need to be kept for seven years typically include your organization's financial statements and payroll records. This duration aligns with legal requirements and gives you a thorough history of your financial practices. Referencing the Florida Financial Record Storage Chart can help clarify exactly what types of records should be kept. Keeping these documents organized is crucial for financial stability and operational effectiveness.

Documentation that should be retained for seven years includes tax returns, bank statements, and receipts for expenses. Keeping these records ensures that your organization is prepared in case of any audits or inquiries. The Florida Financial Record Storage Chart serves as an excellent resource to determine what specific documents are necessary for different financial activities. Proper retention helps in maintaining compliance and fostering trust.