Florida Application for Self-Insurance

Description

How to fill out Florida Application For Self-Insurance?

Obtain one of the most extensive collections of legal templates.

US Legal Forms serves as a platform to locate any state-specific document within moments, including samples for Florida Application for Self-Insurance.

No need to waste your time searching for a court-acceptable template.

After selecting a payment plan, set up an account. Pay using a credit card or PayPal. Download the template to your device by clicking on the Download button. That’s it! You should fill out the Florida Application for Self-Insurance form and review it. To ensure everything is correct, consult your local legal advisor for assistance. Register and easily access over 85,000 valuable templates.

- To utilize the forms library, select a subscription and create an account.

- If you are already registered, simply Log In and then click Download.

- The sample Florida Application for Self-Insurance will promptly be saved in the My documents section (a section for all documents you download on US Legal Forms).

- To create a new account, follow the short steps outlined below.

- When using a state-specific template, ensure you specify the correct state.

- If available, review the description for all details of the form.

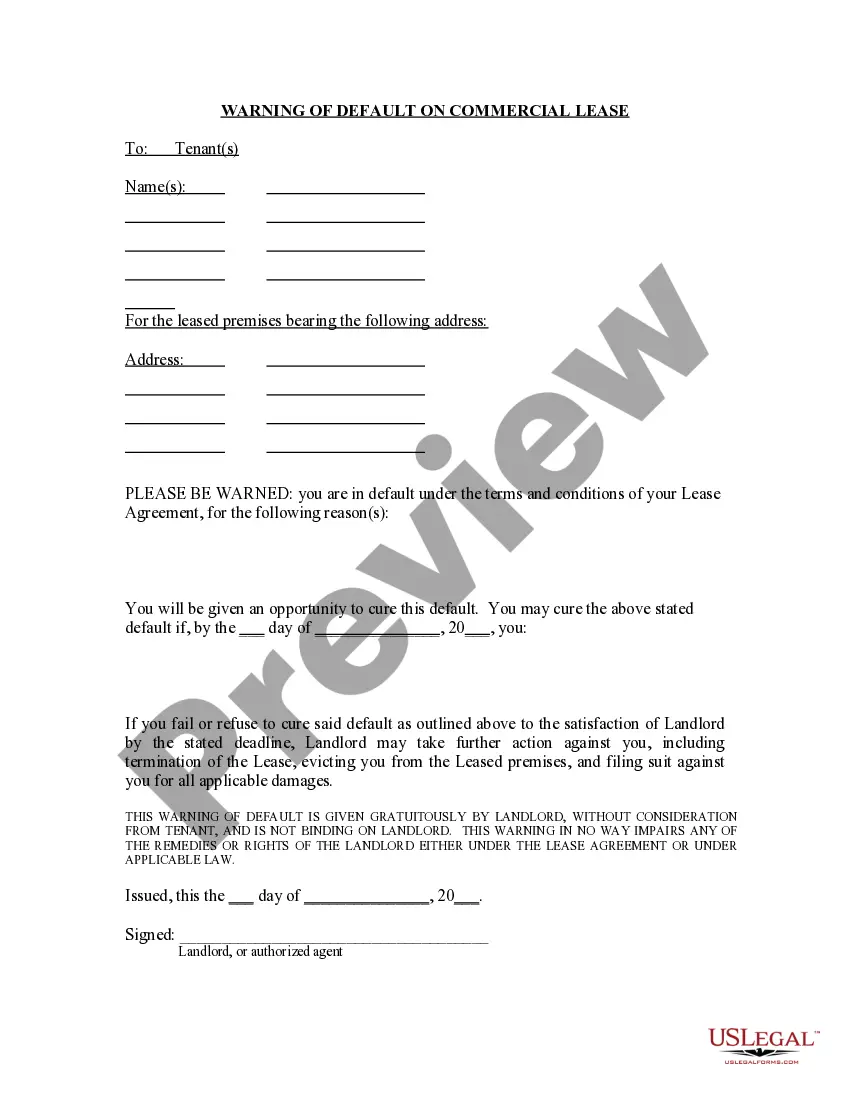

- Use the Preview feature if accessible to examine the contents of the document.

- If everything appears accurate, click on the Buy Now button.

Form popularity

FAQ

To qualify for self-insurance in Florida, you must first submit a Florida Application for Self-Insurance to the appropriate agency. Your application should demonstrate financial stability and a substantial ability to cover potential liabilities. Additionally, you may need to provide evidence of your business's history and its overall insurance needs. By using the uSlegalforms platform, you can efficiently complete your Florida Application for Self-Insurance and ensure that you meet all requirements.

Becoming a self-insured company starts with completing the Florida Application for Self-Insurance, which outlines your financial capability to handle claims. You will also need to establish a sound risk management strategy and set aside adequate funds to cover potential liabilities. Consider working with experts to ensure you meet all legal requirements and understand the implications of self-insurance. Platforms like US Legal Forms can help simplify the application process and provide the necessary guidance.

To qualify as a self-insured trucking company in Florida, you must submit a Florida Application for Self-Insurance to the state authorities. This involves demonstrating adequate financial resources to cover liabilities and comply with state regulations. Additionally, you should maintain proof of sufficient insurance reserves to address potential claims. Effectively, being self-insured means you take on the financial responsibility for your truck’s risk, rather than relying on traditional insurance.

Self-insuring your home in Florida involves evaluating your property’s value and determining your financial ability to cover potential damages. You'll need a thorough understanding of risks specific to your location. While there isn't a formal Florida Application for Self-Insurance for homes, creating a savings account to cover possible losses is a practical step towards self-insuring your home.

To be self-insured in Florida, you must meet several requirements, including demonstrating financial stability and establishing adequate reserves for potential claims. You need to file a Florida Application for Self-Insurance with the necessary documentation, including proof of available funds and your risk management strategy. Consistently maintaining these standards is crucial to retain your self-insured status.

In Florida, you start the self-insurance process by completing a Florida Application for Self-Insurance. This application requires detailed information about your business operations and financial stability. Once approved, you must fulfill ongoing obligations, such as maintaining sufficient funds to cover potential liabilities and complying with state regulations.

To become self-insured, a business or individual must first assess their financial capacity to cover potential losses. After this evaluation, they can submit a Florida Application for Self-Insurance, demonstrating their ability to meet the necessary financial requirements. Additionally, it's important to establish a robust risk management program to mitigate potential claims effectively.

The biggest potential risk for clients opting for self-insurance lies in the unpredictability of claims. If a major event occurs that leads to high claims, a company may struggle to cover these expenses, risking its stability. Understanding the financial implications and planning accordingly is critical. By using the Florida Application for Self-Insurance, clients can better prepare for these unpredictable situations while safeguarding their interests.

Self-insured plans can have several drawbacks. One major concern is that they require a significant amount of upfront capital to establish. Additionally, companies may face unpredictability with fluctuations in claim amounts, putting financial pressure on resources. Utilizing a Florida Application for Self-Insurance helps you assess the advantages and challenges, ensuring you make informed decisions regarding self-insurance.

To become a self-insured company, you must follow a systematic process that begins with evaluating your financial standing and risk exposure. Next, you need to submit a Florida Application for Self-Insurance to the appropriate state authorities, demonstrating your capacity to manage potential claims. Additionally, forming a comprehensive risk management plan is crucial for success. This process may seem intricate, but with guidance from platforms like uslegalforms, you can navigate it with ease.