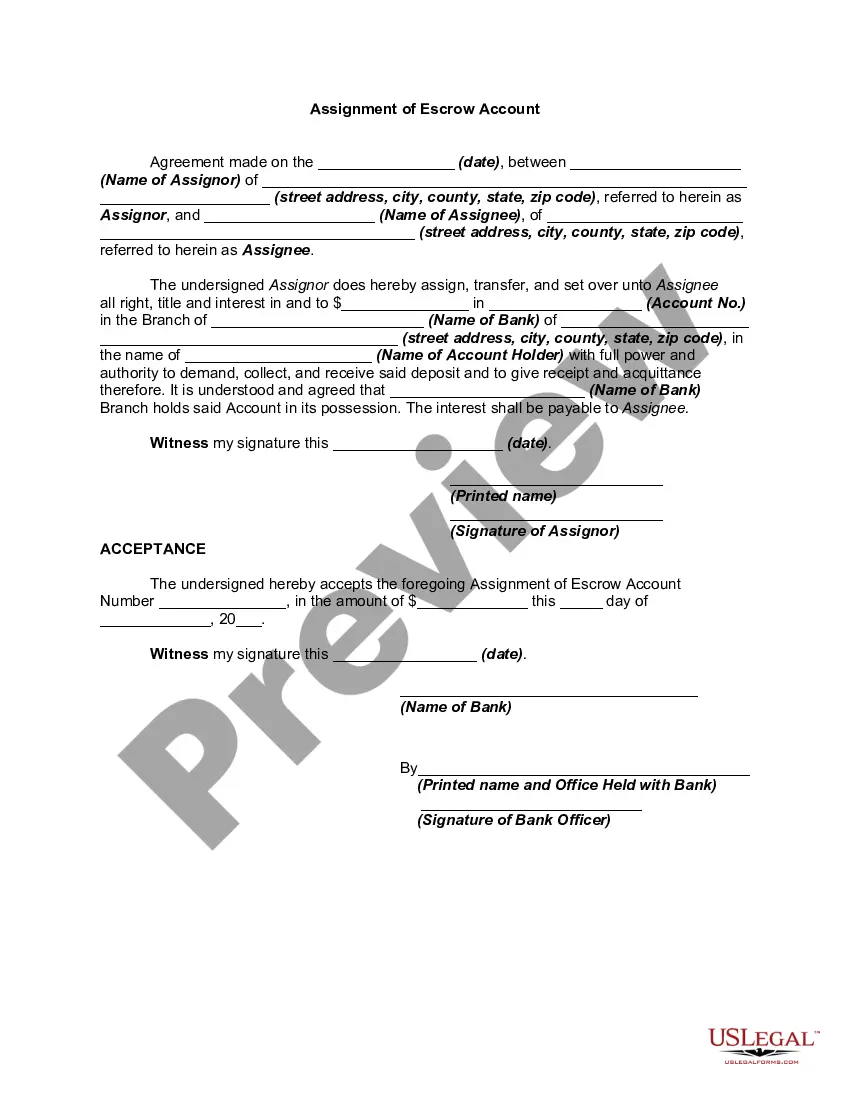

An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Assignment of Escrow Account is a legal document that transfers the rights and interests of an escrow account from one party to another. An escrow account is a special account that holds funds, usually in a real estate transaction, until certain conditions or obligations are met. In Connecticut, there are two main types of Assignment of Escrow Account. The first is the Assignment of Escrow Account in a real estate transaction. This type of assignment occurs when the buyer and seller agree to transfer the escrow account to a new party, such as a new buyer or a different party responsible for fulfilling the terms of the contract. The second type is the Assignment of Escrow Account in a business transaction. This type of assignment is common when a company is acquired or merged with another company. The escrow account is assigned to the new owner or a designated party who will be responsible for managing and using the funds in the account according to the terms of the agreement. When completing a Connecticut Assignment of Escrow Account, it is essential to include specific details to ensure a smooth transfer of ownership. The document should include the current owner's name, contact information, and the new owner's name and contact information. Additionally, the document should specify the amount of funds held in the escrow account, the purpose of the escrow, and any specific conditions or instructions regarding the use of the funds. It is crucial to consult with an attorney or a qualified professional experienced in Connecticut real estate or business law when drafting or executing an Assignment of Escrow Account. This will help ensure that all legal requirements are met, and the transfer of ownership is properly documented. In conclusion, a Connecticut Assignment of Escrow Account is a legal document used to transfer the ownership and responsibilities of an escrow account in a real estate or business transaction. It is crucial to understand the specific requirements and seek professional guidance when drafting or executing such an assignment to ensure compliance with Connecticut laws and regulations.