The dissolution of a corporation package contains all forms to dissolve a corporation in Connecticut, step by step instructions, addresses, transmittal letters, and other information.

Connecticut Dissolution Package to Dissolve Corporation

Description

How to fill out Connecticut Dissolution Package To Dissolve Corporation?

The greater the number of documents you have to prepare - the more anxious you become.

You can find countless Connecticut Dissolution Package to Dissolve Corporation templates online, yet you’re still unsure which ones to rely on.

Eliminate the trouble to make acquiring samples simpler with US Legal Forms. Obtain expertly crafted forms that are designed to comply with state requirements.

Submit the required information to create your account and pay for your purchase using PayPal or a credit card. Select a convenient file format and obtain your template. Access every template you download in the My documents section. Simply navigate there to create a new copy of your Connecticut Dissolution Package to Dissolve Corporation. Even when using well-prepared templates, it’s still crucial that you consider consulting your local attorney to double-check the completed sample to ensure that your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you are already a subscriber of US Legal Forms, Log In to your account, and you will find the Download button on the Connecticut Dissolution Package to Dissolve Corporation’s page.

- If you have never used our website before, complete the registration process by following these steps.

- Verify if the Connecticut Dissolution Package to Dissolve Corporation is applicable in your state.

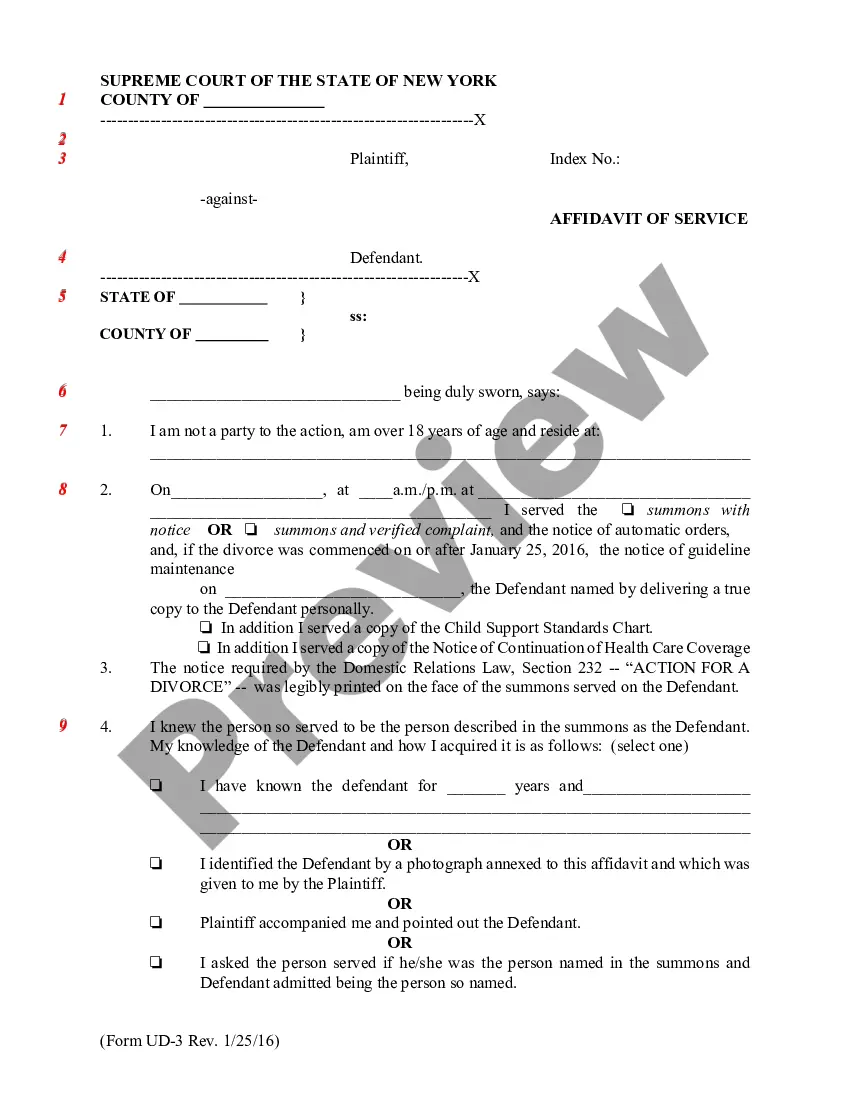

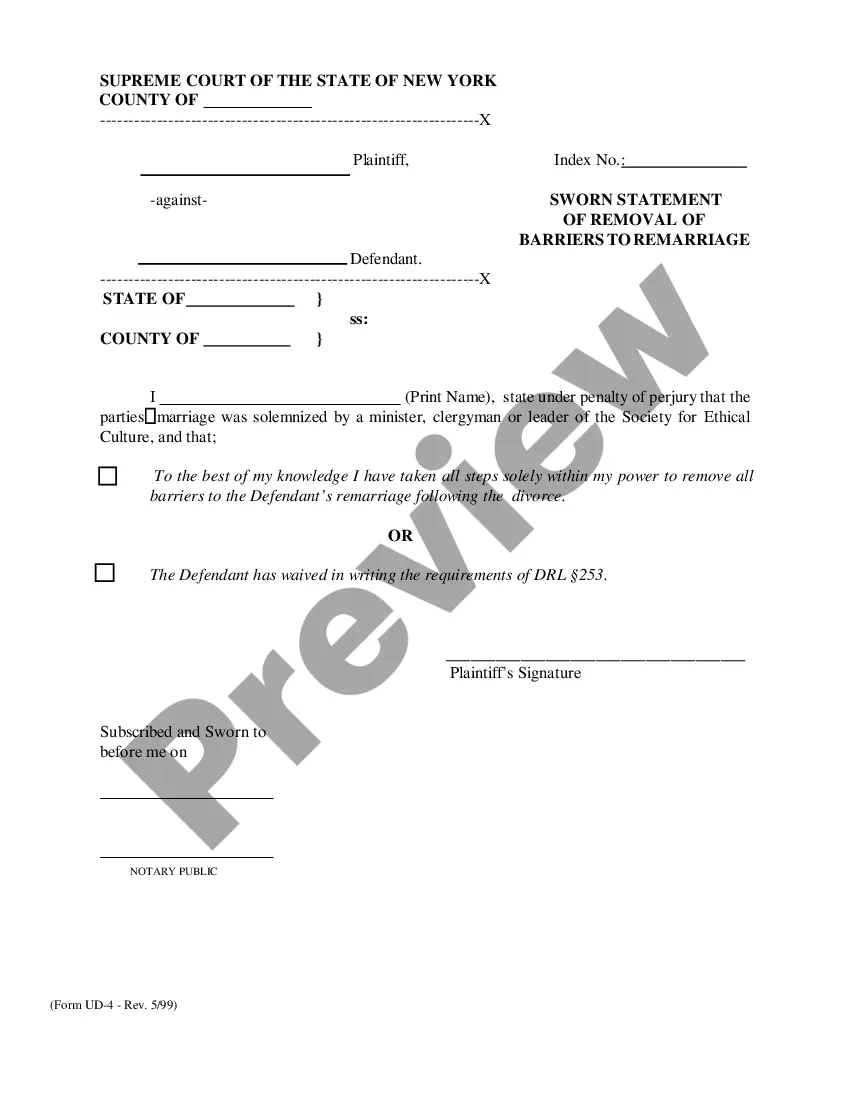

- Confirm your choice by reviewing the description or using the Preview feature if available for the chosen document.

- Click Buy Now to initiate the sign-up process and choose a pricing option that meets your needs.

Form popularity

FAQ

To terminate a corporation with the IRS, submit the necessary forms, including Form 966, along with your final income tax filings. This informs the IRS of the dissolution while ensuring compliance with all tax obligations. Incorporating the Connecticut Dissolution Package to Dissolve Corporation can simplify these steps and provide clarity on required documentation.

Notifying the IRS that your business is closed requires completing Form 966 and filing it with your corporation's final tax return. You should also ensure that all outstanding tax liabilities are resolved. By using the Connecticut Dissolution Package to Dissolve Corporation, you can streamline this notification process and ensure you meet all legal obligations.

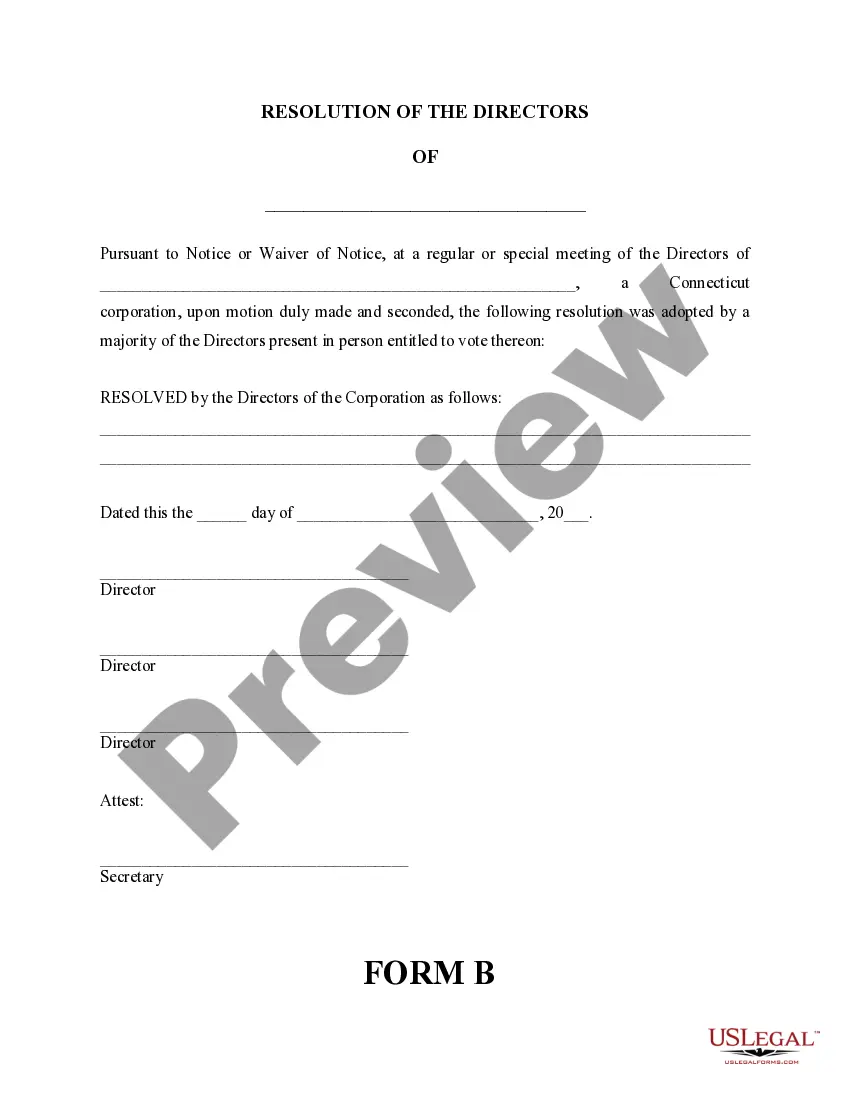

The first step to terminate a corporation involves calling a shareholders’ meeting to vote on the decision to dissolve. It’s crucial to document this decision in minutes and ensure it aligns with your corporation's bylaws. Following this, you can proceed with using the Connecticut Dissolution Package to Dissolve Corporation to formalize the process.

A letter of dissolution is an official document that informs relevant parties, including the IRS, that a corporation is ceasing its operations. This letter typically accompanies the dissolution application and outlines the reasons for dissolving. When using a Connecticut Dissolution Package to Dissolve Corporation, templates for this letter can often be included, ensuring you meet all necessary conditions.

There are several methods for dissolving a corporation, including voluntary dissolution initiated by the shareholders or involuntary dissolution decided by a court. You might also consider using the Connecticut Dissolution Package to Dissolve Corporation to simplify the process and meet all legal requirements. Each method has specific steps that you must follow, so knowing your options will help you choose the best path.

To dissolve a corporation with the IRS, you must first ensure that all federal tax obligations are settled. After that, you will need to file Form 966 to officially notify the IRS of the corporation’s dissolution. It's essential to complete any necessary state filings as well when using the Connecticut Dissolution Package to Dissolve Corporation.

When you dissolve a corporation, there can be various tax consequences depending on your situation. For instance, any assets distributed might be subject to capital gains tax. Therefore, it's wise to consult with a tax professional during this process. The Connecticut Dissolution Package to Dissolve Corporation may also provide insights into these tax implications, ensuring you understand your responsibilities.

Dissolving a corporation with the IRS involves filing your final tax return and submitting it with the articles of dissolution. Utilizing the Connecticut Dissolution Package to Dissolve Corporation can simplify this task by providing all the necessary documentation. Indicate on your tax return that it is the final return, and ensure that all tax obligations are met. This will minimize any potential issues with the IRS after dissolution.

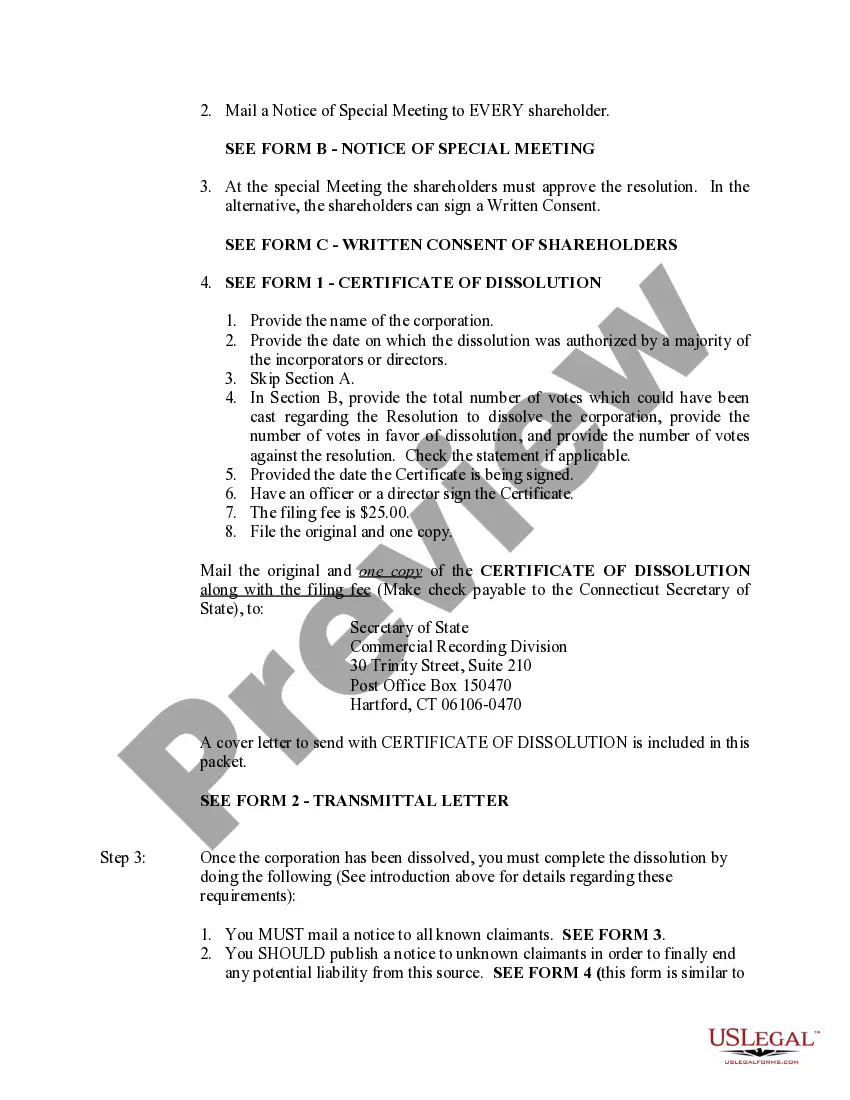

To dissolve a Connecticut corporation, start by obtaining a Connecticut Dissolution Package to Dissolve Corporation. This package will guide you through the steps, including filing the articles of dissolution and notifying creditors. After completing the forms and settling any outstanding obligations, submit everything to the Secretary of State. Doing this ensures a clear and legal termination of your business.

Yes, you need to file articles of dissolution with the Secretary of State to officially dissolve a corporation in Connecticut. This process is a key part of using a Connecticut Dissolution Package to Dissolve Corporation. Make sure to complete the necessary forms accurately to avoid delays. Once filed, your corporation will be recognized as dissolved.