California Affidavit for Collection of Personal Property

Definition and meaning

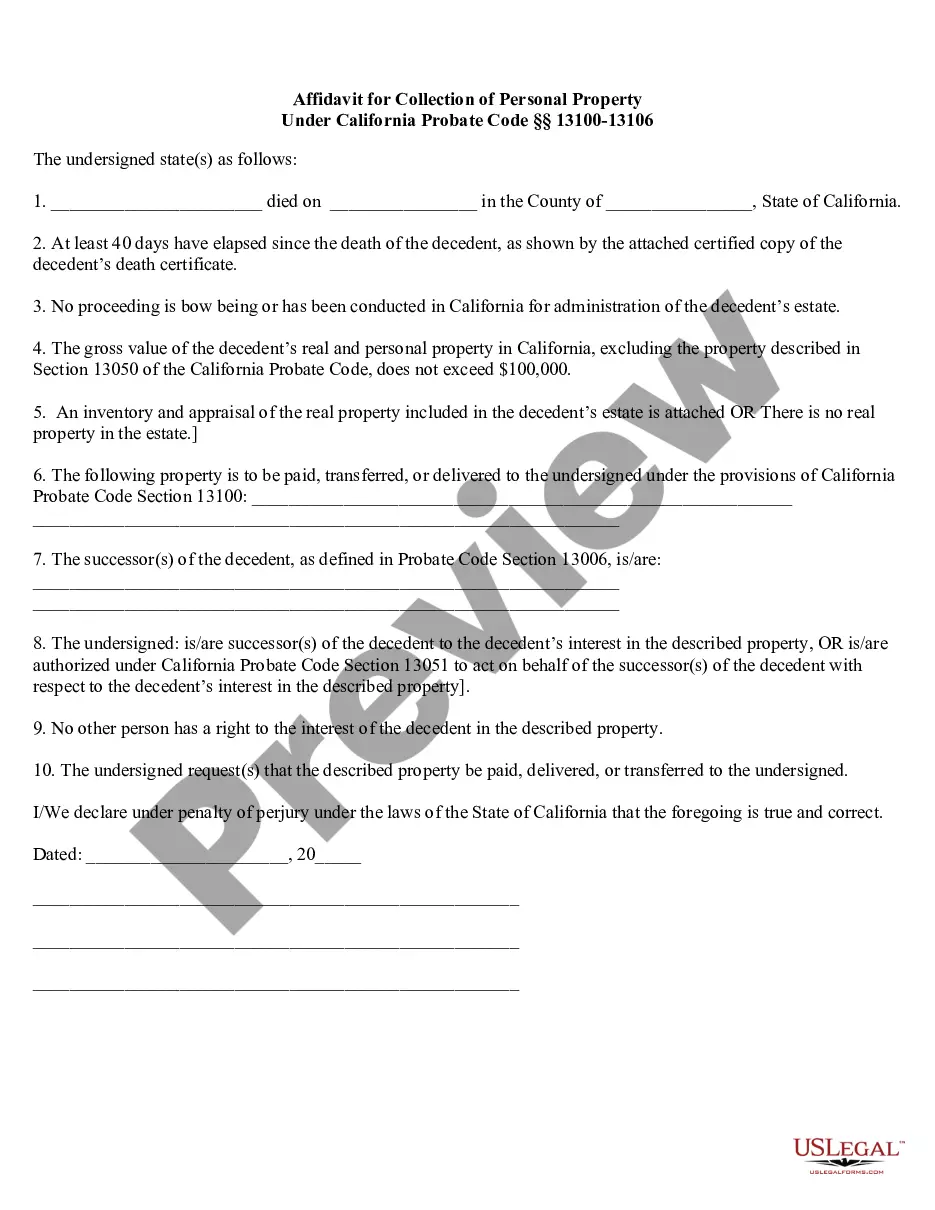

The California Affidavit for Collection of Personal Property is a legal document that allows individuals to claim personal property of a deceased person without going through probate court. This form is primarily utilized when the total value of the deceased's estate is under $100,000, as stipulated by the California Probate Code.

How to complete a form

Completing the California Affidavit for Collection of Personal Property involves several steps:

- Provide the name of the deceased and their date of death.

- Indicate the county where the death occurred.

- Attach a certified copy of the death certificate.

- Confirm that no probate proceedings are taking place.

- List the property to be collected.

- State your relationship to the deceased or your authority to act on behalf of the successors.

Ensure all information is accurate to avoid delays in processing.

Who should use this form

This form is suitable for heirs, beneficiaries, or any individual authorized to act on behalf of the decedent when the total estate value is under the limit of $100,000. It is particularly useful for those needing to collect personal property quickly and without costly legal proceedings.

Key components of the form

The California Affidavit for Collection of Personal Property includes essential sections such as:

- Details of the decedent

- Verification of the absence of probate proceedings

- Inventory of the property being claimed

- Affirmation of the collector's status as a successor or authorized individual

Each section must be completed accurately to ensure legal compliance.

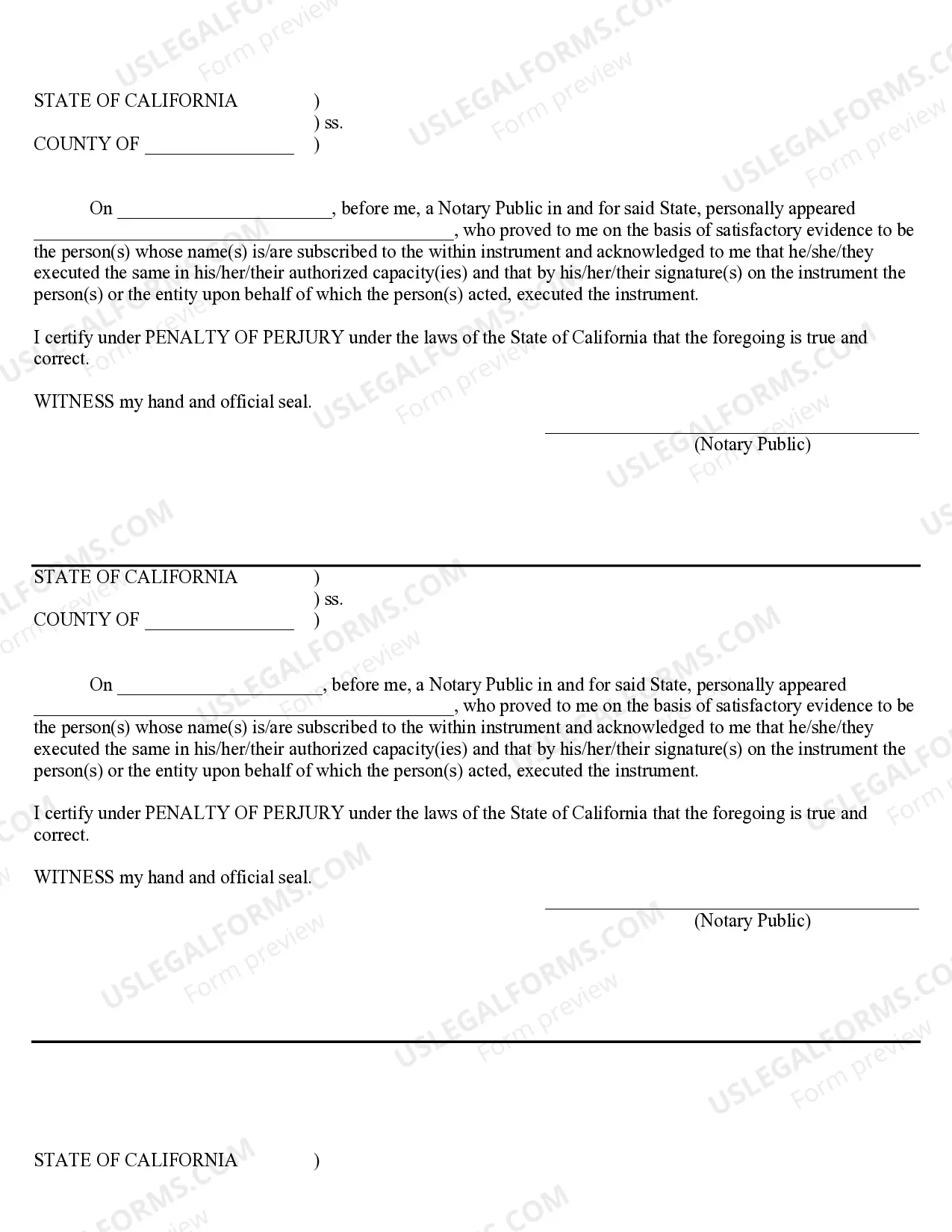

What to expect during notarization or witnessing

When finalizing the California Affidavit for Collection of Personal Property, it must be notarized. Here’s what you can expect:

- Present appropriate identification when meeting the notary.

- Sign the affidavit in the presence of the notary.

- The notary will then complete their section, confirming your identity and the authenticity of your signature.

This process ensures the document's legitimacy in legal matters.

Common mistakes to avoid when using this form

To ensure the smooth processing of the California Affidavit for Collection of Personal Property, be aware of these common mistakes:

- Failing to provide a certified copy of the death certificate.

- Not verifying that the estate's value meets the threshold requirements.

- Leaving sections of the form incomplete or ambiguous.

Double-checking your form can help avoid unnecessary complications.

Form popularity

FAQ

In Florida, you can obtain a small estate affidavit from the local clerk of court's office or through their website. It's vital to ensure that the document aligns with Florida's specific requirements. For those needing assistance in finding the right form, US Legal Forms offers resources, including the California Affidavit for Collection of Personal Property, making the process straightforward and accessible.

To obtain a copy of a small estate affidavit, you can visit your local probate court or county clerk's office. Many jurisdictions allow you to access the forms online, which can include the California Affidavit for Collection of Personal Property. If you prefer convenience, consider using platforms like US Legal Forms, which provide easy access to fillable forms, ensuring you have the correct document for your needs.

To fill out a small estate affidavit, start with the California Affidavit for Collection of Personal Property form. Provide all required information, such as the deceased's details, list of assets, and your relationship to the deceased. Ensure you obtain the necessary signatures and have the affidavit notarized, as this adds a layer of legitimacy. Following these steps will aid in straightforwardly claiming personal property.

A small estate affidavit 13101 in California refers to a specific legal document that allows eligible individuals to collect personal property without going through formal probate. The California Affidavit for Collection of Personal Property must be used for estates where the total value falls below a certain threshold. This affidavit streamlines the process, making it more accessible for those dealing with small estates.

While it's possible to handle the small estate affidavit without a lawyer, consulting one can often alleviate confusion, especially for first-time users. The California Affidavit for Collection of Personal Property can be straightforward, but an attorney can provide valuable insights on legal obligations and correct filing. Engaging an attorney ensures you don't overlook critical details during the process.

To fill out an affidavit of inheritance, start with the California Affidavit for Collection of Personal Property form, ensuring you indicate your relationship to the deceased. Clearly list all pertinent assets and provide proof of the estate's value, without complex legal jargon. After completing the form, sign it in the presence of a notary. This ensures the document holds up legally when claiming inheritance.

Filling out an affidavit of small estate involves completing the California Affidavit for Collection of Personal Property form. You will need to provide details about the deceased's assets and clarify that the total value falls below the legal limit. After filling in the required information, obtain the necessary signatures. This step simplifies transferring assets without undergoing prolonged probate procedures.

To fill out an affidavit example, start by obtaining the California Affidavit for Collection of Personal Property form from a reliable source. Clearly state the purpose of the affidavit, including relevant personal details and information about the estate. Ensure you include all necessary signatures and dates to validate the document. This process helps guarantee your affidavit meets legal requirements.

A small estate affidavit in California is used to collect the property of a deceased person when their estate qualifies as small, meaning the total value falls below a specific threshold. This affidavit allows heirs to receive property without a lengthy probate process. By utilizing a small estate affidavit, you can more quickly and easily access personal belongings and ensure proper redistribution according to inheritance laws.

Yes, in California, an affidavit must typically be notarized to be considered valid. Notarization serves as a means of verifying that the signatures on the document are authentic and that the individuals involved acted voluntarily. This step adds a layer of protection for all parties and ensures that your California affidavit for collection of personal property holds up in legal contexts.