California Grant Deed for Distribution of a Condominium - Trustee to an Individual

Definition and meaning

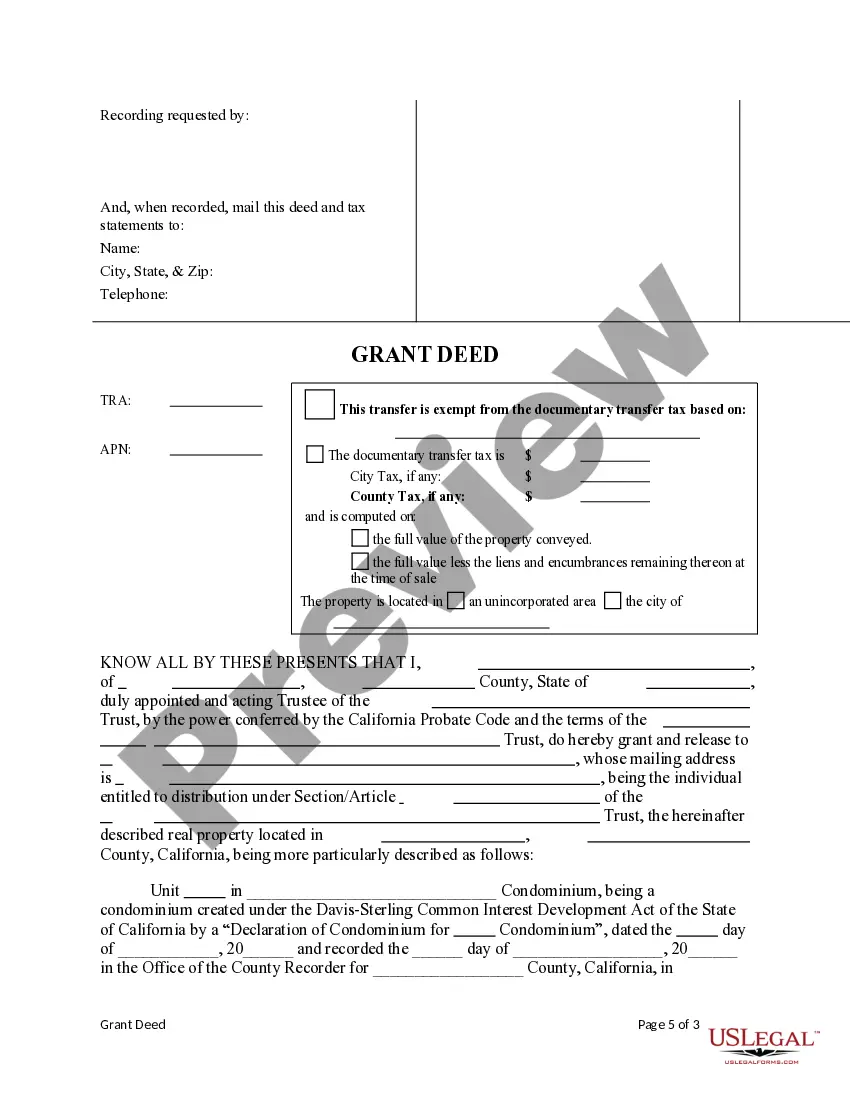

The California Grant Deed for Distribution of a Condominium is a legal instrument used to transfer ownership of a condominium unit from a trustee to an individual. This deed confirms the rights of the individual as entitled to distributions specified in a trust. It is particularly relevant in situations where the property is being conveyed according to the terms of a trust agreement, ensuring that all legal obligations and rights are appropriately transferred.

How to complete a form

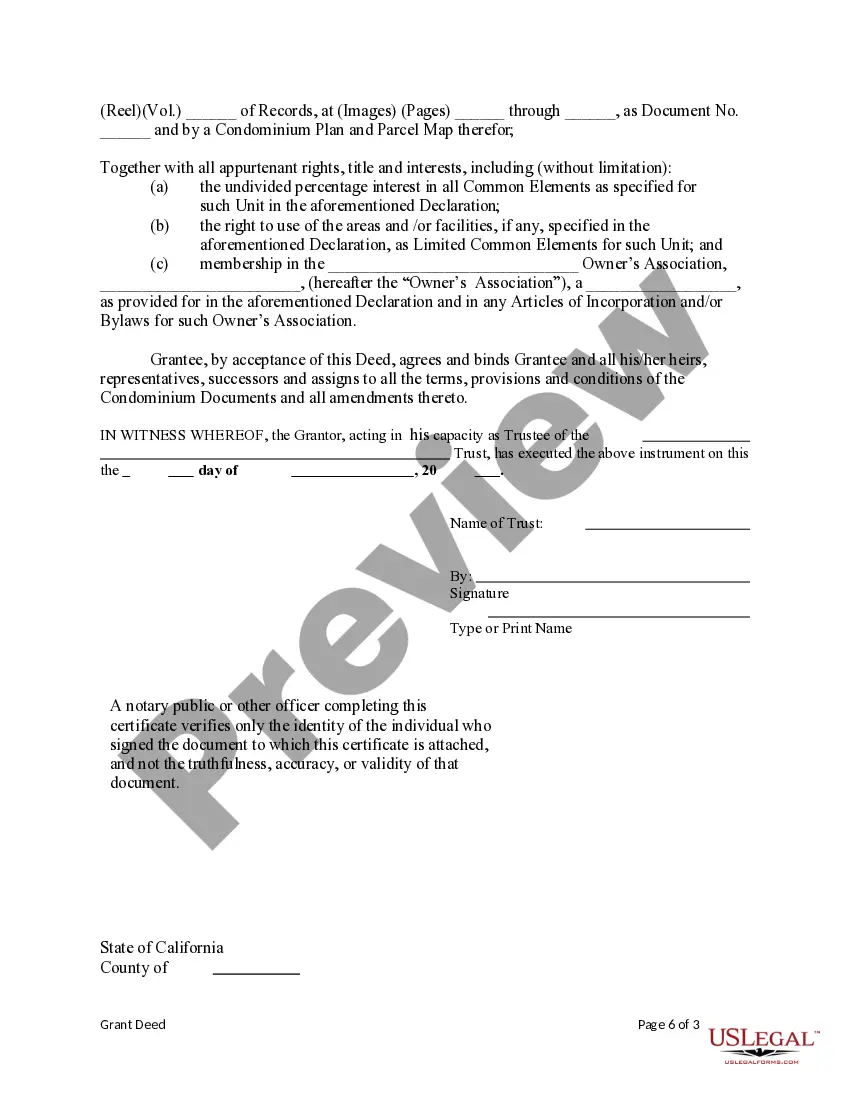

Completing the grant deed form requires attention to detail. Begin by filling out your personal information, including your name and address as the trustee. Specify the name of the individual receiving the condominium unit. It is crucial to accurately describe the property in detail, referencing the condominium declaration, and include the tax documentation as required. Moreover, ensure that the form is signed and notarized for legal validity.

Key components of the form

The California Grant Deed includes several essential elements:

- Grantor Information: Details of the trustee executing the deed.

- Grantee Information: Information of the individual receiving the property.

- Property Description: A comprehensive description of the condominium and its legal identifiers.

- Signature and Notarization: Required signing by the grantor and subsequent notarization to validate the deed.

- Tax Exemption Basis: Any relevant tax exemption must be noted, specifying the applicable California Revenue and Taxation codes.

Who should use this form

This form is ideal for trustees who are distributing property, specifically condominiums, as part of the terms laid out in their trust. Individuals inheriting a condominium or receiving a property as a gift can also find this form useful. It is generally utilized by people settling estates or managing the distribution of assets according to trust laws in California.

What documents you may need alongside this one

When completing the grant deed, you may need several supporting documents to ensure a smooth execution:

- Trust Agreement: To verify the authority of the trustee.

- Deed of Trust or Last Will: Depending on the circumstances of the distribution.

- Tax Documentation: Any required forms regarding documentary transfer taxes.

- Identification: Personal identification of the trustee and grantee for notarization purposes.

Common mistakes to avoid when using this form

Avoid the following pitfalls when completing the California Grant Deed:

- Incomplete Information: Ensure all required fields are filled in accurately.

- Incorrect Property Description: Double-check the legal description of the condominium.

- Signature Errors: Ensure the signature of the trustee is correctly executed and notarized.

- Noting Tax Exemptions: Failure to include tax exemption information can result in additional taxes owed.

Form popularity

FAQ

Filling out a California grant deed involves several steps to ensure correctness. First, clearly state the names of the grantor and grantee, alongside the property's legal description. Include the language indicating the transfer of ownership, especially for the California Grant Deed for Distribution of a Condominium - Trustee to an Individual. US Legal Forms simplifies this process, offering templates and resources to help you complete your deed accurately.

To remove someone from a grant deed in California, you will need to prepare a new grant deed that excludes their name. This process typically involves the current owner, often the trustee, executing the new deed to transfer the property to the remaining owner. The California Grant Deed for Distribution of a Condominium - Trustee to an Individual ensures that ownership reflects the current arrangement. Additionally, consider using US Legal Forms for guided assistance in filing this documentation.

The primary purpose of a trust deed is to establish a legal framework for transferring and managing property on behalf of beneficiaries. It outlines the responsibilities of the trustee and the rights of the beneficiaries, ensuring compliance with the trust's intentions. When utilizing a California Grant Deed for Distribution of a Condominium - Trustee to an Individual, this document serves as a vital tool for clarity and security within the real estate transaction.

A property is most likely conveyed with a trustee's deed in situations involving a trust where the trustee is responsible for managing the property on behalf of the beneficiaries. For example, if a family member passes away and the estate holds a condominium, a California Grant Deed for Distribution of a Condominium - Trustee to an Individual would facilitate the distribution of that property. This process ensures clear legal transfer while adhering to the trust's terms.

In the UK, a deed of grant refers to a legal document that transfers ownership of property or conveys rights associated with it. Unlike the California Grant Deed for Distribution of a Condominium - Trustee to an Individual, the UK version does not commonly apply to trusts but often pertains to easements or rights of way. Understanding this distinction can be critical for property transactions within different jurisdictions.

To create a California Grant Deed for Distribution of a Condominium - Trustee to an Individual, specific requirements must be met. First, the deed must include the names of the trustor and trustee, along with a clear description of the property. Additionally, the deed should be signed by the trustee and notarized. Ensuring these elements are present will help avoid legal complications during the transfer process.

A trustee grant deed is a legal document that allows a trustee to transfer property to another party, such as an individual or beneficiary. This type of deed is commonly used in California and specifically outlines the process of distributing property from a trust, including the California Grant Deed for Distribution of a Condominium - Trustee to an Individual. By utilizing a trustee grant deed, you ensure that the transfer is clear and legally binding. For assistance, consider using USLegalForms to obtain the correct forms and instructions.

To draft a grant deed in California, begin by clearly identifying the grantor and the grantee, along with a legal description of the property. It's essential to include the specific California Grant Deed for Distribution of a Condominium - Trustee to an Individual, which outlines the transfer from the trustee to the individual. Once the deed is drafted, you need to sign it in front of a notary public and record it with the county recorder's office. USLegalForms offers templates and guidance to help you create a compliant grant deed.

A quitclaim deed from a trust to an individual transfers property ownership from the trust directly to the individual without making any guarantees about the property title. This kind of deed allows the trustee to quickly pass ownership of a condominium through the California Grant Deed for Distribution of a Condominium - Trustee to an Individual. It's important to ensure that the property title is clear before proceeding with this type of deed. Using platforms like USLegalForms can guide you through the process and provide you with the necessary documents.

Trusts in California can often avoid property tax reassessment if the property is transferred according to the provisions laid out in Proposition 13. When transferring property like a condominium, executing a California Grant Deed for Distribution of a Condominium - Trustee to an Individual may allow the property to retain its original tax base. It's wise to consult with a tax advisor or an attorney to ensure compliance with current laws.