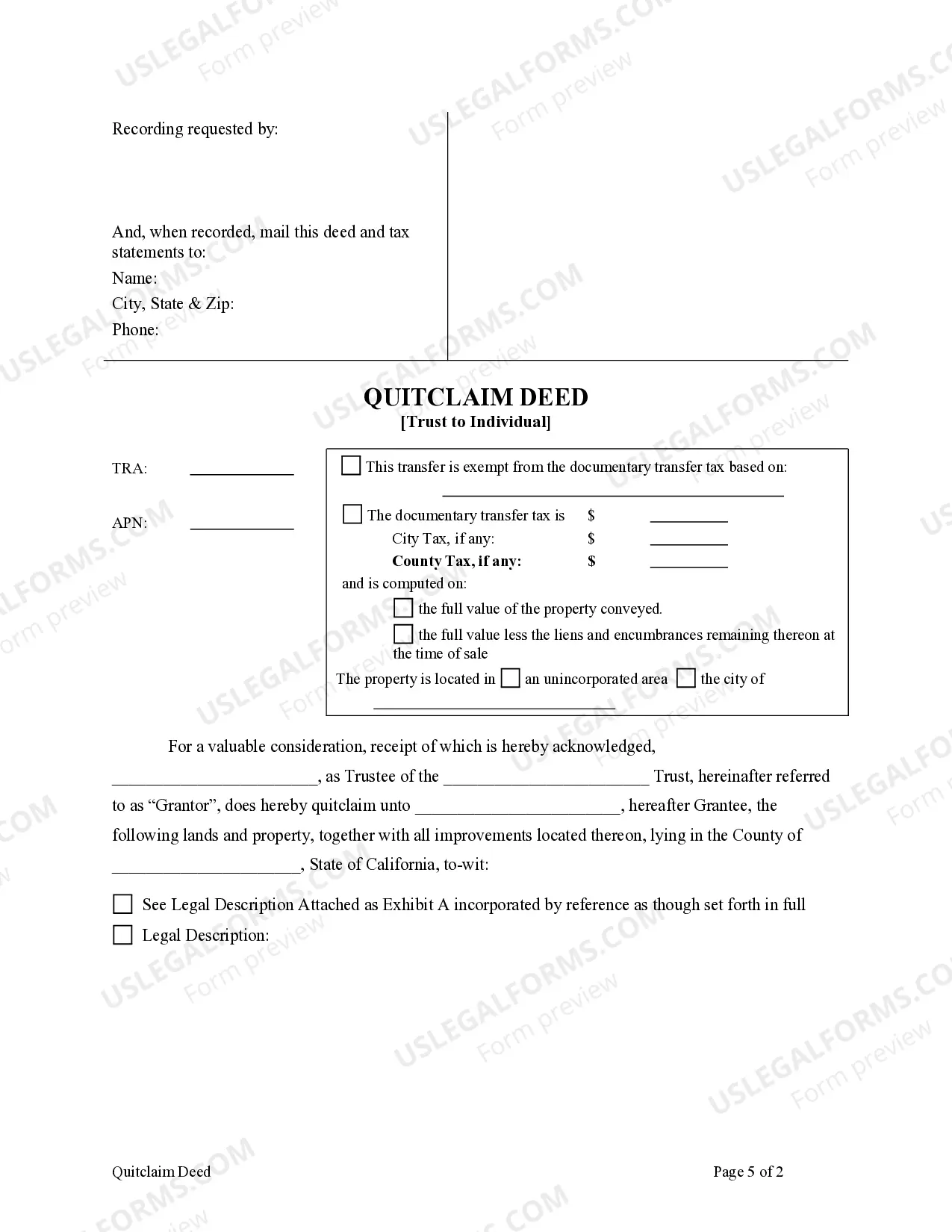

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

California Quitclaim Deed - Trust to an Individual

Description

How to fill out California Quitclaim Deed - Trust To An Individual?

If you're seeking specific California Quitclaim Deed - Trust to an Individual online templates, US Legal Forms is precisely what you require; obtain documents created and reviewed by state-authorized lawyers.

Using US Legal Forms not only alleviates your concerns about legal paperwork; additionally, you save time, effort, and money! Downloading, printing, and submitting a professional template is far more cost-effective than hiring an attorney to do it for you.

And there you have it. In just a few simple clicks, you obtain an editable California Quitclaim Deed - Trust to an Individual. After establishing an account, all future orders will be even easier to manage. With a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form’s page. When you need to use this template again, you can easily locate it in the My documents section. Don't waste your time sifting through numerous forms on various websites. Obtain accurate templates from a single reliable source!

- Begin by completing your registration by providing your email address and creating a password.

- Follow the instructions below to set up your account and access the California Quitclaim Deed - Trust to an Individual template that fits your needs.

- Make use of the Preview option or review the document details (if available) to confirm that the template is suitable for you.

- Verify its relevance in your state.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and make payment with your credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

Filing a deed of trust in California involves drafting the document with essential details about the borrower, lender, and property involved. Once the deed is prepared, it should be signed by the borrower in front of a notary public. After notarization, file the deed with the county recorder's office. For further assistance, platforms like US Legal Forms can provide templates and guidance to ensure compliance with state regulations.

The choice between a quitclaim deed and a trust often depends on your specific needs. A Trust provides a comprehensive strategy for managing and distributing assets, while a California Quitclaim Deed - Trust to an Individual delivers a straightforward method for transferring property rights. Each option has its advantages, so consider how you wish to protect and manage your property before making a decision.

A quitclaim deed cannot be used for transferring property subject to liens or mortgages without the lender's consent. Additionally, it is not appropriate for sales where title is being guaranteed, as quitclaim deeds do not carry warranties. They also may not suffice in divorce settlements or probate situations. Understanding these limitations helps you select the best method for property transfer.

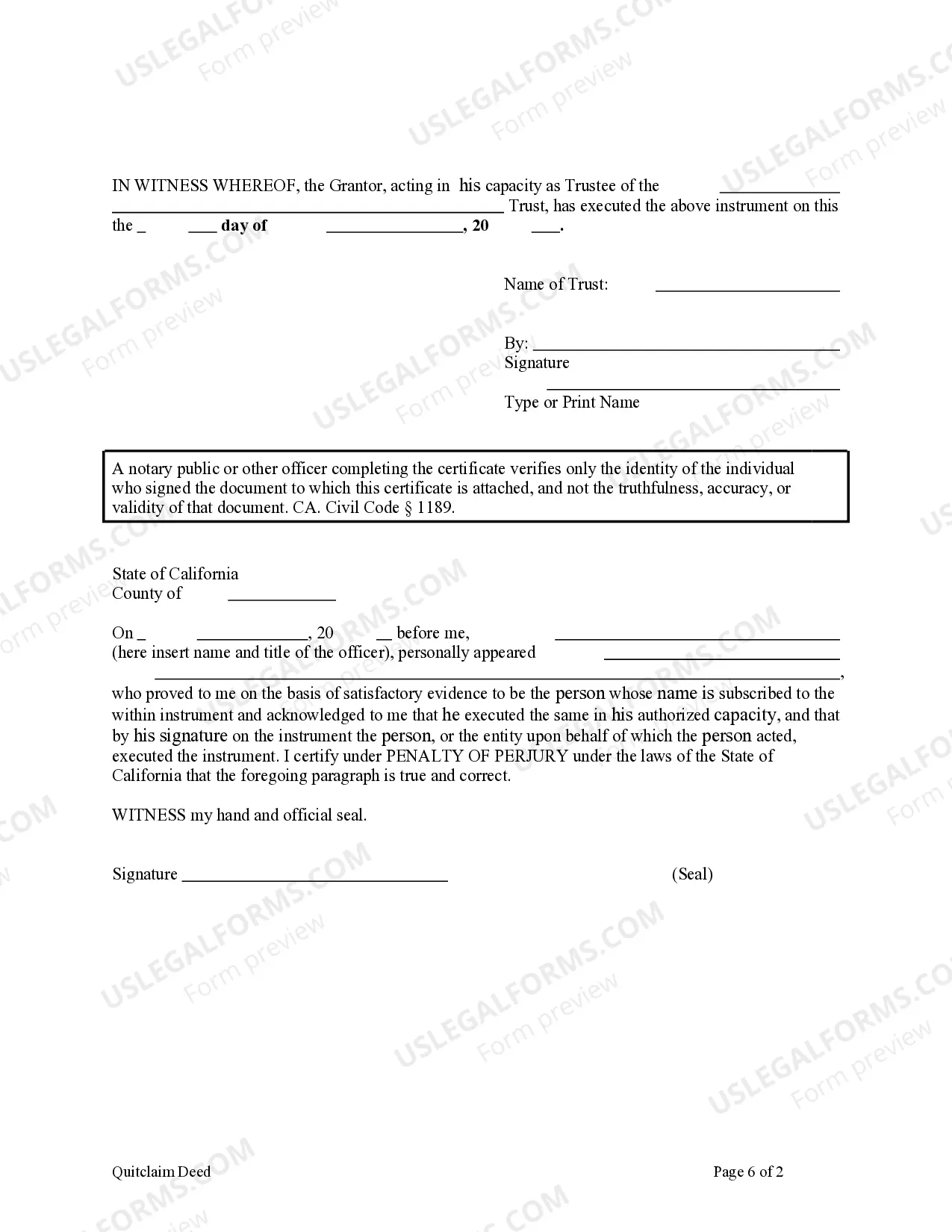

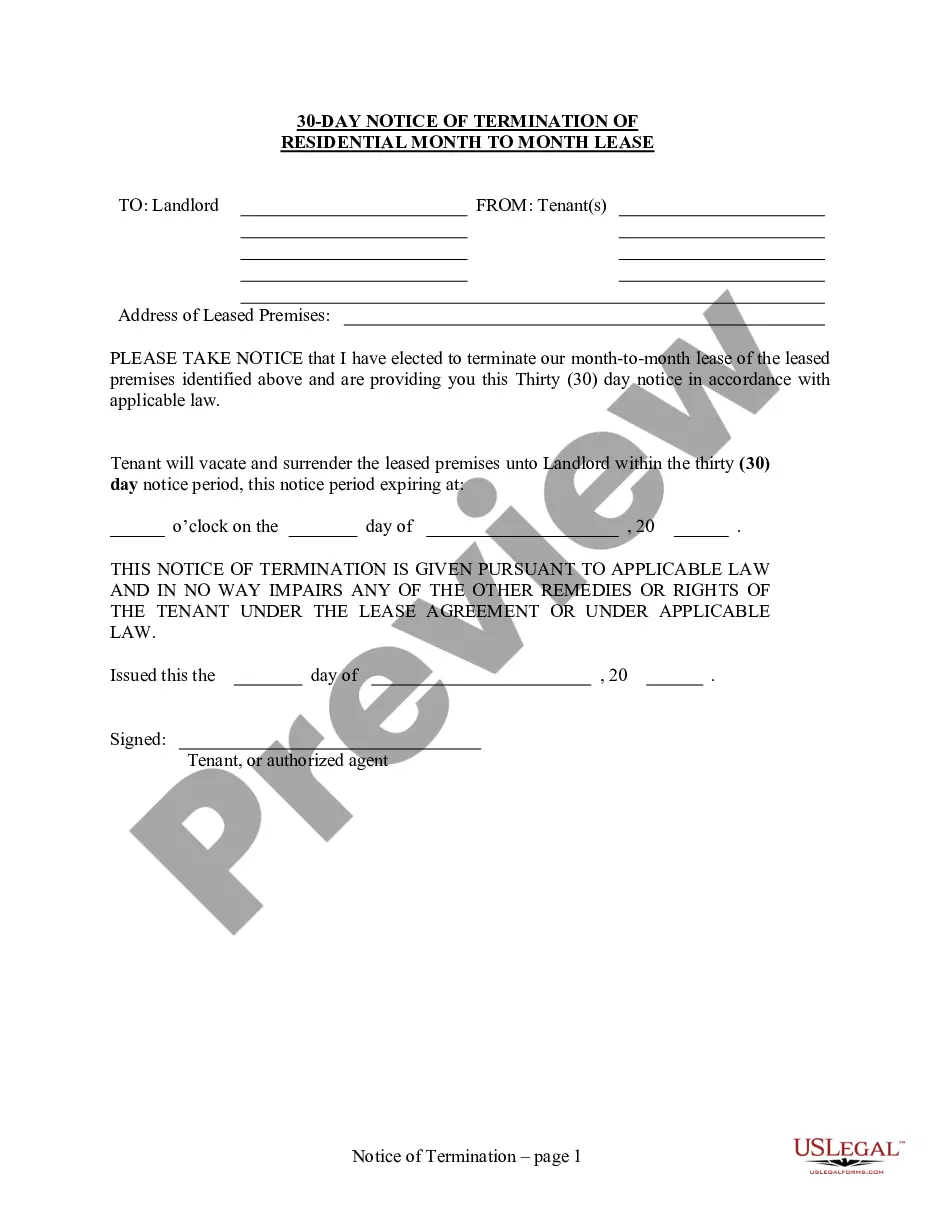

To submit a quitclaim deed in California, first complete the deed form accurately, ensuring that all required information is included. Next, sign the deed in the presence of a notary public. Once notarized, submit the deed to your local county recorder's office by mail or in person. The California Quitclaim Deed - Trust to an Individual should be filed within a reasonable time to avoid complications.

Absolutely, you can execute a California Quitclaim Deed - Trust to an Individual from a trust. In this situation, the trustee must sign the deed, ensuring that it reflects their authority as outlined in the trust documents. This allows for a smooth transfer of property interests to an individual. For assistance in creating this deed, US Legal Forms offers templates that streamline the process.

Yes, a California Quitclaim Deed - Trust to an Individual can effectively transfer property out of a trust. This process involves the trustee executing the quitclaim deed to convey interest in the property to an individual. The deed must include specific details about the property and the parties involved. Remember to file the deed with the appropriate county recorder's office to ensure the transfer is legally recognized.

A quitclaim deed might not be appropriate in situations where you want to guarantee the title's marketability or when conveying property as part of a sale. This deed does not provide any warranties about the property’s condition or marketability, making it unsuitable for more complex transactions. For secure property transfers, consider using a warranty deed instead. If you're unsure, consult professionals to ensure you meet your specific needs.

To transfer a deed to a family member in California, you can use a California Quitclaim Deed - Trust to an Individual. Start by filling out the quitclaim deed form with the necessary details about both parties and the property. After completing the form, you must sign it in front of a notary public and then file it with your county's recorder's office. This process ensures that the deed transfer is legal and documented.

In North Carolina, individuals and corporate entities can also act as trustees on a deed of trust. This diversity allows for flexibility in selecting a trustee that fits your needs. If you're exploring a California quitclaim deed – trust to an individual, it's essential to understand the varying rules in different states. Legal resources can provide guidance for multi-state transactions.

Yes, an individual can definitely serve as a trustee, holding the responsibility of managing trust assets. This individual must act in the best interest of the beneficiaries according to the trust's terms. When employing a California quitclaim deed – trust to an individual, appointing a reliable trustee is crucial for effective management and compliance. Make informed choices about who you select for this important role.