Arkansas Redemption Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Redemption Deed: A legal document that allows a property owner to reclaim their property after it has been sold at a tax sale. In the context of the United States, the right of redemption grants the original property owner a specific period after the tax sale to reimburse the buyer for the purchase price, along with additional penalty fees and interest, to regain ownership of the property.

Step-by-Step Guide

- Identify Eligibility: Determine if your state offers a redemption period following a tax sale.

- Understand the Timeline: Identify the exact time frame you have to redeem the property. This is usually between six months to three years, depending on state laws.

- Gather Financial Resources: Calculate the total amount needed to repay, including purchase cost, penalties, and interest accrued.

- Prepare Documentation: Gather required documents such as proof of ownership, proof of payment, and identity verification.

- Submit the Redemption Deed: File the redemption deed with the relevant local authority and make the necessary payment.

- Confirm Property Ownership: Ensure the property is officially transferred back to your name once the redemption process is completed.

Risk Analysis

- Financial Risk: The cost involved, including high interest and penalty rates, can be substantial.

- Timing Risk: Missing the redemption period deadline could result in permanent loss of property.

- Legal Risks: Inaccuracies in the redemption process could lead to legal challenges or disputes.

Common Mistakes & How to Avoid Them

- Miscalculating Costs: Accurately account for all expenses before initiating redemption to ensure complete payment.

- Overlooking Deadlines: Keep track of the redemption period and plan actions well in advance.

- Neglecting Legal Counsel: Engaging with a lawyer can help navigate the complexities of the redemption process and mitigate legal risks.

- Failing to Verify the Deed: Ensure the deed is correctly processed and recorded to finalize the property transfer.

Key Takeaways

Understanding and effectively managing the redemption deed process is crucial for property owners who wish to regain ownership after a tax sale. It requires careful attention to financial, timing, and legal dimensions to ensure a successful redemption.

How to fill out Arkansas Redemption Deed?

Employing Arkansas Redemption Deed templates designed by knowledgeable lawyers allows you to avert complications when finalizing paperwork.

Easily download the example from our site, complete it, and ask an attorney to validate it.

This approach can save you a considerable amount of time and effort compared to hiring legal assistance to draft a document tailored to your requirements.

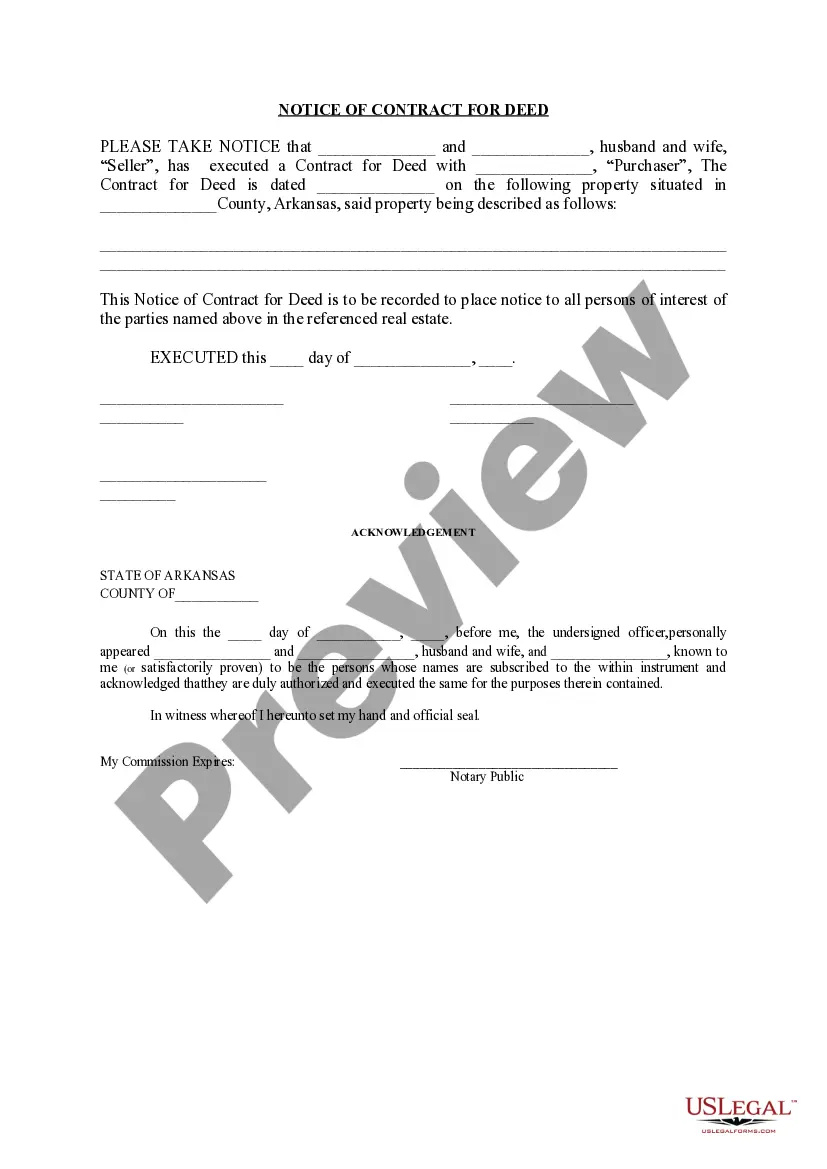

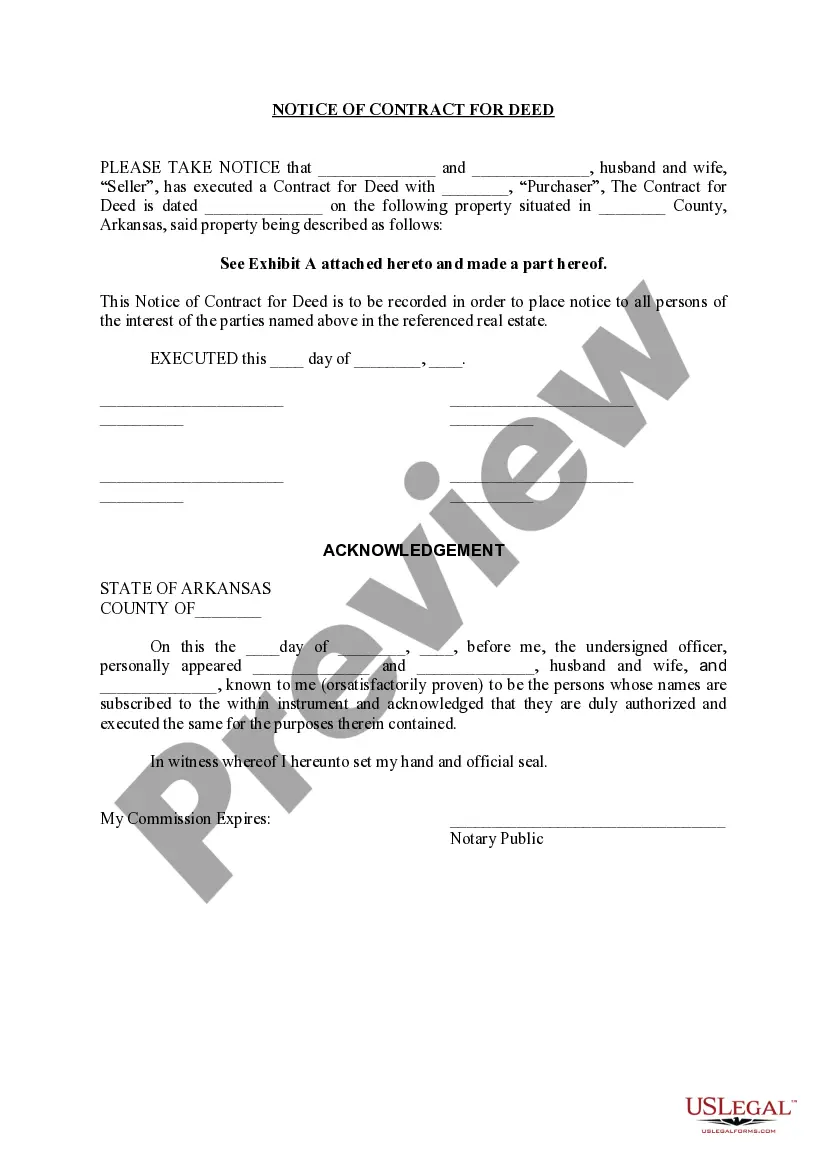

Utilize the Preview function and examine the description (if provided) to determine if you require this specific document, and if so, click Buy Now. Locate an additional sample using the Search box if needed. Choose a subscription that suits your preferences. Begin using your credit card or PayPal. Select a file type and download your document. After completing all the aforementioned steps, you will be able to finalize, print, and sign the Arkansas Redemption Deed template. Remember to double-check all entered information for accuracy before submitting it or dispatching it. Minimize document creation time with US Legal Forms!

- If you have already obtained a US Legal Forms subscription, simply Log In to your account and navigate back to the form section.

- Locate the Download button adjacent to the template you are reviewing.

- Once you download a template, you will find your saved documents in the My documents tab.

- If you do not have a subscription, there's no need to worry.

- Just adhere to the following instructions to register for your account online, acquire, and complete your Arkansas Redemption Deed template.

- Verify and ensure that you are downloading the accurate state-specific form.

Form popularity

FAQ

To transfer ownership of property in Arkansas, you generally need to create a deed, such as a quit claim deed or warranty deed, detailing the transfer. This involves filling out the deed with pertinent information, obtaining signatures, and having the document notarized. Finally, you must record the deed with the county to make the transfer official. For assistance, US Legal Forms provides easy access to the necessary forms and guidance tailored to your Arkansas Redemption Deed needs.

In Arkansas, a quit claim deed requires the names of the grantor and grantee, the property description, and each party's signature. Additionally, the deed must be notarized to be legally effective. Once complete, you should file the quit claim deed with your county's recorder's office. Using the resources available at US Legal Forms can ensure you have all necessary documents ready for your Arkansas Redemption Deed.

The primary beneficiaries of a quit claim deed are individuals looking to transfer property ownership quickly and without complicated legal issues. This deed is often beneficial between family members or in divorce settlements, as it facilitates the straightforward transfer of property rights. Moreover, the Arkansas Redemption Deed often fits well into this scenario, allowing seamless transitions in ownership for concerned parties.

To fill out a quit claim deed in Arkansas, start by obtaining the correct form, which you can find through platforms like US Legal Forms. Next, include your name, the grantee's name, and a legal description of the property. Ensure all information is accurate, then sign the document in the presence of a notary public. This serves as a vital step to establish the Arkansas Redemption Deed effectively.

Yes, deeds are public records in Arkansas, and anyone can access them through the county clerk's office. This transparency allows interested parties to verify property ownership and deed history. To find specific details about the Arkansas Redemption Deed, you can visit the office in person or access their online resources. Services like USLegalForms can help you navigate through public records with ease.

To obtain a quitclaim deed in Arkansas, you must first prepare the deed document, ensuring it includes relevant details such as the grantor and grantee information. After preparing the Arkansas Redemption Deed, you need to sign it in the presence of a notary public. Finally, record it at the county clerk's office where the property is located for it to take effect. Utilizing USLegalForms can simplify the entire process.

A redemption deed in Arkansas is a legal document that signifies the return of property to its original owner after the payment of delinquent taxes. This deed allows the property owner to reclaim their property from a tax sale. Understanding the financial implications of the Arkansas Redemption Deed is vital to maintaining your property rights. For thorough insights, USLegalForms can be an excellent resource.

If property is not redeemed within the two-year redemption period in Arkansas, it may be forfeited to the purchaser of the tax lien. The original owner will lose all rights to the property, and the new owner will receive a clear title. It’s crucial to understand the significance of the Arkansas Redemption Deed during this period to protect your property. Consider checking USLegalForms for detailed information about your rights in this context.

You can acquire a copy of your property deed by visiting your local county clerk's office or by searching their online database if available. Gather any information like your name or property details to make the search easier. With the information you need, you can quickly obtain your Arkansas Redemption Deed without complications. Platforms like USLegalForms can provide guidance in this search.

To obtain a copy of a deed in Arkansas, you need to contact the county clerk's office where the deed was originally recorded. Most counties offer both in-person requests and online access to records. You can easily search for your Arkansas Redemption Deed using the appropriate details such as the property address or legal description. Using services such as USLegalForms can assist you in this process.