Title: Alabama General Form of Factoring Agreement — Assignment of Accounts Receivable: A Comprehensive Overview Introduction: In Alabama, a General Form of Factoring Agreement or Assignment of Accounts Receivable is a legal contract that enables businesses to convert their accounts receivable into immediate cash. This type of financing solution can help companies optimize their cash flow, enhance liquidity, and support growth initiatives. In this article, we will explore the various aspects of Alabama General Form of Factoring Agreement, its benefits, and any related variations. Keywords: Alabama General Form of Factoring Agreement, Assignment of Accounts Receivable, financing solution, cash flow, liquidity, growth initiatives. 1. The Purpose of a General Form of Factoring Agreement: A General Form of Factoring Agreement in Alabama serves as a contractual arrangement between a business (known as the "Assignor") and a financial institution or factor (known as the "Assignee"). The agreement allows the Assignor to sell its accounts receivable to the Assignee at a discounted rate, resulting in immediate cash inflow. Keywords: Assignor, Assignee, accounts receivable, discounted rate, immediate cash inflow. 2. Key Terms and Provisions: The Alabama General Form of Factoring Agreement typically includes the following provisions: 2.1 Assignment of Accounts Receivable: This provision enables the Assignor to transfer their rights, title, and interest in the accounts receivable to the Assignee. The Assignor assigns all its present and future accounts receivable to the Assignee in exchange for immediate cash. Keywords: Assignment, rights, title, interest, present, future, immediate cash. 2.2 Factoring Fee and Discount Rate: The agreement outlines the factoring fee or discount rate, which represents the percentage deducted from the face value of the accounts receivable. This serves as the cost of borrowing or the fee charged by the Assignee for purchasing the receivables. Keywords: Factoring fee, discount rate, face value, borrowing cost. 2.3 Verification and Collection: The Assignee undertakes the responsibility of verifying the assigned accounts receivable and collecting payments from the debtors. These reliefs the Assignor from the burden of managing collections. Keywords: Verification, collection, payments, debtors, burden. 3. Benefits of Alabama General Form of Factoring Agreement: The utilization of an Alabama General Form of Factoring Agreement offers several advantages for businesses, including: 3.1 Improved Cash Flow: By converting accounts receivable into immediate cash, businesses can meet their immediate financial obligations, pay suppliers promptly, and manage day-to-day operations more efficiently. Keywords: Improved cash flow, immediate cash, financial obligations, suppliers, day-to-day operations. 3.2 Enhanced Liquidity: Factoring agreements enhance a company's liquidity position by providing a steady stream of working capital, allowing businesses to invest in growth opportunities, purchase inventory, or expand their operations. Keywords: Enhanced liquidity, working capital, growth opportunities, inventory, expansion. 3.3 Reduced Credit Risk: Transfer of the receivables' ownership and collection responsibility to the Assignee mitigates the risk of non-payment or default by debtors, reducing credit risk for the Assignor. Keywords: Credit risk, non-payment, default, debtors, risk mitigation. 4. Alabama General Form of Factoring Agreement Variations: While the Alabama General Form of Factoring Agreement covers the fundamental elements of a factoring arrangement, specific variations may exist depending on the unique requirements of businesses or factors. Some common variations may include: 4.1 Recourse Factoring Agreement: This type of agreement allows the Assignor to retain the ultimate responsibility of repurchasing any uncollectible receivables from the Assignee. Keywords: Recourse factoring, uncollectible receivables, repurchasing. 4.2 Non-Recourse Factoring Agreement: In this variant, the Assignee assumes the risk of non-payment or default by the debtors, thereby eliminating the Assignor's obligation to repurchase uncollectible receivables. Keywords: Non-recourse factoring, non-payment risk, default risk, uncollectible receivables. Conclusion: The Alabama General Form of Factoring Agreement — Assignment of Accounts Receivable serves as a valuable financial tool for businesses seeking to optimize cash flow, enhance liquidity, and support growth. The agreement's provisions and variations allow companies to tailor the arrangement to their specific needs and requirements, providing them with a flexible financing solution. Keywords: Flexible financing solution, tailored arrangement, specific needs, requirements.

Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

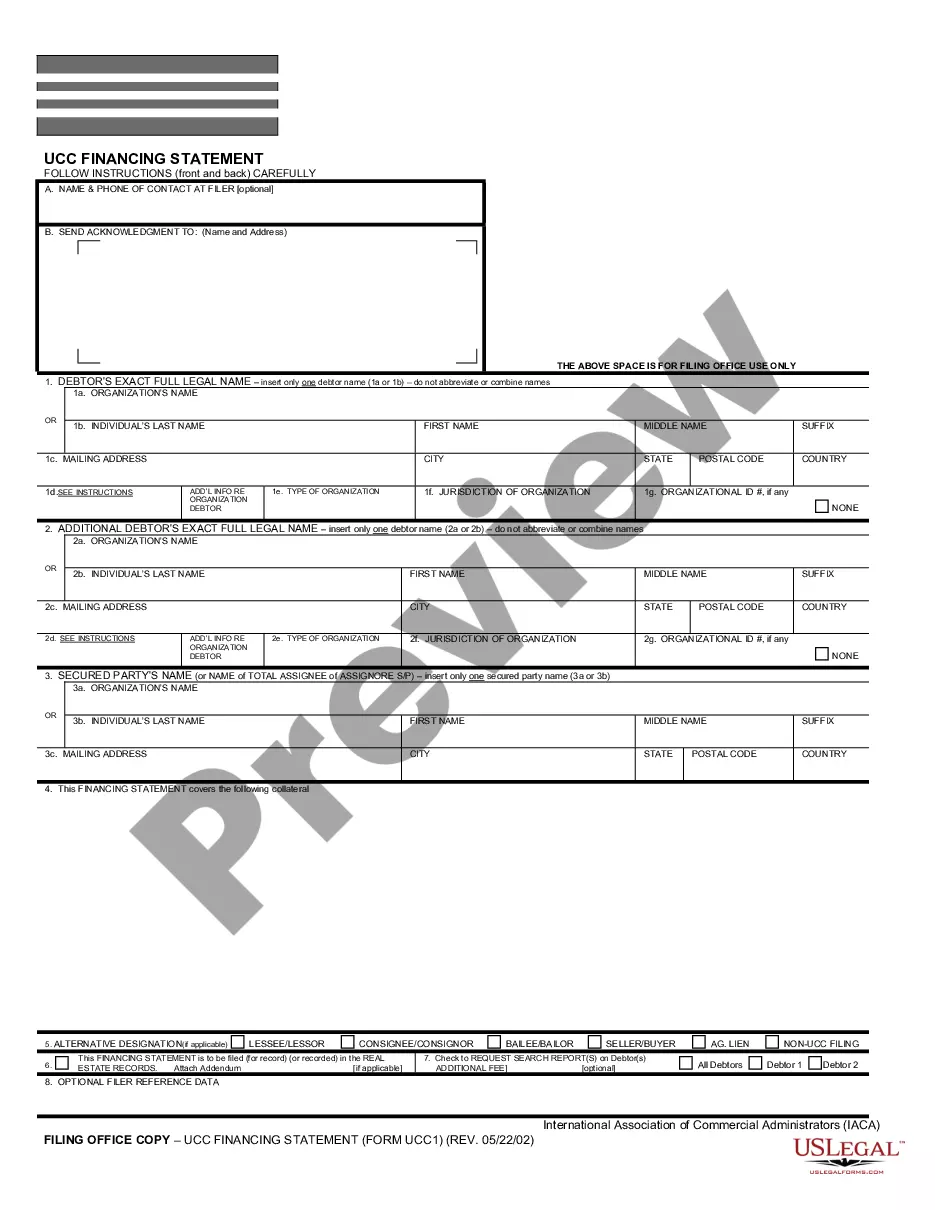

How to fill out Alabama General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Are you currently in a position that requires documents for both business or personal reasons nearly every day? There are countless legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides a vast array of form templates, such as the Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable, which are designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable template.

- Obtain the form you need and ensure it matches the appropriate city/county.

- Use the Preview feature to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search area to find the document that meets your requirements.

- Once you find the correct form, click Acquire now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

- Select a preferred paper format and download your copy.

Form popularity

FAQ

The process of accounts receivable factoring includes identifying invoices that can be sold to a factoring company. The business then enters into an Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable with the factor. After submitting the invoices, the factor advances a portion of the invoice amount, providing rapid access to funds while handling the collection process on behalf of the business.

The accounts receivable step process begins with a business issuing invoices to customers for products or services rendered. Next, the business may choose to sell these invoices to a factor under an Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable. The factor then advances a percentage of the invoice value to the business and collects the payments directly from the customers.

The main difference lies in ownership and risk. Factoring involves selling the receivables to a third party, thus transferring risk, while an assignment of accounts receivable allows the lender to take over the receivables as collateral without transferring ownership. The Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable provides clarity in these transactions, ensuring you understand your obligations. Knowing these distinctions can help businesses choose the best option for their financial situation.

A Notice of Assignment (Noa) in factoring is a formal notification sent to a debtor to inform them that their accounts receivable have been assigned to a factoring company. This document ensures that the debtor knows to direct payments to the factoring company instead of the original seller. In the context of an Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable, this notice is crucial for a smooth transition and clear communication regarding payment responsibilities.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

(3) Any assignment of receivables which constitute security for repayment of any loan advanced by any Bank or other creditor and if the assignor has given notice of such encumbrance to the assignee, then on accepting assignment of such receivable, the assignee shall pay the consideration for such assignment to the Bank

For example, if you sell $100,000 worth of accounts receivables and get a 90 percent advance, you will receive $90,000. The accounts receivable factoring company holds the remaining 10-percent or $10,000 as security until the payment of the invoice or invoices have been received.

Factoring can be done either on a notification basis, where the seller's customers remit directly to the factor, or on a non-notification basis, where the seller handles the collections and remits to the factor.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Factoring allows companies to immediately build up their cash balance and pay any outstanding obligations. Therefore, factoring helps companies free up capital. that is tied up in accounts receivable and also transfers the default risk associated with the receivables to the factor.