Drywall Contractors Virginia Withholding

Description

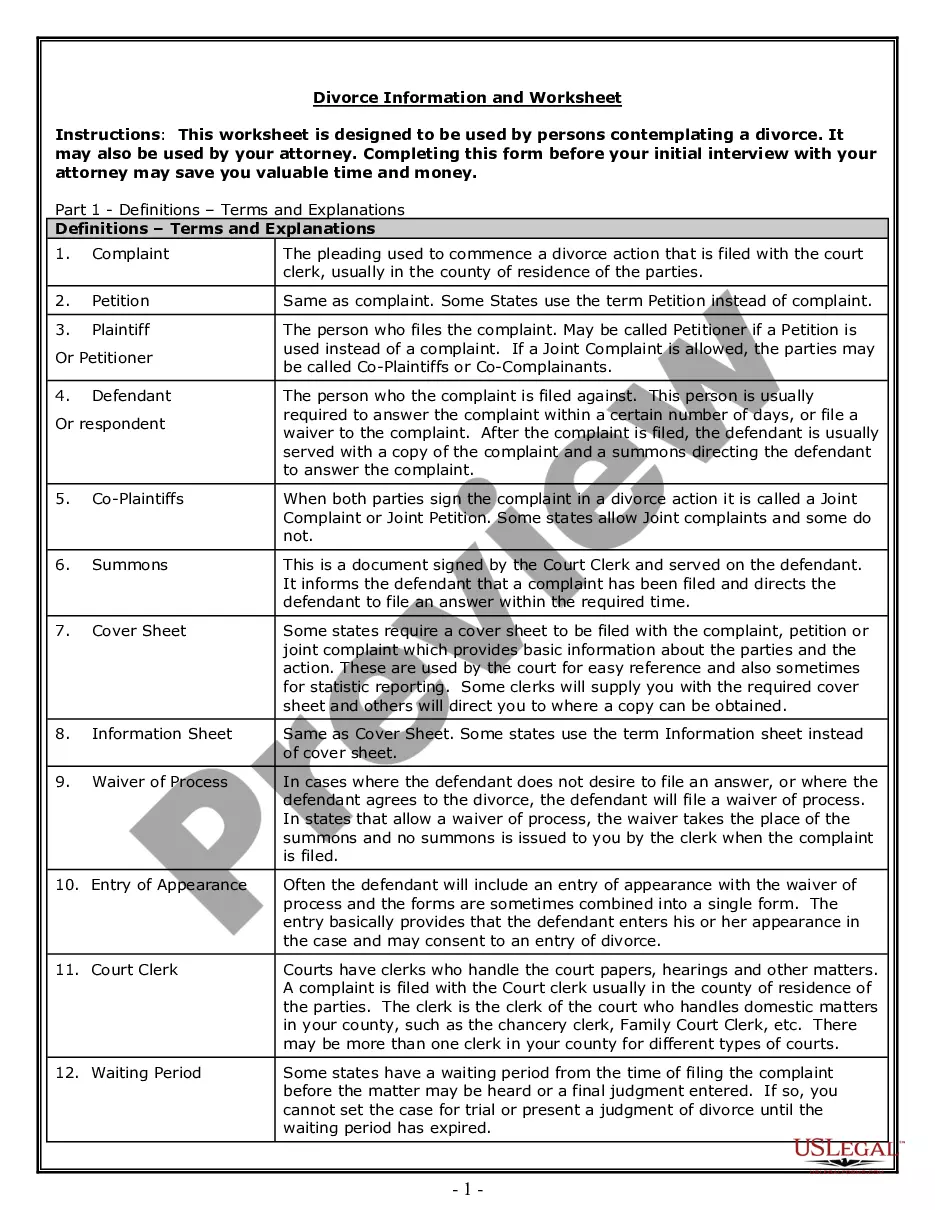

How to fill out West Virginia Sheetrock Drywall Contractor Package?

Bureaucracy demands accuracy and exactness.

Unless you manage the completion of documents like Drywall Contractors Virginia Withholding regularly, it could lead to some misunderstandings.

Choosing the right template from the outset will guarantee that your document submission proceeds smoothly and avoids any hassles of resubmitting a document or starting the same task over again.

Obtaining the correct and current templates for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the uncertainties of bureaucracy and simplify your paperwork.

- Locate the template by utilizing the search function.

- Verify that the Drywall Contractors Virginia Withholding you’ve discovered is applicable for your state or county.

- Examine the preview or review the description that outlines the particulars regarding the use of the template.

- When the result aligns with your search, click the Buy Now button.

- Select the suitable option from the available subscription plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal.

- Download the form in your preferred file format.

Form popularity

FAQ

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

Most employees are subject to withholding tax. Your employer is the one responsible for sending it to the IRS. In order to be exempt from withholding tax you must have owed no federal income tax in the prior tax year and you must not expect to owe any federal income tax this tax year.

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

If your worker is a contractor: they generally look after their own tax obligations, so you don't have to withhold from payments to them unless they don't quote their ABN to you, or you have an agreement with them to withhold tax from their payments.

What Is Withholding? Withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted directly to the federal, state, or local tax authorities. Withholding reduces the amount of tax employees must pay when they submit their annual tax returns.