Active Community Supervision For Wisconsin

Description

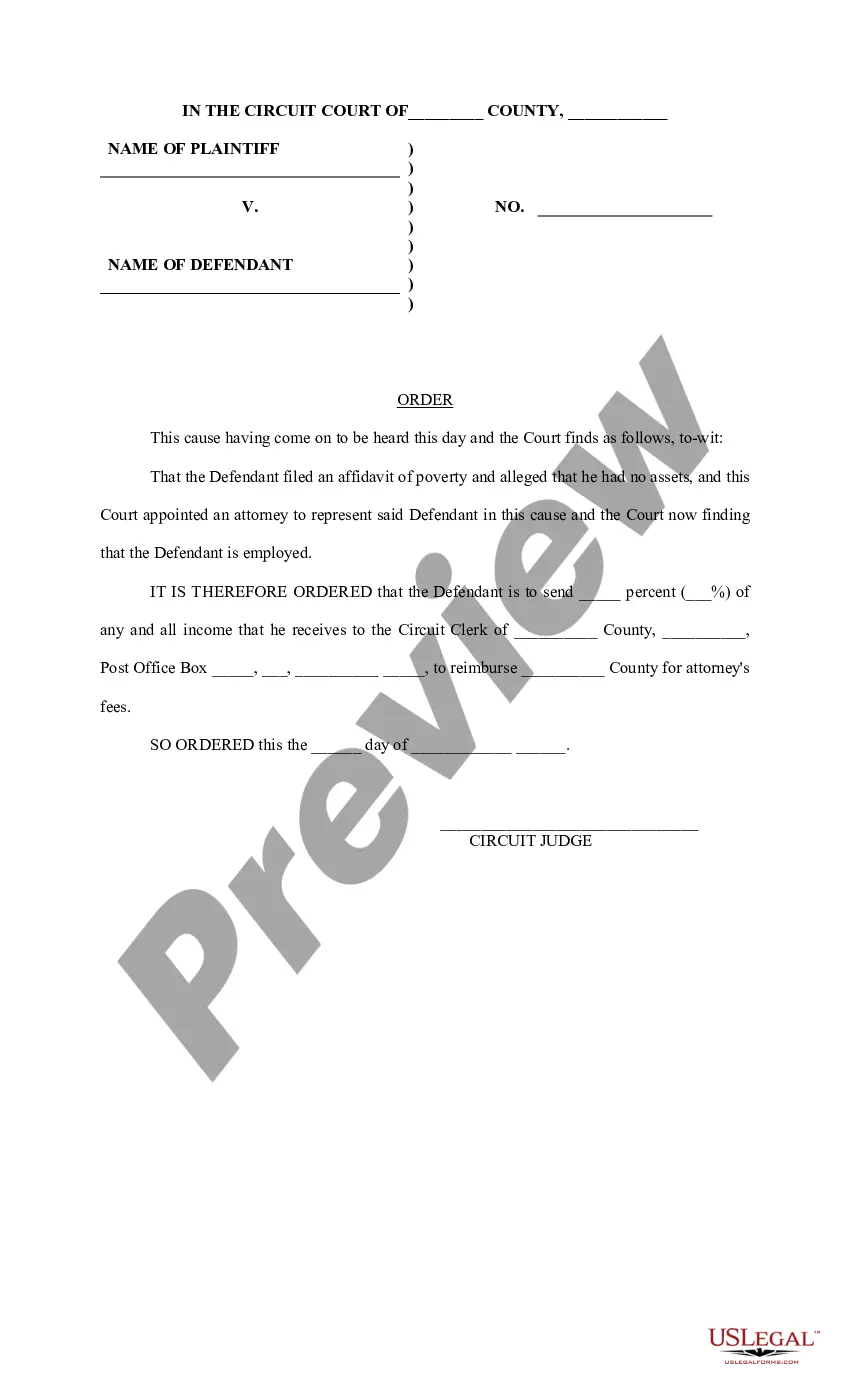

How to fill out Wisconsin Order For Supervised Release?

It's well-known that you cannot become a legal authority instantly, nor can you swiftly learn how to draft Active Community Supervision For Wisconsin without a specific skill set.

Developing legal documents is a lengthy endeavor that necessitates certain training and expertise.

So, why not entrust the creation of the Active Community Supervision For Wisconsin to the experts.

You can regain access to your forms from the My documents tab whenever you wish. If you’re already a customer, you can simply Log In, and find and download the template from the same section.

Regardless of the intent behind your documents, whether financial and legal or personal, our platform has you covered. Explore US Legal Forms today!

- Locate the form you require by utilizing the search feature located at the top of the page.

- Examine it (if this feature is available) and review the accompanying description to ascertain if Active Community Supervision For Wisconsin is what you're looking for.

- If you need a different template, restart your search.

- Create a complimentary account and choose a subscription plan to purchase the form.

- Select Buy now. Once the payment is completed, you can download the Active Community Supervision For Wisconsin, complete it, print it, and deliver it or mail it to the relevant individuals or organizations.

Form popularity

FAQ

LLCs in Rhode Island are taxed as pass-through entities by default. Rather than paying taxes at the entity level, LLCs pass profits and losses on to their members, who then pay taxes at the individual level. In Rhode Island, LLC members are subject to both federal and state personal income tax.

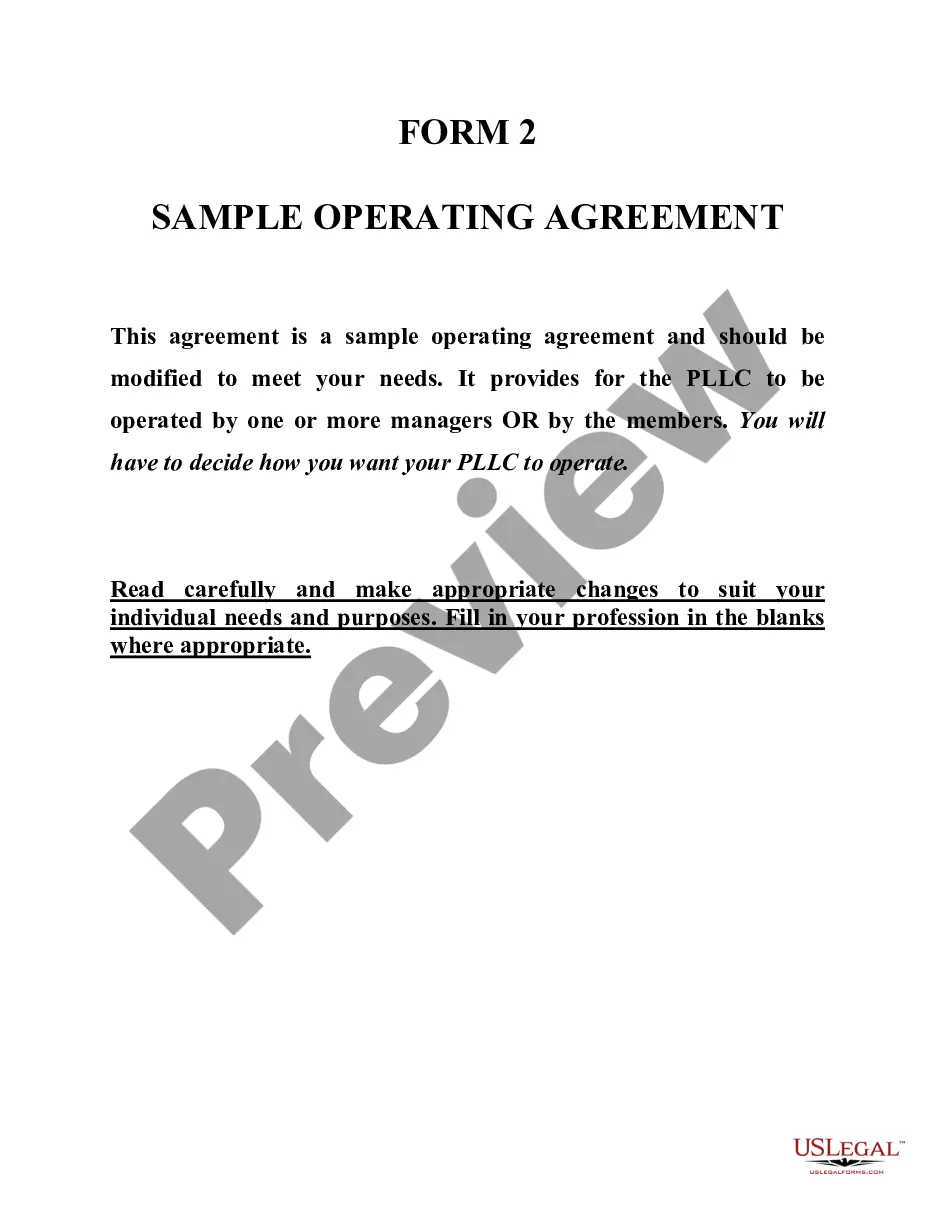

Name your Rhode Island LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

Rhode Island LLC Processing Times Normal LLC processing time:Expedited LLC:Rhode Island LLC by mail:3-4 business days (plus mail time)Not availableRhode Island LLC online:3-4 business daysNot available

The main cost associated with starting an LLC in Rhode Island is the $150 fee to file your articles of organization, which officially register your business with the state. You'll also have a yearly recurring fee of $50 to file your LLC's annual report.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

Rhode Island LLC Cost. The main cost associated with starting an LLC in Rhode Island is the $150 fee to file your articles of organization, which officially register your business with the state. You'll also have a yearly recurring fee of $50 to file your LLC's annual report.

How to start a Rhode Island Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.