Wisconsin S Corp Filing Requirements

Description

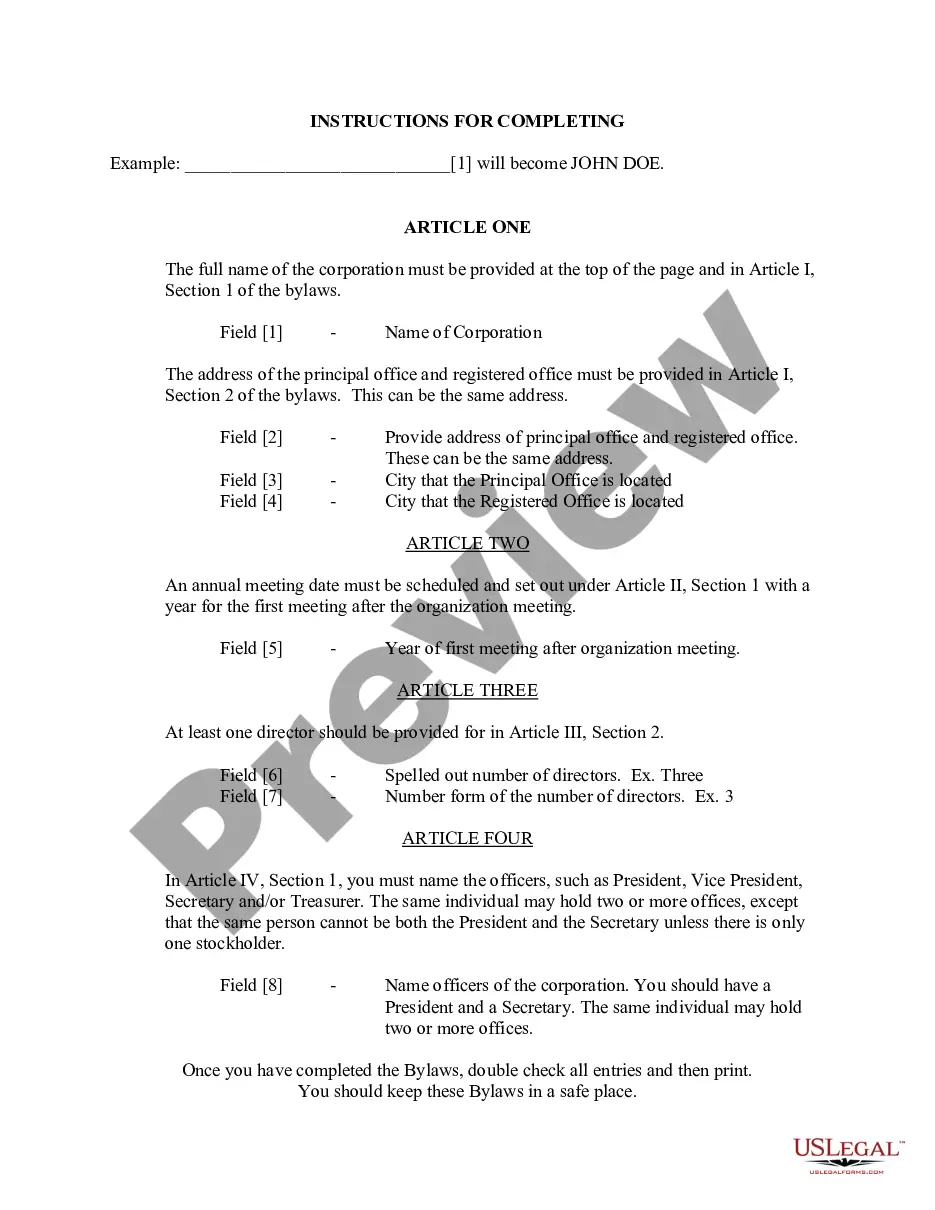

How to fill out Wisconsin Bylaws For Corporation?

Legal document management can be frustrating, even for skilled specialists. When you are looking for a Wisconsin S Corp Filing Requirements and do not get the time to spend in search of the right and updated version, the processes could be stress filled. A strong web form catalogue might be a gamechanger for anyone who wants to handle these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any needs you might have, from individual to enterprise paperwork, all-in-one spot.

- Make use of advanced tools to complete and manage your Wisconsin S Corp Filing Requirements

- Access a useful resource base of articles, tutorials and handbooks and materials related to your situation and requirements

Save effort and time in search of the paperwork you need, and use US Legal Forms’ advanced search and Review tool to get Wisconsin S Corp Filing Requirements and acquire it. For those who have a membership, log in to the US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to see the paperwork you previously downloaded and also to manage your folders as you see fit.

Should it be the first time with US Legal Forms, create an account and acquire limitless access to all advantages of the platform. Listed below are the steps to take after accessing the form you need:

- Verify it is the proper form by previewing it and looking at its description.

- Ensure that the sample is recognized in your state or county.

- Select Buy Now when you are all set.

- Choose a monthly subscription plan.

- Find the formatting you need, and Download, complete, sign, print out and deliver your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Enhance your daily papers management in to a smooth and intuitive process right now.

Form popularity

FAQ

Wisconsin generally follows the federal income tax treatment of an S corporation and its shareholders as set out in IRC Sec. 1361?IRC Sec. 1379 (see ¶10-515 Federal Conformity). Therefore, income and losses, including net business losses, of the S corporation flow to its shareholders.

How to file taxes as an S corporation Prepare your financial statements. One of the first things your tax professional will ask for are financial statements. ... Issue Forms W-2. ... Prepare information return Form 1120-S. ... Distribute Schedules K-1. ... File Form 1040.

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS. Form 2553 ? S Corporation Election. ... Form 1120S ? S Corporation Tax Return. ... Schedule B ? Other Return Information. ... Schedule K ? Summary of Shareholder Information. ... Schedule K-1 ? Individual Shareholder Information.

Step 1: Name Your Wisconsin LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Wisconsin Articles of Organization. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Wisconsin S Corp Tax Designation.

S Corporation Elections A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California.