Public Utility Easement Utah Withholding

Description

How to fill out Utah Grant Of Easement For Utilities?

Individuals commonly link legal documentation with a process that is intricate and only manageable by an expert.

In a certain respect, this is accurate, as preparing the Public Utility Easement Utah Withholding demands in-depth understanding of specific subject criteria, including local and state regulations.

Nevertheless, thanks to US Legal Forms, the process has become easier: pre-made legal templates for any life and business scenario tailored to state laws are compiled in a single online directory and are now accessible to everyone.

You can print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once obtained, they are stored in your profile and can be accessed whenever needed via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and use, allowing you to search for the Public Utility Easement Utah Withholding or any specific template in just minutes.

- Existing users with a valid subscription must Log In to their accounts and click Download to retrieve the form.

- New users will first have to create an account and subscribe before they can save any documentation.

- Here is the detailed process to obtain the Public Utility Easement Utah Withholding.

- Carefully review the page content to ensure it aligns with your requirements.

- Read the form description or view it through the Preview feature.

- If the previous sample does not meet your needs, find another using the Search field provided above.

- When you discover the appropriate Public Utility Easement Utah Withholding, click Buy Now.

- Choose a pricing plan that suits your preferences and financial plan.

- Register for an account or Log In to move to the payment page.

- Complete your subscription payment via PayPal or with a credit card.

- Select the desired file format and click Download.

Form popularity

FAQ

(b) "Public utility easement" means the area on a recorded plat map or other recorded document that is dedicated to the use and installation of public utility facilities.

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household.

The income tax withholding formula for the State of Utah has been updated to eliminate the withholding allowance for employees who have not filed a W-4 form. The tax withheld will be at a flat 4.95 percent for those employees. No action on the part of the employee or the personnel office is necessary.

Unlike many other states, Utah does not have a separate state equivalent to Form W-4, but instead relies on the federal form. You can download blank Forms W-4 from irs.gov. Clearly label W-4s used for state tax withholding as your state withholding form.

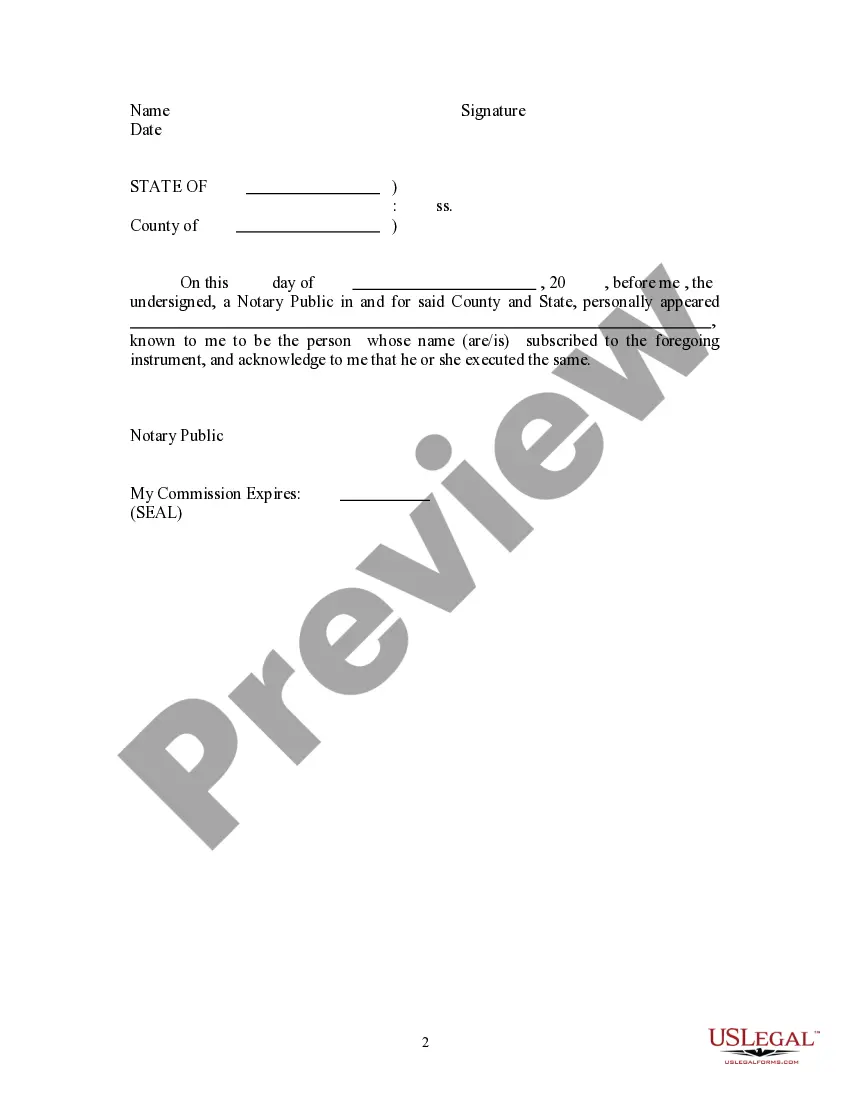

In order for an easement deed to be considered for recordation by a county recorder in Utah, it must be signed and acknowledged by the grantor and accompanied by a certificate of acknowledgment or proof of execution that is signed by the officer taking the acknowledgment (57-3-101).