Babysitting Form Paper For Taxes

Description

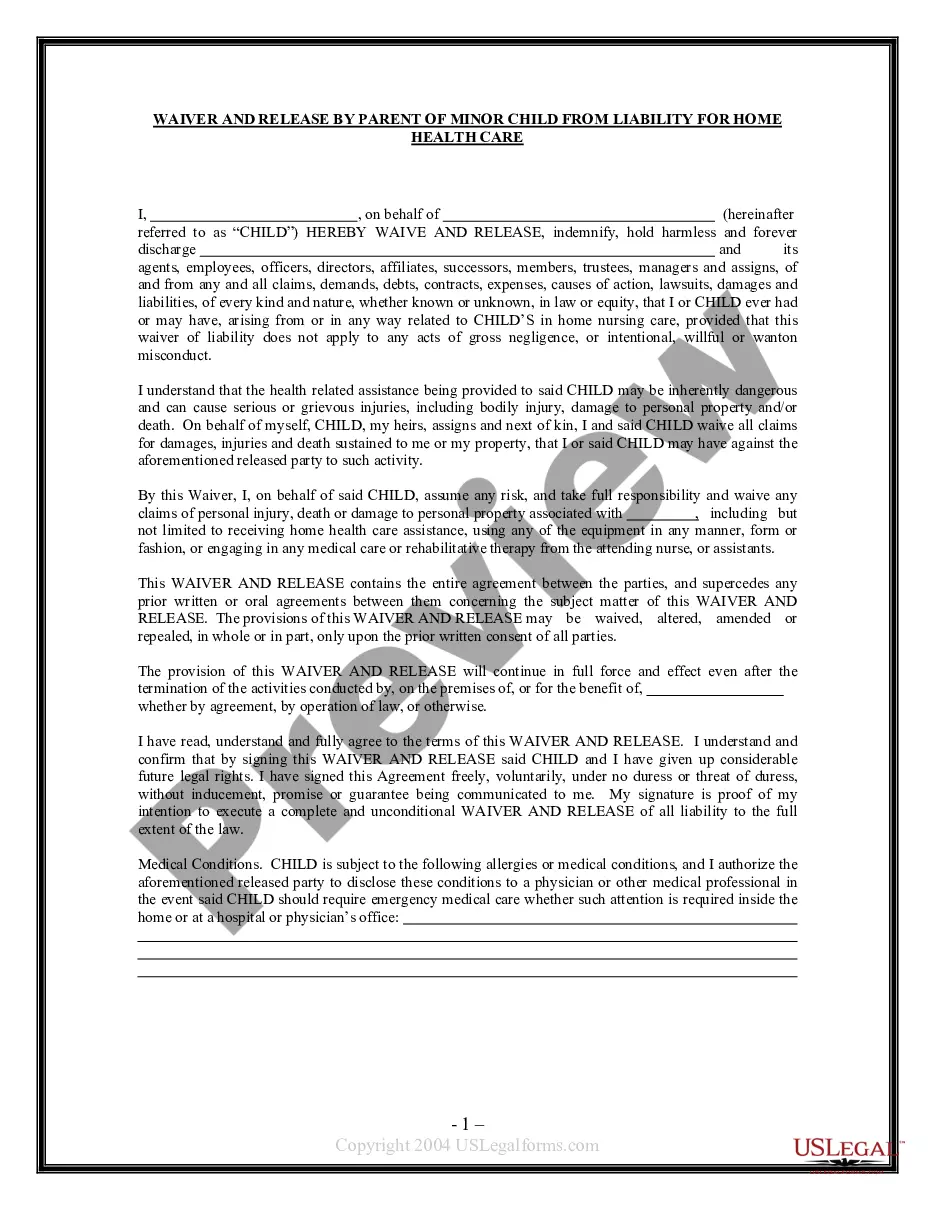

How to fill out Waiver And Release From Liability For Minor Child For Babysitting?

It’s no secret that you can’t become a law professional immediately, nor can you learn how to quickly prepare Babysitting Form Paper For Taxes without having a specialized set of skills. Creating legal forms is a long venture requiring a certain training and skills. So why not leave the preparation of the Babysitting Form Paper For Taxes to the specialists?

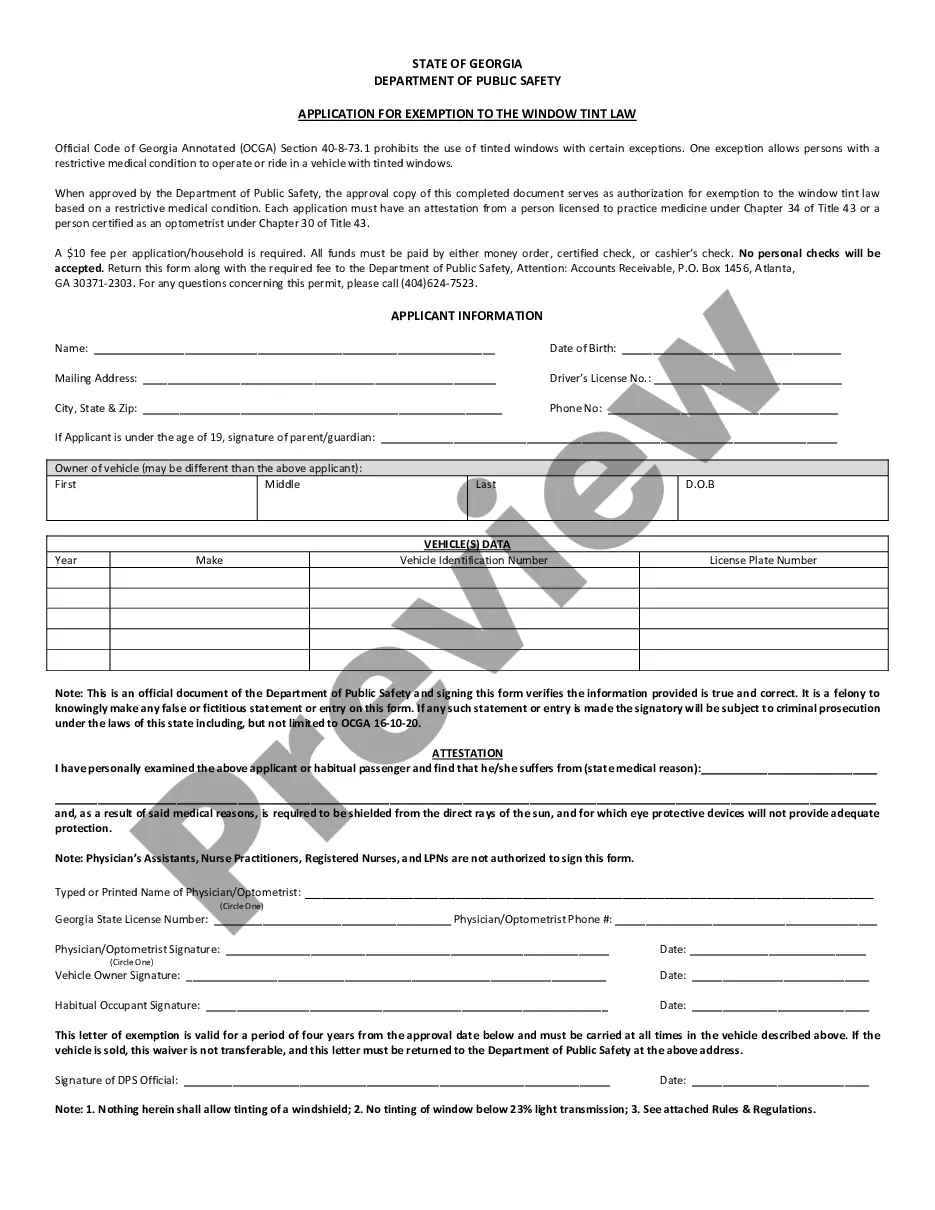

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court documents to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and get the form you require in mere minutes:

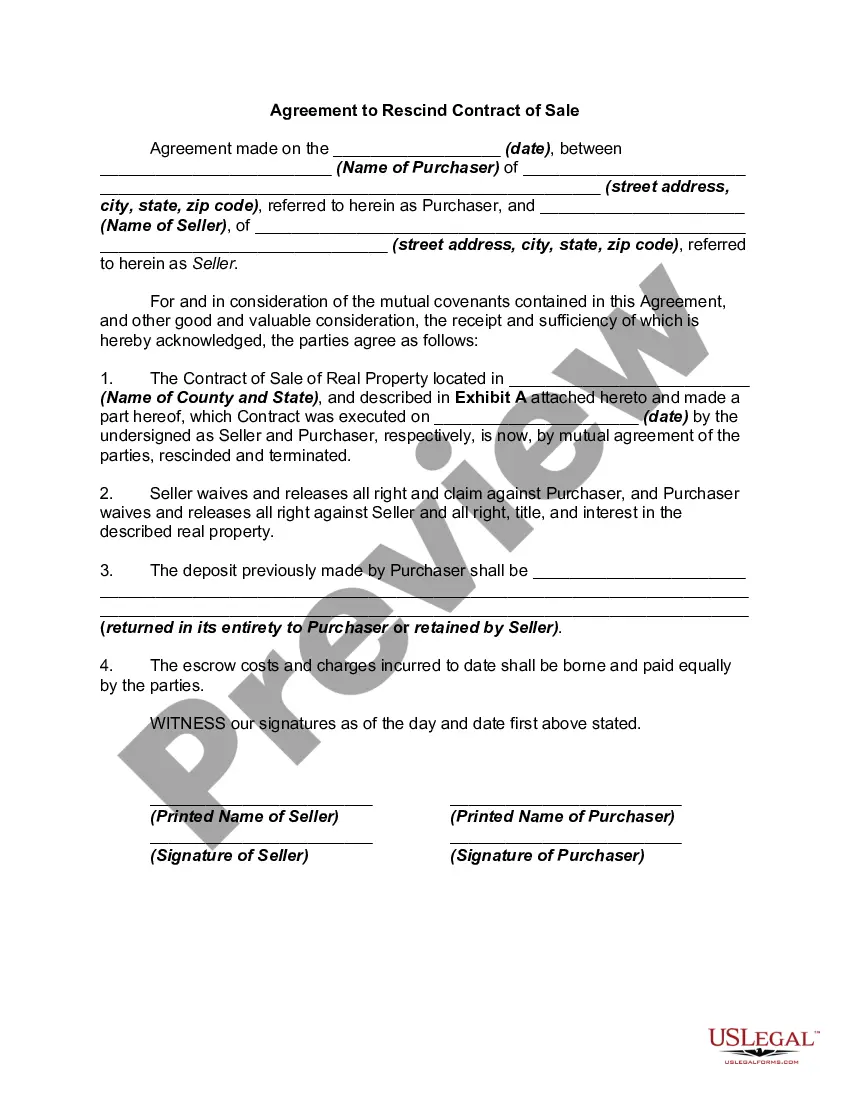

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Babysitting Form Paper For Taxes is what you’re searching for.

- Begin your search over if you need any other form.

- Set up a free account and select a subscription plan to buy the template.

- Pick Buy now. Once the transaction is through, you can download the Babysitting Form Paper For Taxes, complete it, print it, and send or mail it to the necessary people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

In this case, you might receive a Form 1099-NEC if you earned between $600 and $2,600 in 2023 or $2,400 in 2022. Regardless of whether you receive a Form 1099-NEC, you will need to report your income on Form 1040, Schedule C.

Where do I enter babysitting income? Click on Federal Taxes at the top of the screen. Click on Wages & Income across the top of the screen. Under How do you want to enter your income? ... Under Your 2020 Income Summary, go down to Business Items. Click to the right of Business Income and Expenses.

If they operate as an independent contractor, you will need to use a Form 1099-MISC, which is for taxpayers who received payments of $600 or more within the tax year. As their employer, you should need to give your babysitter this form or advise them to file it for their taxes.

If you did not receive a 1099 form from your employer, you are still required to report your income on your tax return. You can do this by using Form 1040 Schedule C. This form is for self-employment income and expenses. You will need to provide your Social Security number and the EIN of your business if you have one.

Self-employed caregivers In this case, you might receive a Form 1099-NEC if you earned between $600 and $2,600 in 2023 or $2,400 in 2022. Regardless of whether you receive a Form 1099-NEC, you will need to report your income on Form 1040, Schedule C. This schedule is for reporting profits or losses from a business.