Copyright Name Search For Books

Description

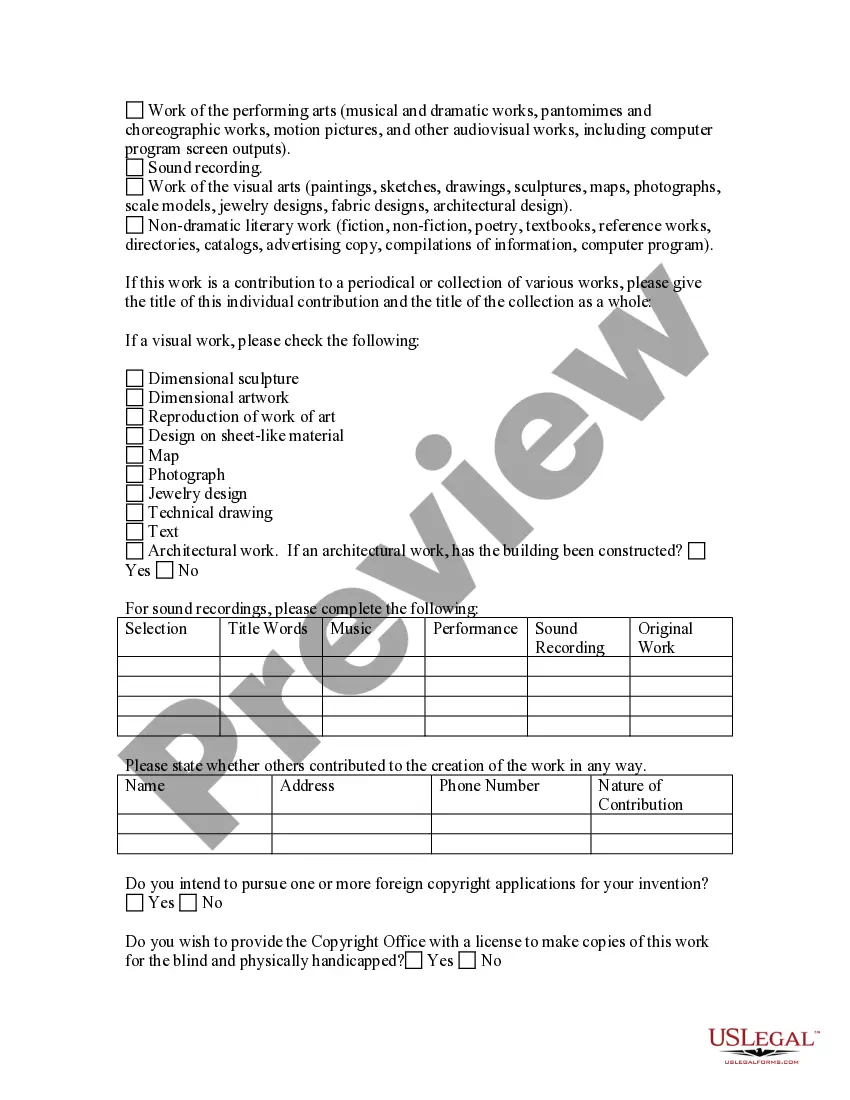

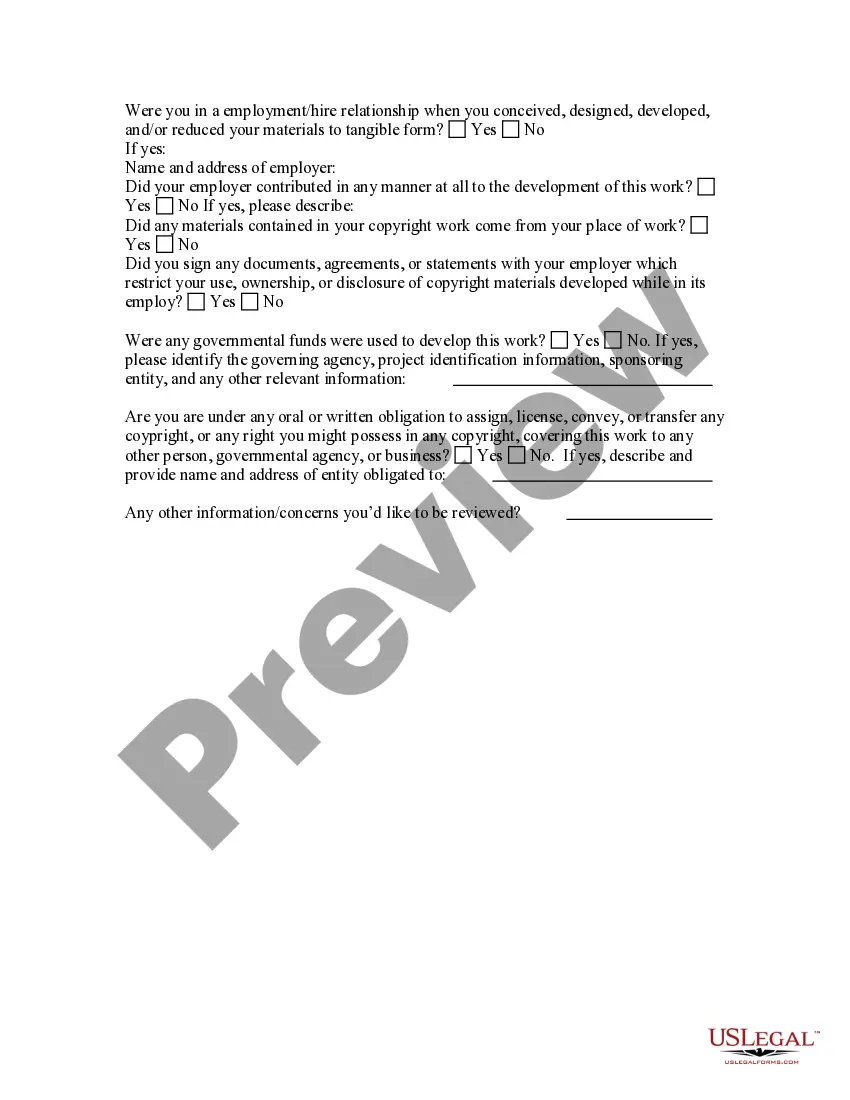

How to fill out Copyright Questionnaire?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their lives.

Filling out legal documents requires meticulous attention, starting with selecting the correct form sample.

Complete the profile registration form. Choose your payment method: use a credit card or PayPal account. Select your desired file format and download the Copyright Name Search For Books. Once saved, you can fill out the form using editing software or print it to complete manually. With a vast US Legal Forms catalog available, you won’t need to waste time searching for the right template online. Utilize the library’s intuitive navigation to discover the suitable form for any event.

- For instance, choosing an incorrect version of the Copyright Name Search For Books will result in its rejection upon submission.

- Thus, securing a trustworthy source for legal documents like US Legal Forms is essential.

- If you need to acquire a Copyright Name Search For Books template, follow these straightforward steps.

- Access the template you need by utilizing the search bar or browsing the catalog.

- Examine the form’s details to ensure it aligns with your circumstances, state, and locality.

- Click on the preview of the form to review it.

- If it’s not the appropriate document, return to the search feature to find the Copyright Name Search For Books sample you require.

- Obtain the template once it fits your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

Form popularity

FAQ

Rhode Island minimum tax is $400.00. If line 22a or 22b of Federal 1120S is applicable, refer to Rhode Island Schedule S for your tax calculation.

If you are a part year Rhode Island resident and are required to file a federal return, you must file a Rhode Island return. If you are a Rhode Island nonresident who has to file a federal return and has income from Rhode Island sources, you must file a Rhode Island return.

Form 1120-S is the annual tax return for businesses that are registered as S corporations. The form is used to report income, gains, losses, credits, deductions, and other information for S corporations.

Generally, most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year. Taxpayers may have to pay a penalty if they're required to file a return but fail to do so.

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

S Corporations: A small business corporation having an election in effect under subchapter S of the Internal Revenue Code is required to file an annual tax return using Form RI-1120S and is subject to the income tax (minimum $400.00).

Follow these five steps to start a Rhode Island LLC and elect Rhode Island S corp designation: Name Your Business. Choose a Resident Agent. File the Rhode Island Articles of Organization. Create an Operating Agreement. File Form 2553 to Elect Rhode Island S Corp Tax Designation.

SUBCHAPTER S CORPORATION FILERS: Form RI-1120S is to be used only by entities taxed as subchapter S corporations for federal tax purposes. LIMITED LIABILITY COMPANY FILERS: (i) If the LLC is to be treated as a corporation for federal tax purposes, it shall pay a tax the same as a ?C? corporation and file Form RI-1120C.