Modification Legal Loan With Interest

Description

How to fill out HAMP Loan Modification Package?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and considerable financial expenditure.

If you’re looking for a more straightforward and economical method of crafting Modification Legal Loan With Interest or any other documents without the need to go through unnecessary processes, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal concerns. With just a few clicks, you can quickly access state- and county-specific templates meticulously prepared by our legal specialists.

Ensure that the template you select meets the guidelines of your state and county. Opt for the suitable subscription plan to acquire the Modification Legal Loan With Interest. Download the file, then complete, sign, and print it out. US Legal Forms enjoys an impeccable reputation and over 25 years of experience. Join us today and make document preparation simple and efficient!

- Access our website whenever you require a trustworthy service that allows you to easily search for and download the Modification Legal Loan With Interest.

- If you’re already familiar with our services and have an account set up, just Log In to your account, find the template, and download it or re-download it anytime from the My documents section.

- Not yet a member? No problem. Setting up an account takes only a few minutes, and you can easily browse through the catalog.

- However, before proceeding directly to download Modification Legal Loan With Interest, keep these advices in mind.

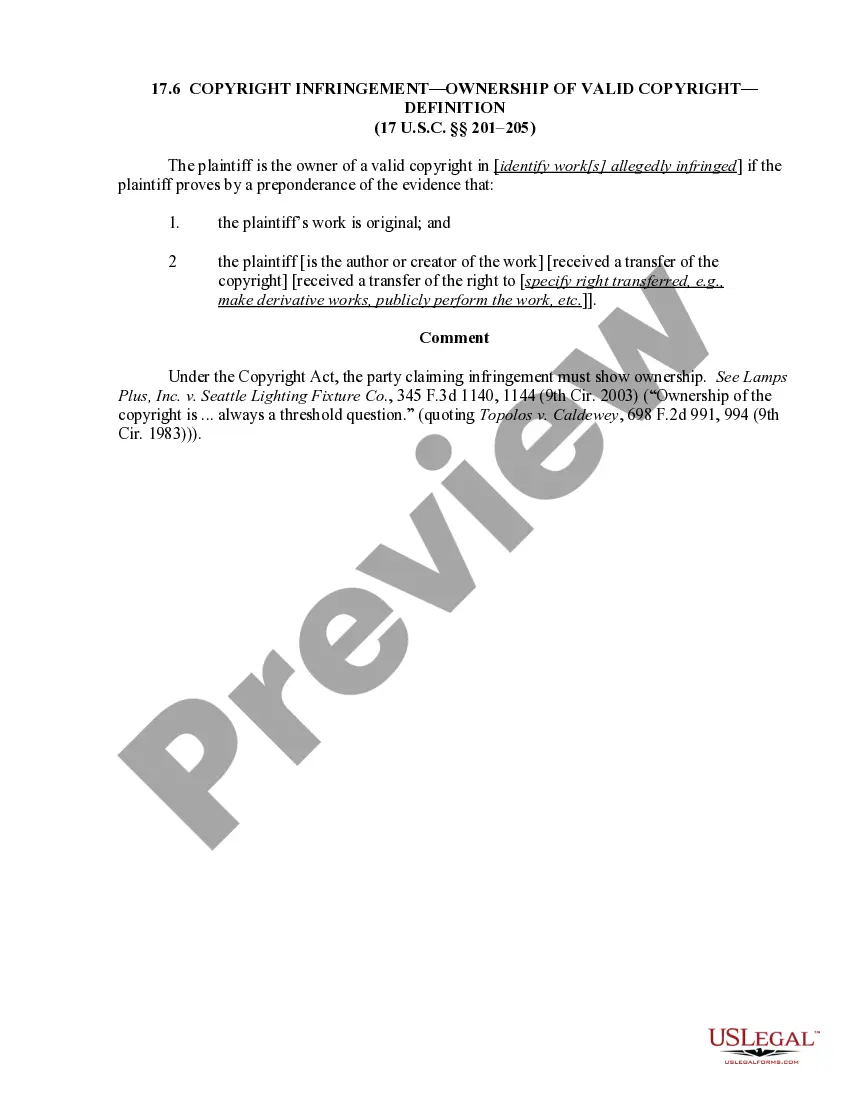

- Examine the form preview and descriptions to confirm that you’ve located the document you need.

Form popularity

FAQ

Winning a loan modification involves submitting a well-prepared application that demonstrates your financial need. You should gather necessary documents, such as proof of income and expenses, to support your request for a modification legal loan with interest. Additionally, it helps to show your lender that you have a stable income and a commitment to meet future payments. Using platforms like US Legal Forms can simplify this process by providing templates and guidance tailored to your situation.

Yes, a modification legal loan with interest must usually be recorded to protect all parties involved. Recording the modification allows for public acknowledgment of the changes to the loan terms. This process helps to prevent misunderstandings regarding your obligations. It’s best to check with your state’s requirements for specific recording rules.

Rules for modification legal loan with interest can vary by lender and state. Generally, you must show proof of financial hardship and supply specific documentation, such as income statements and tax returns. Lenders typically assess your ability to repay the modified loan. Knowing the rules helps you prepare and increases your chances of a successful modification.

Yes, a modification legal loan with interest often changes the interest rate. Lenders may lower your interest rate to make your payments more manageable. Alternatively, they might increase it based on your financial situation or the loan type. Therefore, understanding these changes is crucial before proceeding with any modification.

Several factors can disqualify you from a modification legal loan with interest. A significant one is having a high income that exceeds specific thresholds set by lenders. Additionally, if you are not facing financial hardship or if your mortgage is not owned by a government entity, your chances diminish. Lastly, prior delinquencies or defaults on your current loan can also impact eligibility, so it’s essential to assess your situation thoroughly.

When you receive a modification legal loan with interest, your loan terms change, often resulting in more favorable conditions for repayment. This may include a reduced interest rate, extended loan term, or lowered monthly payments. Typically, you will need to sign a new agreement that outlines these changes. It's wise to consult with a professional or use resources like US Legal Forms to ensure you understand the new terms thoroughly.

Yes, a modification legal loan with interest typically affects your interest rate. Depending on your lender's policies and your financial standing, your interest rate may decrease, making your payments more manageable. However, there are cases where the rate might remain the same or even increase, depending on the specifics of the modification. It's crucial to understand the terms and implications before agreeing to any changes in your loan.

Getting approved for a modification legal loan with interest depends on various factors, including your financial situation and lender requirements. While some may find it challenging, demonstrating a genuine need and providing necessary documentation often eases the process. It's important to prepare your financial statements and show your willingness to meet payment obligations. Utilizing platforms like US Legal Forms can streamline your documentation and improve your chances of approval.