Form Modification Loan Without

Description

How to fill out HAMP Loan Modification Package?

Legal document management might be overpowering, even for the most experienced specialists. When you are searching for a Form Modification Loan Without and do not have the time to commit looking for the right and up-to-date version, the procedures could be stress filled. A strong web form library might be a gamechanger for anybody who wants to handle these situations effectively. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any needs you may have, from personal to organization documents, all-in-one location.

- Employ innovative tools to complete and deal with your Form Modification Loan Without

- Access a useful resource base of articles, instructions and handbooks and resources relevant to your situation and requirements

Help save effort and time looking for the documents you need, and utilize US Legal Forms’ advanced search and Review feature to locate Form Modification Loan Without and download it. In case you have a monthly subscription, log in for your US Legal Forms account, look for the form, and download it. Review your My Forms tab to see the documents you previously downloaded and to deal with your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and get unrestricted access to all benefits of the platform. Listed below are the steps for taking after accessing the form you want:

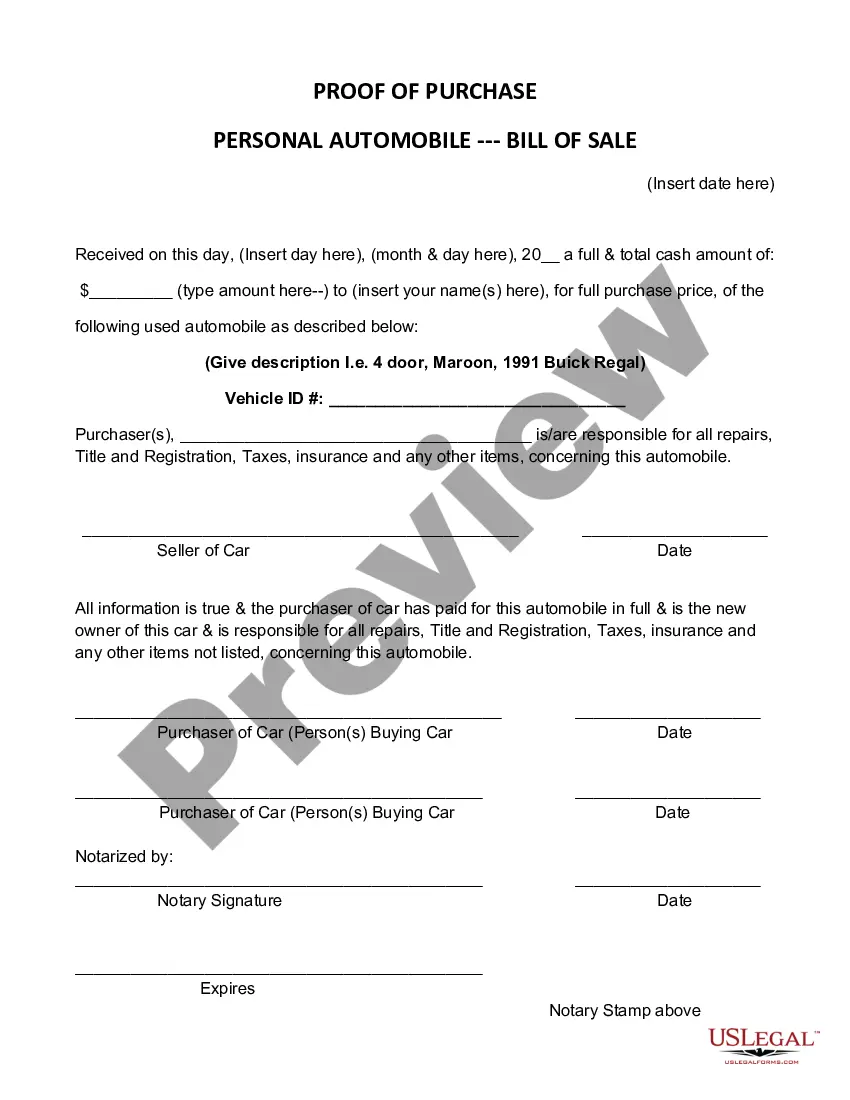

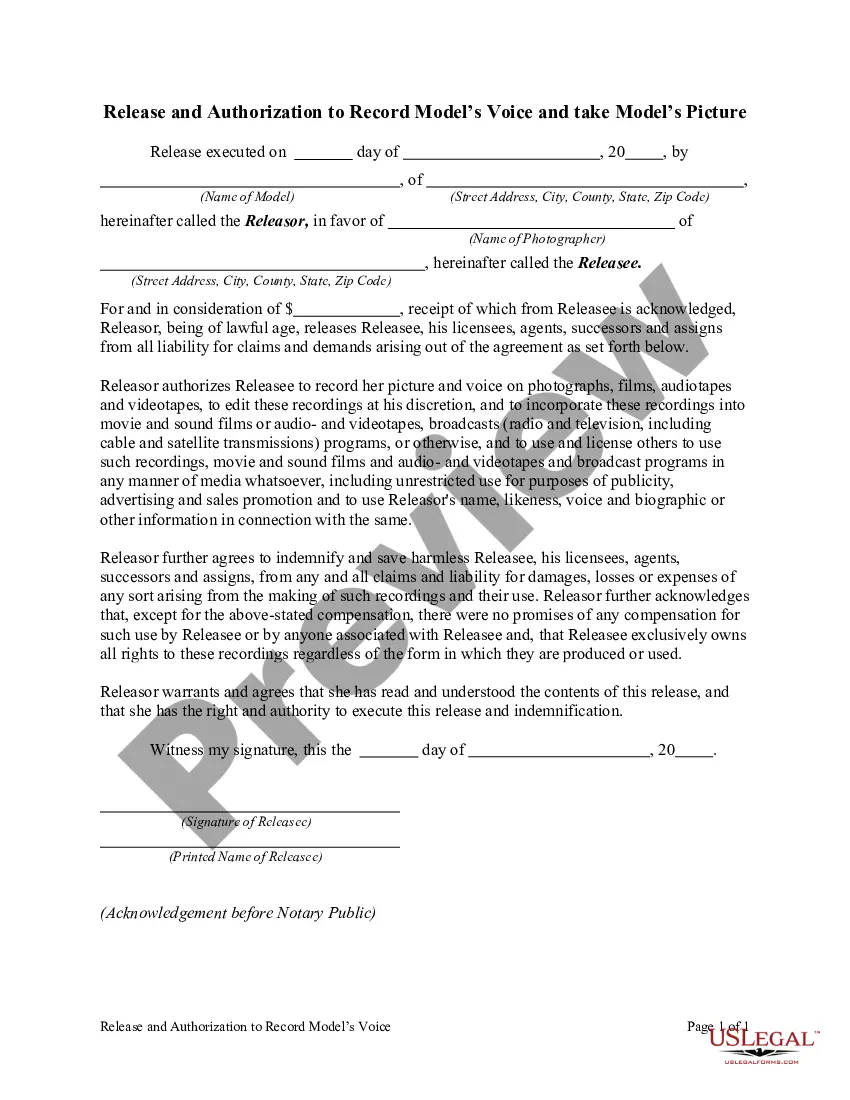

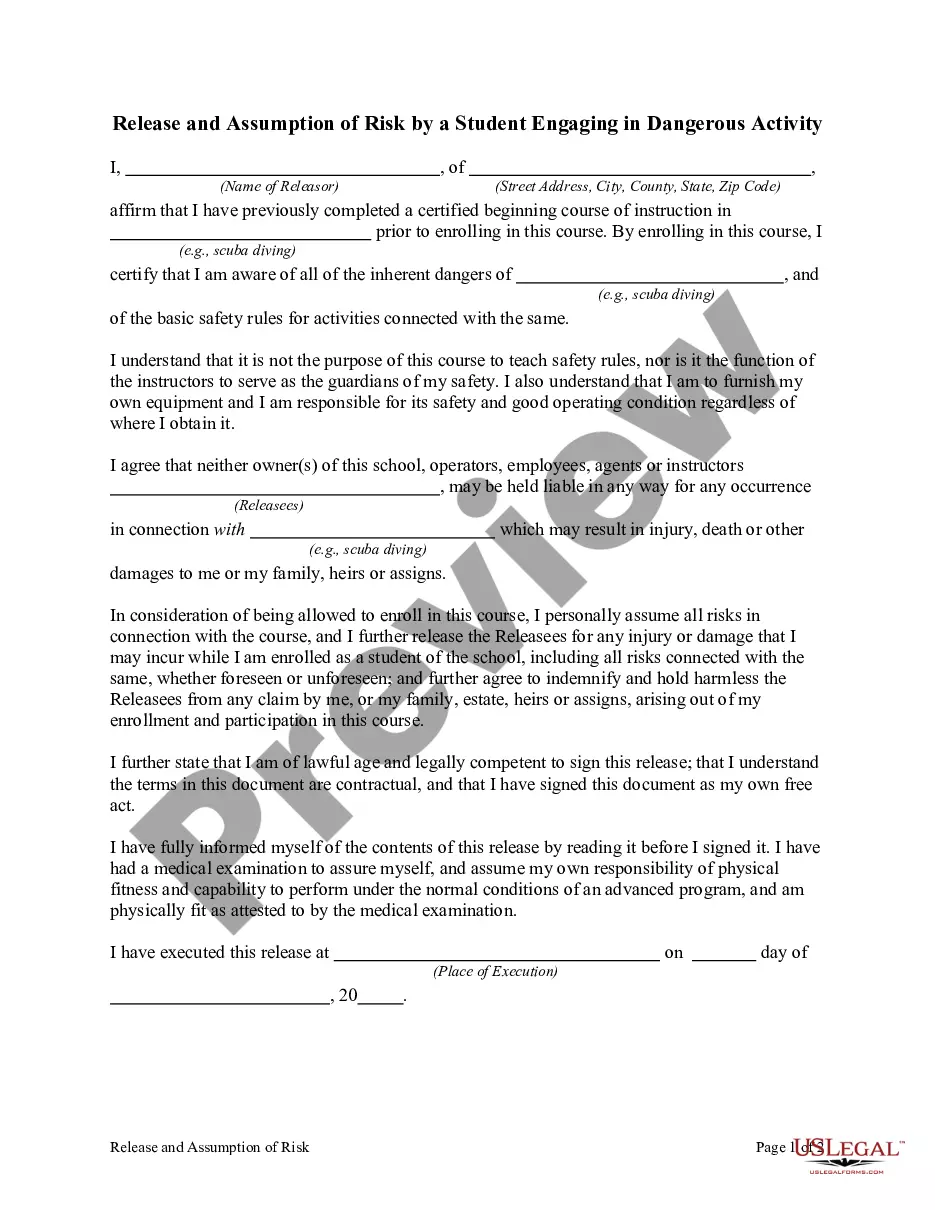

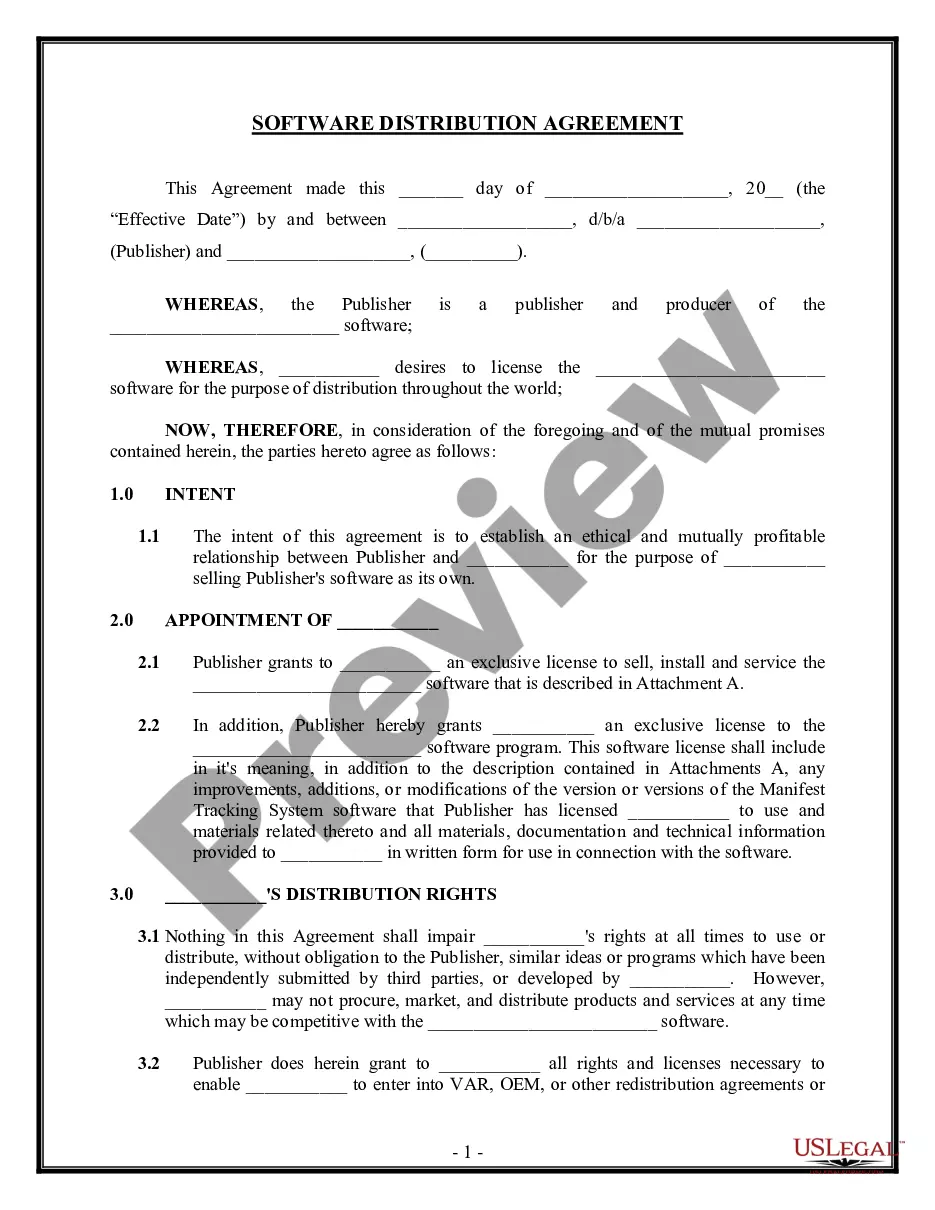

- Validate this is the right form by previewing it and reading its description.

- Be sure that the sample is approved in your state or county.

- Select Buy Now when you are ready.

- Select a subscription plan.

- Pick the file format you want, and Download, complete, eSign, print and send your document.

Benefit from the US Legal Forms web library, backed with 25 years of experience and trustworthiness. Enhance your everyday document management in a smooth and easy-to-use process today.

Form popularity

FAQ

Once you receive the loan modification denial letter, you should look for the reasoning behind the denial. An explanation should be provided in the letter. If the reason is fixable, such as missing information from the application, then all you have to do is reapply.

Most Common Reasons for Loan Modification Denial ingly, lenders may refuse to consider a modification request if you have not proved ?financial hardship,?5 which can include loss of a job, illness or disability, or loss of a spouse.

Most Common Reasons for Loan Modification Denial ingly, lenders may refuse to consider a modification request if you have not proved ?financial hardship,?5 which can include loss of a job, illness or disability, or loss of a spouse.

Required documentation for a loan modification usually includes a formal application, pay stubs, financial statements, proof of income, bank statements, and tax returns, as well as a hardship statement.

You don't have a valid financial hardship reason. You make too much money and have too many assets. You have exceeded the number of loan modifications that you're allowed. Your investor does not offer loan modifications as a loss mitigation option.