Personal Loan Form Document For Self Employed

Description

How to fill out Personal Loan Agreement Document Package?

Utilizing legal templates that adhere to federal and local regulations is crucial, and the internet provides a multitude of choices to select from.

However, what’s the use of spending time searching for the properly created Personal Loan Form Document For Self Employed example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest virtual legal repository with more than 85,000 editable templates prepared by lawyers for any business or personal situation.

If you are new to our site, follow the steps below: Examine the template using the Preview option or through the text description to confirm it fulfills your requirements. Find another example using the search function at the top of the page if necessary. Click Buy Now when you locate the correct form and choose a subscription plan. Create an account or Log In and proceed with a payment through PayPal or a credit card. Select the proper format for your Personal Loan Form Document For Self Employed and download it. All files you discover via US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- They are simple to navigate with all documents organized by state and intended use.

- Our experts stay updated with legislative modifications, ensuring that your form is always current and compliant when obtaining a Personal Loan Form Document For Self Employed from our site.

- Acquiring a Personal Loan Form Document For Self Employed is fast and straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and download the necessary document sample in the appropriate format.

Form popularity

FAQ

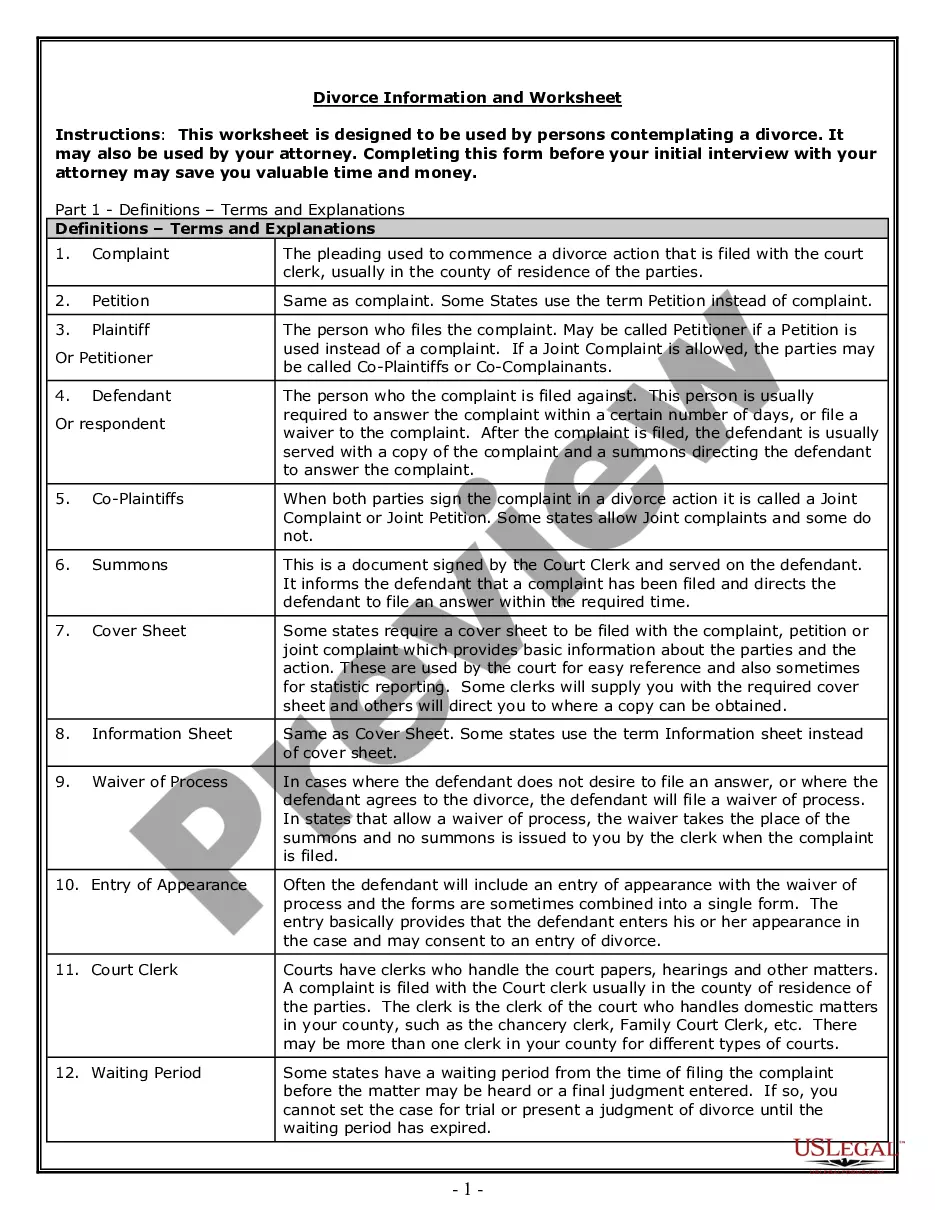

If you are self-employed, you need to gather various pieces of information and documents to complete a personal loan form document for self employed. Essential requirements typically include proof of income, credit history, and identification. Having these materials ready will make applying for a personal loan easier and faster. Consider using platforms like USLegalForms to access standardized documents that meet your needs.

When you are self-employed, several documents support your application for a personal loan form document for self employed. You will generally need your tax returns, profit and loss statements, and bank statements. These documents demonstrate your income stability and help lenders evaluate your financial situation. Collect these pieces of information to streamline your application process.

If you are self-employed, you will need to complete a personal loan form document for self employed. This document typically requires information about your income, business structure, and financial history. It allows lenders to assess your eligibility for a loan based on your self-employment income. Make sure to provide accurate details to increase your chances of approval.

If you're self-employed, you'll need to submit a recent tax return or other forms like a 1099 as proof of income. Ready to find a personal loan? Compare rates from top personal loan lenders to find the right one for you.

Getting any kind of loan usually requires showing proof of income so lenders feel assured a borrower has a steady salary that can keep them making their monthly payments on time. If a borrower is self-employed and makes an irregular income, it can be difficult for them to prove they're ready to take on a loan.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

What you need to apply for credit when self-employed Pay stubs. Depending on your business model, you may have pay stubs from clients (this is more commonplace with freelancers and consultants). Tax statements. ... Bank statements. ... Profit and loss statements. ... Social Security benefits statement. ... Court-ordered agreements.