Personal Loan Form Document For Salaried

Description

How to fill out Personal Loan Agreement Document Package?

Whether for corporate intentions or for personal matters, everyone must confront legal circumstances at some stage in their life.

Filling out legal documents requires meticulous focus, commencing with selecting the proper form template.

With an extensive catalog from US Legal Forms available, you do not need to waste time searching for the correct template online. Use the library’s user-friendly navigation to find the suitable template for any scenario.

- Locate the template you require using the search bar or directory navigation.

- Review the form’s description to confirm it aligns with your situation, state, and county.

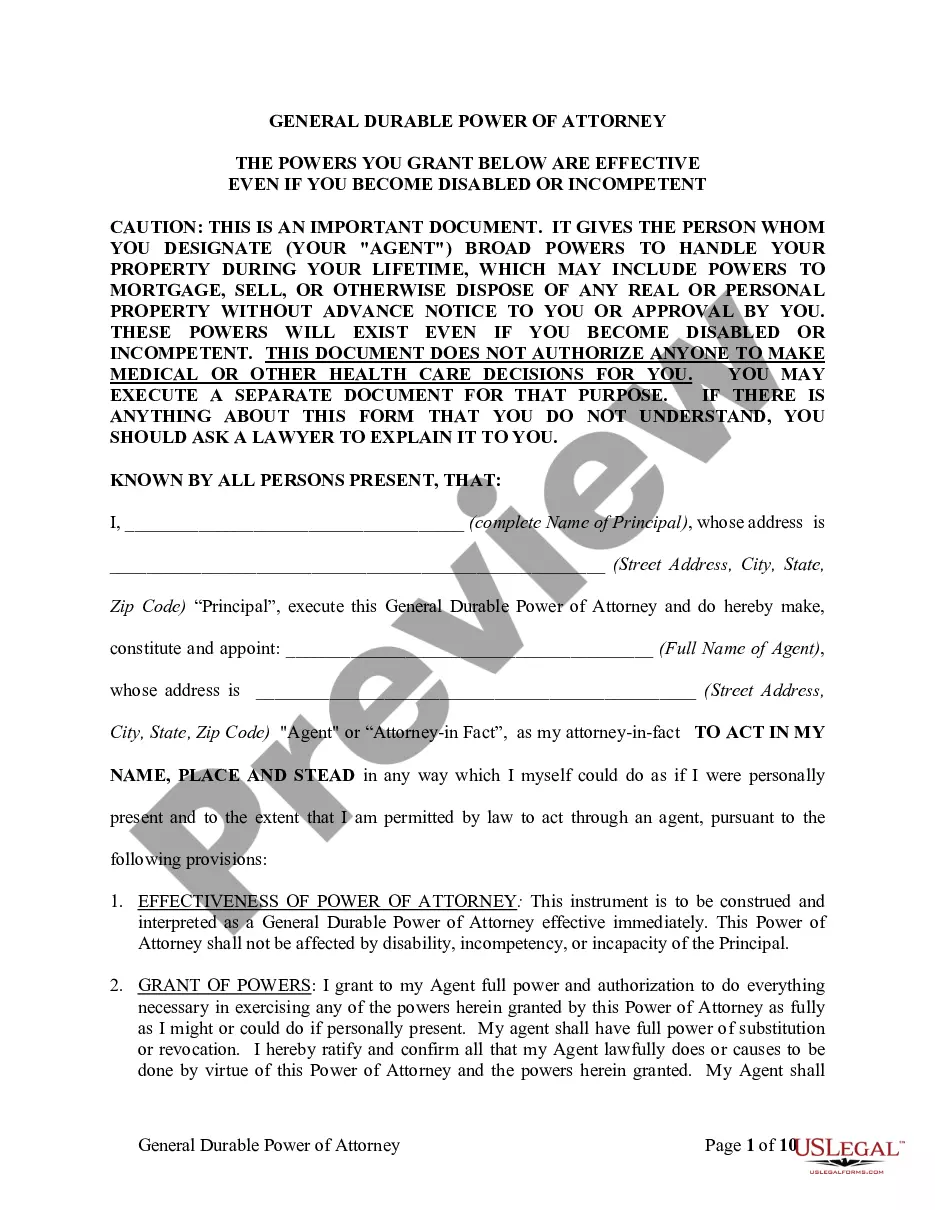

- Click on the form’s preview to inspect it.

- If it is the incorrect form, revert to the search feature to find the Personal Loan Form Document For Salaried sample you require.

- Obtain the template if it satisfies your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you have yet to create an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the file format you desire and download the Personal Loan Form Document For Salaried.

- Once downloaded, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

To apply for a personal loan, you typically need several key documents. Common requirements include a government-issued ID, proof of income, and your credit report. Depending on the lender, you may also need bank statements or tax returns. A personal loan form document for salaried individuals can streamline this process and ensure that you provide all necessary information.

Yes, you can often use an offer letter as proof of income when applying for a personal loan. This document outlines your expected salary and employment status, giving lenders insights into your financial capability. Make sure the letter includes essential details like your start date and salary structure. Additionally, use a personal loan form document for salaried individuals to present a complete application.

Getting approved for a personal loan without proof of income can be challenging, but options exist. Lenders may consider alternative documents like bank statements, tax returns, or asset proof. Additionally, a strong credit score and a solid financial history can increase your chances. If you seek to simplify your application, a personal loan form document for salaried individuals can help clarify your financial status.

To prove income for a personal loan, you can provide your salary slips, tax returns, or bank statements that reflect regular deposits. Lenders typically require this information to assess your ability to repay the loan. It’s crucial to present accurate and up-to-date documentation to enhance your chances of being approved. Using a personal loan form document for salaried individuals can guide you on the specific income proof needed for a smooth application process.

Writing a personal loan document involves outlining the loan amount, interest rate, repayment terms, and any applicable fees. It's important to clearly state the purpose of the loan and ensure both parties agree on the terms. Including specific conditions, such as what happens in the event of missed payments, can also be beneficial. You can use a tailored personal loan form document for salaried individuals to ensure you cover all necessary details accurately.

When applying for a personal loan, you usually need to provide specific documents to verify your identity and income. This documentation may include your salary slips, bank statements, and identification proof. The lender might also ask for your employment details and any existing financial obligations. Using a personal loan form document for salaried professionals can help streamline the submission of these essential documents.

A salaried personal loan is a type of loan available to individuals who receive a regular salary from their employer. This loan allows you to access funds for personal needs, such as home improvement, education, or medical expenses. The loan amount and interest rate typically depend on your income and credit history. You may find that a personal loan form document for salaried individuals simplifies the application process.

Filling a personal loan form involves several key steps. Start by entering your personal details, including name and address, followed by your monthly income and employment information. Make sure to double-check your information for accuracy, and consider utilizing US Legal Forms to access a tailored personal loan form document for salaried individuals.

When applying for a loan, be clear and concise about your financial situation and loan purpose. Highlight your steady income and employment status while explaining how the loan can benefit you. Remember, stating that you have a personal loan form document for salaried professionals prepared can help instill confidence in lenders.

To fill out a personal loan application form document for salaried individuals, gather your personal information, income details, and employment history. Ensure you provide accurate data, as lenders use this information to assess your ability to repay the loan. Review the requirements carefully, and don’t hesitate to use resources like US Legal Forms to simplify the process and ensure completeness.