Loan Document Form Format

Description

How to fill out Personal Loan Agreement Document Package?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more affordable way of creating Loan Document Form Format or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of more than 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific templates diligently put together for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Loan Document Form Format. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and explore the library. But before jumping straight to downloading Loan Document Form Format, follow these recommendations:

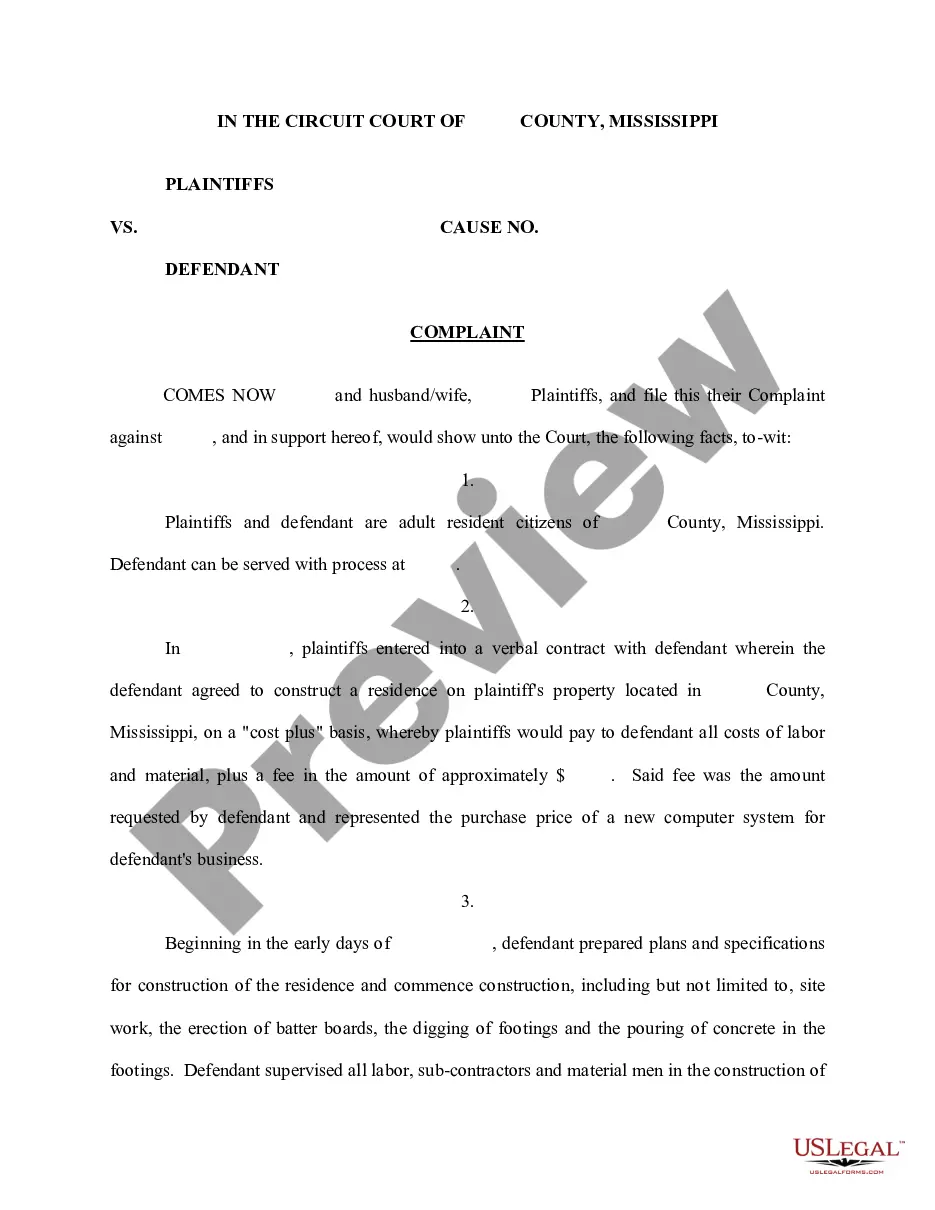

- Check the document preview and descriptions to ensure that you have found the document you are looking for.

- Make sure the template you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Loan Document Form Format.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us today and turn document completion into something simple and streamlined!

Form popularity

FAQ

Visit the branch of the financial lender. Procure the personal loan application form and enter all the required details. Submit relevant documents that prove one's income, age, address and identity. The lender will then verify the documents and check the eligibility of the applicant.

Though the loan application is simple to fill, there are certain things you should keep in mind before filling the form. Check the eligibility criteria. Keep your documents handy. Often the home loan application is delayed or rejected due to submission of incomplete documents. ... Use an EMI calculator.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. ... Mention the purpose of the loan. ... Assure the lender of repayment. ... Closing the business loan request letter.