Assignment Promissory Note With Payment Schedule

Description

How to fill out Assignment Of Promissory Note And Liens?

The Assignment Promissory Note With Payment Schedule you see on this page is a reusable legal template drafted by professional lawyers in line with federal and local regulations. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Assignment Promissory Note With Payment Schedule will take you just a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it fits your requirements. If it does not, use the search bar to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Choose the format you want for your Assignment Promissory Note With Payment Schedule (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

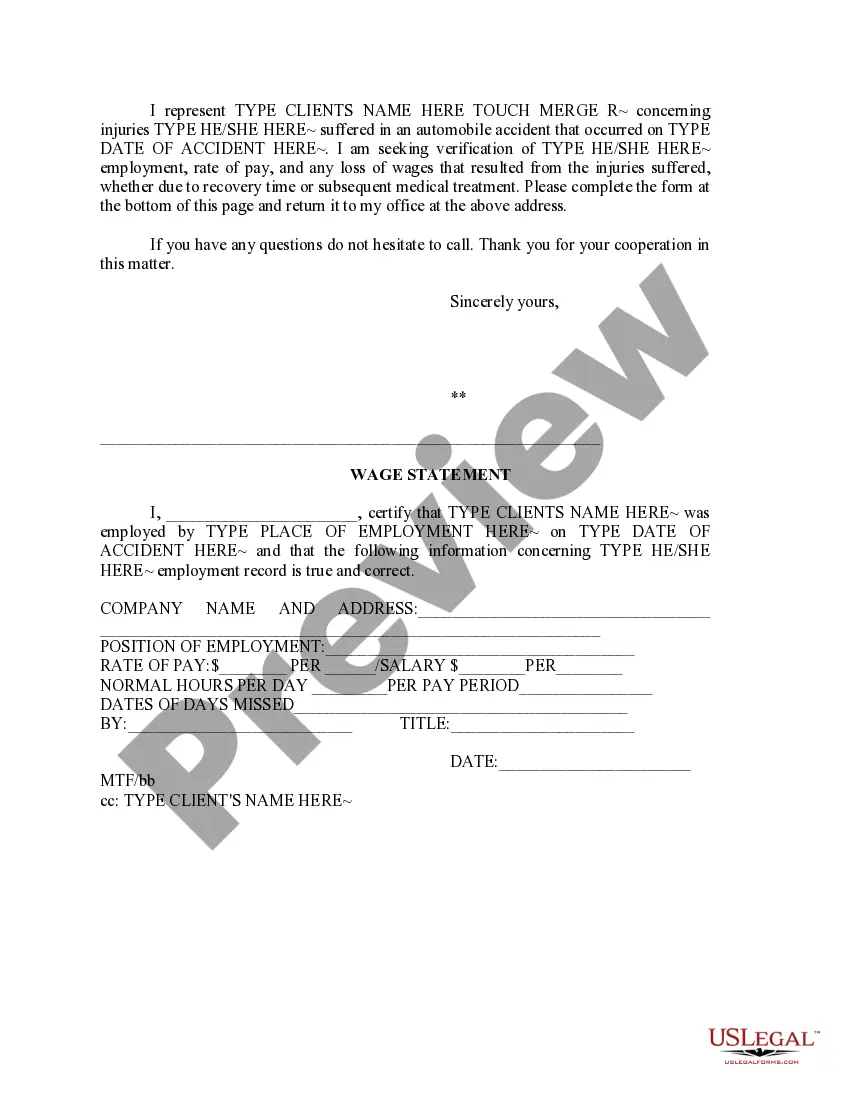

Names of all Parties Involved ? Such a document must include the names of the payee, drawee, and holder. Address and Contact Details ? Should include the residential address and phone number of all parties involved. Promissory Note Amount ? It must show the sum that is outstanding and must be repaid as per the note.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

(1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement. The Lender must retain title to the Promissory Note.

If you are the borrower, issue the promissory note to the institution or individual that needs it to obtain a loan for you. This should be done with an addendum stating the assignment of your rights or the completion of the assignment paperwork required by the lender.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.